Introduction

The cost to set up a Global Capability Center (GCC) is one of the most important considerations for companies expanding globally. A GCC represents a strategic investment, not just an operational cost. It allows businesses to bring core processes like analytics, R&D, IT, and finance under one global framework.

Unlike traditional outsourcing, GCCs are owned entities that maintain a company’s culture, governance, and data security. They provide transparency, efficiency, and innovation at scale.

When carefully planned, the GCC establishment cost transforms into long term business value. It strengthens enterprise resilience, accelerates digital transformation, and fosters innovation across international operations.

What Is a Global Capability Center

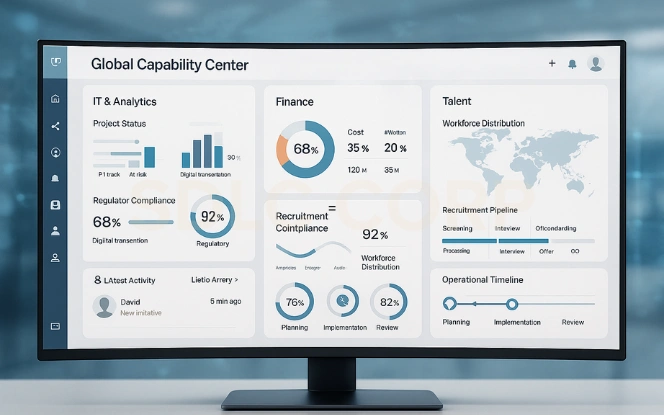

A Global Capability Center (GCC) is a company owned entity created to manage critical business functions such as finance, analytics, IT, customer support, and product development. Unlike outsourcing, GCCs are fully integrated with the parent company’s goals, offering consistency, innovation, and accountability.

GCCs have evolved from cost saving setups into strategic value creators. They are instrumental in driving digital transformation, improving operational efficiency, and enabling data driven decision making. By maintaining ownership of processes and technology, organizations ensure that intellectual property and security remain under internal control.

Today’s GCCs act as innovation engines, leveraging artificial intelligence, cloud platforms, and analytics to deliver continuous improvement. They bridge global talent with business strategy, making them a cornerstone of long term scalability and agility.

To explore how GCCs accelerate enterprise transformation, visit Global Capability Centers.

High Level Cost Components

Understanding the global capability center setup cost requires evaluating all contributing elements, from strategy and planning to execution and governance. Each phase demands thoughtful budgeting to ensure efficiency and sustainability.

Feasibility and Strategy: This initial stage involves market assessment, operational design, and financial modeling. Companies evaluate talent availability, infrastructure readiness, and regional incentives before finalizing the setup plan.

Infrastructure and Technology: Infrastructure contributes roughly 25–30 percent of the overall budget. This includes workspace setup, hardware, cloud systems, cybersecurity, and communication infrastructure. Organizations adopting hybrid and digital first models often reduce capital costs significantly.

Talent Acquisition: The most substantial cost driver, accounting for 50–60 percent of the total budget. This includes hiring skilled professionals, providing upskilling programs, and building leadership pipelines that align with corporate culture.

Legal and Governance: Around 10–15 percent of costs go toward legal structuring, tax registration, compliance frameworks, and governance protocols to ensure regulatory alignment.

Each component contributes to operational maturity and determines how efficiently a GCC scales in its first three years. For deeper insights, see AI First Global Capability Centers (UK).

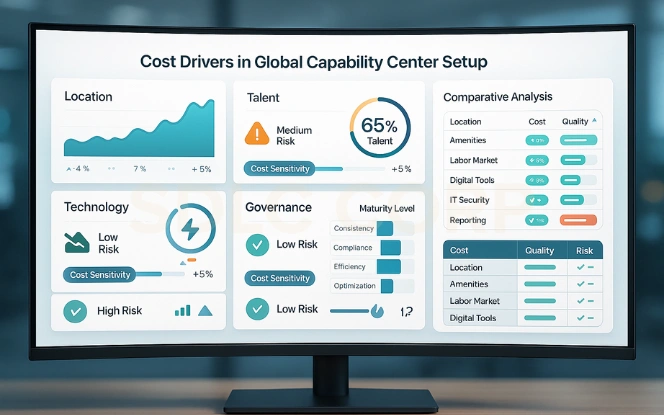

Cost Drivers in Global Capability Center Setup

The cost drivers in global capability center setup determine how budgets evolve across the setup lifecycle. Each factor plays a strategic role in shaping the overall investment and long term ROI.

