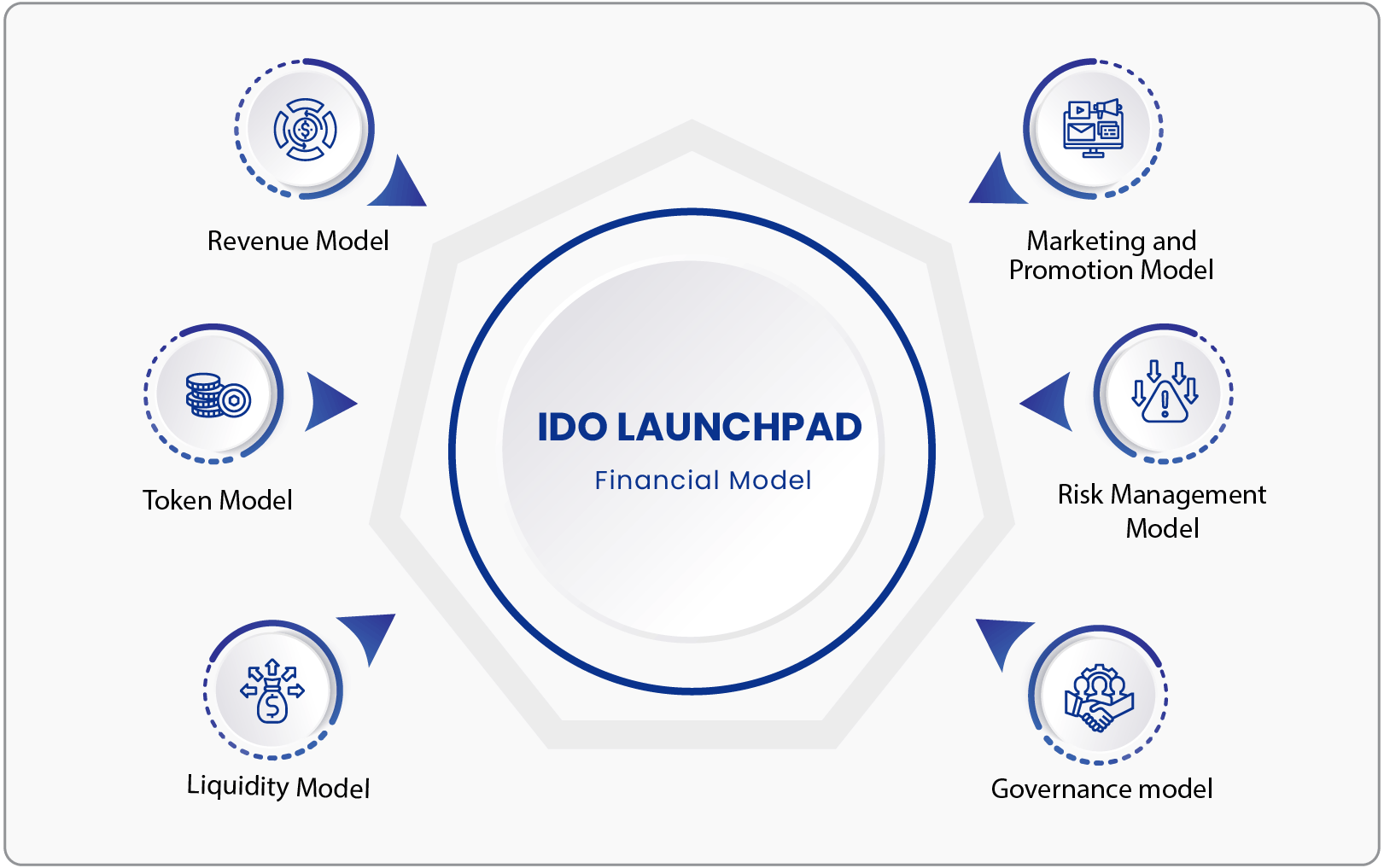

IDO Launchpad Financial Model: The IDO Launchpad has become a popular place for new cryptocurrencies or tokens to be released on decentralized platforms. (DEXs). This platform provides a means for new projects to raise funds from the community and launch their tokens on DEXs. But the success of the IDO Launchpad platform depends a lot on the financial plan it is built on.

