Introduction

In the dynamic landscape of cryptocurrency trading, margin trading has emerged as a key strategy for investors seeking to maximize their returns. Margin trading platforms play a crucial role in facilitating this practice, offering traders the opportunity to amplify their positions by borrowing funds against their existing assets. As the popularity of margin trading continues to soar, the demand for robust and feature-rich platforms has led to the emergence of several leading players in margin trading platform development. Utilizing a white-label exchange platform can significantly expedite the launch and operation of such trading platforms, providing a customizable and scalable solution that meets the needs of traders and ensures a seamless user experience.

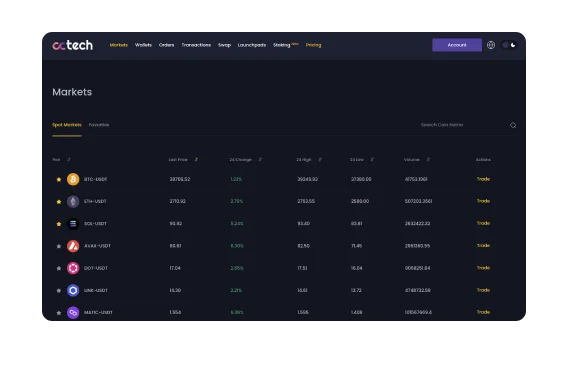

These leading players are at the forefront of innovation, leveraging advanced technologies and sophisticated trading algorithms to provide traders with seamless access to margin trading opportunities across various cryptocurrency markets. With intuitive user interfaces, advanced risk management tools, and comprehensive trading features, these platforms empower traders to execute complex strategies with precision and efficiency. As the crypto market evolves and becomes increasingly competitive, the role of margin trading platform developers becomes even more pivotal in shaping the future of digital asset trading.

What is Margin Trading platform Development?

Margin trading platform development involves creating sophisticated online platforms tailored for traders seeking to leverage their market positions by borrowing funds from brokers. These platforms provide a comprehensive suite of tools for executing trades, analyzing market trends, and managing risk, all within an intuitive and user-friendly interface. Development efforts focus on crafting advanced features that empower traders to capitalize on margin trading opportunities effectively.

From seamless trade execution to real-time market monitoring, these platforms are designed to streamline the trading process and maximize profitability for users. To ensure the successful development and deployment of such platforms, it’s crucial to hire a cryptocurrency developer with expertise in blockchain technology, trading algorithms, and security protocols, who can bring your vision to life and create a cutting-edge trading platform.

Additionally, margin trading platform development prioritizes regulatory compliance and robust security measures to safeguard users’ assets and sensitive information. Adherence to regulatory standards ensures that the platform operates within legal frameworks, providing users with peace of mind while engaging in margin trading activities. By integrating state-of-the-art security protocols and encryption techniques, developers aim to fortify the platform against potential threats and vulnerabilities, thereby enhancing the overall safety and trustworthiness of the trading environment.

Business Advantages of Margin Trading Exchange Development

1. Amplified Trading Activity:

Incorporating margin trading features into your exchange platform can stimulate heightened trading activity. With the ability to leverage borrowed funds, traders can execute larger orders, thereby increasing overall trading volumes and liquidity in the market.

2. Revenue Generation Potential:

Implementing a margin trading module presents lucrative revenue streams for the exchange. Through fees, interest charges on borrowed funds, and capitalizing on trade spreads and slippage, exchanges can capitalize on income generation opportunities while providing valuable services to traders.

3. Expansion of User Base:

Margin trading crypto exchange development enables traditional exchanges to diversify their customer base. By catering to the demands of traders seeking leverage, short-selling, and hedging options, exchanges can attract a broader spectrum of users, enhancing market reach and competitiveness.

4. Heightened Market Competitiveness:

By continually enhancing their service offerings and introducing innovative features, exchanges can distinguish themselves from competitors. This proactive approach to margin trading development not only enhances user experience but also strengthens the exchange’s position in the competitive market landscape.

Why Engage in Margin Trading?

Let’s delve into the reasons:

1. Amplified Profits: Margin trading allows you to leverage borrowed funds, amplifying your profit potential. This means you can capitalize on market movements to potentially increase your gains, taking advantage of price fluctuations to maximize returns.

