Introduction

The fintech sector is undergoing a radical shift powered by Generative AI, where advanced machine learning models, deep neural networks, and natural language processing (NLP) are transforming financial services. Unlike conventional AI that relies on predictive analytics, generative AI enables synthetic data generation, risk modeling, and simulation-based forecasting to enhance decision-making. Its applications span fraud detection, algorithmic trading, robo-advisory, compliance automation, and hyper-personalized customer engagement all critical for modern financial ecosystems. To fully capitalize on these innovations, fintech organizations are partnering with specialized AI Development Company experts who deliver scalable, enterprise-grade solutions. As adoption accelerates, generative AI is redefining how institutions balance operational efficiency, regulatory compliance, and customer trust in the digital-first economy.

1. What is Generative AI in Fintech?

Generative AI in fintech refers to advanced artificial intelligence systems capable of creating new content, generating insights, and simulating human-like interactions by analyzing vast financial datasets. Unlike traditional AI, which depends on rule-based systems and static decision trees, generative AI leverages large language models (LLMs), neural networks, and advanced machine learning algorithms to produce original outputs that adapt to complex financial scenarios. This makes it a game-changer for automation, personalization, fraud detection, and regulatory compliance in financial services.

Generative AI empowers financial institutions to automate high-value processes, deliver hyper-personalized customer experiences, and make data-driven decisions with unparalleled accuracy. Its ability to continuously learn and adapt enables banks, insurers, and fintech startups to respond swiftly to changing market conditions while minimizing risks.

Key Components of Generative AI in Financial Services

- Large Language Models (LLMs): Drive conversational AI, intelligent chatbots, and document automation, enabling seamless customer interactions, regulatory reporting, and content generation.

- Neural Networks: Facilitate fraud detection, credit risk assessment, and anomaly detection by processing millions of transactions in real time and identifying subtle irregularities.

- Machine Learning Algorithms: Power predictive analytics, automated decision-making, and portfolio optimization, improving continuously through feedback loops and new datasets.

- Natural Language Processing (NLP): Converts unstructured financial data from documents, market reports, and customer communications into actionable insights.

- Computer Vision Systems: Enable identity verification, document authentication, and automated claims processing, reducing manual intervention and operational inefficiencies.

2. Revolutionary Applications of Generative AI in Fintech

Generative AI is redefining how financial institutions innovate, automate, and deliver services. By leveraging large language models (LLMs), neural networks, and advanced machine learning algorithms, fintech companies are unlocking new levels of efficiency, security, and personalization. Below are the most transformative applications driving the next generation of AI-powered financial services.

Intelligent Customer Support and Chatbots

Generative AI powers next-generation conversational agents capable of handling complex queries with human-like contextual understanding. Unlike rule-based bots, these systems adapt in real time to user intent and behavior.

Key Capabilities:

- Process loan applications with real-time credit analysis and instant preliminary approvals

- Explain complex financial products in simplified terms tailored to user knowledge levels

- Manage account inquiries, disputes, and chargebacks with contextual awareness

- Provide personalized financial advice based on transaction history, spending patterns, and goals

- Conduct sentiment analysis to escalate high-risk or emotionally charged cases

- Support multilingual and multicultural interactions for global markets

Advanced Fraud Detection and Prevention

Generative AI strengthens financial security through adaptive anomaly detection and behavioral biometrics, far surpassing legacy rule-based fraud detection systems.

Key Capabilities:

- Detect fraudulent transactions in real time using behavioral patterns and anomaly recognition

- Reduce false positives by up to 70% with contextual data analysis

- Adapt continuously to new fraud patterns using self-learning models

- Generate synthetic fraud scenarios for model training and resilience testing

- Provide multi-factor transaction risk scoring across digital channels

- Integrate with blockchain-based verification for enhanced trust

Automated Document Processing and KYC Compliance

Generative AI accelerates regulatory compliance workflows by automating KYC, AML, and identity verification processes at scale.

Key Capabilities:

- Intelligent data extraction from diverse document formats and languages

- Automated ID verification via facial recognition and signature analysis

- Real-time compliance monitoring aligned with global regulations

- Adaptive risk-based onboarding tailored to customer profiles

- Automated audit trail and compliance reporting

- Seamless integration with global sanctions and PEP databases

Personalized Financial Services and Recommendations

By analyzing vast customer datasets, generative AI enables hyper-personalization across the entire financial journey.

