What is automated invoice processing?

Automated invoice processing is the use of technology to automate the various steps involved in handling invoices, such as receiving, validating, approving, and paying invoices. It typically involves the use of software that can extract key information from invoices, validate them against predefined rules, route them for approval, and facilitate payment, all without the need for manual intervention. This automation helps organisations streamline their invoicing processes, reduce errors, and improve efficiency.

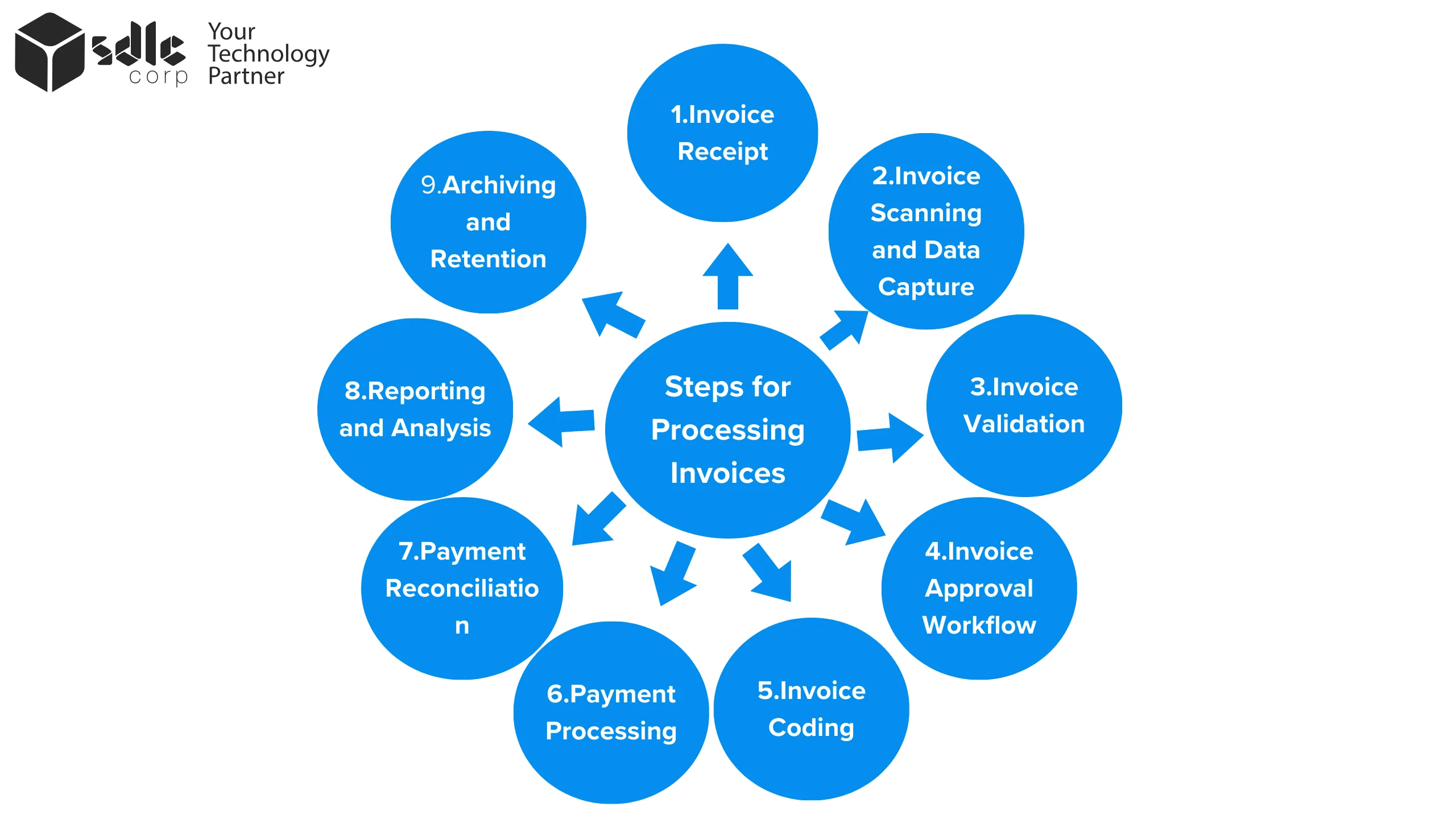

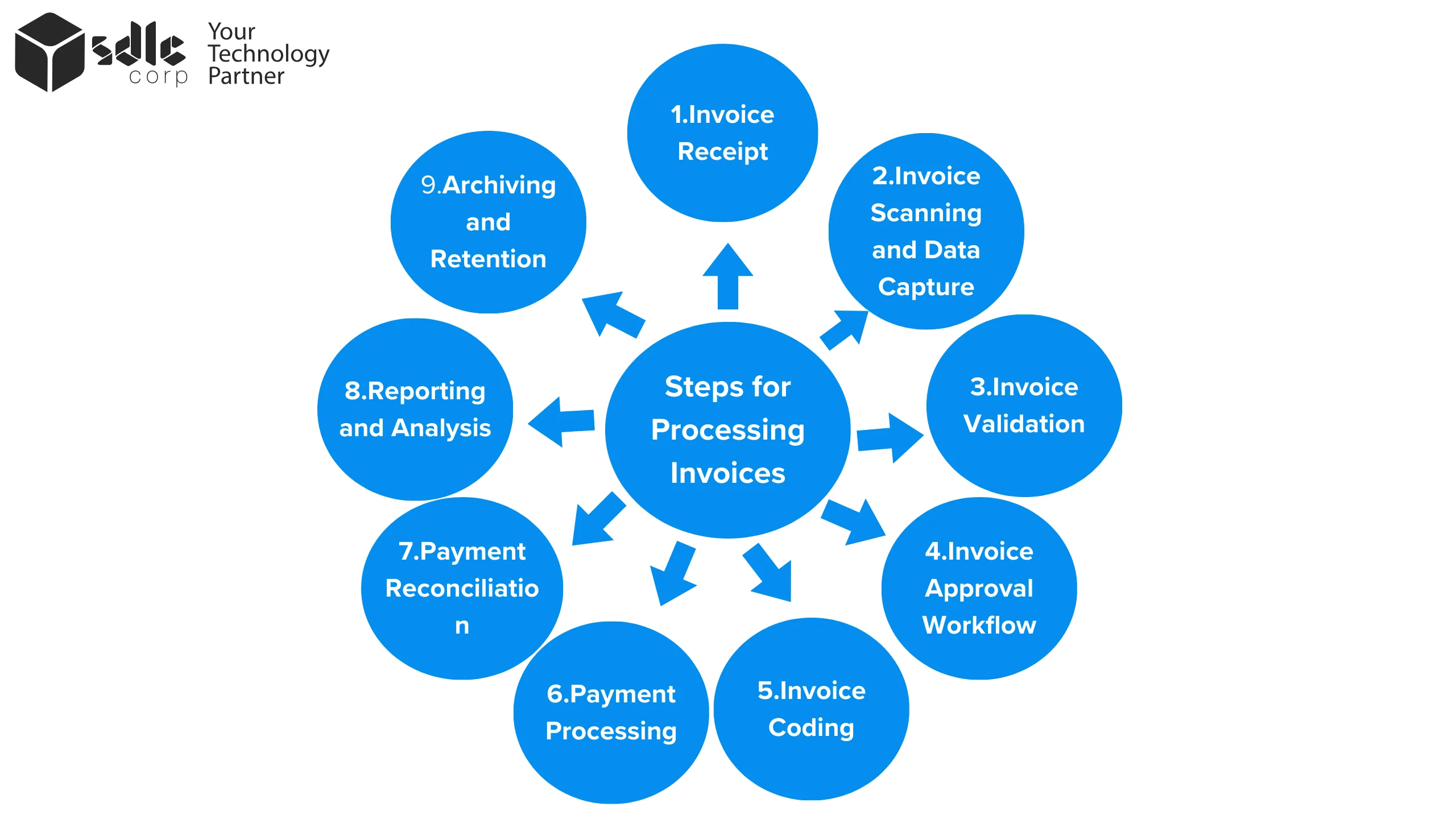

Which steps for processing invoices are as follows?

