What should investors know before participating in an ICO?

Introduction

As the cryptocurrency market continues to evolve, Initial Coin Offerings (ICOs) have emerged as a popular method for startups and blockchain projects to raise funds. However, participating in an ICO can be complex and risky for investors. In this comprehensive guide, we’ll explore ten key points that investors should consider before participating in an ICO, providing detailed explanations, examples, and statistics to help investors make informed decisions and navigate the ICO landscape with confidence.

1. Conduct Thorough Due Diligence

Before investing in an ICO, it’s crucial to conduct thorough due diligence on the project, team, technology, and market potential. Research the whitepaper, team members’ backgrounds, project roadmap, and partnerships to assess the credibility and feasibility of the ICO. Look for red flags such as lack of transparency, unrealistic promises, or plagiarized content.

Explanation

Investors should delve deep into the details of an ICO project to understand its vision, goals, and execution strategy. By scrutinizing the whitepaper, investors can assess the project’s technological innovation, market fit, and competitive advantage. Additionally, evaluating the experience and expertise of the project team can provide insights into their ability to deliver on promises and navigate challenges. For example, a study by ICOrating found that 80% of ICOs in 2017 were identified as scams or failed projects, highlighting the importance of due diligence in mitigating investment risks.

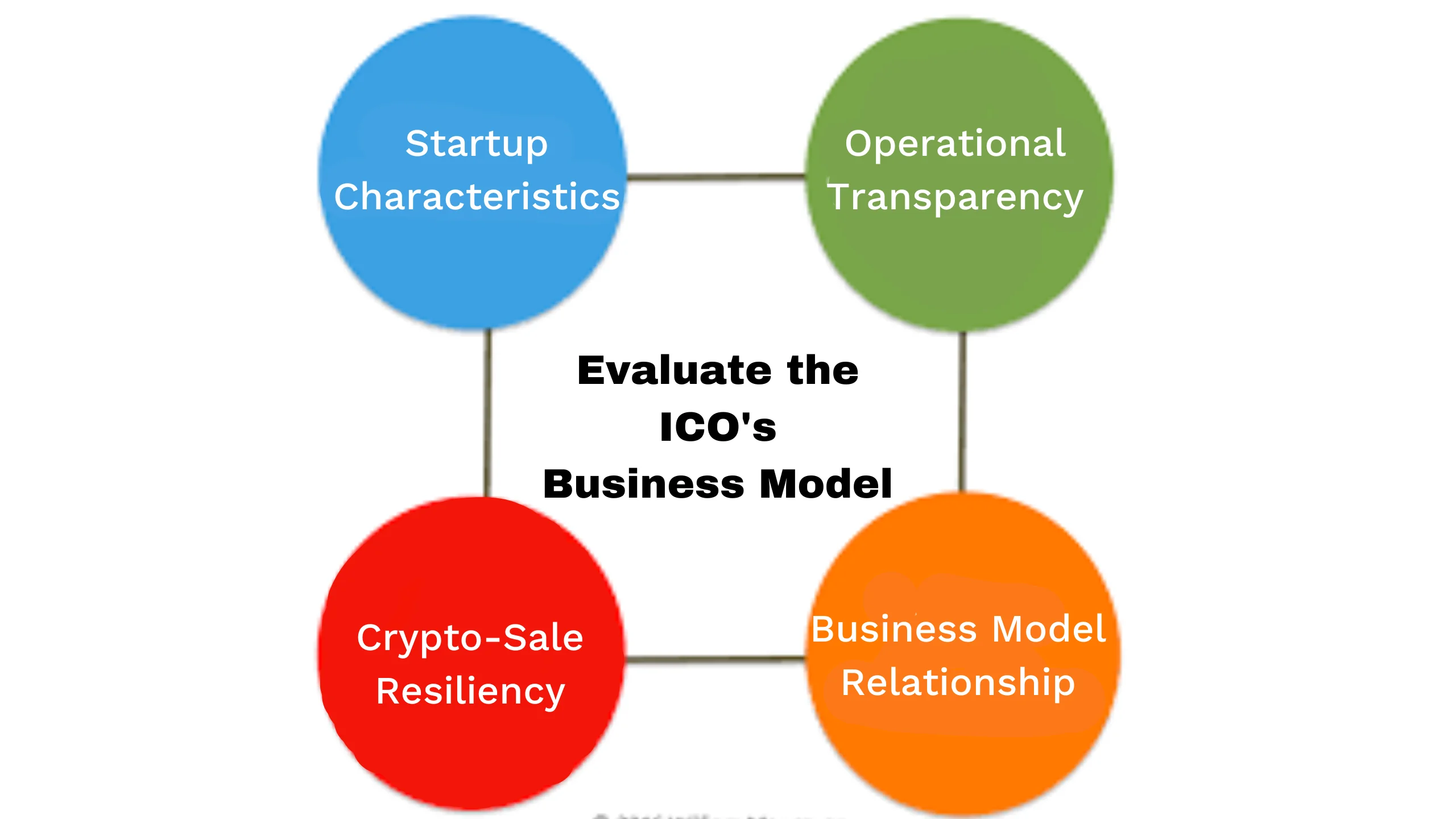

2. Evaluate the ICO's Business Model

Assess the ICO’s business model, revenue streams, and token economics to determine its long-term sustainability and value proposition. Consider how the project plans to generate revenue, allocate funds raised during the ICO, and incentivize token holders to participate in the ecosystem. Evaluate whether the ICO offers a viable solution to a real-world problem and has a clear path to adoption and monetization.

Explanation

Investors should analyze the fundamental aspects of an ICO’s business model to gauge its potential for success and profitability. Understanding the mechanics of token economics, including token distribution, utility, and scarcity, is essential for assessing the value proposition of the ICO. For instance, projects that offer utility tokens with clear use cases and demand within their ecosystems are more likely to attract investor interest and sustain long-term value appreciation. Conversely, ICOs with poorly designed tokenomics or unsustainable revenue models may struggle to gain traction and deliver returns to investors.

3. Assess Regulatory Compliance and Legal Risks

Evaluate the ICO’s regulatory compliance and legal risks, taking into account the regulatory environment in relevant jurisdictions. Determine whether the ICO complies with securities laws, AML/KYC regulations, and other regulatory requirements. Assess the ICO’s legal structure, jurisdiction of incorporation, and potential exposure to legal challenges, enforcement actions, or regulatory scrutiny.

Explanation

