Introduction

In today’s fast-evolving financial technology landscape, fintech companies face constant pressure to innovate while maintaining accuracy, compliance, and customer satisfaction. As regulatory demands tighten and digital transactions multiply, the need for a robust, flexible, and integrated enterprise system becomes critical.

Odoo ERP Solutions offer a unified platform that caters specifically to the needs of fintech businesses, enabling end-to-end automation, transparency, and scalability. Whether it’s managing accounts, automating HR, or enhancing compliance, Odoo ERP for Fintech equips companies with the tools needed to stay competitive in a data-driven and customer-focused environment.

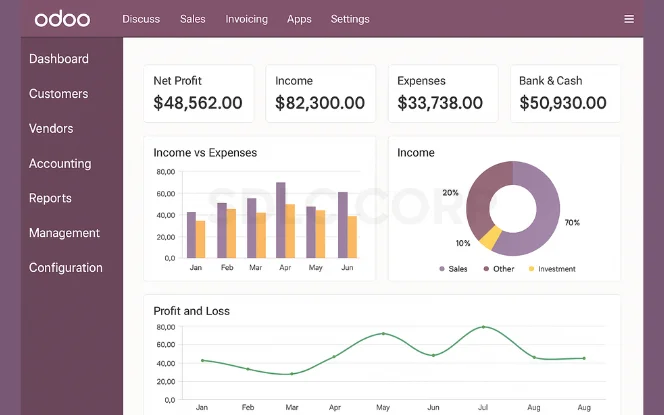

1. Centralizing Operations with Odoo ERP for Fintech

Efficient operation management is the backbone of a successful fintech company. Odoo provides a centralized ecosystem that enables departments to work collaboratively while reducing errors and redundancies.

- Unified Dashboard Access: Odoo integrates all critical modules from finance and HR to compliance and CRM into a single interface, improving collaboration and clarity.

- Real-Time Data Synchronization: Ensures that updates made in one department reflect across all relevant modules, supporting better cross-functional decisions.

- Streamlined Workflows: Customizable workflow engines help automate tasks across departments for increased productivity.

- Advanced User Permissions: Control access levels and data visibility through role-based permissions, enhancing data security.

- Scalable Infrastructure: Designed for startups to large enterprises, Odoo grows alongside your fintech business.

2. Transforming Finance with Odoo Accounting Module

Fintech companies require real-time accuracy, multi-currency capabilities, and automated compliance reporting. The Odoo Accounting Module streamlines financial processes with built-in intelligence and automation.

2.1 Automated Financial Reporting Odoo

Odoo’s financial reporting tools allow fintech companies to generate real-time, dynamic reports such as balance sheets, profit/loss statements, and cash flow summaries. These reports update automatically with each transaction, ensuring accuracy and eliminating manual intervention. This enhances financial visibility and supports faster, data-driven decision-making.

2.2 Seamless Bank Synchronization

With Odoo Banking Integration, fintech firms can connect their bank accounts directly to the ERP system for real-time synchronization. Incoming and outgoing transactions are automatically imported and reconciled, saving valuable time. This reduces human errors and keeps the financial ledger always up to date.

2.3 Multi-Currency Management

Odoo supports multi-currency operations, allowing automatic currency conversions based on current exchange rates. This enables fintech companies to handle global transactions with ease and comply with international financial standards. It’s ideal for businesses operating across multiple countries and currencies.

2.4 Audit Trail and Version Control

Odoo provides a complete audit trail for all financial transactions and system changes. Every update is logged with timestamps and user credentials, supporting internal governance and regulatory compliance. Version control ensures that historic data remains accessible and unaltered for auditing purposes.

2.5 Tax Engine Customization

Odoo’s tax engine allows businesses to define country-specific tax rules, including VAT, GST, and other indirect taxes. It ensures that all sales and purchase transactions are calculated correctly and in compliance with local regulations. Automated tax reports also streamline filing processes and reduce compliance risks.

3. Streamlining Human Resources with Odoo HR Management

People management in fintech is just as critical as financial management. With Odoo HR Management, fintech firms can streamline employee onboarding, payroll, and performance tracking on one platform.

3.1 Employee Centralization

Odoo allows organizations to centralize all employee documents like contracts, IDs, resumes, and certifications in a secure digital repository. This ensures easy access to employee records while maintaining compliance and privacy standards. Advanced filters and search options make retrieving any file quick and efficient.

3.2 Leave and Attendance Management

With Odoo, HR teams can automate leave requests, configure holiday calendars, and manage employee attendance through integrated workflows. Managers receive instant notifications for approval, and employees can track their own leave balances. Timesheet integration ensures accurate tracking of work hours and overtime.

