Introduction

Artificial Intelligence (AI) is rapidly transforming the cryptocurrency ecosystem, reshaping trading, mining, and blockchain governance. Unlike traditional tools, AI for Cryptocurrency enables real-time decision-making, predictive analytics, and automation that reduce human error and improve efficiency.

In modern crypto markets, AI-driven automation boosts liquidity, strengthens security, and enhances transparency through decentralized intelligence. By combining advanced algorithms with blockchain’s decentralized architecture, AI establishes itself as the structural backbone of digital finance powering scalable, intelligent, and self-sustaining cryptocurrency ecosystems. Learn more about our AI Development Services.

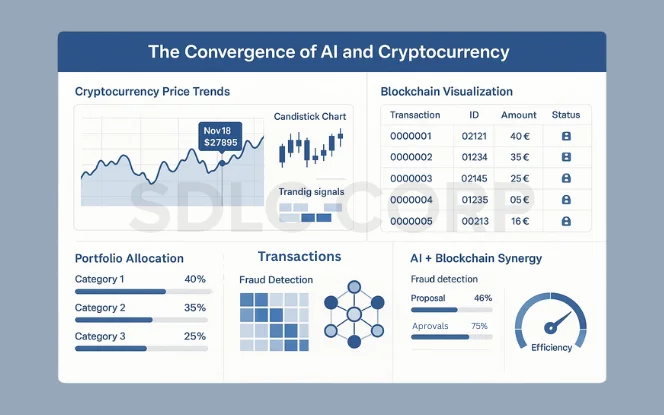

1.The Convergence of AI and Cryptocurrency

AI Capabilities Driving Cryptocurrency Innovation

The capabilities of AI for cryptocurrency extend beyond simple automation. Predictive modeling enables systems to anticipate price fluctuations with greater accuracy. Advanced pattern recognition identifies trading signals that human traders may overlook. Furthermore, automation streamlines portfolio management, enabling real-time decision-making in dynamic markets.

Blockchain Foundations Supporting AI Integration

Blockchain technology establishes the foundation on which these AI capabilities thrive. Its transparency ensures all transactions remain visible to participants. Immutability safeguards records from manipulation, preserving trust within decentralized networks. At the same time, decentralization reduces reliance on intermediaries and enhances system resilience. Together, these attributes create an environment where artificial intelligence operates effectively and securely.

Synergistic Benefits of AI and Blockchain Convergence

When AI and blockchain converge, the benefits multiply across the cryptocurrency ecosystem:

- Data-driven trading: AI models analyze large datasets, recognize hidden correlations, and generate actionable insights that strengthen trading accuracy.

- Enhanced fraud detection: Machine learning algorithms continuously scan transaction patterns to identify anomalies, helping prevent financial crimes.

- AI-governed DAOs: Decentralized Autonomous Organizations leverage AI to optimize governance, streamline decision-making, and ensure fairness in community-driven ecosystems.

This synergy creates a self-regulating and intelligent crypto market. It improves operational efficiency, strengthens security protocols, and advances the overall sustainability of blockchain networks. Therefore, the convergence of AI and cryptocurrency represents not just a technological trend but a structural shift toward smarter, decentralized finance.

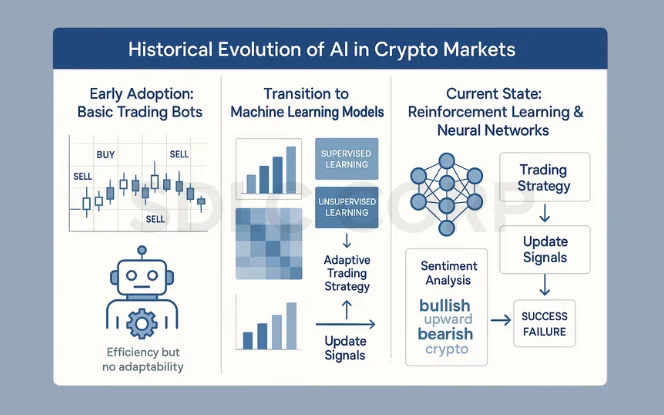

2. Historical Evolution of AI in Crypto Markets

Early Adoption: Basic Trading Bots in Cryptocurrency

In the early years of cryptocurrency markets, AI adoption was limited to simple bots. These bots automated trades based on fixed rules without adapting to external factors. They delivered efficiency but had notable limitations:

- Executed repetitive buy and sell orders automatically.