Key Capabilities:

- Tailored investment recommendations aligned with goals, risk appetite, and market shifts

- Dynamic insurance products that evolve with life events

- Proactive budgeting insights and spending alerts

- AI-driven financial education delivered at optimal engagement points

- Predictive financial planning to anticipate future needs

- Adaptive pricing models based on customer risk and market dynamics

Algorithmic Trading and Investment Management

Generative AI enhances quantitative trading strategies by processing vast datasets from structured and alternative sources in real time.

Key Capabilities:

- Real-time market analysis with sentiment, news, and economic signals

- Automated portfolio optimization with adaptive rebalancing

- Risk-adjusted trading models that account for volatility and correlations

- Integration of alternative data (satellite imagery, social media, IoT signals) for deeper insights

- Support for high-frequency trading (HFT) strategies leveraging micro-market movements

- ESG-compliant investment screening with impact scoring

Credit Scoring and Risk Assessment

Generative AI transforms credit decisioning by integrating alternative datasets and offering explainable AI-driven risk assessments.

Key Capabilities:

- Incorporate non-traditional data sources like social activity, transaction history, and behavioral analytics

- Real-time credit score recalibration based on evolving financial health

- Explainable AI (XAI) models that justify credit decisions transparently

- Fair lending algorithms to eliminate bias and discrimination

- Adaptive risk-based pricing tied to market conditions

- Optimized SME and micro-lending decisions via cash flow analysis and local market data

3. The Power of Retrieval-Augmented Generation (RAG) in Finance

Retrieval-Augmented Generation (RAG) is a transformative AI framework that combines the creative reasoning of generative AI with the precision of information retrieval systems. For fintech, this hybrid architecture ensures that outputs are not only context-aware and conversational but also grounded in accurate, real-time financial data. Unlike standalone generative models that rely on static training data, RAG dynamically fetches the latest information before generating responses making it invaluable for regulatory compliance, market intelligence, and customer support.

Key Applications of RAG in Fintech

- Real-Time Market Intelligence

Provides up-to-date financial insights by integrating live feeds on stock performance, economic indicators, and trading signals, ensuring that investment recommendations and market forecasts reflect the latest conditions. - Regulatory Compliance Automation

Accesses current laws, compliance requirements, and jurisdictional policies in real time, allowing institutions to maintain regulatory alignment as frameworks evolve across regions. - Customer Query Resolution

Delivers accurate, context-rich answers by combining generative capabilities with retrieval of the latest product updates, fee structures, and policies, reducing risks of misinformation. - Advanced Risk Assessment

Merges historical financial datasets with real-time market conditions to generate more robust risk evaluation models, factoring in both long-term trends and short-term volatility. - Document Analysis & Regulatory Reporting

Enhances financial document processing by pairing generative reasoning with retrieval of reference data and regulatory guidelines, streamlining KYC, AML, and audit processes

Check Out : Retrieval-Augmented Generation (RAG)

4. Multimodal AI: The Next Frontier in Financial Technology

The future of financial technology (fintech) is being shaped by multimodal AI systems that can process and analyze textual, visual, and auditory data simultaneously. Unlike traditional single-input models, multimodal AI integrates diverse data streams to create more comprehensive, accurate, and intelligent financial solutions. For fintech companies, this advancement means stronger fraud detection, hyper-personalization, compliance automation, and market intelligence powered by unified data interpretation.

Visual Document Processing

Multimodal AI is redefining how financial institutions manage document-heavy workflows by integrating computer vision, optical character recognition (OCR), and AI-powered verification systems.

Applications include:

- Automated check processing with OCR and fraud-resistant validation

- Insurance claim assessment through AI-driven image recognition and damage estimation

- Property valuation using satellite imagery, geospatial intelligence, and historical market data

- Identity verification with facial recognition + document security checks

- Investment property analysis leveraging visual market comparisons and location intelligence

Voice-Enabled Financial Services

Voice AI enhances customer experience and accessibility in digital banking by enabling natural, conversational interactions.

Key use cases:

- Voice-activated banking transactions secured with biometric authentication

- Multilingual financial support with real-time AI translation

- Sentiment and emotion analysis to boost customer satisfaction

- Hands-free account management ensuring accessibility compliance

- AI-driven financial planning through conversational voice assistants

Integrated Data Analysis

The power of multimodal AI lies in its ability to merge text, images, audio, and real-time market data into unified insights for decision-making and compliance.