Location: Selecting the right city impacts labor cost, infrastructure quality, and scalability. Tier 1 cities offer premium connectivity and access to specialized talent, while Tier 2 regions reduce costs by up to 40 percent with emerging tech ecosystems and lower rent.

Talent and Compensation: Workforce costs vary by specialization. Technology heavy GCCs that rely on data engineers, cybersecurity professionals, or AI developers face higher initial costs but greater innovation returns.

Technology Stack: Around 25–30 percent of the budget covers cloud computing, software licenses, automation tools, and cybersecurity infrastructure. Choosing modular systems helps reduce upgrade and maintenance costs later.

Governance and Compliance: Strong internal controls prevent compliance risks, data breaches, and legal penalties. Companies that implement centralized governance early often see smoother scaling and reduced operational bottlenecks.

Efficiently managing these drivers ensures financial predictability while maintaining high quality output and governance.

Infrastructure Costs (GCC Infrastructure Costs)

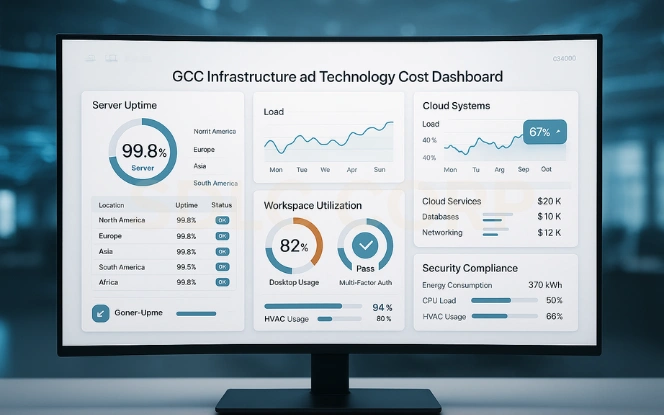

The GCC infrastructure costs define how efficiently a center can function and expand. A robust foundation ensures scalability, security, and smooth collaboration across global teams.

Physical Infrastructure: This includes workspace design, utilities, backup systems, and hybrid work environments. Many organizations now favor flexible coworking models that allow expansion without major capital reinvestment.

Digital Infrastructure: Covers connectivity, cloud platforms, cybersecurity, and collaboration tools. Building a cloud native digital ecosystem enhances agility and reduces hardware dependency.

Technology Integration: Incorporating automation, AI driven monitoring, and real time data dashboards increases productivity and ensures transparent reporting.

The initial infrastructure cost for most GCCs ranges from USD 200,000 to 1 million, depending on scale, location, and industry. Firms leveraging shared services and cloud systems can save 20–30 percent on capital expenditure while improving long term efficiency.

To explore infrastructure strategies, visit Build a High Performance GCC (UAE).

Estimating Global Capability Center Operating Expenses

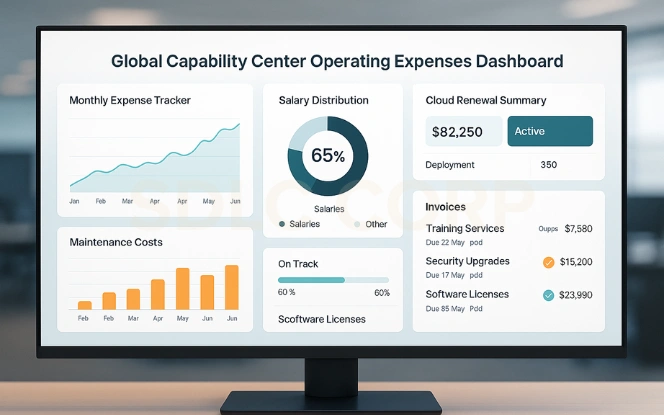

After establishment, global capability center operating expenses define long term financial performance. These recurring costs ensure continuity, quality, and compliance.

Workforce Costs: Typically represent 60–70 percent of operational expenses. Salaries, training programs, and retention initiatives maintain high productivity and reduce turnover costs.

Technology and Licensing: Cover software renewals, system maintenance, and data security. Cloud based subscriptions provide scalability and cost predictability.

Facilities and Compliance: Include rent, maintenance, and ongoing legal audits. Adopting sustainable operations such as energy efficient systems lowers annual facility costs.

On average, a GCC with 300–400 employees spends USD 3–5 million annually. Implementing automation and AI driven management tools can reduce recurring expenses by up to 20 percent.

For optimization examples, read High Performance GCC (US).