- Invoice Receipt: Invoices are received either electronically (via email or electronic data interchange) or in paper format. Electronic invoices are typically easier to process as they can be directly imported into the invoice processing software.

- Invoice Scanning and Data Capture: For paper invoices, they are scanned and converted into digital format using OCR technology. The software extracts key information from the invoice, such as the invoice number, date, amount, and vendor details.

- Invoice Validation: The software validates the invoice against predefined rules and policies to ensure accuracy and compliance. This may include checking for duplicate invoices, verifying the invoice against purchase orders and receiving documents, and ensuring the invoice meets company-specific requirements.

- Invoice Approval Workflow: Once validated, the invoice is routed for approval according to predefined workflows. Approvers are notified of pending invoices and can review them online. They can approve the invoice for payment, request corrections, or send it back for additional information.

- Invoice Coding: Invoices are coded to allocate costs to the correct general ledger accounts, cost centres, or projects. This step ensures that the financial impact of the invoice is accurately recorded in the organization’s accounting system.

- Payment Processing: Once approved and coded, the invoice is scheduled for payment. This may involve integration with the organization’s accounting or ERP system to initiate the payment process.

- Payment Reconciliation: After payment is made, the software reconciles the payment with the original invoice to ensure that the correct amount was paid to the correct vendor. Any discrepancies are flagged for investigation and resolution.

- Reporting and Analysis: The software provides reporting and analytics capabilities to track key metrics related to the invoicing process, such as invoice processing time, approval cycle times, and payment accuracy. This information can be used to identify areas for improvement and optimize the invoicing process.

- Archiving and Retention: Invoices and related documents are archived for future reference and compliance purposes. The software may offer features for secure storage and retrieval of archived invoices.

