Introduction

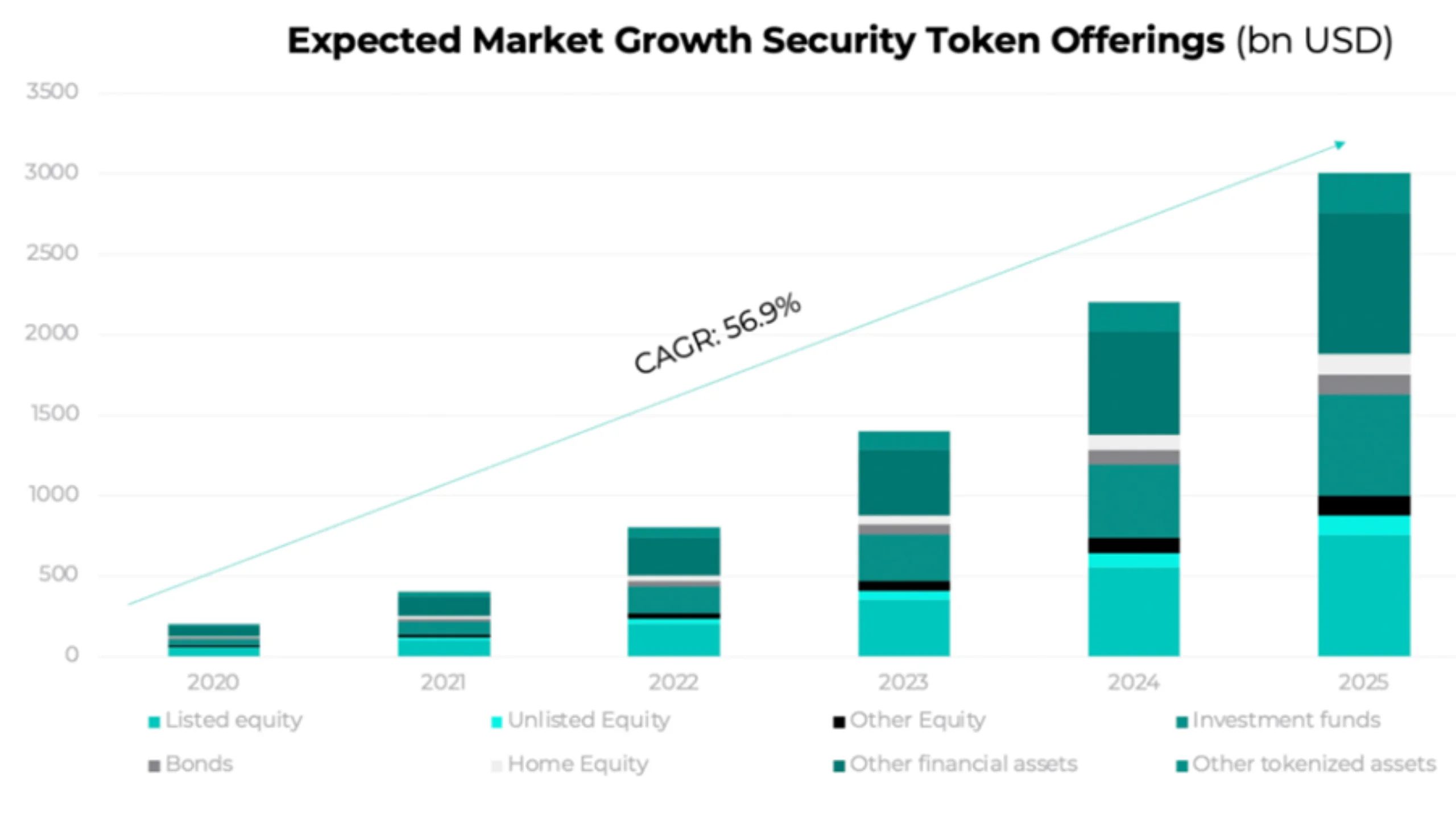

Security tokens represent a groundbreaking addition to the cryptocurrency landscape, acting as a crucial link between traditional financial assets and blockchain networks. Backed by regulations from the Securities and Exchange Commission (SEC), these tokenized assets are gaining significant traction among financial institutions, service providers, and investors.