IDO Launchpad’s financial model is an essential component of how the company gets money, how tokens are distributed, and how it makes money. It is important that the financial plan is clear, it works well, and is fair to everyone involved. The plan should have a clear mechanism for raising money, token distribution, and revenue generation. (“Read More about IDO Launchpad Business Investment in 2023″)

IDO Launchpads are becoming more and more popular in the crypto world, so it is important to look at and understand how this platform makes money. A thorough analysis of the financial model can help find the problems it has and offer ways to fix them. This will make the model work better.

This topic intends to examine the financial model of IDO Launchpad in detail. This discussion will include an examination of how the platform raises capital, distributes tokens to investors, and generates revenue. In addition, we will discuss potential solutions to the challenges associated with developing a sustainable financial paradigm for IDO Launchpad.

It is essential for the growth of new crypto projects to understand how IDO Launchpad makes money. So, the study of this topic will give you important information about how IDO Launchpads can help the crypto ecosystem grow.

IDO launchpads have seen significant growth and success in recent years. Here are some statistics that showcase their popularity:

The Significance of Having a Solid Financial Model for an IDO Launchpad

An IDO launchpad must have a firm financial model for its success and sustainability. An IDO launchpad is a platform that facilitates the introduction of new cryptocurrencies or tokens, typically via an initial decentralized offering. (IDO). Many investors and users are seeking to participate in the launch of new projects, which has led to the rise in popularity of these platforms in the crypto space.

A solid financial model is essential for an IDO launchpad because it ensures the platform’s long-term viability. This is because a well-structured financial model can assist the platform in generating revenue, covering expenses, and achieving profitability. Without a defined financial plan, an IDO launchpad may have difficulty attracting investors and users, leading to its demise.

Another important advantage of a solid financial model for an IDO launchpad is that it can aid in risk management. The cryptocurrency market is extremely volatile, with token prices and market sentiment fluctuating rapidly. A well-structured financial model can assist the launchpad in mitigating these risks by providing a clear image of the platform’s income and expenditures, as well as its profitability under various scenarios. This can assist the launchpad in making informed decisions regarding resource allocation and risk management to ensure the platform’s long-term success.

A reliable financial model can also be crucial for establishing investor and user confidence and credibility. Investors and users who are contemplating participating in a new project via an IDO launchpad want to know that the platform is well-managed and financially stable. By demonstrating the launchpad’s financial viability and its capacity to generate returns for investors, a clear and transparent financial model can help establish this trust.

Overall, a reliable financial model is essential to the success of any IDO launchpad. It can contribute to the platform’s long-term viability, risk management, and investor and user trust. The importance of a well-structured financial model will only increase as the crypto space continues to evolve and more initiatives are launched through IDO launchpads.

Creating a Solid Financial Model for Your IDO Launchpad

Components of the Financial Model of an IDO Launchpad

1. Revenue Model

The revenue strategy of an IDO Launchpad is based on platform transaction fees. These fees, which are typically a percentage of the overall transaction value, are charged to both buyers and sellers. The revenue generated by these fees is the IDO Launchpad’s main source of income. The revenue model typically includes the following components:

Platform Fees

The IDO Launchpad charges a fee for listing new initiatives on the platform. The platform fees can vary based on the project’s size, complexity, and the number of tokens being sold. Typically, the platform will charge a percentage of the funds raised during the IDO event. This revenue model incentivizes the platform to promote and incorporate high-quality, high-potential projects.

