Introduction

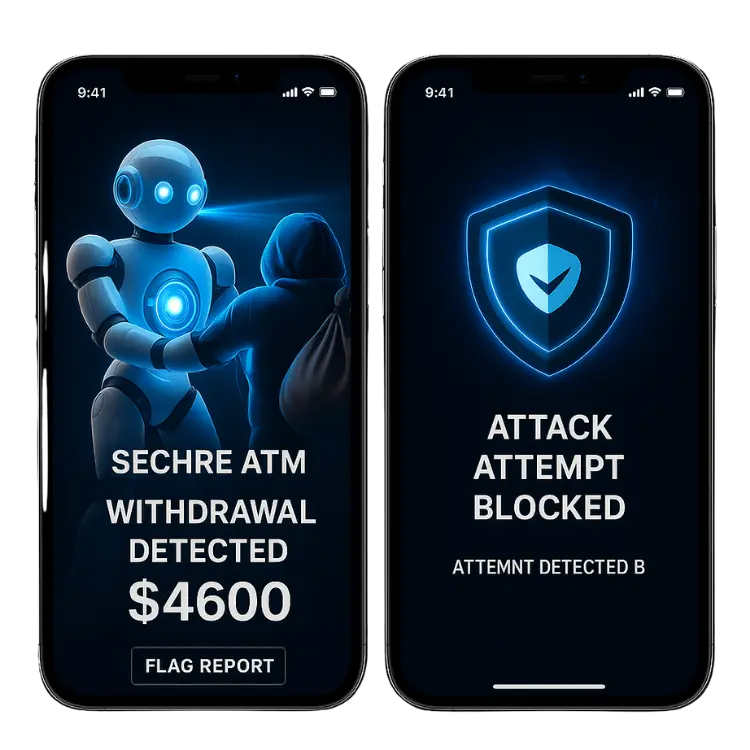

Digital payments are growing fast. However, so are fraud risks. In 2023, global fraud losses crossed $40 billion. Criminals used bots, phishing, and synthetic IDs to bypass outdated rule-based systems.

One global fintech and payments provider faced this reality. A single fraud attack caused $500,000 in losses in one day. As a result, the company adopted an AI-powered fraud detection platform built with advanced AI development services. This solution now stops fraud in real time and protects customer trust.

Company Profile

Global fintech leader with 15M+ customers in 40+ countries, processing $100B annually.

Services

Digital wallets, P2P transfers, merchant payments, BNPL, and loans.

Market Impact

Drives global digital finance adoption for users and businesses.

Key Challenge

Growth caused 10K+ daily fraud alerts and rising customer dissatisfaction.

Secure Transaction

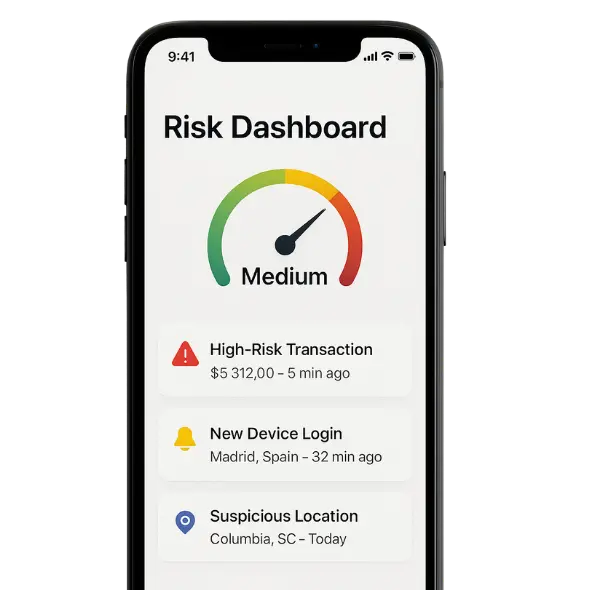

Risk Dashboard

Assistant

Compliances

Project Objectives

Executives needed a real-time fraud dashboard with KPIs for risk, compliance, trust, and efficiency. Any red alert triggered immediate action to stop attacks and adjust strategies.

The company launched a Fraud Prevention Transformation Program with these goals:

Detect and block fraud in under 300ms.

Reduce false positives by 40%.

Automate 70% of manual investigations.

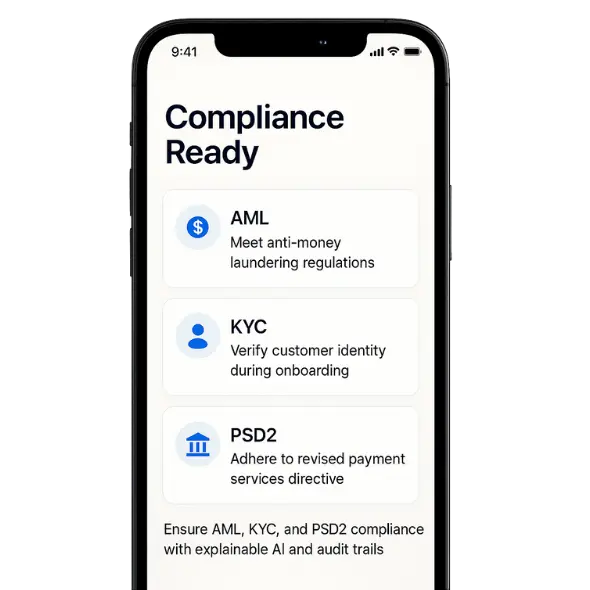

Ensure AML, KYC, PSD2, and GDPR compliance.