3.3 Payroll and Benefits

Odoo automates payroll calculations, generates payslips, and applies tax deductions and benefits according to region-specific laws. Users can customize salary structures, allowances, and deductions for each employee. This reduces human error and ensures timely and accurate payroll processing.

3.4 Performance Appraisals

Build a transparent appraisal system in Odoo using predefined KPIs, periodic review cycles, and 360-degree feedback mechanisms. Performance data is recorded over time and accessible to both managers and employees. This structured process helps align individual goals with organizational objectives.

3.4 Recruitment and Onboarding

Odoo streamlines recruitment by managing job postings, candidate applications, interview scheduling, and hiring workflows in one place. Once hired, onboarding checklists guide new employees through document submission, orientation, and system access. This integrated approach speeds up hiring and improves the onboarding experience.

4. Enabling Customer Intelligence with Odoo CRM for Fintech

Customer experience is a key differentiator in the fintech industry. Odoo CRM for Fintech empowers companies to manage client interactions across multiple channels while maintaining a unified customer profile.

- 360-Degree Customer View: Aggregate customer behavior, interactions, and financial activities into a single interface.

- Automated Pipeline Management: Track lead stages, assign reps, and automate follow-ups and reminders.

- Lead Scoring and Prioritization: Use AI-driven analytics to prioritize leads based on conversion potential.

- Omnichannel Communication Tools: Interact with clients via email, chat, calls, and web forms without switching platforms.

- Customer Segmentation: Target customers with personalized campaigns based on demographics, location, or transaction history.

5. Driving Digital Transformation in Fintech

Digital transformation is no longer optional for financial institutions. Odoo ERP Solutions enable fintechs to shift from siloed operations to agile, tech-enabled business models.

- Cloud ERP for Fintech Companies: Accessible from anywhere, scalable, and secure, Odoo supports remote workforces and fast-growing operations.

- Modular System Architecture: Choose only the modules you need and expand gradually without disrupting existing workflows.

- Process Automation Across Departments: Eliminate repetitive tasks such as data entry, invoice generation, and compliance reporting.

- Low-Code Customization Tools: Adapt the ERP system to fit unique business needs with Odoo Studio or developer customization.

- Integration with Fintech APIs: Connect Odoo with mobile apps, wallets, payment gateways, and regulatory bodies for seamless data flow.

6. Financial Data Integration and Real-Time Analytics

Data is the foundation of fintech success. With Financial Data Integration Odoo, businesses ensure accurate reporting, fast decision-making, and seamless multi-system connectivity.

6.1 Real-Time Analytics

With Odoo’s real-time analytics, businesses can monitor revenue, expenses, and financial ratios instantly. Dashboards provide immediate visibility into financial health across departments. This enables faster, data-backed decisions and supports agile financial planning.

6.2 API-Driven Integration

Odoo supports seamless integration with platforms like Stripe, Plaid, and PayPal using robust APIs. These connections ensure real-time data flow between systems without manual input. It improves accuracy and allows finance teams to work within a unified ecosystem.

6.3 Data Warehouse Support

Odoo facilitates structured consolidation of financial data into external or internal data warehouses. This enables compatibility with BI tools for advanced reporting and trend analysis. The unified data structure improves consistency and supports enterprise-level insights.

6.4 Automated Data Cleansing

To maintain data integrity, Odoo uses automated validation rules and duplicate detection algorithms. It flags inconsistencies and performs real-time corrections across transactions and records. This results in cleaner datasets, reducing compliance risks and operational inefficiencies.

6.5 Scheduled Imports and Exports

Odoo allows scheduled data imports and exports to sync with internal software or external partner platforms. This automation eliminates the need for manual data handling and ensures timely updates. Businesses benefit from reliable, hands-free data synchronization.

7. Enhancing Compliance and Risk Management with Odoo

Regulatory compliance is paramount in fintech. With Odoo Compliance Management, companies stay aligned with financial laws and reduce exposure to fines or reputational damage.

- Customizable Compliance Workflows: Build step-by-step KYC, AML, and transaction screening processes.

- Audit-Ready Logs: Keep full trails of every user activity, financial entry, and system change.

- Access Restrictions and Data Encryption: Limit sensitive data access to authorized personnel and ensure encrypted storage.

- Regulatory Alerts and Updates: Automate alerts for expiring licenses, new regulations, or missing documentation.

- Document Lifecycle Management: Version control and track every change to contracts, policies, and compliance documents.

8. Facilitating Fintech Process Optimization and Automation

Operational excellence is a competitive advantage. Odoo supports Fintech Process Optimization through process streamlining, task automation, and intelligent triggers.