Transaction Fees

In addition to platform fees, the IDO Launchpad also generates revenue from the decentralized exchange’s transaction fees. The transaction fees are typically calculated as a percentage of the exchange’s total transaction volume. Additionally, the IDO Launchpad may charge additional fees for services such as market-making and liquidity provision.

Staking Fees

Some IDO Launchpads permit users to stake their tokens to receive rewards or participate in governance. The platform may charge a fee for staking services or take a portion of the rewards that users earn. This revenue model incentivizes users to hold tokens and partake in platform governance.

Partnership Fees

The IDO Launchpad may also generate revenue from partnerships with other cryptocurrency ventures, investors, or service providers. For marketing, consulting, or advisory services provided to these partners, the platform may charge fees. This revenue model enables the IDO Launchpad to generate additional revenue streams by leveraging its expertise and network.

Token Sales

Lastly, the IDO Launchpad could generate revenue through its own token sale. The platform may issue and offer its own tokens to investors to raise capital for platform development and operations. This revenue model coordinates the platform’s incentives with those of its users, as both parties have a stake in the platform’s success.

Overall, an IDO Launchpad’s revenue model is a crucial component of its financial model. The platform can generate a sustainable revenue stream and ensure its long-term viability by charging fees for platform services, transaction fees, staking fees, and partnership fees, and by conducting its own token sales.

Explore our other insights!

Types of IDO Launchpad and Their Unique Features

Introduction In the ever-evolving landscape of blockchain technology and decentralized finance (DeFi), Initial DEX Offerings (IDO) have

IDO Launchpad Case Study

Initial Decentralized Exchange Offering is referred to as IDO. Simply put, it refers to the technique of crowdfunding

IDO Launchpad – Business Model

IDO Launchpad for Business Model: Initial DEX Offering (IDO) has become a popular way for the cryptocurrency business

2. Token Model

The token model is an important component of an IDO Launchpad Financial Model. This section describes the structure and features of the token that will be used to collect money through the initial DEX offering. (IDO).

The token model’s main components are as follows:

Tokenomics

The economics of the coin are referred to as tokenomics. This contains information such as the total token quantity, the initial token price, token allocation to various stakeholders, and the token distribution schedule. Tokenomics should be designed to encourage investors to participate in the IDO and keep the token for the long run.

Token Utility

Token utility alludes to the token’s use cases within the ecosystem. This contains information such as the token’s functions, how it will be used to access the platform’s services, and the governance rights it grants holders. The token utility should be intended to add value to investors and encourage them to keep the token.

Token Vesting

The schedule for releasing tokens to various parties is referred to as token vesting. Details such as vesting times for team members, investors, and advisors are included. Token vesting should be intended to align the interests of all stakeholders and incentivize them to contribute to the project’s long-term success.

Token Governance

Token governance refers to the method by which token holders make decisions. This contains information such as token holders’ voting rights, the quorum required for decision-making, and the types of decisions that token holders can make. Token governance should be designed to ensure that all stakeholders’ interests are reflected and decisions are made in the best interests of the project.

Token Allocation

The distribution of tokens among various parties is referred to as token allocation. This includes specifics like token distribution to the team, investors, advisors, and community members. Token distribution should be designed to guarantee that all stakeholders are incentivized to contribute to the project’s long-term success.

The token model component of an IDO Launchpad Financial Model describes the form and characteristics of the token that will be used to collect funds via an initial DEX offering. Tokenomics, token utility, token vesting, token governance, and token allocation are important components of the token model. The token model should be intended to incentivize investors to participate in the IDO and hold onto the token over time, align the interests of all stakeholders, and ensure that decisions are made in the best interests of the project.

Navigating Financial Waters: Designing Your IDO Launchpad's Financial Model

3. Liquidity Model

The liquidity model’s goal is to assess the liquidity of the token being launched on the IDO launchpad. This model considers a variety of variables that influence token liquidity, such as market demand, trading volume, and token distribution among investors.

