What is invoice reconciliation?

Invoice reconciliation is the process of comparing two sets of records to ensure they are in agreement and accurate. In the context of accounting, it typically involves comparing the amounts on supplier invoices with the amounts recorded in the company’s accounting records. This process helps identify any discrepancies, such as incorrect amounts, missing invoices, or duplicate payments.

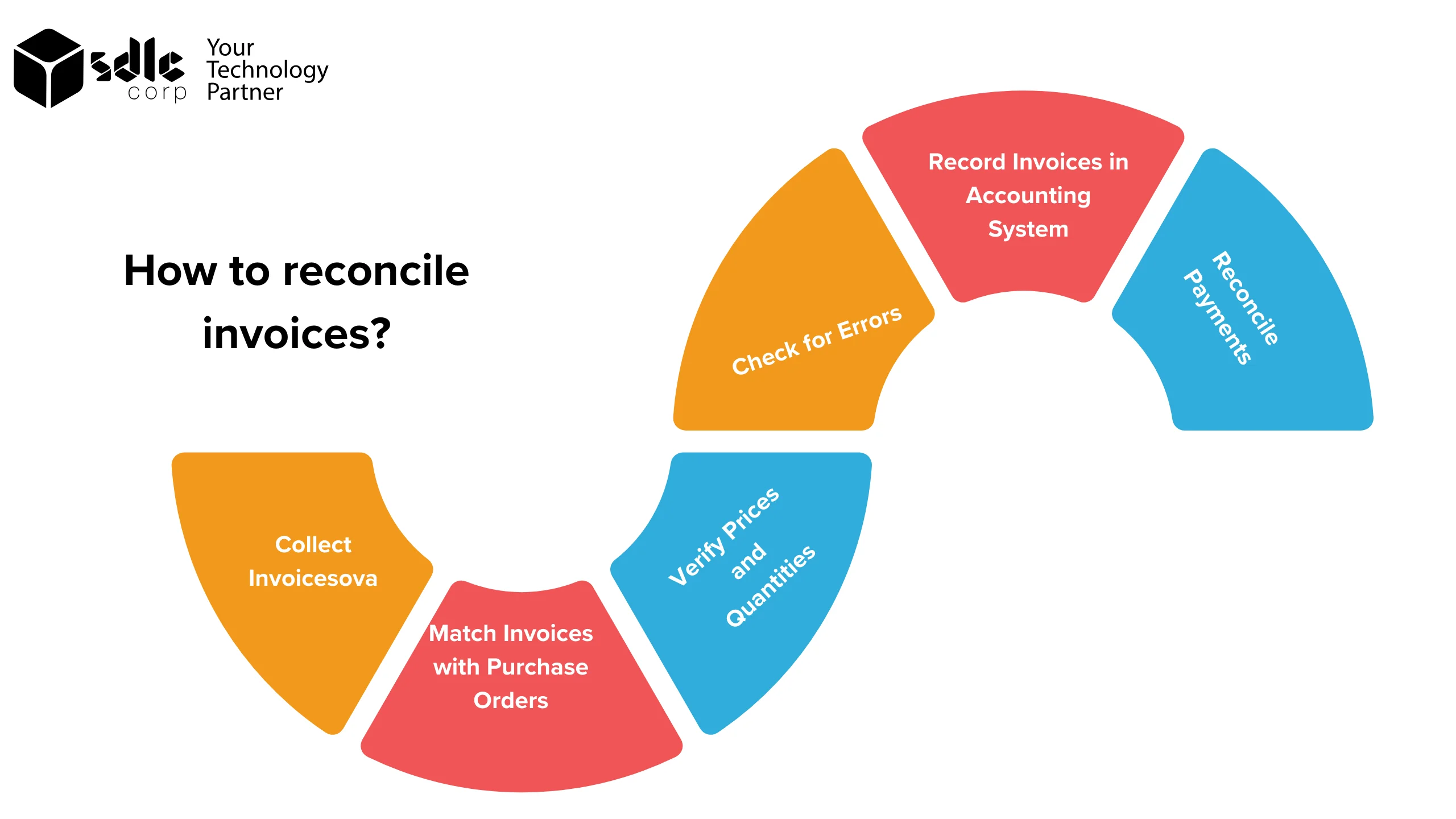

How to reconcile invoices?

To reconcile invoices effectively, follow these steps:

- Collect Invoices: Gather all invoices received from suppliers for goods or services.

- Match Invoices with Purchase Orders (POs): Match each invoice with the corresponding PO to verify that the goods or services were ordered and received.

- Verify Prices and Quantities: Ensure that the prices and quantities on the invoices match the prices and quantities specified in the POs.

- Check for Errors: Look for any errors, such as incorrect calculations, duplicate invoices, or invoices for goods or services not received.

- Record Invoices in Accounting System: Enter the invoice details into your accounting system if they are not already recorded.

- Reconcile Payments: Compare the total amount owed to suppliers based on the invoices to the total amount recorded as payable in the accounting records.

