Introduction

The insurance industry is evolving rapidly, driven by technological innovation and rising customer expectations. As a result, digital transformation in insurance has become essential. However, many insurance companies still rely on outdated systems and fragmented processes. Because of this, teams face delayed claims management, weak policy management, and inconsistent customer service. Ultimately, these gaps reduce profitability and weaken trust. That’s where robust insurance ERP software like Odoo plays a transformative role.

Enter Odoo for Insurance, a powerful open-source ERP platform that brings end-to-end automation and visibility to insurance operations. So, insurers can manage accounting, claims, and customer interactions in one connected system. With this approach, Odoo ERP for insurance helps address the day-to-day challenges insurers face. For example, it can improve the customer experience in insurance and support insurance workflow automation. Meanwhile, it helps teams stay competitive and compliant in a demanding environment.

What is Odoo Financial Management?

Odoo Financial Management is part of Odoo’s complete suite of open-source business applications, which also includes CRM, Sales, Inventory, HR, and more. It is especially useful for the insurance sector, where compliance, accurate reporting, and workflow automation are mission-critical.

With Odoo ERP, insurers can manage

- Advanced Accounting Tools: Real-time dashboards, bank reconciliation, and tax management.

- Billing and Invoicing: Automate premium collections for individual and group policies.

- Claims Tracking: Full lifecycle claims management from submission to resolution.

- Budget Management: Monitor financial health and allocate

funds effectively. - Regulatory Reporting: Generate accurate, audit-ready reports instantly.

This centralized ecosystem enables ERP for insurance companies to shift from manual, reactive systems to data-driven, automated processes.

Key Benefits of Odoo for Insurance Providers

Insurance companies that implement Odoo ERP for insurance enjoy benefits such as:

- Operational Efficiency

Automation of repetitive tasks such as policy renewals, document approvals, and premium reminders reduces manual workload. - Improved Customer Experience

Deliver faster service and better transparency with insurance CRM with Odoo and client portals. - Cost Reduction

An all-in-one insurance software platform eliminates the need for multiple systems and vendors. - Better Compliance and Security

Stay ahead of evolving regulations with built-in audit trails, tax reporting, and secure data handling. - Customizable to Your Needs

For life, health, auto, or property insurance, Odoo can be tailored to any model.

Challenges Faced by the Insurance Sector

The insurance landscape presents a wide range of operational and regulatory challenges:

1. Fragmented Systems and Manual Processes

Siloed platforms for CRM, claims, and accounting increase the risk of error and inefficiency. Integration is critical.

2. Compliance and Regulatory Pressure

Regulatory frameworks are complex and ever-changing. Generating audit trails and financial reports manually can be risky and time-consuming.

3. Claims Processing Delays

Slow, manual claims processing frustrates policyholders. Odoo claims processing automates approvals and document tracking.

4. Poor Customer Experience

Policyholders expect real-time access, self-service portals, and fast communication features that legacy systems often lack.

5. Lack of Operational Visibility

Decision-makers struggle to get real-time insights across claims, finances, and customer service.

This environment calls for a smart, integrated insurance claims management system and Odoo delivers just that.

How Odoo Addresses These Challenges

Odoo offers a modular platform that integrates all insurance processes. Here’s how it tackles each challenge:

1. Centralized Policy Management

Insurers manage all aspects of a policy lifecycle in one interface term dates, beneficiaries, premium schedules, and renewals.

2. Automated Claims Workflows

Odoo claims processing automates claim scoring, document verification, and settlement tracking, significantly reducing turnaround time.

3. Compliance-Ready Tools

Generate instant, audit-ready reports. Odoo maintains a secure and complete trail of transactions and communication.

4. Self-Service Portal for Clients

Policyholders can file claims, view policy documents, and check claim status without calling an agent improving customer experience in insurance.

5. Real-Time Dashboards

Visualize claims ratios, cash flow, customer retention, and operational KPIs at a glance.

Real-World Use Cases

Here are examples of how insurers are using Odoo:

1. Auto Insurance Provider – Faster Claims

Using Odoo, claims settlement time dropped from 10 days to 3. Automated task assignment and document validation helped streamline approvals.

2. Health Insurance – Unified Client Experience

Odoo integrated customer service, billing, and policy tracking. Clients now get automated premium reminders and claim updates.

3. Life Insurance – Compliance Simplified

The firm used Odoo to automate tax and agent commission reports, reducing manual data entry by over 60%.

These are real examples of how Odoo ERP helps insurance companies automate operations and improve efficiency.

