Introduction

Asset-backed tokens are a category of cryptocurrencies that derive their value from physical or digital assets. These tokens serve as digital representations of real-world assets, offering stability and tangible value within blockchain ecosystems. Here’s an exploration of asset-backed tokens, including their characteristics, operational mechanisms, functionalities, and common use cases:Asset-backed tokens are a category of cryptocurrencies that derive their value from physical or digital assets. These tokens serve as digital representations of real-world assets, offering stability and tangible value within blockchain ecosystems. Here’s an exploration of asset-backed tokens, including their characteristics, operational mechanisms, functionalities, and common use cases. For expert guidance on developing asset-backed tokens, consider engaging with a Crypto Token Development Company.

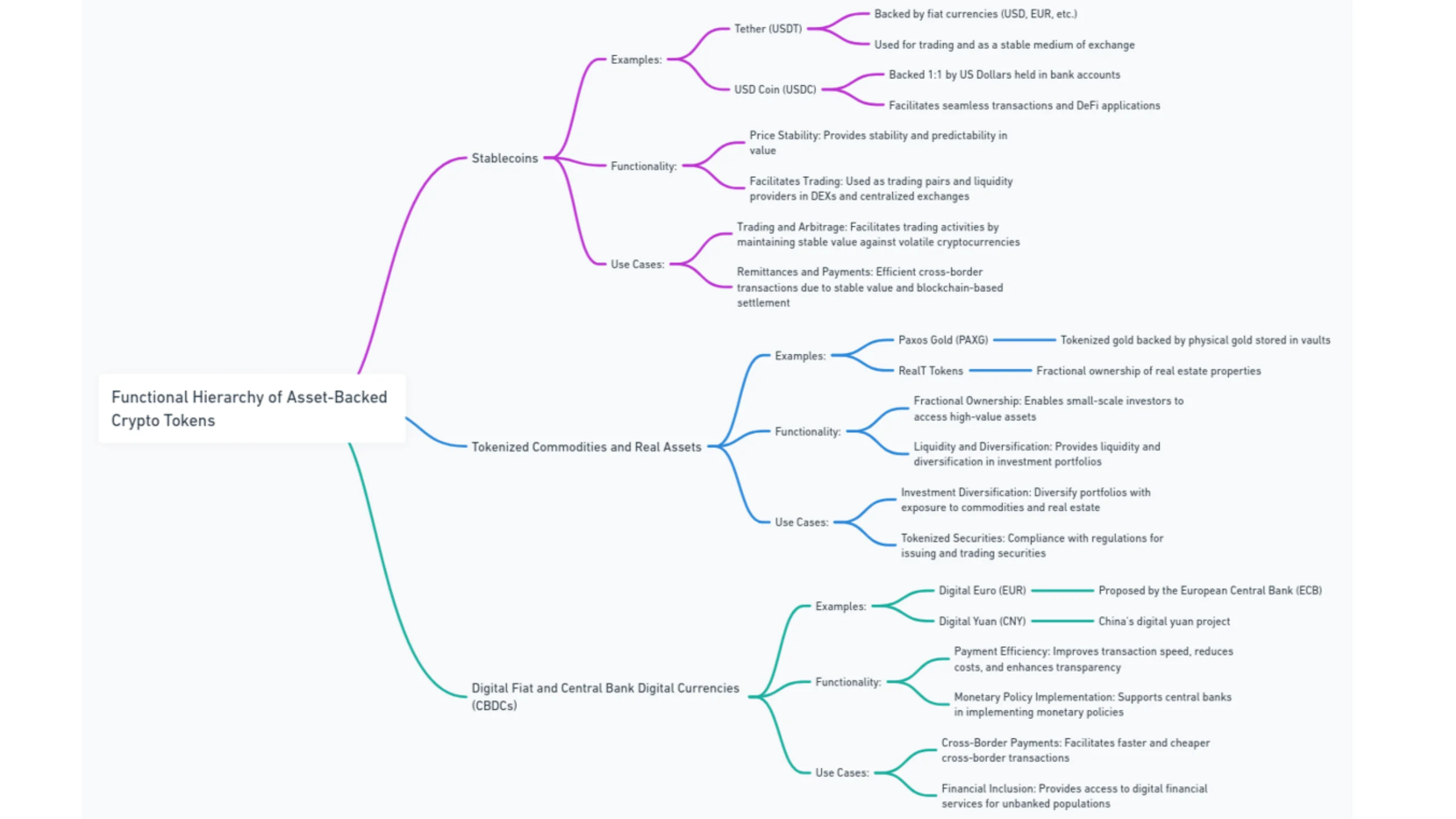

Hierarchy of Asset Backed Crypto Tokens

In the blockchain ecosystem, asset-backed cryptocurrencies form a functional hierarchy based on their roles, functionalities, and applications within decentralized finance (DeFi), investment, and digital asset management. Here’s an overview of the functional hierarchy of asset-backed crypto tokens:

1. Stablecoins

Stablecoins are the most prominent category of asset-backed tokens, designed to maintain stability by pegging their value to real-world assets such as fiat currencies, commodities, or other cryptocurrencies.