- Reduced manual intervention in volatile crypto environments.

- Lacked adaptability to sudden market swings.

Transition to Machine Learning Models in Crypto Trading

The second phase introduced machine learning in cryptocurrency trading, which enhanced decision-making capabilities. Algorithms started learning from data rather than following rigid scripts. This stage brought several advancements:

- Processed large sets of historical data to detect correlations.

- Applied supervised and unsupervised learning for price forecasting.

- Enabled adaptive strategies instead of fixed, rule-based systems.

Current State: Reinforcement Learning and Neural Networks

Today, AI for cryptocurrency is powered by sophisticated models such as neural networks and reinforcement learning. These tools redefine market intelligence through continuous adaptation. Key characteristics include:

- Neural networks analyze unstructured data like social media, news sentiment, and blockchain metrics.

- Reinforcement learning improves trading strategies by rewarding successful predictions and penalizing errors.

- Sentiment-driven models capture community behavior, anticipating sudden shifts in investor confidence.

This evolution demonstrates the clear trajectory of AI in crypto markets. From early bots to advanced deep learning systems, each stage strengthens automation, predictive power, and overall market resilience. Therefore, the historical journey highlights how AI has become a structural backbone of decentralized finance rather than an auxiliary tool.

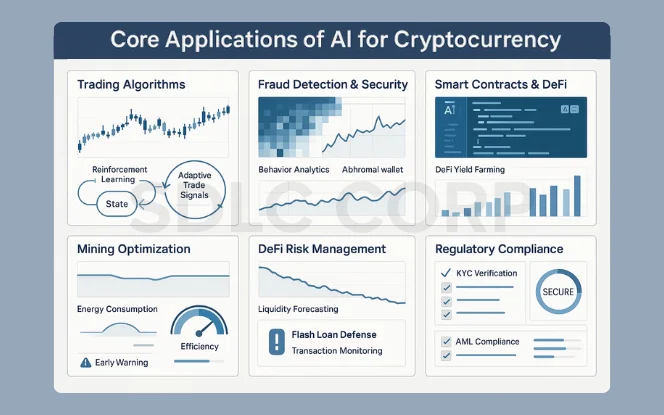

3. Core Applications of AI for Cryptocurrency

Artificial Intelligence reshapes how cryptocurrency ecosystems function by enhancing efficiency, scalability, and security. The integration of AI for cryptocurrency is not limited to trading alone it extends across fraud prevention, smart contracts, mining, decentralized finance (DeFi), and regulatory compliance. The following table highlights major applications, the AI techniques involved, and their industry-wide impact.

| Application | AI Techniques | Impact on Crypto Industry |

|---|---|---|

| Trading Algorithms | Predictive analytics, reinforcement learning | Optimized decision-making & higher profitability |

| Fraud Detection & Security | Anomaly detection, behavioral analytics | Reduced hacks, improved AML compliance |

| Smart Contracts | NLP auditing, predictive execution | Transparent, self-healing DeFi ecosystems |

| Mining Optimization | AI-driven energy efficiency | Sustainable blockchain infrastructure |

| DeFi Risk Management | AI liquidity forecasting | Safer lending, borrowing, and flash loan defense |

| Regulatory Compliance | AI-powered KYC/AML models | Increased institutional adoption |

AI in Crypto Trading

AI trading algorithms represent the most widely recognized use case of AI in cryptocurrency. Predictive analytics process market signals in real time, while reinforcement learning optimizes trade execution by adapting to dynamic conditions.

- AI bots manage portfolios by analyzing liquidity, volatility, and historical patterns.

- Predictive algorithms forecast short-term price fluctuations with high accuracy.

- High-frequency trading models execute thousands of microtransactions in milliseconds.