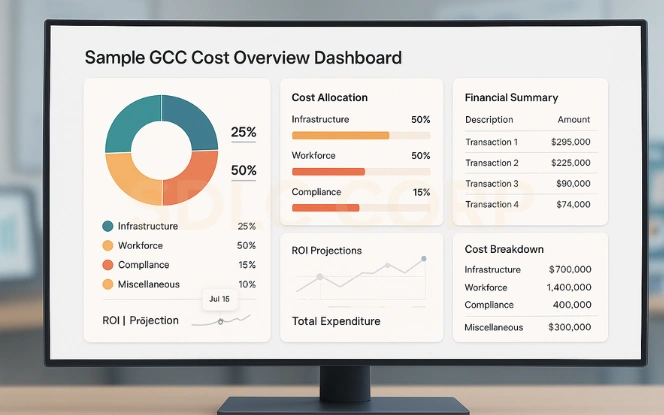

Sample Cost Overview

Below is a simplified cost breakdown for a mid sized GCC in its first year of operation:

| Cost Component | Estimated Cost (USD) |

|---|---|

| Infrastructure and IT | 700,000 |

| Workforce Hiring and Development | 2,000,000 |

| Legal and Compliance | 100,000 |

| Miscellaneous | 150,000 |

| Total (Year 1) | ≈ 2.95 million |

While costs vary by geography and business scope, organizations usually achieve ROI within 24–36 months. Beyond cost recovery, mature GCCs generate strategic value through automation, faster time to market, and operational independence.

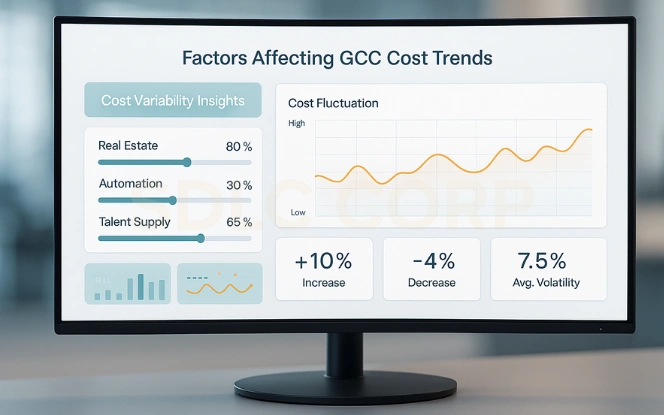

Factors That Push Costs Up or Down

The total GCC establishment cost can fluctuate depending on both internal decisions and external market conditions. Understanding these variations helps businesses plan budgets realistically and maintain financial agility during setup.

Costs tend to rise when organizations invest heavily in premium real estate, top tier technology infrastructure, or niche skill sets that demand higher salaries. For instance, Tier 1 cities offer robust ecosystems but come with higher labor and operational expenses. Legacy on premise technology, fragmented communication systems, and delayed implementation timelines can also add up quickly.

On the other hand, companies that adopt phased rollouts and hybrid operational models often gain better cost control. Setting up in Tier 2 or Tier 3 cities with strong infrastructure but lower rent can reduce the total setup cost by up to 40 percent. Similarly, leveraging automation tools, shared service models, and government incentives such as tax holidays or grants further lowers the initial capital burden.

Another major factor is scalability. Building a GCC with flexible digital infrastructure and cloud integration allows expansion without additional hardware or significant reinvestment.

Risks and Hidden Costs to Watch

Even with meticulous planning, setting up a GCC often comes with hidden costs that can affect profitability and long term sustainability. These unplanned expenses typically emerge during the transition and operational phases, making proactive governance essential.

One of the most common hidden risks is talent attrition. The cost of rehiring and retraining employees can exceed initial projections, especially in competitive markets. Additionally, integration issues between legacy systems and new digital platforms can cause downtime, productivity loss, or unplanned technology investments.

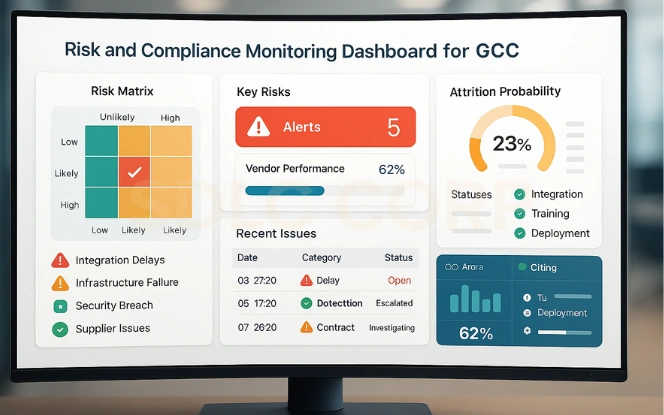

Regulatory and compliance related costs are another area of concern. Changes in local labor laws, taxation, or data privacy regulations can create additional overheads. If not addressed early, these can delay project timelines and increase operational complexity. Vendor mismanagement and contractual ambiguities also pose financial risks, particularly if service providers fail to meet performance or compliance standards.

