Introduction

Features

1. Fixed or Variable Total Supply

2. Maximum Token Limit

3. Token Distribution

4. Token Allocation Strategy:

5. Inflationary or Deflationary Mechanisms:

6. Economic Model:

do you need a foundation for an ico? :Launching an Initial Coin Offering (ICO) requires more than just a whitepaper and a promising concept. A strong foundation is essential to build trust, attract investors, and ensure compliance with regulations. This foundation encompasses thorough planning, robust legal frameworks, transparent communication, and secure technological infrastructure.

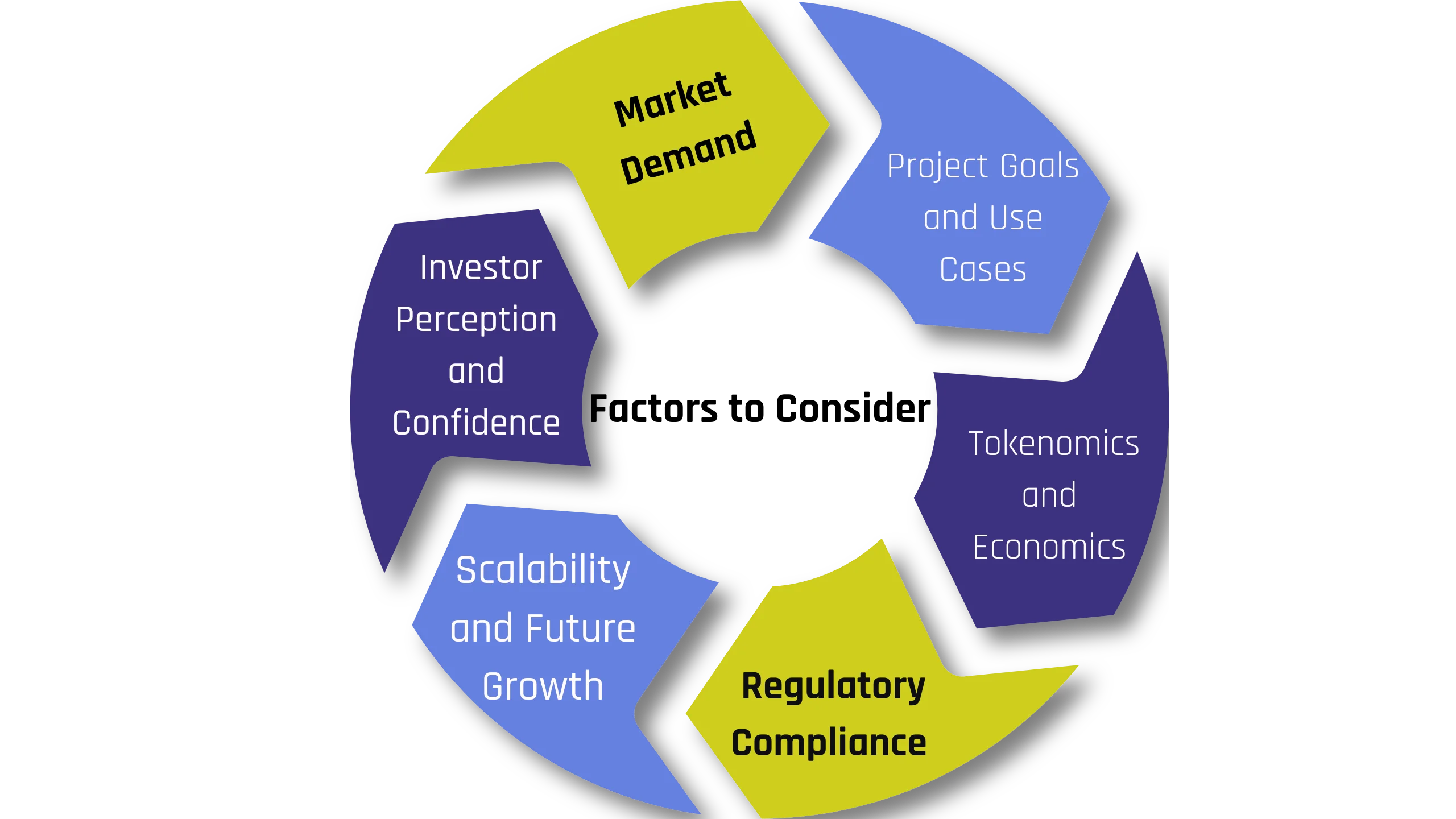

Factors to Consider

1. Market Demand

2. Project Goals and Use Cases

3. Tokenomics and Economics

4. Regulatory Compliance

5. Investor Perception and Confidence

6. Scalability and Future Growth

how to launch a legal compliant ico in singapore? :To launch a legal compliant Initial Coin Offering (ICO) in Singapore, you must adhere to the guidelines set forth by the Monetary Authority of Singapore (MAS). This involves obtaining regulatory approval, ensuring compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, and providing transparent disclosure of project details and token issuance. Engaging legal counsel familiar with Singapore’s cryptocurrency regulations is essential for navigating the complex regulatory landscape and ensuring compliance throughout the ICO process.

Discover the ideal total supply for your ICO chain today!

Common Approaches to Total Supply

1. Fixed Supply

In a fixed supply model, the total supply of tokens is predetermined and remains constant throughout the lifespan of the project. Once the tokens are created during the initial token generation event (such as an ICO or token sale), no additional tokens are minted or burned. This means that the total supply is finite and cannot be changed, providing clarity and certainty to investors and users regarding the tokenomics of the project.

2. Inflationary Model

3. Deflationary Model

4. Dynamic Supply Adjustments

Ready to set your ICO chain's total supply? Let's do it!

Benefits

1. Scarcity and Value Proposition

2. Market Perception and Investor Confidence

3. Economic Stability and Sustainability

4.Regulatory Alignment

Projects that choose an appropriate total supply are more likely to comply with regulatory requirements governing securities, cryptocurrencies, and financial instruments. Regulatory compliance is essential for maintaining investor trust, avoiding legal risks, and ensuring the project’s legitimacy and credibility in the eyes of regulators, investors, and stakeholders

5. Flexibility and Adaptability

Conclusion

Maximize fundraising opportunities for your project with SDLC Corp’s ICO development company

FAQs

1. What is the total supply of an ICO coin?

The total supply refers to the maximum number of tokens that will ever exist within the project’s ecosystem.

2. Why is choosing the total supply important?

Choosing the total supply is crucial as it impacts various aspects of the project, including tokenomics, market dynamics, investor perception, and long-term viability.

3. What factors should I consider when choosing the total supply?

Factors to consider include market demand, project goals and use cases, tokenomics and economics, regulatory compliance, investor perception, scalability, and competitive landscape.

4. What are the common approaches to total supply?

Common approaches include fixed supply, inflationary models, deflationary models, and dynamic supply adjustments.

5. How does total supply affect token scarcity and value?

Total supply influences token scarcity, with limited supply often increasing the token’s perceived value among investors and users.

Share a few details about your project, and we’ll get back to you soon.

Let's Talk About Your Project

- Free Consultation

- 24/7 Experts Support

- On-Time Delivery

- sales@sdlccorp.com

- +1(510-630-6507)