For those considering the development of a security token exchange, the prospects for generating substantial revenue are promising. This is primarily due to the widespread acceptance and adoption of security tokens, driving a surge in demand for platforms facilitating the buying and selling of these tokens. Additionally, leveraging white-label exchange software can significantly expedite the development process, providing a robust and customizable foundation for your platform. Delving deeper into the transformative potential of security tokens in the crypto industry can provide valuable insights, reinforcing the decision to embark on building a security exchange.

What is Security Token Exchange Platform?

Security token exchanges fall under the category of Alternative Trading Systems (ATS), where they facilitate the matching of buyers and sellers for transactions. Unlike traditional exchanges, ATS platforms operate under the same regulatory framework as broker-dealers. They serve as marketplaces for securities trading and must comply with regulations set forth by the Securities and Exchange Commission (SEC).

These exchanges specifically cater to the trading of security tokens, necessitating advanced technological infrastructure to ensure compliance with SEC regulations. Unlike traditional securities, security tokens face restrictions in terms of regional jurisdiction. However, security token exchanges address these limitations by leveraging blockchain technology, enabling trading on a broader scale without geographical constraints or closure times. Moreover, blockchain facilitates the secure and instantaneous transfer of ownership of security tokens by recording ownership directly on the token itself. Additionally, utilizing white label exchange crypto software can streamline the creation and deployment of these platforms, providing a customizable, scalable, and compliant solution for trading security tokens.

How does Security Token Exchanges Drive Security Token Trading work?

Security token exchanges are instrumental in facilitating the trading of security tokens, providing investors with a secure and convenient platform to engage in transactions. These exchanges host a variety of security tokens, each specializing in different underlying assets and supporting various blockchains. They play a pivotal role in the security token ecosystem by offering the following benefits:

1. Enhancing Liquidity: Security token exchanges boost liquidity for assets by enabling fractional ownership and facilitating secondary market trading. This increased liquidity makes it easier for investors to buy and sell security tokens.

2. Diversifying Investment Opportunities: Investors gain access to a wide range of investment opportunities through security token exchanges, allowing them to invest in specific assets that align with their investment objectives and risk preferences.

3. Empowering Businesses: Security token exchanges serve as platforms for businesses to raise funds, attract investors, manage shareholders, and provide liquidity for their security tokens. This helps businesses streamline their fundraising and investor management processes.

4. Trustworthy Trading: Some security token exchanges issue their own security tokens, adding an additional layer of trust and specialization to the platform. This allows users to trade these tokens with confidence, knowing they are backed by a reputable exchange.

5. Educating Beginners: Security token exchanges offer educational resources and information to beginners, helping them understand the concept of security tokens and navigate the complexities of token trading more effectively.

Enhancing Security Token Exchange Development: Key Considerations

Developing a security token exchange entails careful consideration of various factors, particularly essential features unique to such exchanges. Some of these crucial considerations include:

1. Robust Matching Engines: Incorporating excellent matching engines is vital for efficiently pairing buy and sell orders with minimal latency, ensuring smooth trading operations.

2. Secure Hot Wallets: Ensuring the security of hot wallets is essential to provide clients with a safe environment for sending, receiving, and storing their security tokens securely.

3. Multi-Layered Security: Implementing multi-layered security protocols is crucial to bolster the exchange’s security, utilizing industry-leading features to safeguard user assets and data.

4. KYC/AML Authentication: Integration of Know Your Customer (KYC) and Anti-Money Laundering (AML) authentication mechanisms enables user identification verification while complying with regulatory protocols.

5. Support for Multiple Currency Transactions: Facilitating streamlined integration of various cryptocurrencies and fiat currencies into the exchange allows for diverse trading options tailored to the firm’s requirements.