Investors should be aware of the regulatory landscape surrounding ICOs and assess the legal risks associated with their investments. Regulatory compliance is critical for ICOs to operate within the bounds of the law and maintain investor trust. For example, ICOs that offer securities tokens may be subject to securities regulations in various jurisdictions, requiring compliance with registration, disclosure, and investor protection requirements. Failure to comply with regulatory requirements can result in legal repercussions, such as fines, penalties, or enforcement actions, impacting the viability and value of the ICO investment.

4. Evaluate the Technology and Product Development

Assess the technology behind the ICO project and evaluate its readiness, scalability, and potential for adoption. Review the project’s GitHub repository, codebase, and development activity to gauge the progress and quality of the technology. Consider whether the project has a working prototype, alpha/beta version, or minimum viable product (MVP) that demonstrates its functionality and utility.

Explanation

Investors should carefully evaluate the technological aspects of an ICO project to assess its feasibility and potential for long-term success. A strong technological foundation is essential for driving innovation, achieving scalability, and delivering value to users. By reviewing the project’s GitHub repository and development activity, investors can gain insights into the project’s technical prowess, code quality, and commitment to ongoing development. Additionally, assessing the presence of a working prototype or MVP can provide validation of the project’s capabilities and demonstrate progress towards achieving its objectives.

5. Analyze Market Demand and Competition

Examine the market demand for the ICO’s product or service and assess the competitive landscape to understand the project’s positioning and differentiation. Identify existing competitors, market trends, and potential challenges that could impact the adoption and success of the ICO. Evaluate the project’s unique value proposition, market fit, and potential for capturing market share in the industry.

Explanation

Investors should analyze the market dynamics and competitive landscape to assess the demand for the ICO’s solution and its ability to gain traction in the market. Understanding market trends, customer needs, and competitive positioning can help investors gauge the project’s potential for success and market acceptance. By conducting market research and competitor analysis, investors can identify opportunities, threats, and competitive advantages that may influence the ICO’s performance and investment potential.

6. Consider Risk Factors and Investment Challenges

Identify and evaluate the potential risks associated with investing in the ICO, including technological risks, regulatory risks, market risks, and project-specific risks. Assess the likelihood and impact of each risk factor on the investment outcome and develop risk mitigation strategies to minimize exposure. Consider factors such as project execution, market volatility, liquidity constraints, and geopolitical risks.

Explanation

Investing in ICOs carries inherent risks, and investors should be prepared to assess and manage these risks effectively. By identifying and evaluating potential risk factors, investors can make informed decisions and mitigate the impact of adverse events on their investment portfolios. Risk factors such as technological vulnerabilities, regulatory uncertainties, market volatility, and project-specific challenges can affect the success and viability of an ICO investment. Therefore, investors should conduct thorough risk assessments and implement risk management strategies to protect their capital and maximize returns.