2. Short Selling Opportunity: Margin accounts enable you to engage in short selling, a strategy where you sell assets you don’t currently own, anticipating to repurchase them at a lower price in the future. This feature provides traders with added flexibility to benefit from market downturns, enhancing profit opportunities.

3. Increased Trading Activity: Incorporating margin trading functionalities into your trading platform encourages traders to participate more actively. By facilitating larger orders through borrowed funds, margin trading can significantly boost trading volumes, fostering a more dynamic and liquid market environment.

The essential components that define an exemplary margin trading exchange platform:

1. Compliance: Upholding legal and regulatory standards for secure operations.

2. Asset Variety: Offering a wide array of cryptocurrencies for diverse trading options.

3. User-Friendly Interface: Providing an intuitive platform for seamless trading experiences.

4. Transparent Fees: Establishing clear and competitive fee structures for trades.

5. Security Measures: Implementing robust protocols to protect user assets and data.

6. Scalability Planning: Designing for efficient handling of increased activity and volume.

7. Leverage Options: Providing leverage choices to enhance trading potential.

8. Risk Management: Setting margin requirements and call mechanisms for effective risk control.

9. Advanced Security: Utilizing encryption and authentication for heightened platform security.

10. Support Services: Delivering responsive customer assistance for user queries and issues.

The Elite 5 Margin Trading Exchanges

Binance

Renowned for its robust trading infrastructure, vast array of supported digital assets, and substantial liquidity, Binance stands as a prominent figure in the cryptocurrency exchange realm. With leverage options of up to 5X for spot markets and an impressive 125X for futures markets, Binance provides traders with ample opportunities for margin trading.

Bybit

Bybit has emerged as a leading platform for margin trading, offering an intuitive UI and competitive fee structure. Traders flock to Bybit for access to a diverse range of markets, including spot and derivatives, while its user-centric design and robust features make it a preferred choice for seamless trading experiences and diverse market opportunities.

KuCoin

KuCoin shines as a standout option for margin trading, boasting a significant user base, support for over 800 cryptocurrencies, and robust liquidity. With leverage options of up to 10x for spot trading and 100x for derivatives, KuCoin offers traders abundant opportunities to capitalize on market movements, catering to both novice and experienced traders with its comprehensive platform and advanced trading features.

BitMEX

BitMEX, the abbreviated form of Bitcoin Mercantile Exchange, ranks among the top choices for margin trading platforms, renowned for offering leverage of up to 100X across various contracts. Renowned for its advanced trading features, BitMEX attracts traders seeking enhanced flexibility and potential gains in the cryptocurrency markets.

Coinbase

Coinbase Pro stands out as a secure and reliable margin trading exchange, providing traders with an intuitive platform and advanced trading features. It introduces a unique 5x margin level functionality specifically for Bitcoin (BTC) and Ethereum (ETH), enabling traders to amplify their positions and potentially maximize their profits. With a focus on security and regulatory compliance, Coinbase Pro ensures a safe trading environment while empowering users with the tools they need to navigate the cryptocurrency markets efficiently.

Conclusion

The landscape of margin trading platform development is characterized by a diverse array of players, each contributing to the evolution of this dynamic sector. From established giants like Binance and Coinbase to emerging platforms like Bybit and KuCoin, the market is ripe with innovation and competition. These platforms not only offer traders the ability to leverage their positions and amplify their gains but also provide advanced features, robust security measures, and user-friendly interfaces to enhance the trading experience.

As the cryptocurrency market continues to mature and regulatory frameworks evolve, margin trading platforms will play an increasingly pivotal role in facilitating trading activities and driving liquidity. With the relentless pursuit of innovation and the commitment to meeting the needs of traders, the leading players in margin trading platform development are poised to shape the future of digital asset trading and contribute to the broader adoption of cryptocurrencies worldwide. Incorporating a white-label exchange solution can further enhance these platforms by providing a customizable, ready-to-deploy option that allows for rapid market entry, robust security features, and compliance with evolving regulations. This approach ensures that margin trading platforms remain at the forefront of the industry, delivering exceptional value to traders and investors alike.