6. Payment Gateways: Incorporating payment gateways is essential to enable the trading of security tokens with fiat currencies through multiple payment systems, enhancing accessibility and convenience for users.

7. Multilingual Support: Providing multilingual support broadens the reach of the security token exchange internationally, catering to a diverse user base.

Transformative Potential of Security Tokens:

1. Empowerment through Compliance:

Security tokens boast a programmable essence, enabling the integration of compliance protocols directly into the asset itself, with the flexibility for future adjustments. This dynamic capability ensures limitless possibilities for driving Security Token Offerings Services (STOs) with tailored rules and systems.

2. Combatting Fraud and Money Laundering:

With fewer intermediaries involved, the likelihood of corruption and manipulation in investment processes significantly diminishes. This reduction in middlemen enhances transparency and trust, fostering a more secure environment for financial transactions.

3. Strengthening the Cryptocurrency Ecosystem:

Heightened credibility and adherence to regulations linked with security tokens are set to instill confidence in traditional investors skeptical of digital currencies. This renewed trust will attract fresh market participants and capital, expanding the scope beyond Bitcoin to include security tokens in institutional adoption strategies.

4. Direct Ownership of Tokenized Assets:

Unlike utility tokens, which offer future access to products or services, security tokens provide tangible ownership of underlying assets. Investors in real estate tokens, for instance, gain fractional ownership of the physical property rather than mere promises.

5. Driving Innovation:

Regulated tokenized ecosystems pave the way for greater acceptance and innovation within the crypto sphere. This environment not only presents numerous investment opportunities but also promises substantial returns, motivating businesses and individuals to explore security token development and exchange platforms.

Cost Factors for Building a Security Token Exchange

Embarking on the journey of building a security token exchange from the ground up demands a substantial investment, typically ranging from $80,000 to $100,000. This extensive process involves assembling expert teams to craft a bespoke platform tailored to your specific requirements.

Alternatively, opting for a white-label Security Token Exchange software offers a more cost-effective solution, with expenses ranging between $8,000 and $14,000. This pre-built software can be customized to align seamlessly with your business needs, significantly reducing both development time and expenditure.

Considering factors such as development timelines and budget constraints, integrating a white-label software solution into your platform emerges as the ideal choice. However, ensuring the selection of a reputable development company is crucial to guarantee the delivery of efficient software that meets your expectations.

Leading Security Token Exchanges: A Rundown of Top Platforms

1. Open Finance:

Open Finance Security Token Exchange has established itself as a notable player in the market, catering to individual investors, institutional investors, and issuers with distinct modules. Issuers benefit from reduced costs, efficient secondary markets, and improved valuations.

2. Securitize:

Securitize stands out as a prominent security token exchange, offering users a diverse range of investment options to explore on its platform. It provides opportunities for investment and trading while also enabling business individuals to raise capital and enhance liquidity.