- Investigate Discrepancies: If there are any discrepancies, investigate them by reviewing the invoices, POs, and receiving documents. Contact the supplier if necessary to resolve the issue.

- Adjust Accounting Records: Make any necessary adjustments to the accounting records to correct errors or discrepancies.

- Approve Invoices for Payment: Once all invoices are reconciled and any discrepancies are resolved, approve the invoices for payment.

- Update Records: After payment is made, update the accounting records to reflect the payment and mark the invoices as paid.

- Reconcile Bank Statements: Periodically reconcile your bank statements with your accounting records to ensure that all payments to suppliers are accounted for and recorded correctly.

What’s the Purpose of Invoice Reconciliation?

Invoice reconciliation is a crucial process for businesses to verify and ensure the accuracy of their financial transactions. It involves comparing the amounts and details on supplier invoices with the corresponding purchase orders and receiving documents. The primary purpose of invoice reconciliation is to identify and rectify any discrepancies, such as incorrect amounts, duplicate invoices, or goods or services not received. By reconciling invoices, businesses can ensure that they only pay for goods or services that have been received and that they pay the correct amount. This process also helps maintain strong relationships with suppliers by ensuring timely and accurate payments. Additionally, invoice reconciliation helps businesses comply with internal controls and external regulations, contributing to overall financial transparency and integrity.

Types of Invoice Reconciliation:

There are several types of invoice reconciliation processes that businesses may use, depending on their specific needs and requirements. Some common types include:

- Three-Way Match: This is the most common type of invoice reconciliation, involving a comparison of the supplier invoice, the purchase order (PO), and the receiving report. The goal is to ensure that the quantities, prices, and terms on all three documents match.

- Two-Way Match: In this process, only the supplier invoice and the PO are compared. This is simpler than a three-way match and is typically used for low-value or non-critical purchases.

- Exception-Based Reconciliation: This approach focuses on identifying and reconciling only the discrepancies or exceptions between the invoice and the PO or receiving report. It streamlines the process by not requiring a match of all line items.

- Invoice-to-Contract Reconciliation: This type of reconciliation compares supplier invoices to the terms and conditions of a contract or agreement. It ensures that the invoiced amounts comply with the agreed-upon pricing and terms.

- Self-Billing Reconciliation: In self-billing, the buyer creates the supplier invoice based on receipt of goods or services. The reconciliation involves verifying that the self-billed invoice matches the original agreement or transaction.

- Periodic Reconciliation: This involves reconciling invoices over a specific period, such as a month or quarter, to ensure that all invoices for that period have been received, processed, and paid accurately.

Each type of invoice reconciliation has its own benefits and is used based on the complexity of the purchasing process, the value of the transactions, and the level of control required by the business.

Simplify Your Finances: Learn How Invoice Reconciliation Works!

Difference Between Manual and Automated Invoice Reconciliation

Manual and automated invoice reconciliation differ in terms of the process, efficiency, accuracy, and scalability. Here’s a comparison between the two:

| Aspect | Manual | Automated |

|---|---|---|

| Process | Involves reviewing and matching invoices, purchase orders, and receiving documents by hand. Requires manual data entry and verification. | Uses software to electronically match invoices with purchase orders and receiving documents. Streamlines the process and reduces manual intervention. Offers customizable workflows to adapt to various business needs. |

| Efficiency | Time-consuming and labor-intensive, especially for large volumes of invoices. Prone to errors and delays. | Increases efficiency by processing invoices quickly and accurately. Reduces the time and effort required for reconciliation. May employ machine learning to improve accuracy over time. Provides real-time status updates for faster decision-making. |

| Accuracy | Susceptible to errors such as data entry mistakes, incorrect matching, and missed discrepancies. | Improves accuracy by using algorithms to match invoices with purchase orders and flag discrepancies. Reduces the risk of errors. Allows for continuous improvement through feedback loops. Ensures compliance with regulatory standards and audit requirements. |

| Scalability | Limited scalability due to the manual nature of the process. Can become overwhelming for large volumes of invoices. | Highly scalable, capable of processing large volumes of invoices efficiently. Can handle increased workload without significant impact on performance. Easily integrates with existing ERP systems for seamless scalability. Offers cloud-based solutions for on-demand scalability. |

| Cost | Can be costly in terms of labor, time, and potential errors. Requires more resources for data entry and verification. | Initially higher implementation cost, but leads to long-term cost savings due to increased efficiency and reduced errors. May offer flexible pricing models based on usage. Provides transparent cost analysis for informed decision-making. |

| Audit Trail | May lack a comprehensive audit trail, making it difficult to trace and verify past transactions. | Provides a detailed audit trail of all transactions, making it easier to track and verify invoices. Enhances transparency and compliance with regulatory requirements. Facilitates forensic analysis in case of disputes or audits. |

| Customization | Limited flexibility in adapting to changing business needs and evolving regulatory requirements. | Offers customization options to tailor the reconciliation process according to specific business requirements. Allows for the creation of custom rules and workflows. Supports dynamic rule adjustments for continuous optimization. |

| Integration | Integration with other systems may be complex and time-consuming, leading to data silos and inefficiencies. | Seamlessly integrates with existing ERP, accounting, and procurement systems for data synchronization and real-time updates. Facilitates interoperability and data consistency across platforms. Supports API integration for enhanced connectivity with third-party applications. |

| User Interface | Relies on manual data entry and paper-based documentation, which can be cumbersome and error-prone. | Offers intuitive user interfaces with interactive dashboards and visualizations for easy monitoring and analysis. Provides role-based access control for enhanced security and user experience. Supports mobile applications for on-the-go access and approval workflows. |