The following is a comprehensive breakdown of the liquidity model, which is part of the IDO Launchpad Financial Model:

Market Demand

Market demand is the first element that influences a token’s liquidity. The liquidity model should consider present market conditions as well as market demand for similar tokens. This can be accomplished by examining the trading volume and price of similar tokens in the market and determining potential demand for the token being released.

Token Distribution

The liquidity of a token is also determined by how widely it is distributed among buyers. The liquidity model should evaluate the token’s distribution among investors and find potential liquidity gaps. This can be accomplished by analyzing the number of tokens owned by various investors and finding potential token buyers or sellers.

Trading Volume

The liquidity model should take the token’s trading volume into account. The model should evaluate the potential trading volume of the token being launched by analyzing the historical trading volume of comparable tokens. This can aid in the identification of possible liquidity risks and opportunities.

Market Makers

The liquidity model should take into account market makers’ part in providing liquidity to the token. Market makers are companies that purchase and sell tokens to provide liquidity. The liquidity model should find potential market makers and evaluate their willingness to provide liquidity to the newly launched token.

Token Lockup

The liquidity model should take the lockup time for the token being released into account. Many IDO launchpads require a lockup period for the token to avoid early market dumping. The liquidity model should evaluate the lockup period’s effect on token liquidity and identify potential liquidity risks.

Token Distribution Incentives

The liquidity model should take token distribution rewards into account. Many IDO launchpads provide benefits such as airdrops and token distribution rewards. The liquidity model should evaluate the effect of these incentives on the liquidity of the token and identify possible liquidity risks.

Overall, the funding model is an important part of an IDO Launchpad Financial Model. The liquidity model can help spot possible liquidity risks and opportunities by assessing the liquidity of the token being launched, as well as inform the overall financial model for the IDO launchpad.

4. Marketing and Promotion Model

To guarantee the success of the platform launch and long-term growth, a well-defined marketing strategy must be in place. The marketing and promotional model component of the IDO Launchpad Financial Model is described below:

Target Market Analysis

Conducting a thorough analysis of the target market is the first step in developing a marketing plan for the IDO Launchpad platform. This study should include demographic data such as age, gender, location, and salary, as well as psychographic data such as cryptocurrencies and blockchain technology interests, behaviors, and attitudes.

Marketing Channels

After identifying the target market, the next stage is to determine the most effective marketing channels for reaching them. Social media, influencer marketing, community building, email marketing, and paid advertising are common marketing methods for IDO Launchpad platforms. A comprehensive strategy that combines these channels is frequently the most effective.

Branding and Messaging

The IDO Launchpad platform’s branding and messaging are important components of the marketing strategy. It is critical to create a powerful brand identity that is appealing to the target market. Across all marketing platforms, the content should be clear, concise, and consistent.

Launch Campaign

The launch campaign is a significant component of the IDO Launchpad platform’s marketing and promotional model. It should include a variety of marketing activities intended to produce buzz and interest in the platform. Social media promotions, influencer partnerships, community building efforts, news releases, and events are examples of these activities.

Ongoing Marketing

Once the IDO Launchpad platform is live, ongoing marketing activities are critical to maintaining momentum and driving long-term development. Regular social media promotions, email marketing campaigns, community building efforts, and collaborations with relevant personalities and organizations may all be part of this.

Referral and Loyalty Programs

Referral and loyalty programs are effective tools for incentivizing users to promote the IDO Launchpad platform and promoting loyalty among current users. These programs may include referral bonuses and exclusive perks for loyal customers.

Metrics and Analytics

Metrics and analytics are essential for tracking the efficacy of a marketing strategy. This includes monitoring key performance metrics like website traffic, user engagement, conversion rates, and marketing campaign ROI. These metrics can be used to improve marketing strategy and future marketing endeavors.