7. Understand Token Utility and Use Cases

Understand the utility and use cases of the ICO’s tokens within its ecosystem, including their function, purpose, and value proposition. Evaluate whether the tokens provide access to products or services, enable participation in governance mechanisms, or serve as a means of exchange or store of value. Assess the demand drivers, tokenomics, and economic incentives that drive token adoption and value creation.

Explanation

Investors should have a clear understanding of the utility and use cases of the tokens offered by an ICO to assess their investment potential. Tokens that offer tangible benefits, such as access to products/services, voting rights, or revenue-sharing mechanisms, are more likely to attract investor interest and sustain long-term value. Evaluating the demand drivers, tokenomics, and economic incentives within the ICO’s ecosystem can provide insights into the token’s utility and potential for value appreciation. Additionally, understanding the role of tokens in facilitating network effects, incentivizing user participation, and driving ecosystem growth is essential for assessing their long-term viability and investment attractiveness.

8. Assess Tokenomics and Token Distribution

Evaluate the tokenomics of the ICO, including token supply, distribution, allocation, and vesting schedules. Understand the mechanisms for token issuance, distribution, and governance, as well as the impact of tokenomics on supply-demand dynamics and price stability. Assess whether the token distribution model is fair, transparent, and aligned with the interests of investors and ecosystem participants.

Explanation

Tokenomics plays a crucial role in determining the value and sustainability of an ICO project. Investors should analyze the token supply, distribution, and allocation mechanisms to understand the potential impact on token scarcity, liquidity, and price dynamics. Projects with transparent and equitable token distribution models are more likely to attract investor confidence and support long-term price stability. Evaluating token vesting schedules, lock-up periods, and governance mechanisms can provide insights into the project’s commitment to token holder interests and ecosystem governance.

9. Consider Liquidity and Secondary Markets

Before investing in an ICO, it’s crucial to conduct thorough due diligence on the project, team, technology, and market potential. Research the whitepaper, team members’ backgrounds, project roadmap, and partnerships to assess the credibility and feasibility of the ICO. Look for red flags such as lack of transparency, unrealistic promises, or plagiarized content.Assess the liquidity of the ICO tokens and the availability of secondary markets for trading and liquidity provision. Evaluate the listing plans, exchange partnerships, and trading volumes of the tokens to gauge investor interest and market liquidity. Consider the potential risks and challenges associated with liquidity, including price volatility, market manipulation, and regulatory scrutiny.

Explanation

Investors should consider the liquidity of ICO tokens and the accessibility of secondary markets for trading and liquidity provision. Liquidity is essential for investors to buy, sell, and trade tokens freely, and lack of liquidity can impact price discovery and investor confidence. Evaluating the listing plans, exchange partnerships, and trading volumes of ICO tokens can provide insights into market liquidity and investor interest. Additionally, investors should be aware of the potential risks and challenges associated with liquidity, such as price manipulation, slippage, and regulatory concerns, and develop risk management strategies accordingly.

10. Diversify Your Investment Portfolio

Diversify your investment portfolio by allocating funds to a range of ICO projects with different risk profiles, industries, and growth potential. Avoid putting all your capital into a single ICO and spread your investments across multiple projects to minimize risk and maximize returns. Consider factors such as project stage, team credibility, market traction, and investment thesis when diversifying your portfolio.

Explanation

Diversification is a fundamental principle of investment strategy that helps investors manage risk and optimize returns. By spreading investments across multiple ICO projects, investors can reduce their exposure to individual project risks and industry-specific challenges. Diversification allows investors to capture opportunities in different market segments, industries, and geographic regions, mitigating the impact of adverse events on their overall investment portfolio. However, investors should conduct thorough research and due diligence on each project and allocate capital based on their risk tolerance, investment goals, and market outlook. Diversification is not a guarantee against losses, but it can help investors build a resilient and well-balanced investment portfolio over time.

Conclusion

Participating in an ICO can offer lucrative investment opportunities but also carries significant risks and challenges. By considering the ten key points outlined in this guide, investors can make informed decisions, mitigate risks, and navigate the ICO landscape with confidence. Conducting thorough due diligence, assessing regulatory compliance, evaluating technology and market dynamics, and diversifying investment portfolios are essential strategies for successful ICO investing. As the cryptocurrency market continues to evolve, investors should stay vigilant, adapt to changing market conditions, and seek professional advice when necessary to maximize their investment potential and achieve their financial goals.

Contact Us

File a form and let us know more about you and your project.

Let's Talk About Your Project

- Free Consultation

- 24/7 Experts Support

- On-Time Delivery

- [email protected]

- +15106306507