In summary, automated invoice reconciliation offers significant advantages over manual reconciliation in terms of efficiency, accuracy, scalability, and cost-effectiveness. It helps streamline the reconciliation process, reduce errors, and improve overall efficiency in accounts payable operations.

Stay on Top of Your Books: Explore the Benefits of Invoice Reconciliation!

What are the benefits of Invoice Reconciliation?

Invoice reconciliation offers numerous benefits to businesses. Firstly, it ensures accuracy by comparing invoices with purchase orders and receiving documents, reducing the risk of errors and discrepancies in payments. This accuracy leads to cost savings by avoiding overpayments and the associated financial losses. Additionally, invoice reconciliation improves efficiency by automating the process, reducing the time and effort required for manual reconciliation.

This efficiency not only saves time but also improves cash flow management by ensuring that invoices are processed and paid on time. Furthermore, invoice reconciliation helps maintain compliance with internal controls and external regulations, providing a clear audit trail of financial transactions. Overall, invoice reconciliation is essential for businesses to improve financial management, reduce costs, and enhance supplier relationships.

What are some essential suggestions for invoice reconciliation?

Here are some essential suggestions for invoice reconciliation:

- Maintain Organized Records: Keep all purchase orders, receiving documents, and invoices well-organized and easily accessible for reconciliation purposes.

- Use Automation: Consider using software or tools that automate the reconciliation process to improve efficiency and accuracy.

- Implement Three-Way Matching: Always compare invoices with purchase orders and receiving documents to ensure that all details match.

- Regular Reconciliation: Perform invoice reconciliation regularly, such as monthly or quarterly, to stay on top of payments and avoid discrepancies.

- Verify Prices and Quantities: Double-check that the prices and quantities on the invoices match the prices and quantities specified in the Sales orders.

- Address Discrepancies Promptly: Investigate and resolve any discrepancies between invoices, purchase orders, and receiving documents as soon as possible.

- Communicate with Suppliers: Maintain open communication with suppliers to clarify any issues or discrepancies in invoices.

- Train Staff: Provide training to staff involved in the invoice reconciliation process to ensure they understand the importance of accuracy and compliance.

- Review and Improve Processes: Regularly review your invoice reconciliation processes to identify areas for improvement and implement changes as necessary.

- Document Everything: Keep detailed records of all reconciliation activities, including any adjustments made, for audit and compliance purposes.

Efficiently Manage Your Cash Flow: Discover Invoice Reconciliation Today!

Conclusion

In conclusion, invoice reconciliation is a critical process that ensures the accuracy and integrity of a company’s financial transactions. By comparing invoices with purchase orders and receiving documents, businesses can identify and rectify any discrepancies, such as incorrect amounts or missing invoices. This process helps prevent overpayments or underpayments to suppliers, leading to cost savings and improved cash flow management. Additionally, invoice reconciliation helps maintain compliance with internal controls and external regulations, providing a clear audit trail of financial transactions. Overall, implementing effective invoice reconciliation practices can help businesses improve financial management, reduce errors, and enhance supplier relationships.

FAQs

1.How often should invoice reconciliation be done?

- Invoice reconciliation should be done regularly, such as monthly or quarterly, to ensure that all invoices are processed and paid accurately and on time.

2. What are some tips for effective invoice reconciliation?

- Some tips for effective invoice reconciliation include maintaining organized records, using automation tools, implementing three-way matching, verifying prices and quantities, addressing discrepancies promptly, and communicating with suppliers.

3. How can I improve my invoice reconciliation process?

- You can improve your invoice reconciliation process by implementing automation tools, maintaining open communication with suppliers, regularly reviewing and improving processes, and providing training to staff involved in the process.

4. How often should invoice reconciliation be performed?

- Invoice reconciliation should ideally be performed regularly, such as monthly or quarterly, to stay on top of payments and avoid discrepancies.

5. How can I ensure compliance with internal controls and regulations during invoice reconciliation?

You can ensure compliance by maintaining detailed records, implementing control procedures, and regularly reviewing reconciliation processes to identify and address any compliance issues.

Contact Us

Let's Talk About Your Project

- Free Consultation

- 24/7 Experts Support

- On-Time Delivery

- sales@sdlccorp.com

- +1(510-630-6507)