Advanced capabilities include:

- Cross-modal fraud detection using transaction data, voice stress analysis, and identity verification

- Comprehensive risk assessment combining structured financial records, market reports, and visual intelligence

- Enhanced customer profiling through diverse behavioral and transactional data

- Market sentiment analysis across social media, financial news, and expert commentary

- Sustainability and ESG scoring using satellite imagery, environmental reports, and regulatory disclosures

Read This: Multimodal AI Technologies

5. Generative AI Implementation: Cost and Timeline Comparison

Implementing Generative AI in fintech requires careful consideration of scope, cost, and ROI timelines. The investment varies based on complexity—from basic chatbots to enterprise-grade multimodal AI solutions. Below is a structured comparison for financial institutions evaluating adoption.

Cost & Timeline Breakdown

| Implementation Scope | Timeline | Cost Range | Key Features | ROI Timeline |

|---|---|---|---|---|

| Basic Chatbot | 3–4 months | $50K – $150K | AI-powered customer support, FAQ automation, contextual query handling | 6–12 months |

| Document Processing | 4–6 months | $100K – $300K | Automated KYC, AML compliance, intelligent data extraction | 8–15 months |

| Fraud Detection | 6–8 months | $200K – $500K | Real-time anomaly detection, behavioral biometrics, transaction monitoring | 12–18 months |

| Personalized Services | 6–9 months | $300K – $700K | Custom recommendations, robo-advisory, portfolio optimization | 15–24 months |

| Enterprise Solution | 9–12 months | $500K – $2M+ | End-to-end integration, multimodal AI, scalable enterprise architecture | 18–30 months |

6. Benefits of Implementing Generative AI in Fintech

Adopting Generative AI in fintech delivers measurable value across operations, customer experience, risk management, and competitive strategy. By integrating large language models (LLMs), neural networks, and advanced automation workflows, financial institutions gain both efficiency and resilience while reducing costs and accelerating innovation.

Enhanced Operational Efficiency

Generative AI automates repetitive, labor-intensive processes, enabling financial teams to focus on strategic decision-making.

Efficiency Gains Include:

- 40–60% reduction in manual processing time for transactions and document workflows

- 85% improvement in document accuracy, minimizing costly errors and rework

- 24/7 AI-powered customer service, reducing wait times and improving satisfaction scores

- 20–30% reduction in operational costs through intelligent automation

- Automated compliance reporting and monitoring, streamlining regulatory alignment

- Enhanced data quality with built-in validation and error correction

Improved Customer Experience

AI-powered personalization transforms the way customers interact with financial services, ensuring faster, smarter, and more relevant engagement.

Customer Experience Benefits:

- Instant query resolution with human-like response times

- Hyper-personalized product recommendations based on customer data and behavior

- Simplified onboarding with automated KYC and risk assessment

- Proactive alerts and guidance for smarter financial health management

- Consistent omnichannel experiences across mobile, web, and in-person banking

- Improved accessibility via multilingual and voice-enabled interfaces

Strengthened Risk Management

Generative AI enhances risk frameworks by combining predictive analytics, anomaly detection, and real-time monitoring.

Risk Management Enhancements:

- Real-time fraud detection with minimal false positives

- Predictive credit risk modeling for more accurate lending decisions

- Automated compliance monitoring & regulatory reporting

- Advanced cybersecurity defense through behavioral analytics

- Market risk assessments powered by real-time scenario simulations

- Reduced operational risks with automated process monitoring

Competitive Market Advantage

Generative AI adoption positions financial institutions as innovation leaders capable of scaling rapidly while maintaining efficiency.

Strategic Advantages Include:

- Faster time-to-market for new financial products using automated development

- Lower operational costs, enabling competitive pricing and higher profit margins

- Improved data-driven decision-making for strategic planning

- Stronger regulatory compliance and reduced penalty risks

- Differentiation through innovation leadership, attracting top talent and customers

- Scalability advantages that support rapid expansion with minimal overhead

7.Generative AI vs. Traditional AI in Fintech

While traditional AI has already streamlined processes such as credit scoring and fraud detection, generative AI introduces a more advanced paradigm—enabling natural interactions, multi-modal data synthesis, and adaptive learning. The table below illustrates the key differences between the two approaches in the context of financial technology.