Currency fluctuations and inflation are external factors that can significantly impact operational budgets, especially for multinational organizations.

How to Reduce Uncertainty in Your Estimate

Reducing uncertainty in cost estimation ensures that your GCC operates within predictable financial boundaries while maintaining flexibility for future growth. The more visibility you have into cost behavior, the easier it becomes to make informed strategic decisions.

Start by creating a phased financial model that breaks down investment milestones such as setup, stabilization, and scale. This approach allows decision makers to assess expenditure patterns and adjust for market changes. Running pilot projects before a full rollout is another proven way to validate assumptions and identify potential bottlenecks early.

Leveraging AI and data analytics tools for real time cost tracking adds another layer of control. These systems offer predictive insights into budget deviations, enabling faster corrective actions. Integrating financial dashboards with operational KPIs helps leaders correlate cost performance with efficiency metrics.

Collaboration with local consultants or government agencies can also help reduce uncertainty. They provide regional knowledge on tax structures, incentive programs, and regulatory frameworks.

When Does a GCC Pay Off

The payoff period for a GCC varies depending on its size, scope, and efficiency, but most organizations achieve breakeven within 24 to 36 months. However, the return on investment goes far beyond financial metrics. A well structured GCC provides operational control, strategic agility, and innovation at a global scale.

Initially, the benefits come from cost reduction. By centralizing critical business functions such as IT, analytics, and finance, companies typically save 30 to 50 percent compared to outsourcing or fragmented global models. This efficiency stems from shared technology platforms, optimized workflows, and lower dependency on third party vendors.

In the medium term, the value shifts toward innovation and performance. GCCs foster a culture of experimentation and agility, empowering teams to develop new digital solutions, improve customer experiences, and accelerate time to market.

Long term benefits include greater scalability, access to global talent, and stronger intellectual property protection.

Structure of Implementation (Phases)

Establishing a GCC requires a structured, multi phase approach to ensure efficient setup and scalability.

- Feasibility Study: Assess potential markets, evaluate cost benefit ratios, and identify workforce pools.

2. Legal Setup: Handle entity registration, compliance documentation, and local licensing.

3. Infrastructure Deployment: Develop office spaces, integrate digital platforms, and ensure secure connectivity.

4. Talent Onboarding: Recruit specialized professionals and leadership teams to align with strategic goals.

5. Pilot Run: Test systems, workflows, and governance frameworks before full scale launch.

6. Expansion and Optimization: Scale operations, enhance automation, and establish Centers of Excellence for continued innovation.

This structured approach helps manage risk, ensure compliance, and deliver sustainable growth from day one.

Conclusion

The global capability center setup cost extends beyond infrastructure-it is a strategic blueprint for efficiency, innovation, and sustainability. Aligning GCC infrastructure costs, GCC establishment cost, and global capability center operating expenses ensures long term value.

By understanding the cost drivers in global capability center setup, companies can balance scalability and cost efficiency. With automation, hybrid models, and strong governance, GCCs evolve into global growth enablers.

For expert guidance, contact SDLC Corp today to enhance your GCC with AI and automation.

FAQs

What is the average cost to set up a Global Capability Center?

The cost to set up a global capability center typically ranges from USD 2–5 million for mid sized setups, depending on workforce size, technology investments, and region.

What factors influence GCC setup costs the most?

The biggest cost drivers in global capability center setup include location, talent acquisition, technology infrastructure, and legal compliance, all of which shape long term ROI.

How much do GCC infrastructure costs contribute to total setup?

GCC infrastructure costs usually make up 20–30 percent of total expenses, covering workspaces, IT systems, and cloud infrastructure essential for efficient operations.

When does a GCC typically break even?

Most GCCs achieve cost recovery and positive ROI within 24–36 months, depending on efficiency, automation adoption, and workforce performance.

How can companies reduce global capability center operating expenses?

Organizations lower global capability center operating expenses by using hybrid work models, automation, and cloud solutions to cut recurring costs and improve efficiency.