Case in point: Binance employs AI-driven trade monitoring to detect anomalies, identify market manipulation, and optimize trade matching. These systems ensure faster decision-making and enhance profitability, especially in volatile crypto environments.

AI for Fraud Prevention and Security

The decentralized nature of crypto attracts fraud, hacks, and illicit transactions. AI for fraud prevention strengthens blockchain security with anomaly detection and behavioral analytics.

- Real-time transaction monitoring ensures continuous surveillance of blockchain activity.

- AI models track suspicious wallet interactions, preventing money laundering.

- Behavioral analytics recognize abnormal patterns in user activity to block unauthorized access.

Example: Chainalysis leverages AI-driven fraud detection models to scan billions of transactions, uncover illicit networks, and support Anti-Money Laundering (AML) compliance. As a result, crypto platforms gain credibility and protect investors from significant losses.

AI in Smart Contracts and DeFi

Smart contracts drive decentralized ecosystems, but they are vulnerable to coding errors and exploitation. AI introduces adaptive intelligence into smart contract design, ensuring trust and transparency.

- Natural Language Processing (NLP) automates contract auditing to detect bugs before deployment.

- Predictive execution models anticipate contract behavior, reducing operational risks.

- AI-oracle integrations enable adaptive contracts that respond to real-world data changes.

In decentralized finance (DeFi), AI enhances yield farming and liquidity pools:

- Dynamic yield optimization ensures real-time balancing of returns.

- AI-driven monitoring prevents flash loan exploits and reduces systemic risks.

By embedding AI into smart contracts, DeFi ecosystems evolve into transparent, self-healing networks with reduced vulnerabilities.

AI in Mining and Network Optimization

Mining remains critical to sustaining blockchain infrastructure, but it demands vast energy. AI in mining optimization introduces models that increase efficiency while reducing environmental costs.

- AI-driven energy optimization reduces electricity usage in Proof-of-Work systems.

- Predictive maintenance prevents downtime by detecting equipment failures early.

- Reinforcement learning models optimize hash rate distribution across global nodes.

For large-scale mining farms, these improvements result in sustainable operations and long-term profitability. Moreover, AI enhances network optimization, ensuring blockchain nodes remain resilient under high transaction loads.

AI in DeFi Risk Management

DeFi protocols face unique challenges, including liquidity crises and flash loan attacks. AI risk management models strengthen resilience by forecasting market conditions.

- Liquidity forecasting prevents sudden shortfalls in lending and borrowing pools.

- AI-powered defense mechanisms monitor flash loan transactions to detect manipulation.

- Predictive analytics stabilize interest rates, supporting safer DeFi adoption.

These tools ensure that decentralized lending and borrowing platforms gain trust among retail and institutional investors.

AI in Regulatory Compliance

Cryptocurrency systems operate under evolving regulatory and compliance expectations. Advisory support helps define governance frameworks for AI usage, especially where automated decision-making is involved. An AI consulting company may assist in aligning AI systems with compliance, transparency, and audit requirements.

Finally, AI-powered compliance models bridge the gap between decentralization and regulation. They provide real-time insights into Know Your Customer (KYC) and AML monitoring.

- Machine learning models verify user identities with higher accuracy.

- Anomaly detection uncovers fraudulent onboarding attempts.

- Automated AML frameworks strengthen regulatory confidence and reduce penalties.

As regulators demand more oversight, AI ensures cryptocurrency platforms maintain compliance without sacrificing decentralization. Consequently, institutional adoption of blockchain technologies accelerates.

Final Insight

The applications of AI for cryptocurrency extend far beyond trading. By driving automation, improving security, optimizing mining, and strengthening compliance, AI becomes the cornerstone of the digital economy. Its ability to adapt, predict, and self-correct transforms blockchain into a scalable and resilient ecosystem fit for global financial adoption.