To summarize, the success of an IDO Launchpad platform requires a well-defined marketing and promotional strategy. The platform can achieve long-term growth and success by conducting a thorough analysis of the target market, utilizing effective marketing channels, creating a strong brand identity and messaging, executing a comprehensive launch campaign, and implementing ongoing marketing efforts. Furthermore, incorporating referral and loyalty programs, as well as tracking metrics and analytics, can improve the efficacy of the marketing plan.

5. Risk Management Model

It is critical to recognize and assess potential platform risks before implementing measures to mitigate or manage these risks. The risk management model component of the IDO Launchpad Financial Model is described below:

Risk Identification

Identifying potential risks connected with the IDO Launchpad platform is the first step in the risk management model. Legal and regulatory risks, cybersecurity risks, operational risks, market risks, and money risks are all possible.

Risk Assessment

After identifying potential risks, the next stage is to assess the likelihood and potential impact of each risk. This assessment should take into account the possibility of incurring the risk as well as the possible effect on the platform and its users.

Risk Mitigation

After assessing the risks, the next stage is to put measures in place to mitigate or manage them. Implementing security protocols, developing contingency plans, acquiring suitable insurance coverage, and ensuring compliance with legal and regulatory requirements are examples of such measures.

Risk Assessment

It is critical to continuously assess potential risks connected with the IDO Launchpad platform. This involves assessing the effectiveness of risk management measures on a regular basis and identifying new risks that may emerge.

Crisis Management

It is critical to have a crisis management strategy during a crisis or unexpected event. This strategy should include a clear protocol for communicating with stakeholders, assessing the event’s effect, and implementing crisis mitigation or management measures.

Legal and Regulatory Compliance

Legal and regulatory compliance is an important element of risk management for IDO Launchpad platforms. Compliance with securities laws and regulations, data protection laws, and other pertinent legal and regulatory requirements are all part of this.

Training and Education

Finally, it is critical to provide platform stakeholders with training and education to ensure they understand the risks associated with the IDO Launchpad platform and how to mitigate these risks. This includes instruction in best practices for cybersecurity, regulatory compliance, and crisis management procedures.

Finally, the risk management model is an important part of the IDO Launchpad Financial Model. By identifying potential risks, assessing their likelihood and potential impact, implementing measures to mitigate or manage these risks, continuously monitoring for new risks, developing a crisis management plan, ensuring legal and regulatory compliance, and providing training and education to stakeholders, the IDO Launchpad platform can minimize risks and ensure long-term success.

IDO Launchpad Finance: Building a Sustainable Model"

6. Governance Model

A key component of the IDO Launchpad Financial Model is the governance model. A well-defined governance structure is required to guarantee that the platform is managed successfully and transparently. The governance model component of the IDO Launchpad Financial Model is described below:

Governance Framework

Defining a governance framework is the first step in creating a governance model for the IDO Launchpad platform. This framework should include important stakeholders’ roles and responsibilities, decision-making procedures, and mechanisms to ensure accountability and transparency.

Governance Structure

After defining the governance framework, the next stage is to create a governance structure. This structure should include a board of directors, executive management, and any required advisory committees or working groups.

Decision-making Procedures

The governance model should include transparent and accountable decision-making procedures that engage relevant stakeholders. This could include the formation of formal committees, regular reporting and communication channels, and a system for seeking and considering stakeholder input.

Risk Management and Compliance

The governance model should also include processes for risk management and assuring legal and regulatory compliance. This could include establishing a risk management committee, conducting frequent risk assessments, and tracking and reporting on compliance with legal and regulatory requirements.

Token Governance

If the IDO Launchpad platform contains a governance token, the governance model should include procedures for managing the token and ensuring token holders’ interests are represented in decision-making processes. This could include the formation of a token holder committee, frequent reporting on token holder engagement, and mechanisms for soliciting and considering token holder input.

Transparency and Accountability

Transparency and accountability are critical components of the IDO Launchpad platform’s governance paradigm. The platform should report on key performance metrics, financial performance, and decision-making processes on a regular basis. This may include the publication of regular reports as well as the establishment of a method for soliciting and responding to stakeholder input.