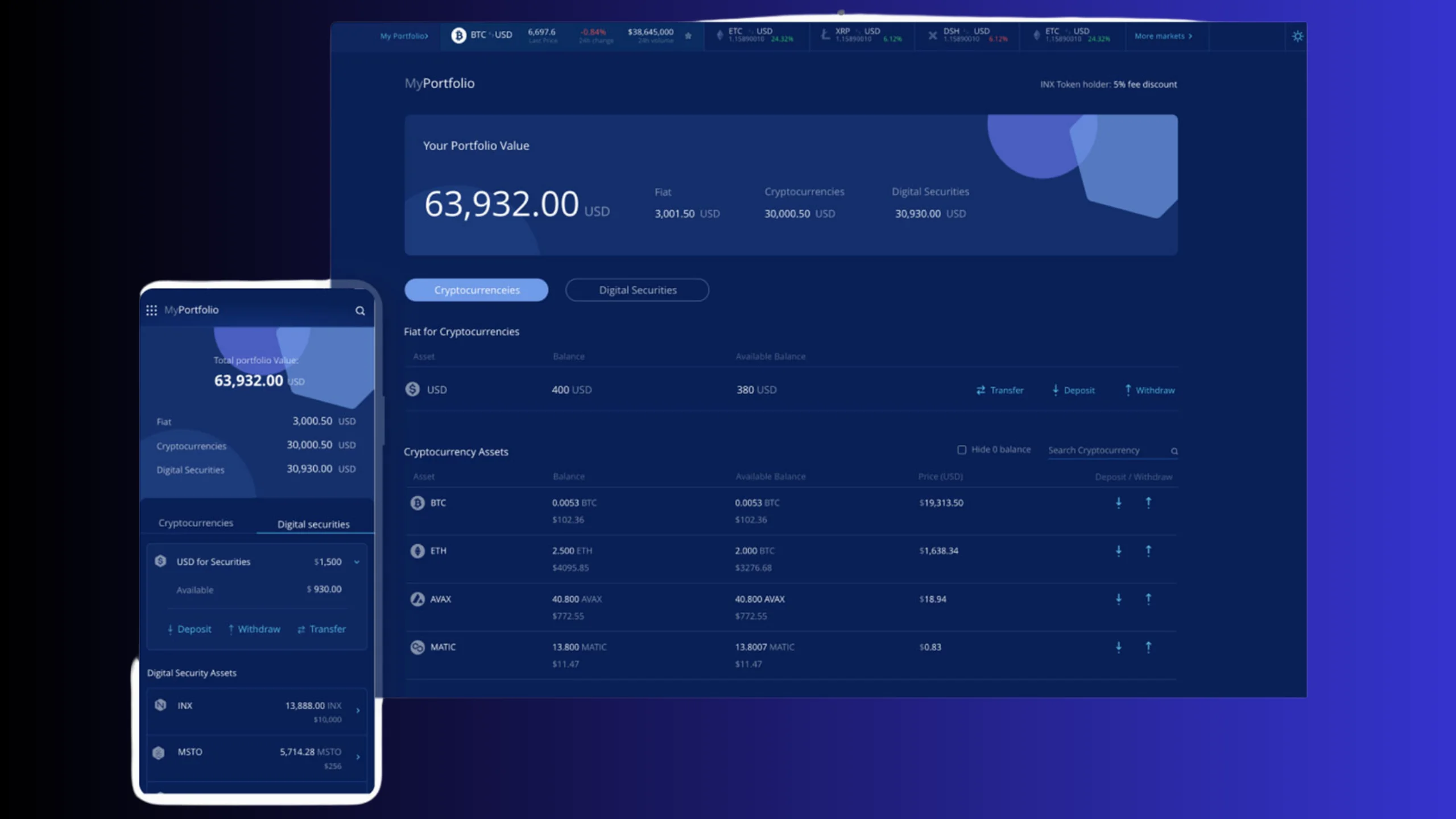

3. INX:

INX emerges as a significant player in the security token exchange arena, providing users with trading, investment, fundraising, and INX token services. It also offers guidance and educational resources to assist beginners in navigating the platform effectively.

4. tZERO:

tZERO Security Token Exchange is another noteworthy platform in the crypto landscape, offering a range of functionalities such as secondary trading solutions, tokenization services, third-party support, advisory services, and robust security features.

Conclusion

Embarking on the journey of building a security token exchange platform requires careful planning, consideration of various factors, and selecting the right development approach. Whether opting for custom development or a white-label solution, the goal remains to create a secure, compliant, and user-friendly platform that meets the needs of investors, issuers, and traders. Utilizing a white-label crypto exchange solution can significantly expedite the development process, providing a robust and customizable foundation that ensures compliance and security while offering a seamless user experience.

By adhering to regulatory standards, implementing robust security measures, and offering innovative features, a well-executed security token exchange has the potential to disrupt the financial landscape and unlock new opportunities in the crypto market. With the demand for security tokens on the rise, building a reliable exchange platform can position businesses at the forefront of this evolving industry, fostering growth and driving innovation in the digital asset space.