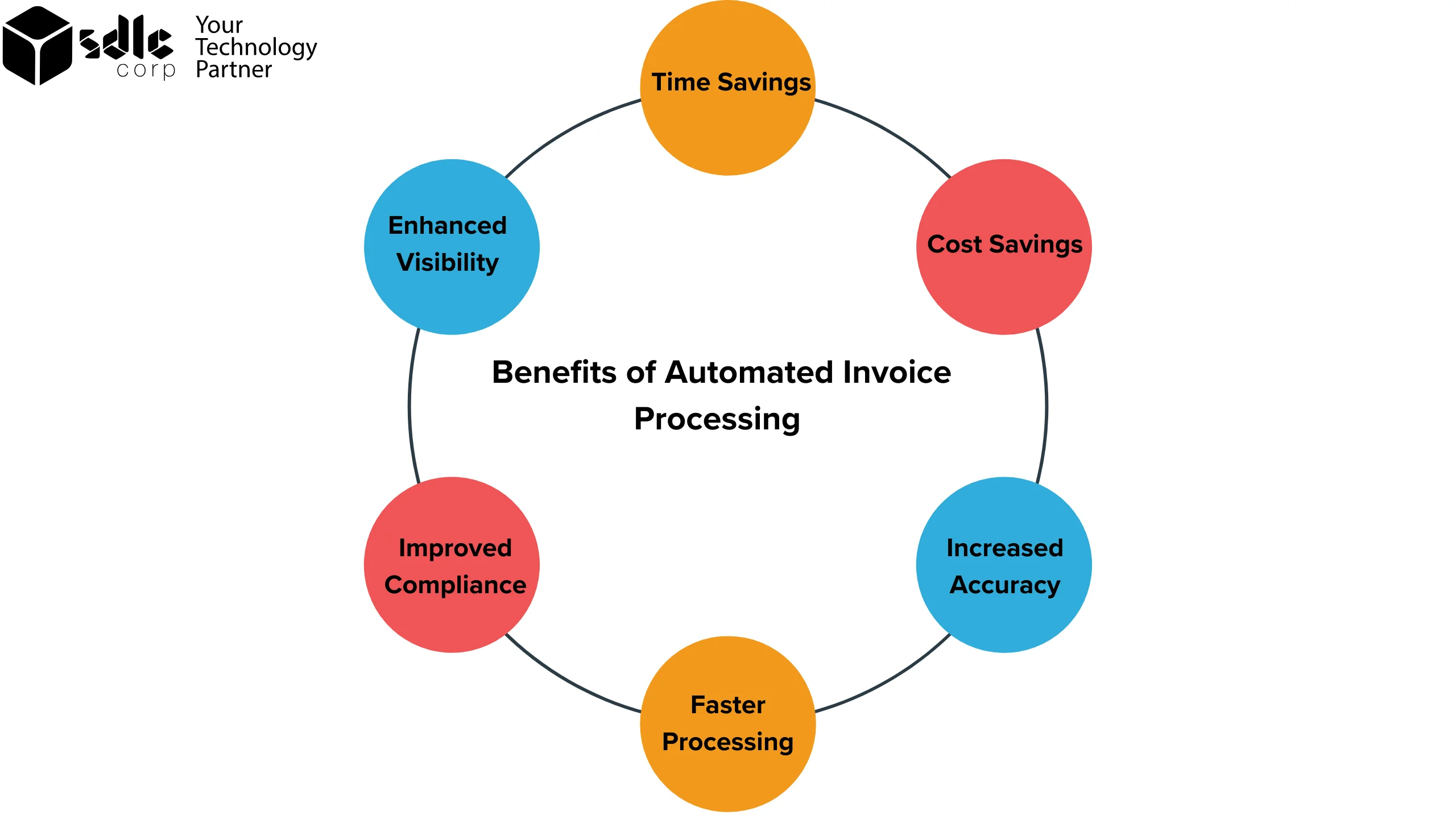

What are the Benefits of Automated Invoice Processing?

Automated invoice processing offers a wide range of benefits for organisations looking to streamline their accounts payable processes. Some of the key benefits include:

- Time Savings: Automation significantly reduces the time spent on manual data entry, validation, and approval processes. This frees up employees to focus on more strategic tasks.

- Cost Savings: By reducing the need for manual labour and minimizing errors, automated invoice processing can lead to cost savings for organizations.

- Increased Accuracy: Automation helps eliminate errors associated with manual data entry, such as typos and duplicate entries, leading to more accurate financial records.

- Faster Processing: Automated systems can process invoices much faster than manual processes, leading to shorter processing cycles and improved cash flow.

- Improved Compliance: Automated systems can enforce compliance with company policies and regulatory requirements, reducing the risk of errors and fraud.

- Enhanced Visibility: Automated systems provide real-time visibility into the status of invoices, allowing organizations to track invoices and identify bottlenecks in the process.

- Better Supplier Relationships: Faster processing times and fewer errors can lead to improved relationships with suppliers, potentially leading to discounts and other benefits.

- Scalability: Automated systems can easily scale to accommodate changes in the volume of invoices, ensuring that the process remains efficient as the organization grows.

- Audit Trail: Automated systems provide a comprehensive audit trail of all invoice processing activities, which can be valuable for internal audits and compliance purposes.

- Environmental Impact: By reducing paper usage and streamlining processes, automated invoice processing can help organizations reduce their environmental footprint.

Overall, automated invoice processing offers significant benefits for organizations looking to improve Invoice reconciliation, efficiency, reduce costs, and enhance compliance in their accounts payable processes.

Automate invoice processing for efficiency and visibility into your finances!

How Do You Guide Invoice Processing Software ?

- Features and Capabilities:

- OCR Technology: Optical Character Recognition (OCR) technology is essential for extracting data from scanned or digital invoices.

- Automation: Look for software that automates key steps such as data extraction, validation, approval routing, and payment processing.

- Integration: Ensure the software integrates with your existing accounting or ERP system for seamless data transfer.

- Compliance and Security: Choose software that complies with relevant regulations and offers robust security features to protect sensitive financial data.