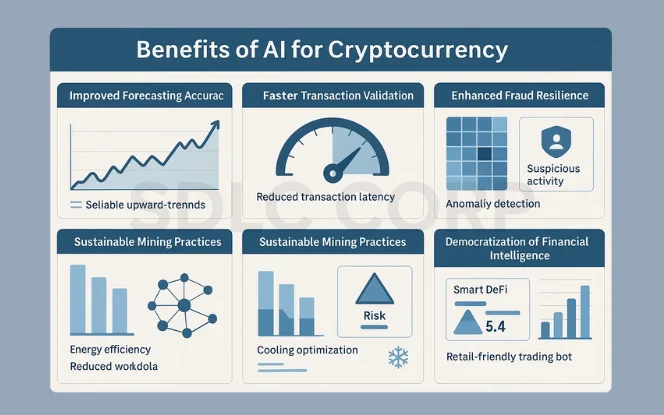

4. Benefits of AI for Cryptocurrency

The integration of AI for cryptocurrency delivers transformative advantages that extend across trading, security, mining, and decentralized finance. These benefits not only improve technical efficiency but also enhance trust, sustainability, and accessibility within the crypto ecosystem.

Improved Forecasting Accuracy

AI strengthens market prediction models by analyzing vast datasets in real time. Machine learning algorithms recognize hidden correlations across trading volumes, sentiment, and global economic trends. As a result, forecasting accuracy increases and traders gain reliable insights for making strategic decisions.

- Predictive analytics minimize losses by identifying risk patterns.

- Reinforcement learning continuously adapts to market volatility.

- Sentiment analysis integrates community behavior into forecasts.

Faster Transaction Validation

Cryptocurrency networks rely on speed. AI-enhanced validation accelerates transaction confirmation while maintaining blockchain integrity.

- Automated consensus models reduce latency in transaction verification.

- AI-powered optimization balances workloads across network nodes.

- Faster processing supports scalable adoption of crypto payments worldwide.

Enhanced Fraud Resilience

Fraud remains one of the largest threats to decentralized finance. AI creates resilient fraud detection frameworks by monitoring blockchain activity in real time.

- Anomaly detection spots irregular transaction flows.

- Behavioral analytics track suspicious wallet interactions.

- AI-driven compliance models strengthen Anti-Money Laundering (AML) efforts.

Sustainable Mining Practices

The environmental impact of mining challenges blockchain adoption. AI introduces energy-efficient approaches that reduce waste and emissions.

- Predictive models adjust mining intensity to cut electricity usage.

- AI-driven cooling systems optimize hardware efficiency.

- Sustainable practices ensure greener blockchain infrastructure.

Democratization of Financial Intelligence

Finally, AI for cryptocurrency democratizes access to advanced market intelligence once reserved for institutions. Retail investors benefit from transparent insights, user-friendly bots, and community-driven analytics.

- Open-source AI trading tools empower smaller investors.

- Smart DeFi dashboards deliver real-time risk metrics.

- Broader accessibility fosters inclusive financial ecosystems.

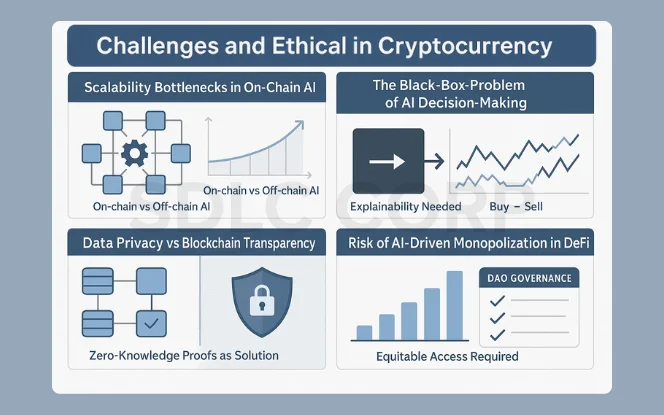

5. Challenges and Ethical Implications of AI for Cryptocurrency

The convergence of AI and cryptocurrency unlocks immense opportunities, yet it also introduces technical, ethical, and structural challenges. To ensure sustainable adoption, the industry must address issues related to scalability, transparency, data security, and market fairness.

Scalability Bottlenecks in On-Chain AI

Running complex AI models directly on blockchain networks creates scalability challenges. Processing large datasets and executing predictive algorithms demand high computational power.

- On-chain AI consumes more gas fees and increases network congestion.

