Introduction

Agentic AI for Finance enables financial systems to observe data, make decisions, and act with limited human input. Traditional automation relies on fixed rules, which often fail in volatile markets. Agentic systems introduce autonomy, reasoning, and context-aware execution, allowing financial workflows to respond continuously within defined constraints. As transaction volumes increase and regulatory pressure grows, organizations need AI that goes beyond analysis and supports responsible action across operations. Many organizations begin this journey by exploring enterprise AI development services for modern financial systems.

Understanding Agentic AI in Financial Contexts

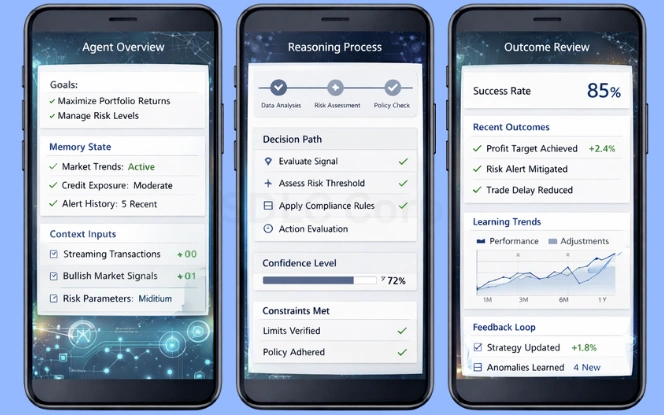

Agentic AI differs from conventional AI because it operates with goals, memory, and controlled autonomy. Instead of stopping at recommendations, it executes actions within defined constraints.

Core characteristics include:

- Continuous observation of financial data

- Context-aware reasoning based on outcomes

- Policy-bound autonomous execution

In practice, Agentic AI in Financial Services supports ongoing evaluation of transactions, portfolios, and market signals. These systems adapt their behavior over time, allowing finance teams to shift from manual intervention to strategic oversight.

This architecture closely reflects how intelligent AI agents are designed for regulated financial workflows.

Why Finance Requires Agentic Systems

Finance operates under constant uncertainty. Market volatility, evolving risks, and regulatory pressure challenge static automation models. Traditional systems follow predefined paths and struggle to adjust.

Agentic systems address these gaps by:

- Learning from prior outcomes

- Reassessing decisions in real time

- Acting without waiting for manual triggers

With Agentic AI for Financial Decision Making, financial operations respond faster to change while maintaining accuracy and governance. This capability is essential during high-risk or time-sensitive scenarios.

Many financial institutions apply this approach while strengthening decision intelligence frameworks within finance operations.

Autonomous Decision Execution in Finance Operations

Agentic AI transforms how financial decisions move from insight to execution. Autonomous agents act within approved boundaries rather than routing decisions through multiple layers.

Common applications include:

- Adjusting credit exposure dynamically

- Rebalancing portfolios during market shifts

- Resolving low-risk transaction anomalies

- Optimizing liquidity positions

These capabilities rely on Autonomous AI Agents for Finance that combine reasoning, memory, and action. Over time, feedback loops improve consistency and reduce operational friction.

Such execution models are often implemented through automation-led financial process optimization initiatives.

Risk Management with Agentic Intelligence

Risk management benefits significantly from agentic systems because risk conditions change continuously. Periodic assessments often miss emerging threats.

Using Agentic AI for Risk Management, organizations gain:

- Continuous exposure monitoring

- Real-time anomaly detection

- Automated low-risk resolution

- Context-rich escalation for high-impact risks

This balance reduces noise for risk teams while ensuring serious issues receive timely attention with full operational context.

Application Across Banking and Investment Operations

Agentic systems adapt well to both retail and institutional finance. In banking, they manage transaction flows, detect fraud, and adjust credit controls. In investments, they monitor assets and optimize execution timing.

Within Agentic AI in Banking and Investment Operations, agents:

- Coordinate across multiple systems

- Align execution with strategic intent

- Reduce delays between insight and action

This coordination improves efficiency while maintaining consistency across financial operations.

Governance, Control, and Trust

Autonomy in finance requires strong governance. Agentic systems operate within defined rules, audit trails, and approval frameworks.

Effective governance includes:

- Policy-based decision boundaries

- Continuous logging and monitoring

- Human override mechanisms

- Explainable decision paths

When designed correctly, agentic systems increase trust by reducing human error while maintaining transparency and accountability.

Implementation Considerations for Finance Teams

Successful adoption depends on structure, not speed. Finance teams must define objectives, constraints, and accountability early.

Key implementation steps include:

- Identifying processes suitable for autonomy

- Defining escalation thresholds

- Integrating reliable data sources

- Testing agents in controlled environments

Organizations that treat Agentic AI for Finance as a strategic capability achieve stronger long-term outcomes.

The Strategic Impact on Financial Roles

Agentic AI does not replace financial expertise. Instead, it reshapes how expertise is applied. Analysts move toward oversight, interpretation, and policy design.

Operational benefits include:

- Reduced manual decision cycles

- Improved consistency across workflows

- Greater focus on judgment-driven tasks

This shift allows finance professionals to operate at a higher strategic level.

Conclusion

Agentic AI for Finance represents a practical evolution in financial intelligence. By combining autonomy, reasoning, and accountability, agentic systems support faster decisions, adaptive risk management, and controlled execution. These capabilities help financial teams maintain governance while improving responsiveness. As finance grows more complex, organizations adopting agentic approaches gain resilience and operational clarity. Contact us SDLC Corp to explore how agentic systems can be applied responsibly within your financial environment.

FAQs

What Is Agentic AI for Finance?

Agentic AI for Finance refers to autonomous AI systems that observe financial data, make decisions, and take action within defined rules while adapting based on outcomes.

How Does Agentic AI Work in Financial Services?

Agentic AI in Financial Services uses intelligent agents to monitor transactions, risks, and market signals in real time while operating under governance constraints.

Why Is Agentic AI Important for Financial Decision Making?

Agentic AI for Financial Decision Making improves speed and accuracy by enabling systems to evaluate situations and act without manual delays.

Can Autonomous AI Agents Be Used Safely in Finance?

Autonomous AI Agents for Finance include audit trails, escalation thresholds, and policy controls to ensure transparency and regulatory compliance.

How Does Agentic AI Improve Risk Management?

Agentic AI for Risk Management continuously assesses exposure, resolves low-risk issues automatically, and escalates critical risks with full context.

Is Agentic AI Applicable to Banking and Investment Operations?

Agentic AI in Banking and Investment Operations supports fraud detection, portfolio monitoring, liquidity management, and execution optimization.

How Is Agentic AI Different From Traditional Financial Automation?

Traditional automation follows fixed rules, while Agentic AI adapts its behavior based on outcomes and changing conditions.