- Examples:

- Tether (USDT): Backed by fiat currencies (USD, EUR, etc.), used for trading and as a stable medium of exchange.

- USD Coin (USDC): Backed 1:1 by US Dollars held in bank accounts, facilitating seamless transactions and DeFi applications.

Functionality:

- Price Stability: Provides stability and predictability in value, making them suitable for transactions and as a store of value in volatile crypto markets.

- Facilitates Trading: Used as trading pairs and liquidity providers in decentralized exchanges (DEXs) and centralized exchanges.

Use Cases:

- Trading and Arbitrage: Facilitates trading activities by maintaining stable value against volatile cryptocurrencies.

- Remittances and Payments: Efficient cross-border transactions due to stable value and blockchain-based settlement.

2. Tokenized Commodities and Real Assets

These tokens represent ownership or fractional ownership of physical assets such as real estate, precious metals, and commodities.

- Examples:

- Paxos Gold (PAXG): Tokenized gold backed by physical gold stored in vaults.

- RealT Tokens: Fractional ownership of real estate properties, allowing global investment and diversification.

Functionality:

- Fractional Ownership: Enables small-scale investors to access high-value assets traditionally reserved for institutional investors.

- Liquidity and Diversification: Provides liquidity and diversification in investment portfolios through digital fractional ownership.

Use Cases:

- Investment Diversification: Investors can diversify portfolios with exposure to commodities and real estate without the burden of physical ownership.

- Tokenized Securities: Compliance with regulations for issuing and trading securities in tokenized form, enhancing accessibility and liquidity.

3. Digital Fiat and Central Bank Digital Currencies (CBDCs)

These tokens represent digital versions of fiat currencies issued by central banks or financial institutions, operating on blockchain networks for efficiency and transparency.

- Examples:

- Digital Euro (EUR): Proposed digital euro by the European Central Bank (ECB), aimed at enhancing cross-border payments and financial inclusion.

- Digital Yuan (CNY): China’s digital yuan project aimed at modernizing payment systems and enhancing financial transparency.

Functionality:

- Payment Efficiency: Improves transaction speed, reduces costs, and enhances transparency in financial transactions.

- Monetary Policy Implementation: Supports central banks in implementing monetary policies effectively.

Use Cases:

- Cross-Border Payments: Facilitates faster and cheaper cross-border transactions compared to traditional banking systems.

- Financial Inclusion: Provides access to digital financial services for unbanked populations, promoting economic participation.

Characteristics of Asset-Backed Tokens

- Backed by Real-World Assets: Asset-backed tokens are directly backed by physical assets (like gold or real estate) or digital assets (like fiat currencies or other cryptocurrencies), ensuring stability and intrinsic value.

- Tokenization: They leverage blockchain technology to tokenize and represent fractional ownership or rights to the underlying assets, allowing for efficient trading and transfer on decentralized platforms.

- Transparency and Security: Asset-backed tokens offer transparency through blockchain immutability, enabling users to verify the existence and ownership of underlying assets, enhancing trust and security.

How Asset-Backed Tokens Work

Asset-backed tokens operate through the following mechanisms to ensure their value and functionality within blockchain ecosystems:

- Collateralization: The tokens are backed by collateralized assets held in custody or verified through smart contracts, ensuring one-to-one or fractional representation of the underlying asset.

- Redemption Mechanism: Some asset-backed tokens provide mechanisms for users to redeem tokens for the underlying asset (e.g., redeeming stablecoins like USDT for fiat currency), maintaining stability and pegging to real-world value.

- Token Issuance and Auditing: Issuers of asset-backed tokens often undergo third-party audits to verify the collateralization and ensure compliance with regulatory standards, enhancing token credibility and investor confidence.

Functionality and Use Cases

- Stablecoin Functionality:

- Purpose: Asset-backed tokens often function as stablecoins, maintaining a stable value relative to the underlying asset (e.g., fiat currency or gold), facilitating reliable transactions and hedging against cryptocurrency volatility.