Comparison Table

| Aspect | Traditional AI | Generative AI |

|---|---|---|

| Primary Function | Classification & prediction | Content creation, simulation & generation |

| Data Processing | Structured data analysis (e.g., transaction logs) | Multi-modal synthesis of text, voice, images & market signals |

| Customer Interaction | Rule-based responses, scripted chatbots | Context-aware, human-like natural conversations |

| Adaptability | Pre-programmed rules, static models | Self-learning, adaptive models that evolve with new data |

| Use Cases | Credit scoring, basic fraud detection, compliance reporting | Personalized financial advice, document automation, regulatory intelligence, portfolio optimization |

| Implementation Complexity | Moderate | High (requires advanced LLMs, neural networks & integration) |

| Cost Range | $25K – $200K | $50K – $2M+ (depending on scope & scale) |

| Maintenance Requirements | Low to moderate | High (continuous training & monitoring needed) |

8. Implementation Challenges and Solutions in Generative AI for Fintech

While Generative AI in fintech offers transformational benefits, its deployment comes with significant technical, regulatory, and organizational challenges. Financial institutions must address these issues strategically to ensure scalability, compliance, and security. Below are the most pressing challenges and their proven solutions.

Data Privacy and Security Concerns

Challenge: Safeguarding sensitive financial data while harnessing AI models is a major obstacle due to cybersecurity risks, compliance mandates, and cross-border regulations.

Solution:

- Deploy end-to-end encryption protocols and zero-trust security architectures

- Utilize federated learning to keep data localized and prevent central data exposure

- Apply differential privacy techniques to anonymize customer data

- Conduct penetration testing and continuous security audits to defend against evolving threats

Regulatory Compliance Requirements

Challenge: Ensuring compliance across multiple jurisdictions while preserving AI system performance and adaptability.

Solution:

- Build AI systems with embedded compliance monitoring and automated audit trails

- Implement explainable AI (XAI) to provide transparent decision rationales

- Maintain real-time compliance databases that auto-update with regulatory changes

- Collaborate proactively with regulatory bodies to align with evolving frameworks

Integration with Legacy Systems

Challenge: Incorporating modern AI solutions into existing core banking systems without causing disruptions.

Solution:

- Use API-first development and microservices architecture for smooth integration

- Deploy middleware solutions to bridge legacy systems with AI frameworks

- Apply gradual migration strategies to minimize operational risk

- Ensure resilience with comprehensive testing and rollback procedures

Model Explainability and Transparency

Challenge: Meeting regulatory demands for AI explainability without compromising model accuracy or speed.

Solution:

- Implement explainable AI frameworks that generate clear decision rationales

- Maintain model lineage documentation and traceability logs

- Use interpretable architectures balancing accuracy with transparency

- Perform bias testing, validation, and fairness audits regularly

Talent Acquisition and Training

Challenge: Building and retaining teams with AI expertise in areas like ML engineering, data science, and compliance-aware AI deployment.

Solution:

- Upskill current staff with targeted AI and fintech training programs

- Partner with universities, AI research labs, and training institutions

- Create career progression frameworks for AI specialists

- Build cross-functional teams combining technical expertise with financial domain knowledge

9. Best Practices for Generative AI Implementation in Fintech

Implementing Generative AI in fintech requires a strategic approach to maximize ROI while ensuring compliance, scalability, and trust. The following best practices help financial institutions deploy AI responsibly and effectively.

Start with Clear Use Case Definition

A successful deployment begins with precisely defined objectives and measurable expectations. Instead of broad implementations, fintech firms should target specific, high-value business challenges.

Implementation Strategy:

- Define success metrics with baseline benchmarks and target outcomes

- Establish ROI expectations aligned with industry standards

- Prioritize high-impact, low-risk projects that deliver quick wins

- Use phased rollout strategies to minimize risks and encourage adoption

- Engage stakeholders early to secure buy-in and address concerns proactively

Ensure Data Quality and Governance

High-quality data is the foundation of effective AI model training and compliance. Poor data quality leads to inaccurate outputs and regulatory risks.

Data Management Best Practices:

- Implement data validation and cleansing pipelines

- Establish data governance frameworks with clear ownership and accountability

- Maintain data lineage tracking and audit trails

- Enforce access controls, encryption, and GDPR/CCPA compliance

- Conduct regular data quality assessments and improvement cycles

Build Cross-Functional Teams

AI projects succeed when technical expertise aligns with business, compliance, and customer experience needs.