Stakeholder Engagement

Finally, the governance model should include methods for engaging stakeholders such as platform users, investors, and other interested parties. This could include the creation of neighborhood forums, regular town hall meetings, and mechanisms for soliciting and considering stakeholder input.

Finally, a well-defined governance paradigm is critical for an IDO Launchpad platform’s success. By defining a governance framework, establishing a governance structure, implementing clear decision-making processes, managing risks and ensuring compliance, managing governance tokens, ensuring transparency and accountability, and engaging with stakeholders, the platform can ensure effective management and long-term success.

How DuckStarter’s Financial Model Contributes to its Success?

DuckStarter, an IDO Launchpad, is a platform that lets startups and projects on the DuckDAO community launch their own Initial DEX Offering (IDO). IDOs are a different way for startups to raise money. They can do this by selling their tokens on a decentralized market. (DEX).

DuckStarter’s success is due to a number of things, including its financial models, which have been a big part of its growth and fame. Here are a some of the most important financial plans that have helped DuckStarter succeed:

Tokenomics

A project’s tokenomics are very important to its growth, and DuckStarter has done a great job with this. The platform has a unique model for tokens that gives users benefits for taking part in IDOs. The platform’s native token, DUCK, can be used to stake in IDOs. Users who stake their DUCK tokens get a share of the IDO’s tokens. This system of rewards has brought a lot of people to the site and helped to make more people want to buy DUCK tokens.

Revenue Sharing

DuckStarter has a unique way of making money from IDOs started on its platform through revenue sharing. The platform gets a cut of the money raised during an IDO, and some of this money is shared with people who own DUCK tokens. This revenue-sharing plan gives users another reason to hold on to DUCK tokens, which has helped make the token more popular.

Token Burns

DuckStarter regularly burns a part of its DUCK token supply in order to raise the value of the DUCK token and keep a healthy token economy. Token burns lower the number of DUCK tokens in circulation, which makes them harder to get and can help drive up their value. This financial model has done a great job of making DUCK token users feel like there aren’t enough of them and that they need to act quickly.

Governance

DuckStarter has a strong governance plan that lets people who own DUCK tokens have a say in how the platform is run. This plan makes sure that the platform is run by the community and helps users trust and stay with the platform. Governance is an important part of any autonomous platform, and DuckStarter has put in place a model of governance that is open and includes everyone.

In short, DuckStarter’s success has been largely due to the financial methods it has used. The growth and popularity of the site have been helped by its tokenomics, revenue-sharing, token burns, and governance models. DuckStarter has become a top IDO launchpad in the decentralized finance (DeFi) space by building a strong and stable token economy.

