About

BNPL apps have gained popularity as an alternative to traditional credit cards for making purchases. They often appeal to consumers who want to spread out the cost of a purchase without accruing high-interest charges. However, it’s important for users to understand the terms and fees associated with BNPL services and manage their payments responsibly to avoid financial difficulties.

Industry

Services

Business Type

Build your idea

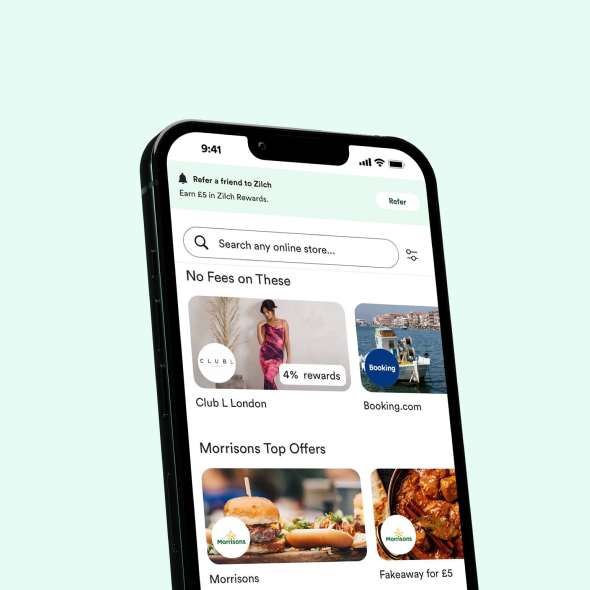

Awesome Deals

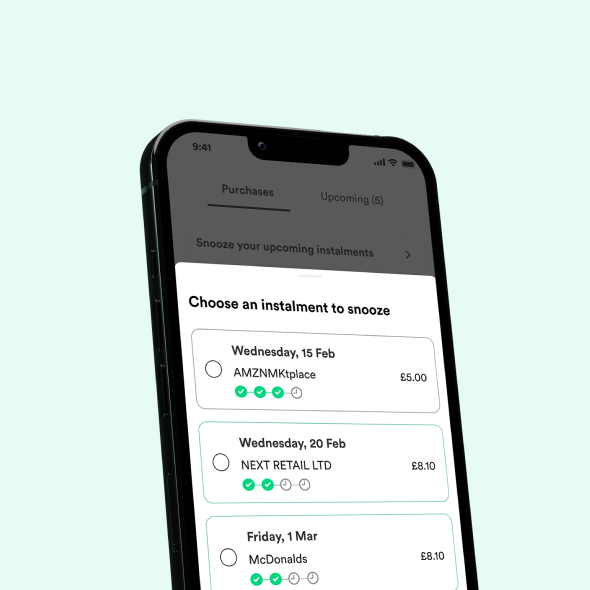

Snooze Payments.