- Automated Notifications and Triggers: Define conditional logic to initiate actions based on user behavior or data inputs.

- Custom Workflow Builders: Map out business processes visually and modify them easily as strategies evolve.

- Intelligent Task Routing: Automatically assign tickets, tasks, and requests to the right team or person.

- Performance Dashboards: View operations KPIs, SLA breaches, and pending approvals at a glance.

- Cross-Module Automation: Trigger actions across Accounting, HR, CRM, and Project modules to improve responsiveness.

9. Simplifying Odoo ERP Implementation for Fintech Firms

Implementing ERP can be a complex project. However, Odoo’s modular design and fintech-focused templates make Odoo ERP Implementation smoother and faster.

9.1 Phased Implementation Strategy

Start by deploying the most critical Odoo modules such as Accounting, CRM, or Invoicing to ensure early operational impact. Once users are comfortable, gradually introduce advanced features like automated reporting, API integrations, or risk management tools. This staged approach minimizes disruption and allows teams to adapt progressively.

9.2 Preconfigured Fintech Templates

Odoo offers ready-to-use templates specifically designed for fintech operations, including workflows for compliance, client onboarding, and financial reporting. These templates help reduce setup time while aligning with industry standards. They also ensure consistency across departments right from the start.

9.3 Change Management Support

Transitioning to a new ERP system is smoother with proper change management strategies. Odoo enables structured training, onboarding guides, and detailed documentation to support team readiness. These tools reduce resistance to change and foster a smoother system adoption.

9.4 Odoo Community and Enterprise Editions

Businesses can choose between Odoo’s free Community Edition for flexibility or the Enterprise Edition for advanced features and official support. The Enterprise option includes cloud hosting, faster updates, and dedicated customer service. This allows fintech firms to select a model that fits both budget and business needs.

9.5 Ongoing Updates and Scalability

Odoo regularly releases updates to enhance performance, security, and usability, ensuring your ERP stays current with industry evolution. As your fintech company grows, you can scale by adding new modules without rebuilding the system. This ensures long-term sustainability and continuous innovation.

10. Real-World Benefits of Odoo for Financial Services

Finally, let’s summarize how Odoo for Financial Services delivers tangible value to fintech firms:

- Operational Efficiency: Reduced manual work and improved departmental coordination.

- Faster Time-to-Market: Quicker product launches and go-live times with modular deployments.

- Lower Total Cost of Ownership: Pay only for what you use with no unnecessary features.

- Improved Decision-Making: Real-time access to financial, HR, and customer data.

- Increased Customer Satisfaction: Faster response times, personalized services, and error-free transactions.

Conclusion

The fintech industry demands systems that are not only agile and scalable but also capable of maintaining precision, compliance, and exceptional service delivery. Odoo ERP Solutions provide a future-ready framework for fintech companies to automate operations, streamline compliance, manage customer relationships, and accelerate growth.

Whether it’s through Odoo HR Management for workforce optimization, Odoo CRM for Fintech for customer engagement, or Odoo Accounting Module for financial accuracy, Odoo delivers unmatched value tailored to modern financial enterprises.

Embracing Fintech ERP Software like Odoo means investing in smarter business processes, better customer outcomes, and long-term sustainability. For any fintech organization aiming to lead the digital future, Odoo ERP Implementation is not just a solution it’s a strategic transformation.

FAQ's

How does Odoo ERP improve customer experience for fintech firms?

Odoo’s CRM and marketing tools enable personalized communication and customer segmentation. Automation enhances onboarding and support. Fintech companies can offer a smoother, data-driven user experience.

What role does Odoo ERP play in risk management for fintech?

Odoo provides real-time dashboards, alerts, and audit trails to monitor financial risks. Its automated controls help mitigate fraud. Decision-makers can detect anomalies early and respond faster.

How does Odoo help fintech companies with performance analytics?

Odoo ERP includes advanced business intelligence and KPIs. It offers visual dashboards to track revenue, churn, transaction volumes, and customer growth. Fintech leaders can make data-backed decisions quickly.

What modules in Odoo ERP are most beneficial for fintech companies?

Key modules include Accounting, Invoicing, CRM, Document Management, Helpdesk, and Studio for custom development. These modules streamline critical fintech operations. They enhance agility and operational control.

Can Odoo ERP integrate with third-party fintech platforms?

Yes, Odoo offers robust APIs and connectors to integrate with payment gateways, KYC tools, and fintech APIs. Seamless integration improves workflow automation and data accuracy.

What are the benefits of real-time data in Odoo ERP for fintech?

Odoo provides live updates across accounting, sales, support, and transactions. Fintech firms benefit from faster insights and decisions. It helps mitigate risks and seize opportunities quickly.