Build a future-proof and scalable fraud detection platform.

In short, the goal was simple: stop fraud quickly while also keeping customers safe and satisfied.

Project Challenges

With rapid growth, the company faced mounting obstacles. Rising transaction volumes, evolving fraud tactics, fragmented data, and regulatory pressure made legacy fraud systems increasingly ineffective and left customers frustrated.

Massive Transaction Volume

Over 5 million daily transactions overwhelmed legacy tools, causing delays that let fraud slip through.

Evolving Fraud Tactics

Bot farms, phishing, card testing, and deepfake IDs bypassed static rule-based systems.

Fragmented Data

KYC, merchant histories, and chargebacks were siloed, making it hard to detect suspicious patterns.

Overloaded Teams

Analysts faced 10,000+ daily alerts, with false positives wasting time while real fraud was missed.

Regulatory Pressure

Compliance with AML, PSD2, and GDPR required explainability, which legacy black-box systems lacked.

Customer Friction

False declines frustrated users, weakened trust, and drove churn by disrupting seamless payments.

Solutions

The company built a custom AI fraud detection system designed for speed, accuracy, and compliance.

Core Capabilities

Machine Learning Models: Supervised learning identified known fraud patterns, while unsupervised anomaly detection flagged new threats.

Graph Analytics: Detected collusion rings by mapping connections between users, merchants, and devices.

Real-Time Risk Scoring: Each transaction was scored instantly using 300+ variables.

Behavioral Biometrics: Keystrokes, geolocation, and login patterns highlighted account takeovers.

Explainable AI (XAI): Transparent decision-making reassured regulators and built trust.

API Integration: Unified data across payment gateways, mobile apps, and CRM systems into a single fraud hub.

As a result, fraud prevention became both proactive and customer-friendly.

Development Process

With rapid growth, the company faced mounting obstacles. Rising transaction volumes, evolving fraud tactics, fragmented data, and regulatory pressure made legacy fraud systems increasingly ineffective and left customers frustrated.

Discovery & Prioritization

Engaged HR leadership to define KPIs such as reduced time-to-hire and attrition rate targets.

Data Preparation

Prepared historical HR and recruitment data for AI model training.

Model Development

Built and validated ML models for resume parsing, candidate matching, and attrition prediction.

System Integration

Integrated the platform with ATS and HRMS for end-to-end automation.

Pilot Program

Piloted in one department to test usability and refine models.

Change Management

Trained analysts to become fraud intelligence specialists, leveraging dashboards and automated alerts.

Development Process

The development process moved from identifying fraud scenarios and unifying data to building ML models, integrating them with payment systems, piloting in high-risk regions, and finally rolling out globally with analyst training for real-time fraud detection.

Discovery & Prioritization

Identified top fraud scenarios like account takeovers and chargeback abuse.

Data Engineering

Built a fraud data lake, consolidating siloed systems and improving data quality.

Model Development

Built a fraud data lake, consolidating siloed systems and improving data quality.

Integration

Linked AI models to payment gateways and mobile apps for real-time scoring in <200ms.

Pilot Program

Tested in high-risk regions, refined thresholds, and reduced false positives.

Full Rollout & Training

Trained analysts to become fraud intelligence specialists, leveraging dashboards and automated alerts.

Insights From Our AI Consulting Company Experts

Stay updated with the latest trends, insights, and real‑world AI use cases. Our expert‑written blogs cover everything from machine learning, automation, and agentic AI to strategic AI consulting, implementation best practices, and the role of an AI strategist in enterprise success.

Results Achieved

Within one year, the AI solution delivered measurable business impact:

Fraud losses dropped by 60%, saving millions annually.

False positives fell by 50%, restoring customer trust.

Manual reviews decreased by 70%, allowing teams to focus on strategy.

Decision speeds improved to under 200ms, ensuring frictionless payments.

Operational costs fell by 20%, thanks to automation.

Compliance improved 100%, with full AML, PSD2, and GDPR adherence.

Customer satisfaction rose by 22% (NPS), reflecting restored confidence

Award-Winning Excellence Across Industries

Trusted by SelectedFirms, C2CReview, iTRate, SoftwareWorld, TopSoftwareCompanies and many others, our award-winning AI solutions accelerate innovation and ROI across healthcare, finance, retail and logistics, backed by enterprise-grade security and seamless user experiences.

Our Clients’ Experience With Us

From startups to global enterprises, we’ve helped businesses unlock real value through AI and digital innovation. Here’s what our clients say about partnering with us. Their success stories, our collaboration with an expert AI consultant, and the impact we’ve achieved together.

SDLC CORP guided our team through an AI discovery sprint, mapped key use cases, fixed messy data, and delivered a clear step-by-step roadmap. Thanks to their work, executives now green-light projects faster and engineers move from idea to pilot without delays.

Overall Satisfaction

We hired SDLC CORP’s AI consultancy to automate document review with NLP. They built and trained a model in weeks, plugged it into our workflow, and walked staff through daily use. The system now flags errors on its own and cut processing time by more than half.

Overall Satisfaction

SDLC CORP audited our machine-learning models for bias and drift, added explainability tools, and set up alert dashboards. Compliance audits now finish sooner, regulators like the clarity, and our data science team trusts model performance day to day.

Overall Satisfaction

Share a few details about your project, and we’ll get back to you soon.

Let's Talk About Your Project

- Free Consultation

- 24/7 Experts Support

- On-Time Delivery

- sales@sdlccorp.com

- +1(510-630-6507)