What are Crypto Tokens?

Crypto tokens are digital assets created on a blockchain. Unlike cryptocurrencies like Bitcoin and Ethereum, which have their own blockchains, tokens are built on top of existing blockchains. These tokens can represent a variety of assets and can be used for multiple purposes within the blockchain ecosystem.

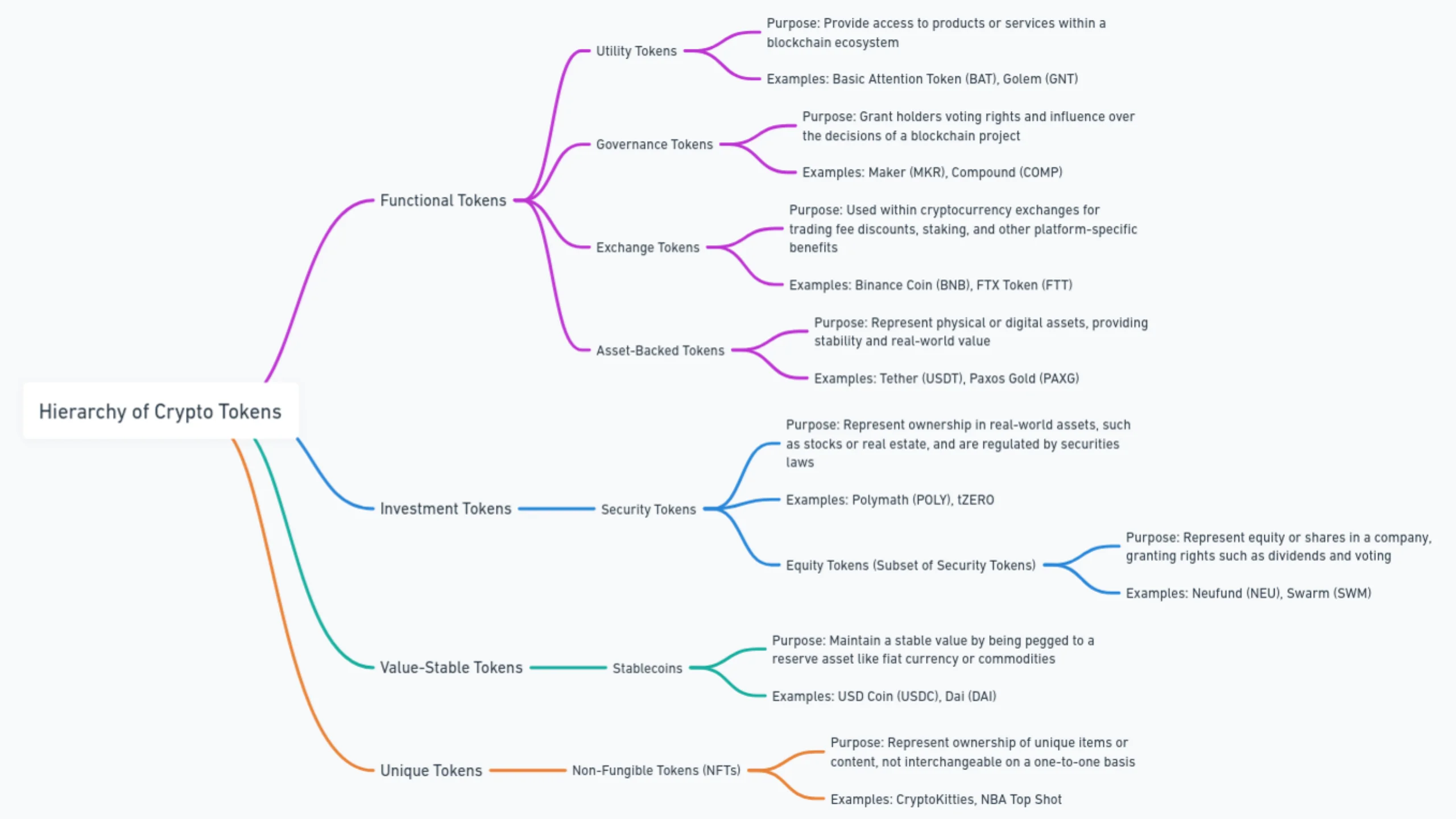

Hierarchical Structure of Crypto Tokens

Crypto tokens can be classified into four primary categories: Functional Tokens, Investment Tokens, Value-Stable Tokens, and Unique Tokens. Within each category, there are subcategories that specify their distinct purposes and applications. Let’s dive into each category and explore their respective subcategories with relevant examples.