Team Composition:

- AI/ML engineers and data scientists for development and optimization

- Business domain experts to align solutions with operational goals

- Compliance and risk specialists to ensure regulatory adherence

- CX/UX designers for customer-centric solutions

- Change management specialists to drive organizational adoption

Focus on Continuous Learning and Improvement

Generative AI systems must evolve with market dynamics, regulations, and customer behavior. Continuous optimization ensures long-term success.

Continuous Improvement Practices:

- Deploy monitoring systems for model accuracy and business performance

- Build feedback loops using customer and employee input

- Retrain models with updated datasets for relevance and accuracy

- Stay updated with emerging AI techniques and fintech best practices

- Benchmark performance against industry standards and competitors

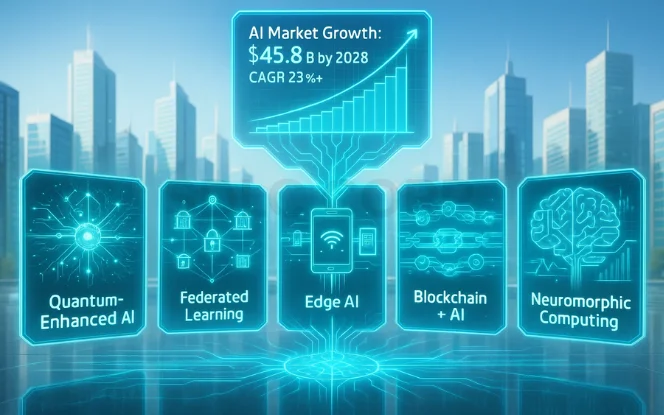

10. Future Trends and Opportunities in Generative AI for Fintech

The future of Generative AI in fintech will be shaped by breakthrough technologies and accelerating adoption across global markets. As financial institutions embrace automation, personalization, and compliance-driven AI systems, new opportunities will emerge for innovation, scalability, and competitive differentiation.

Emerging Technologies in Fintech AI

Several next-generation technologies are set to enhance how Generative AI operates within financial ecosystems:

- Quantum-Enhanced AI: Harnesses quantum computing for high-performance risk modeling, portfolio optimization, and real-time financial simulations beyond the capabilities of classical systems.

- Federated Learning: Enables collaborative AI training across institutions without sharing raw data, ensuring data privacy and sovereignty while benefiting from shared insights.

- Edge AI: Processes financial transactions at the edge (mobile, IoT, ATMs) for low-latency decisions and improved data privacy.

- Blockchain + AI Integration: Combines distributed ledger technology (DLT) with intelligent automation to secure transactions, enhance transparency, and enable self-executing smart contracts.

- Neuromorphic Computing: Adopts brain-inspired architectures to achieve energy-efficient learning and faster AI processing for financial modeling.

Market Growth Projections

The fintech AI market is set to expand rapidly, driven by digitization, evolving customer expectations, and competitive pressures.

Key Market Insights:

- Market size projected to reach $45.8 billion by 2028, with a CAGR above 23%

- Generative AI identified as the fastest-growing segment in fintech AI applications

- Significant R&D investments from global banks, insurers, and fintech startups

- Growth of AI-as-a-Service (AIaaS) solutions lowering barriers for small-to-medium institutions

- Expansion into emerging markets, where mobile-first banking accelerates adoption

Growth Drivers:

- Rising demand for cost-efficient automation in financial services

- Customer expectations for personalized, instant financial experiences

- Increasing regulatory pressure for compliance and risk management

- Global digital banking adoption and ecosystem modernization

- Intensifying competitive landscape, pushing firms to innovate with AI

11. Measuring Success: KPIs for Generative AI in Fintech

The success of Generative AI implementation in fintech must be measured through key performance indicators (KPIs) that reflect efficiency, customer impact, and business outcomes. By monitoring the right metrics, financial institutions can validate ROI, identify optimization opportunities, and ensure compliance with industry standards.

Operational Metrics

Operational KPIs capture the efficiency and reliability improvements driven by AI-powered automation.

Key Indicators:

- Processing time reduction (%) → Faster transaction execution and customer service handling

- Accuracy improvement rates in fraud detection, credit scoring, and document verification

- Cost per transaction optimization, proving scalability and operational savings

- System uptime and reliability scores, ensuring high availability of AI systems

- Automation rate (%) showing the proportion of processes successfully automated

- Error reduction percentage, measuring quality improvements in AI-driven workflows

Customer Experience Metrics

Customer-focused KPIs measure how Generative AI enhances user satisfaction, loyalty, and adoption.