- Example: Tether (USDT) is a prominent stablecoin backed by fiat currencies, providing stability and liquidity within the crypto market.

- Fractional Ownership and Investment:

- Purpose: Asset-backed tokens allow fractional ownership and investment in high-value assets (e.g., real estate, fine art) traditionally inaccessible or illiquid for individual investors.

- Example: RealT tokens represent fractional ownership in real estate properties, enabling global investment and diversification opportunities.

- Cross-Border Payments and Remittances:

- Purpose: Asset-backed tokens facilitate efficient cross-border payments and remittances by leveraging blockchain technology’s speed, security, and low transaction costs.

- Example: XRP by Ripple Labs aims to streamline international payments using XRP tokens as a bridge currency, enhancing liquidity and reducing settlement times.

Examples of Asset-Backed Tokens

- Tether (USDT):

- Asset: Fiat currencies (USD, EUR, etc.)

- Functionality: USDT maintains a 1:1 peg to the US Dollar, providing stability and liquidity in cryptocurrency trading and decentralized finance (DeFi) applications.

- Paxos Standard (PAX):

- Asset: USD held in FDIC-insured banks

- Functionality: PAX offers a regulated stablecoin option backed by US Dollars, facilitating seamless transactions and compliance with regulatory standards.

At SDLC CORP, we specialize in comprehensive crypto token development services tailored to meet the diverse needs of blockchain projects. Our expertise spans across various facets of tokenization, ensuring robust solutions that align with industry standards and client objectives.

We offer end-to-end solutions for creating custom crypto tokens that cater to specific functionalities and use cases within blockchain ecosystems. Whether it’s utility tokens for access and rewards, governance tokens for decentralized decision-making, or asset-backed tokens for stability and value representation, our team leverages cutting-edge technology to deliver secure and scalable token solutions.

Our NFT token development services empower clients to tokenize unique digital assets, including art, collectibles, and virtual real estate, on blockchain platforms. We ensure seamless integration of smart contracts and metadata standards, enabling verifiable ownership and provable scarcity for digital collectibles and assets.

SDLC CORP excels in DeFi token development, offering solutions that drive innovation in decentralized finance. From yield farming tokens to governance tokens for DeFi protocols, we facilitate secure token creation and integration with DeFi platforms, enhancing liquidity, yield generation, and decentralized governance.

Our stablecoin development services focus on creating stable digital assets pegged to fiat currencies or commodities. We ensure regulatory compliance and stability mechanisms, facilitating seamless transactions, hedging against market volatility, and promoting wider adoption of blockchain-based financial solutions.

SDLC CORP offers expert tokenomics consulting to optimize token design, distribution strategies, and economic models. We provide in-depth analysis and strategic guidance to enhance token utility, value proposition, and ecosystem sustainability, helping clients achieve their long-term goals in the competitive crypto market.

SDLC CORP specializes in Security Token Offering (STO) development services, offering expert consultancy to optimize the design, distribution strategies, and economic models of security tokens. We provide comprehensive analysis and strategic guidance to enhance token utility, strengthen value propositions, and ensure sustainability within the regulatory framework. Our tailored solutions assist clients in achieving their long-term objectives in the competitive landscape of security token offerings, empowering them to navigate complexities and capitalize on opportunities in the evolving digital securities market

Why Choose SDLC CORP?

- Expertise: Deep understanding of blockchain technology and tokenization trends.

- Custom Solutions: Tailored token development aligned with client-specific requirements.

- Security: Emphasis on robust security measures and compliance with industry standards.

- Innovation: Continuous innovation in tokenomics and decentralized technologies.

- Client-Centric Approach: Dedicated support and transparent communication throughout the development lifecycle.

Partner with SDLC CORP for cutting-edge crypto token solutions that drive growth, innovation, and value creation in the digital economy. Contact us today to explore how we can transform your blockchain vision into reality. Hire cryptocurrency developers who are skilled in crafting bespoke solutions tailored to your specific needs and goals.

Conclusion

Asset-backed tokens play a crucial role in bridging the gap between traditional finance and blockchain technology by offering stability, transparency, and tangible value within decentralized ecosystems. Their characteristics, operational mechanisms, and functionalities ensure reliability in financial transactions, investment diversification, and global payments, contributing to the broader adoption and utility of cryptocurrencies across various industries and use cases. Understanding asset-backed tokens helps stakeholders navigate and leverage their benefits for enhanced financial efficiency and innovation within the digital economy. For expert assistance in developing and deploying asset-backed tokens, consider partnering with Cryptocurrency Development Services.