1. Functional Tokens

Functional tokens are designed to perform specific roles within a blockchain ecosystem. They enhance the functionality and utility of decentralized applications (dApps) and blockchain platforms. This category includes utility tokens, governance tokens, exchange tokens, and asset-backed tokens.

1.1 Utility Tokens

Purpose: Utility tokens provide users with access to products or services within a blockchain ecosystem. They are often integral to the operation of decentralized applications (dApps) and platforms.

Examples:

Basic Attention Token (BAT):

- Platform: Brave Browser

- Function: BAT is used within the Brave browser to reward users for their attention while viewing ads. It also compensates content creators based on user engagement.

- Stats: As of June 2024, BAT has a market capitalization of over $1 billion and is utilized by millions of Brave browser users.

- Live Projects:

- Brave Rewards: Users earn BAT for viewing privacy-respecting ads, and content creators receive BAT tips from their audience.

- Use Cases:

- Advertising: Provides a decentralized, privacy-focused advertising model.

- Content Monetization: Allows content creators to earn directly from user engagement.

2. Golem (GNT):

- Platform: Golem Network

- Function: GNT is used to access and pay for computational power on the Golem network, which offers a decentralized marketplace for computing resources.

- Stats: Golem’s market cap is approximately $500 million, with a growing number of developers utilizing its services.

- Live Projects:

- Golem Unlimited: A platform that enables businesses and individuals to rent out their idle computing power.

- Use Cases:

- Computational Power: Offers affordable and scalable computing resources for tasks such as rendering, scientific calculations, and machine learning.

1.2 Governance Tokens

Purpose: Governance tokens grant holders the right to participate in the decision-making process of a blockchain project. They empower users to vote on changes, upgrades, and other critical aspects of the project’s protocol.

Examples:

- Maker (MKR):

- Platform: MakerDAO

- Function: MKR holders can vote on changes to the MakerDAO system, including adjustments to the collateralization ratios and risk parameters of the Dai stablecoin.

- Stats: MakerDAO manages over $5 billion in collateralized assets, and MKR has a market cap exceeding $1.5 billion.

- Live Projects:

- MakerDAO Protocol: A decentralized platform for creating and managing the Dai stablecoin, governed by MKR holders.

- Use Cases:

- Governance: Enables decentralized control over the stability and functionality of the Dai stablecoin.

- Risk Management: Allows the community to propose and vote on risk management strategies.

- Compound (COMP):

- Platform: Compound Finance

- Function: COMP tokens are used to vote on protocol upgrades, including changes to interest rates, supported assets, and other parameters within the Compound DeFi platform.

- Stats: Compound’s total value locked (TVL) exceeds $10 billion, with COMP having a market cap of around $2 billion.

- Live Projects:

- Compound Protocol: A decentralized finance platform for lending and borrowing cryptocurrencies, governed by COMP holders.

- Use Cases:

- Protocol Governance: Facilitates decentralized decision-making for protocol improvements and changes.

- Incentives: Rewards users for participating in the governance process.

1.3 Exchange Tokens

Purpose: Exchange tokens are native to cryptocurrency exchanges and provide various benefits, including trading fee discounts, staking rewards, and participation in token sales.

Examples:

- Binance Coin (BNB):

- Platform: Binance Exchange

- Function: BNB is used for discounted trading fees on Binance and for accessing other services within the Binance ecosystem, such as staking and participating in token sales (Launchpad).

- Stats: BNB has a market capitalization of over $50 billion and is among the top 10 cryptocurrencies by market cap.

- Live Projects:

- Binance Launchpad: A platform for launching new tokens, where users can participate using BNB.