Bring Your App Concept To Life With Our Skilled Team

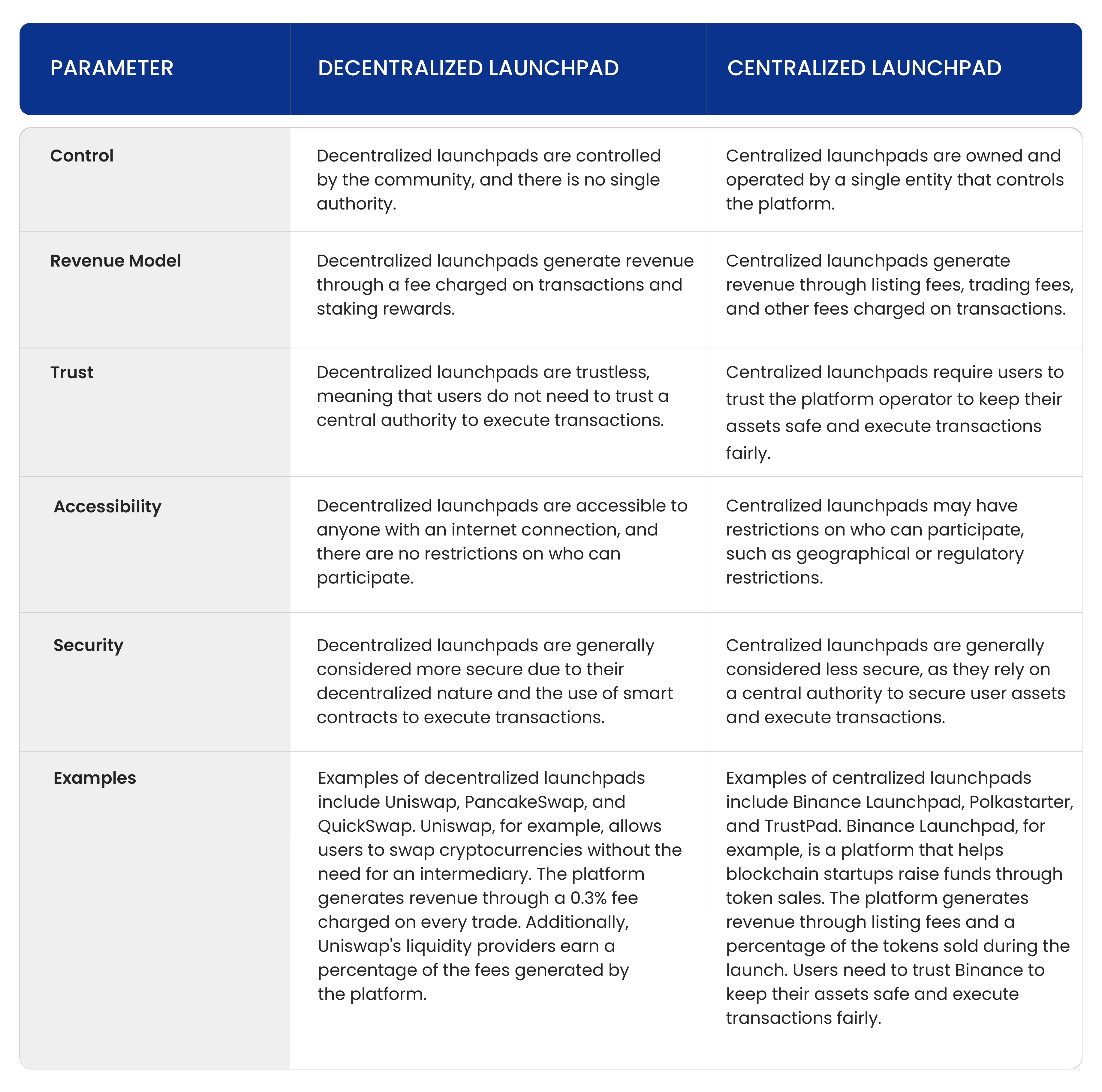

Decentralized vs. Centralized Launchpad

Conclusion

FAQs

1. How do IDO launchpads work?

An IDO launchpad is a decentralized platform that lets new blockchain projects raise money and give their tokens to early investors and donors.

2. How does the financial model behind an IDO launchpad work?

The way an IDO launchpad makes money is usually through a token sale, in which investors and other contributors can buy tokens at a cost. These tokens often come with different perks and incentives, such as voting rights and rewards for holding them.

3. Why is it a good idea to use an IDO launchpad to raise money?

IDO launchpads give new projects an easier and more open way to raise money and get access to cash. They also make it possible to give tokens to the community in a fair way, which can help build a strong group of users who are interested and involved.

4. What are some of the risks of taking part in an IDO launchpad?

5. How can investors and donors know that they are taking part in a real and reliable IDO launchpad?

Before taking part, investors and contributors should do their study on the project and the launchpad platform. They should also look for signs of openness and trustworthiness, such as a clear plan, a white paper, and team members with experience in the field.