- Reporting and Analytics: Select software that provides reporting and analytics capabilities to track key metrics and improve process efficiency.

- Ease of Use:

- The software should be user-friendly and intuitive, with a clear interface that makes it easy to navigate and use.

- Scalability:

- Choose software that can scale with your organization’s needs, whether you’re processing a few dozen invoices or thousands per month.

- Cost:

- Consider the cost of the software, including any upfront fees, subscription costs, and implementation expenses. Also, weigh the potential cost savings from increased efficiency.

- Customer Support:

- Look for software providers that offer comprehensive customer support, including training, troubleshooting, and ongoing assistance.

- Reviews and Reputation:

- Read reviews and testimonials from other users to gauge the software’s performance, reliability, and customer satisfaction.

- Customization:

- Consider whether the software can be customized to meet your organization’s specific needs and workflows.

- Trial and Demo:

- Before making a decision, request a trial or demo of the software to see how it works and how it fits into your organization’s processes.

How Automating Invoice Processing Save Our Time and Money?

Automating invoice processing can save your organization significant time and money by streamlining the accounts payable process and reducing manual labor. Here’s how:

- Faster Processing Times: Automated invoice processing can significantly reduce the time it takes to process invoices compared to manual methods. This can lead to quicker approvals, faster payments to suppliers, and improved cash flow.

- Reduced Manual Errors: Manual data entry is prone to errors, such as typos and duplicate entries. Automated invoice processing can help eliminate these errors, reducing the need for time-consuming manual corrections.

- Elimination of Paperwork: Automated systems can digitize and store invoices electronically, eliminating the need for paper-based filing systems. This can save time and money spent on printing, storing, and retrieving paper documents.

- Improved Compliance: Automated systems can enforce compliance with company policies and regulatory requirements, reducing the risk of errors and penalties. This can save money by avoiding costly mistakes.

- Better Visibility and Control: Automated systems provide real-time visibility into the status of invoices, allowing organizations to track invoices and identify bottlenecks in the process. This can help streamline operations and improve efficiency.

- Streamlined Approval Process: Automated systems can route invoices for approval based on predefined workflows, ensuring that invoices are approved promptly and efficiently. This can reduce delays and save time spent chasing approvals.

- Integration with Accounting Systems: Automated invoice processing software can integrate with your organization’s accounting or ERP system, streamlining the transfer of invoice data and reducing the need for manual data entry.

- Scalability: Automated systems can easily scale to accommodate changes in the volume of invoices, ensuring that the process remains efficient as your organization grows.

By automating invoice processing, your organization can save time and money, improve accuracy and compliance, and streamline operations for better efficiency and cost savings.

Streamline your accounts payable with automated invoice processing - save time, reduce errors!

FAQs

1. Can automated invoice processing help with compliance and auditing?

Yes, automated invoice processing can help with compliance by ensuring that invoices are processed according to established policies and procedures. It can also provide a detailed audit trail of invoice processing activities.

2. What are the costs associated with implementing automated invoice processing?

The costs of implementing automated invoice processing can vary depending on the solution chosen, the size of the organization, and other factors. Costs may include software licensing fees, implementation costs, and ongoing support and maintenance fees.

3.Is automated invoice processing secure?

Yes, automated invoice processing can be secure, provided that proper security measures are in place. This may include encryption of sensitive data, secure storage of invoices, and access controls to ensure that only authorized personnel can view or process invoices.

4. Can automated invoice processing handle different types of invoices?

Yes, automated invoice processing software is designed to handle various types of invoices, including paper invoices, electronic invoices, and invoices in different formats. The software uses OCR technology to extract data from scanned or digital invoices, making it compatible with different invoice types.

5. How can I implement automated invoice processing in my organization?

Implementing automated invoice processing involves selecting the right software solution for your organization’s needs, integrating it with your existing systems, and training employees on how to use the software. It may also involve working with vendors to ensure that invoices are submitted in a format that is compatible with the automated system.

Contact Us

Let's Talk About Your Project

- Free Consultation

- 24/7 Experts Support

- On-Time Delivery

- [email protected]

- +15106306507