- Binance Smart Chain (BSC): A blockchain network supporting smart contracts and decentralized applications, with BNB as the native token.

- Use Cases:

- Fee Discounts: Reduces trading fees for users holding BNB on Binance.

- Token Sales: Allows participation in exclusive token sales and initial exchange offerings (IEOs).

- FTX Token (FTT)

- Platform: FTX Exchange

- Function: FTT provides trading fee discounts, staking rewards, and access to other benefits on the FTX platform.

- Stats: FTT has a market capitalization of around $5 billion, with FTX being one of the top exchanges by trading volume.

- Live Projects:

- FTX Staking: Users can stake FTT to receive rewards and benefits like increased referral rates and fee rebates.

- Use Cases:

- Fee Discounts: Reduces trading fees for FTX users holding FTT.

- Staking: Offers rewards and additional benefits for staking FTT tokens.

1.4 Asset-Backed Tokens

Purpose: Asset-backed tokens represent physical or digital assets, providing stability and real-world value. These tokens are pegged to assets like fiat currencies, commodities, or real estate.

Examples:

- Tether (USDT):

- Platform: Tether

- Function: USDT is a stablecoin backed by fiat currencies, primarily the US dollar, maintaining a 1:1 value peg.

- Stats: Tether’s market cap exceeds $70 billion, making it the most widely used stablecoin.

- Live Projects:

- Tether on Multiple Blockchains: USDT is available on various blockchains, including Ethereum, Tron, and Binance Smart Chain, enhancing its utility and accessibility.

- Use Cases:

- Stability: Provides a stable store of value in the volatile crypto market.

- Transactions: facilitates fast, low-cost transactions across different blockchain networks.

- Paxos Gold (PAXG):

- Platform: Paxos

- Function: PAXG is a token backed by physical gold, allowing users to own and trade gold in a digital form.

- Stats: Each PAXG token is backed by one fine troy ounce of gold stored in professional vault facilities, with Paxos managing assets worth hundreds of millions of dollars.

- Live Projects:

- Paxos Platform: Offers a range of regulated digital assets, including PAXG, ensuring transparency and security.

- Use Cases:

- Gold Ownership: Enables digital ownership and trading of physical gold.

- Hedge Against Inflation: Provides a stable investment option backed by a historically valuable asset.

2. Investment Tokens

2.1 Security Tokens

Purpose: Security tokens represent ownership in real-world assets, such as stocks, bonds, or real estate, and are subject to securities regulations.

Examples:

- Polymath (POLY):

- Platform: Polymath

- Function: POLY is used to create and manage security tokens on the Polymath platform, ensuring compliance with regulatory requirements.

- Stats: Polymath has facilitated the creation of over 200 security tokens, with a market cap of around $100 million.

- Live Projects:

- Polymath Token Studio: A platform for issuing and managing compliant security tokens.

- Use Cases:

- Token Issuance: Simplifies the process of creating legally compliant security tokens.

- Regulatory Compliance: Ensures that security tokens adhere to legal and regulatory standards.

- tZERO:

- Platform: tZERO

- Function: tZERO is a platform for trading security tokens, providing liquidity and transparency to digital securities.

- Stats: tZERO has partnerships with multiple firms and manages assets worth hundreds of millions of dollars.

- Live Projects:

- tZERO ATS: An alternative trading system for security tokens, offering a compliant and regulated trading environment.

- Use Cases:

- Secondary Market: Facilitates the trading of security tokens, enhancing liquidity.

- Investor Access: Provides a platform for investors to buy and sell digital securities.

2.2 Equity Tokens (Subset of Security Tokens)

Purpose: Equity tokens represent ownership in a company, granting rights similar to traditional shares, such as dividends and voting rights.

Examples:

- Neufund (NEU):

- Platform: Neufund

- Function: NEU tokens are used on the Neufund platform to facilitate the issuance of equity tokens representing ownership in companies.

- Stats: Neufund has raised millions of euros through tokenized equity offerings, with a market cap of around $50 million.

- Live Projects:

- Equity Token Offerings: Neufund enables companies to raise funds by issuing equity tokens to investors.