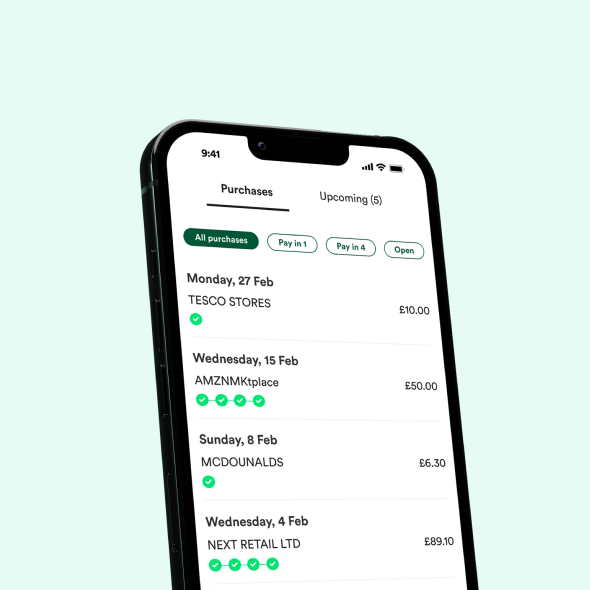

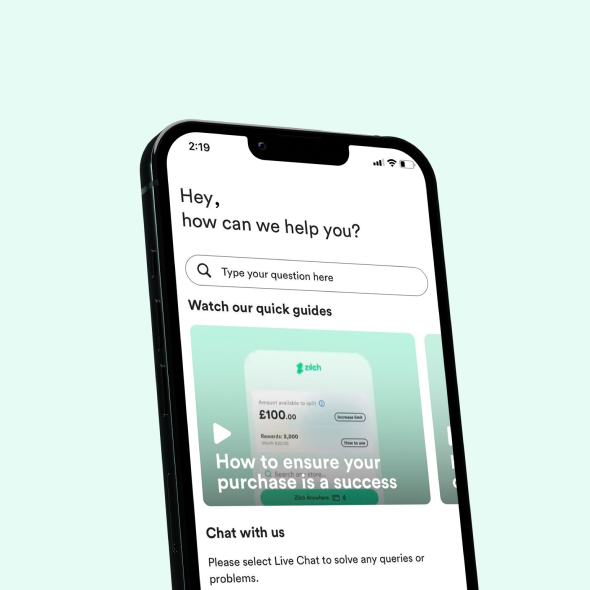

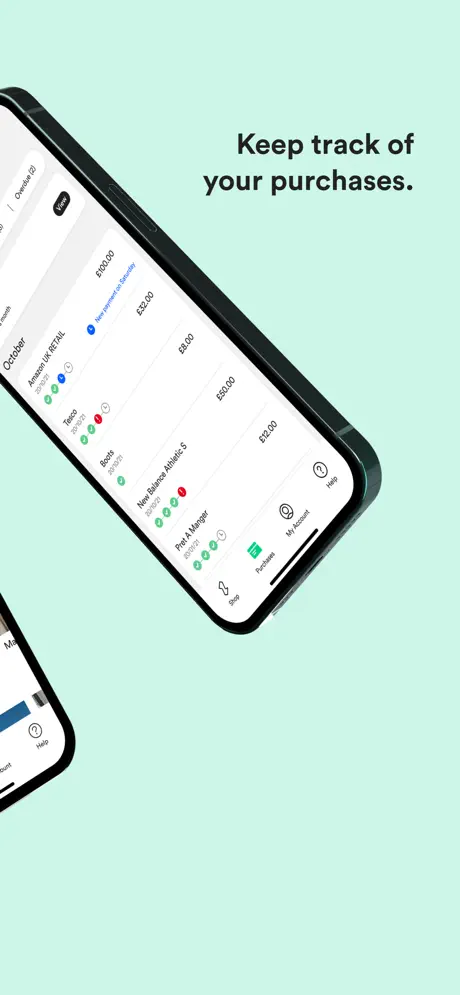

Manage Payments.

Get Help.