Key Indicators:

- Customer Satisfaction Score (CSAT) → Direct reflection of improved service quality

- Net Promoter Score (NPS) → Gauges loyalty and likelihood of customer referrals

- First-call resolution rate, measuring AI chatbot and support effectiveness

- Customer retention & engagement rates → Impact of hyper-personalized services

- Average handling time reduction in service interactions

- Digital adoption rates, showing customer trust in AI-powered banking channels

Business Impact Metrics

Strategic KPIs assess the financial and competitive impact of AI investments.

Key Indicators:

- Revenue growth from AI-enabled products and services

- Return on Investment (ROI), accounting for development costs and operational gains

- Market share expansion due to faster, more innovative AI-driven services

- Compliance score improvements, reflecting regulatory adherence and reduced risks

- Time-to-market acceleration for new financial products and features

- Employee productivity gains through AI-augmented workflows

12. Security Considerations for Fintech AI Systems

The deployment of Generative AI in fintech introduces not only opportunities but also new security and compliance challenges. Since financial data is among the most sensitive in any industry, organizations must adopt robust security frameworks and ensure strict adherence to regulatory requirements.

Robust Security Framework Implementation

Financial AI systems must be protected against both traditional cybersecurity threats and AI-specific vulnerabilities such as data poisoning and adversarial model attacks.

Key Security Framework Components:

- Multi-Layer Security Architecture → Defense-in-depth with firewalls, intrusion detection, and fail-safes

- Regular Security Audits → Comprehensive vulnerability testing, including AI-specific risks

- Incident Response Planning → AI-focused protocols for model attacks, poisoning attempts, and data breaches

- Continuous Monitoring → Real-time anomaly detection for both network intrusions and AI-driven exploits

- Privacy-Preserving AI → Differential privacy, homomorphic encryption, and federated learning to protect sensitive data

- Model Security Measures → Safeguards against adversarial attacks, model inversion, and intellectual property theft

Compliance with Financial Regulations

AI-powered fintech systems must remain compliant with global financial regulations to protect institutions and customers from legal, reputational, and financial risks.

Key Regulatory Considerations:

- GDPR Compliance → Data subject rights, consent mechanisms, and secure cross-border data transfers

- PCI DSS Adherence → Ensuring secure cardholder data processing in payment systems

- SOX Compliance → Transparent, auditable AI-driven financial reporting

- Basel III Standards → Incorporating AI-driven risk management into banking frameworks

- Fair Lending Practices → Eliminating algorithmic bias to ensure equitable access to financial services

Model Risk Management (MRM) → Regulatory-aligned AI model validation, governance, and lifecycle management

Conclusion

Generative AI is reshaping the fintech industry, enabling intelligent automation, advanced fraud detection, regulatory compliance, and hyper-personalized financial services. By integrating large language models (LLMs), neural networks, and multimodal AI frameworks, financial institutions achieve operational efficiency, risk reduction, and customer-centric innovation. Successful adoption requires robust technical infrastructure, strong governance, and strategic partnerships with expert AI Development Solution providers who ensure enterprise-grade scalability and compliance. As fintech continues to evolve, the fusion of AI and human expertise will define the future of secure, accessible, and data-driven financial services. Organizations that embrace Generative AI as a core strategic capability will not only gain a competitive advantage but also drive sustainable growth in an increasingly digitized economy.

FAQs

What’s the difference between Generative AI and Traditional AI in fintech?

Traditional AI predicts and classifies data, while Generative AI creates new outputs such as personalized reports and natural conversations.

How much does Generative AI implementation cost?

Costs range from $50K for chatbots to $2M+ for enterprise solutions, with ROI often seen in 12–18 months.

Is Generative AI secure for financial data?

Yes, if implemented with encryption, federated learning, differential privacy, and compliance (GDPR, PCI DSS, Basel III).

How long does implementation take?

Typically 3–12 months, depending on complexity chatbots are faster, enterprise systems take longer.

What are the main regulatory challenges?

Key issues include data compliance, model explainability, Basel III risk alignment, algorithmic bias, and AI governance.

Can small fintech startups use Generative AI?

Yes. Cloud-based AI and APIs make it accessible and cost-effective, offering startups a competitive edge.

How does AI impact fintech employment?

AI automates routine tasks but creates roles in AI management, compliance, data science, and strategy.