- Use Cases:

- Fundraising: Provides companies with a new way to raise capital through tokenized equity.

- Investor Participation: Allows investors to participate in equity offerings with lower barriers to entry.

- Swarm (SWM):

- Platform: Swarm

- Function: SWM tokens are used to tokenize real-world assets, including equity in businesses, making them tradable on the blockchain.

- Stats: Swarm has tokenized millions of dollars worth of assets, with a market cap of around $20 million.

- Live Projects:

- Asset Tokenization: Swarm facilitates the tokenization of various asset classes, including equity, real estate, and art.

- Use Cases:

- Asset Liquidity: Increases liquidity for traditionally illiquid assets by enabling fractional ownership and trading.

- Democratized Investment: Opens up investment opportunities to a broader range of investors.

3. Value-Stable Tokens

3.1 Stablecoins

Purpose: Stablecoins aim to provide stability in value, mitigating the volatility typically associated with cryptocurrencies.

Examples:

- USD Coin (USDC):

- Platform: Centre Consortium (by Circle and Coinbase)

- Function: USDC is a stablecoin pegged to the US dollar, ensuring a 1:1 value ratio.

- Stats: USDC has a market capitalization exceeding $25 billion and is widely used in DeFi and other blockchain applications.

- Live Projects:

- DeFi Platforms: USDC is integrated into numerous decentralized finance (DeFi) platforms for lending, borrowing, and trading.

- Crypto Payments: USDC is used for seamless and stable cryptocurrency transactions across various services.

- Use Cases:

- Stable Value: Provides a stable medium of exchange and store of value.

- DeFi Integration: Used extensively in DeFi protocols for various financial services.

- Dai (DAI):

- Platform: MakerDAO

- Function: DAI is a decentralized stablecoin pegged to the US dollar, maintained by the MakerDAO system through collateralized debt positions (CDPs).

- Stats: DAI has a market cap of over $6 billion, with widespread use in DeFi applications.

- Live Projects:

- Maker Protocol: The system that manages the creation and maintenance of DAI, governed by MKR holders.

- DeFi Platforms: DAI is used across multiple DeFi platforms for lending, borrowing, and trading.

- Use Cases:

- Decentralized Stability: Provides a stable and decentralized medium of exchange.

- Financial Services: Enables various financial services in the DeFi ecosystem.

4. Unique Tokens

4.1 Non-Fungible Tokens (NFTs)

Purpose: NFTs are used to represent ownership and prove the authenticity of unique digital or physical items, such as art, collectibles, and real estate.

Examples:

- CryptoKitties:

- Platform: Dapper Labs

- Function: CryptoKitties are collectible digital cats, each with unique attributes and characteristics, represented as NFTs on the Ethereum blockchain.

- Stats: CryptoKitties has facilitated millions of dollars in transactions, with some rare kitties selling for over $100,000.

- Live Projects:

- CryptoKitties Game: A blockchain-based game where users can breed, trade, and collect unique digital cats.

- Use Cases:

- Digital Collectibles: Provides a platform for owning and trading unique digital collectibles.

- Gaming: Integrates unique NFTs into gaming environments, enhancing player engagement.

- NBA Top Shot:

- Platform: Dapper Labs

- Function: NBA Top Shot offers collectible, tokenized NBA highlights as NFTs, allowing users to buy, sell, and trade officially licensed digital moments.

- Stats: NBA Top Shot has generated over $700 million in sales, with a rapidly growing user base.

- Live Projects:

- Marketplace: A platform for trading and showcasing tokenized NBA highlights.

- Use Cases:

- Sports Collectibles: Provides a digital platform for sports fans to own and trade official NBA highlights.

- Digital Ownership: Ensures verifiable ownership and authenticity of digital content.

Conclusion

The various types of crypto tokens, including utility, security, governance, and stablecoins, each serve distinct roles within the blockchain ecosystem. They offer versatile solutions for a myriad of applications, from facilitating transactions to granting voting rights and stabilizing value. Understanding these types of tokens is crucial for anyone looking to navigate the complex landscape of cryptocurrency and leverage their unique advantages in technological and financial innovations.