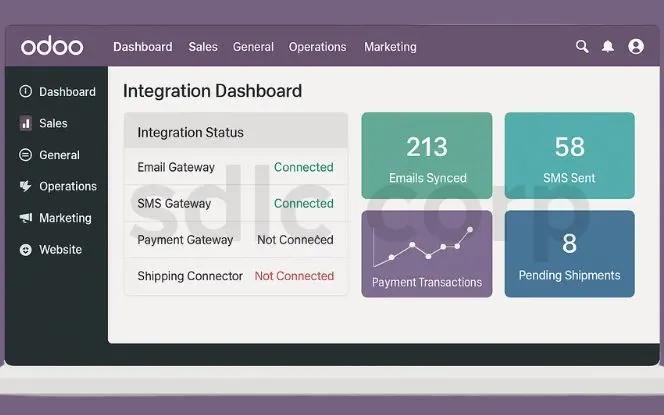

Integration Capabilities of Odoo

Odoo offers excellent integration potential, turning it into an Insurtech ERP solution:

- CRM: Nurture leads and upsell existing policyholders.

- HR and Payroll: Manage agent commissions, salaries, and compliance.

- Document Storage: Securely store all policy-related files and IDs.

- Email/SMS Gateways: Notify clients of claim updates or renewals.

- APIs: Integrate with government systems, reinsurers, and fraud detection tools.

With these capabilities, Odoo becomes a top ERP system for insurance customer service and operations.

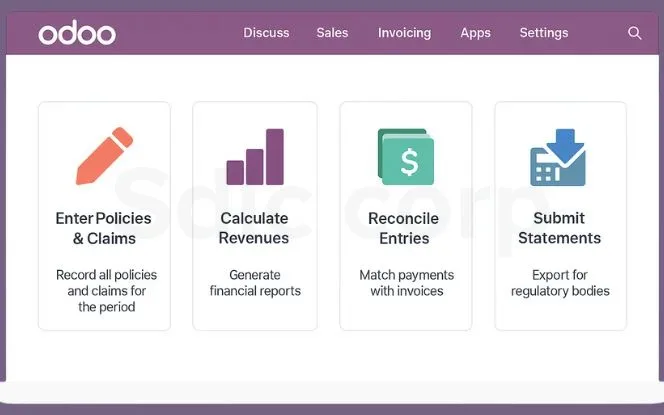

Steps to Implement Odoo Financial Management for Insurance

- Assessment & Planning

Identify gaps in policy and claims workflows. - Customization

Tailor Odoo’s modules for your lines of insurance. - Data Migration

Migrate customer and policy data securely. - Training & Onboarding

Train users for smooth adoption. - Go-Live & Support

Launch, monitor, and optimize with help from an expert Odoo development company.

Why Choose Odoo Over Other ERP Solutions?

Let’s compare Odoo ERP with big names like SAP and Oracle:

| Feature | Odoo | SAP/Oracle |

|---|---|---|

| Cost | Open-source, lower TCO | High upfront + recurring |

| Customization | Highly flexible | Expensive and limited |

| Deployment | Fast (4–12 weeks) | Long (6–18 months) |

| Integration | Easy with APIs | Complex, often rigid |

| Support | Community + Partner Ecosystem | Vendor-locked support |

Streamline insurance workflows with Odoo ERP without the high costs and rigid systems of traditional ERP solutions.

Conclusion

In a time where agility, compliance, and customer experience are everything, Odoo stands out as the best ERP for managing insurance policies and claims. From claims automation to real-time reporting, Odoo solutions for digital transformation in insurance deliver exceptional value.

Whether you’re a small agency or a large insurer, Odoo empowers you to manage operations smarter, faster, and at scale.

Ready to revolutionize your insurance business? Partner with a trusted Odoo development company and get started with a tailored demo today.

Related Blogs You May Also Like

FAQ'S

What is Odoo Financial Management?

It’s a suite of ERP modules that automate and manage accounting, invoicing, budgeting, and compliance. Designed for flexibility, it supports both small and large finance teams.

Is Odoo suitable for financial institutions?

Yes, Odoo supports multi-currency, multi-company setups, and financial compliance, making it ideal for banks, fintechs, and investment firms.

What modules are included in Odoo’s finance suite?

Core modules include Accounting, Invoicing, Budgeting, Payroll, Bank Reconciliation, and Accounts Payable.

How does Odoo improve financial accuracy?

By automating data entry, reconciliations, and payment tracking, Odoo reduces human error and improves data integrity.

Can Odoo help with tax compliance?

Yes, Odoo has built-in tools for tax management and reporting, supporting local and international standards like IFRS.

How customizable is Odoo for finance companies?

Odoo is highly customizable and can be tailored by Odoo development partners to meet industry-specific financial workflows.

What are the benefits for smaller finance teams?

Odoo is cost-effective, easy to use, and scalable perfect for startups and SMEs looking for professional-grade tools without the complexity.

How does SDLC Corp help?

SDLC Corp helps finance companies plan, implement, and customize Odoo to fit their specific needs. From selecting the right modules to handling data migration and team training, they ensure a smooth, results-driven Odoo deployment.