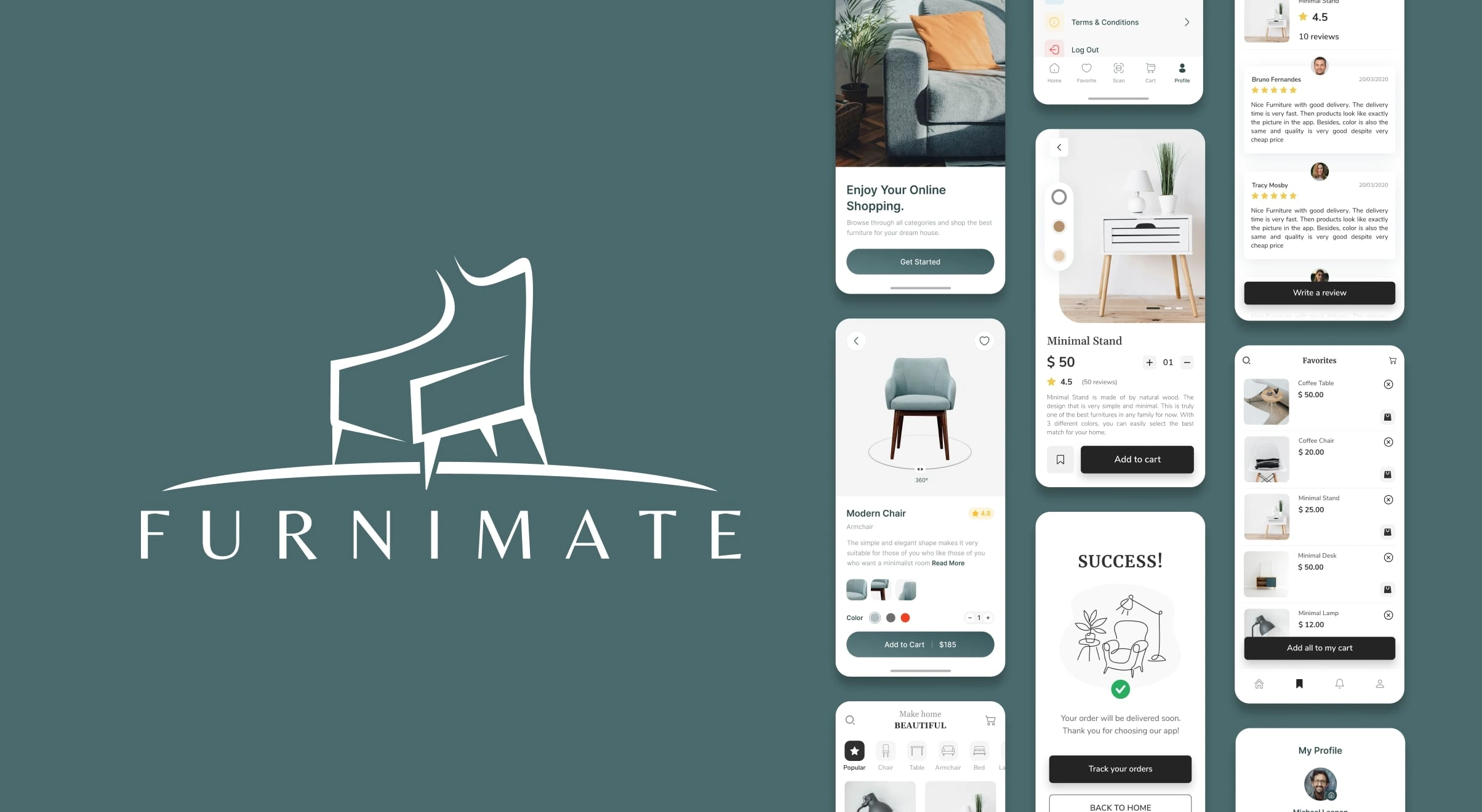

Apps success is Directly Propotional to UI/UX

Key User Experience (UX) challenges for a BNPL app often involve

1. Complex onboarding processes.

2. Cross-platform consistency.

3. Overwhelming choices during checkout.

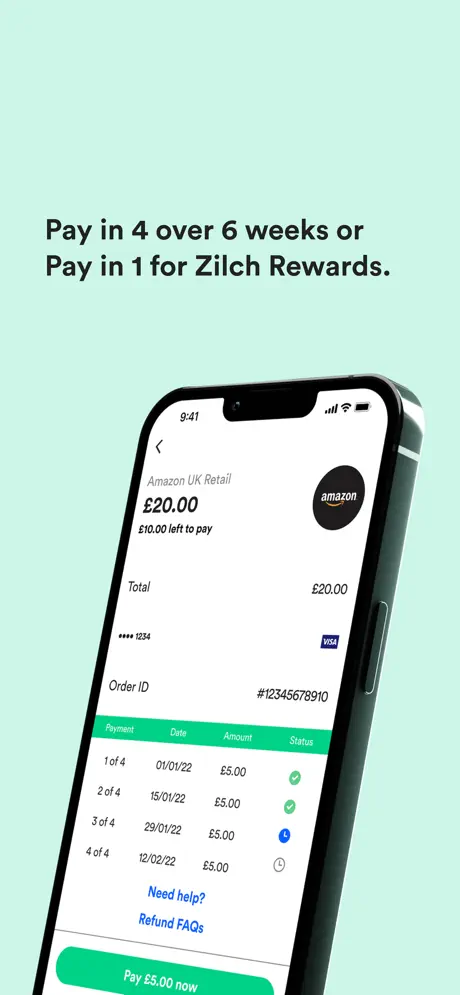

4. Payment transparency issues.

5. Lack of Personalization.

6. Mobile responsiveness.

7. Security concerns

8. Inadequate feedback and support mechanism.

Addressing these challenges is vital for delivering a user-friendly and trustworthy BNPL app experience.

We work on Keep It Simple, Stupid design approach by drafting clear User Journey and User Stories with minimal touchpoints towards effective results.

Akshay Jadhav

Fintech & BNPL Account SPOC

Simple iterative Agile Process

1

Discover

Prototype

Wireframing

2

3

Development

iOS app

Test

4

5

Deployment

Review

6

Our Project Challenges

1

Balancing Simplicity and Clarity with Comprehensive Information

Solution: Achieving a balance between simplicity and comprehensive information is crucial. With the help of intuitive visual design, hierarchy, and progressive disclosure techniques to guide users through the app.

- We started with showcasing most essential information upfront, such as the purchase amount and due date, and allow users to access more detailed terms and conditions if they wish.

- Visualize the payment schedule and fees clearly, perhaps through interactive infographics or charts, to help users understand the financial implications of their decisions.

2

User Education

Solution: Implement user education measures such as clear explanations, calculators, guides, and notifications to empower users with knowledge about fees, credit impact, and responsible usage, ensuring they make informed financial decisions.

Our Development Journey

Our journey in developing the BNPL app began with a thorough examination of user feedback and reviews to identify core issues. We delved into the customers’ comments to gain a precise understanding of the challenges they faced while using the app for their Buy Now, Pay Later (BNPL) transactions. Additionally, we put ourselves in the users’ shoes by exploring the app from their perspective.

After an in-depth analysis of user feedback and our own experiences, we zeroed in on the primary issue: a complex design system that made the process of utilizing the BNPL service challenging. We also identified minor issues, such as location fetching, which were leading to user frustration and drop-offs.

Having pinpointed these problem areas, including the specific screens causing user attrition, our next step was to revisit the wireframe of the BNPL app and initiate a comprehensive redesign.

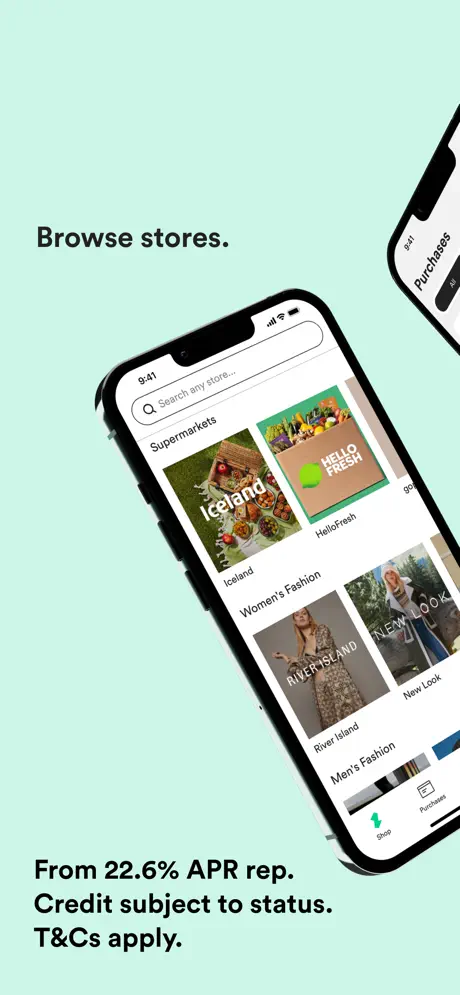

Given that speed and simplicity are paramount for our app’s success, our UI design strategy mirrored these principles. Through careful selection of fonts and image sizes, we eliminated distracting elements, streamlining the user flow for swift and hassle-free transactions. In addition to this, we introduced various engaging features within the BNPL app, such as categorized menu sorting, online order placement, order customization, store location finder for home delivery, in-app payments, and real-time tracking of BNPL transactions—enhancements aimed at providing an efficient and enjoyable user experience.

The Results - App bounce Rate down by 56%

Our effective product development principles, combined with close collaboration with stakeholders and a simplified design approach, have led to a substantial 56% reduction in the bounce rate for the app.

This achievement underscores our dedication to delivering a user-friendly and engaging experience within the Buy Now, Pay Later (BNPL) sector, reinforcing our position for success in this competitive market.

Our approach Increased the Conversion Rate by

35%

Through Transformative UI/UX

Testimonials

Prabhakar Posam

On time delivery:

Reporting:

Communication:

Code Quality:

Availability:

Praful Tembhurne

On time delivery:

Reporting:

Communication:

Code Quality:

Availability:

On time delivery:

Reporting:

Communication:

Code Quality:

Availability:

I was impressed with the project development solution provided by SDLC Corp for my mobile app. Their cross-platform apps are available on both the iOS (apple app store) and Android app stores, and I highly recommend them as a mobile app development company.

Kickstart Your Dream Project With Us

We have worked with some of the best innovative ideas and brands in the world across industries.