- Resource-intensive models slow transaction throughput.

- Off-chain solutions reduce load but weaken decentralization.

Therefore, balancing AI scalability with blockchain efficiency remains a pressing obstacle.

The Black-Box Problem of AI Decision-Making

AI systems often function as opaque “black boxes,” where the reasoning behind decisions is not easily interpretable. In cryptocurrency markets, this creates trust concerns.

- Traders may not understand why algorithms trigger buy or sell signals.

- Smart contracts audited by AI may hide unseen vulnerabilities.

- Regulatory bodies face difficulty verifying compliance outcomes.

Thus, increasing explainability and accountability in AI systems becomes essential for market confidence.

Data Privacy vs Blockchain Transparency

A central ethical dilemma lies in reconciling AI’s hunger for data with blockchain’s transparency. While open ledgers encourage trust, they also risk exposing sensitive financial behavior.

- AI models require large volumes of user transaction data.

- Public blockchains make anonymization difficult.

- Privacy-preserving AI techniques, such as zero-knowledge proofs, emerge as potential solutions.

This tension highlights the need for frameworks that balance innovation with individual privacy rights.

Risk of AI-Driven Monopolization in DeFi

The integration of AI in decentralized finance (DeFi) carries risks of power centralization. Entities with superior AI infrastructure may dominate decision-making.

- High-frequency trading bots can outpace smaller market participants.

- AI-governed DAOs risk manipulation by resource-rich actors.

- Unequal access to advanced models threatens financial inclusivity.

Addressing these risks requires strong governance, transparent AI protocols, and equitable access to computational resources.

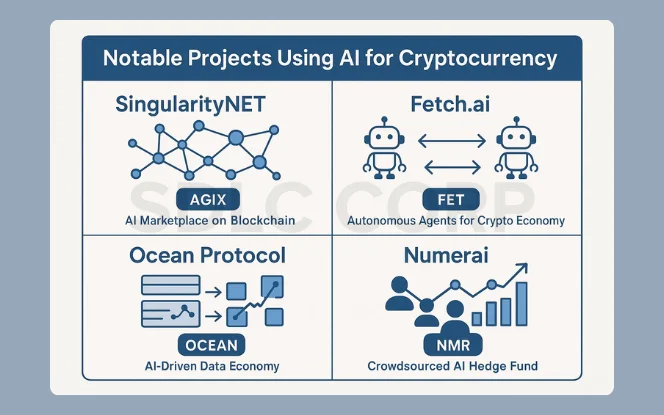

6. Notable Projects Using AI for Cryptocurrency

Several innovative projects highlight the practical convergence of AI and cryptocurrency, proving that artificial intelligence is more than a supporting tool it is a driving force for decentralized ecosystems. These platforms integrate AI to optimize trading, data management, and autonomous decision-making.

| Project | AI Focus | Crypto Role |

|---|---|---|

| SingularityNET | Decentralized AI marketplace | AGIX token |

| Fetch.ai | Autonomous AI agents for economic coordination | FET token |

| Ocean Protocol | AI-driven data economy | OCEAN token |

| Numerai | Crowdsourced AI hedge fund | NMR token |

SingularityNET: AI Marketplace on Blockchain

Platforms such as SingularityNET enable decentralized marketplaces where AI developers can publish, share, and monetize models on the blockchain. This ecosystem ensures transparent transactions, fair pricing, and verifiable model performance.

Fetch.ai: Autonomous Agents for Crypto Economy

- Employs autonomous AI agents that handle complex economic tasks.

- Coordinates logistics, DeFi services, and energy trading using the FET token.

- Enhances decentralized coordination without human intermediaries.

Ocean Protocol: Data Economy Powered by AI

- Focuses on building a decentralized AI-driven data marketplace.

- Allows data providers to tokenize datasets via the OCEAN token.

- Encourages transparent and secure data sharing for AI model training.

Numerai: AI Hedge Fund with Crowdsourced Models

- Leverages thousands of data scientists to build predictive AI trading models.

- Operates with the NMR token, rewarding accurate predictions.

- Demonstrates the power of collective intelligence in financial markets

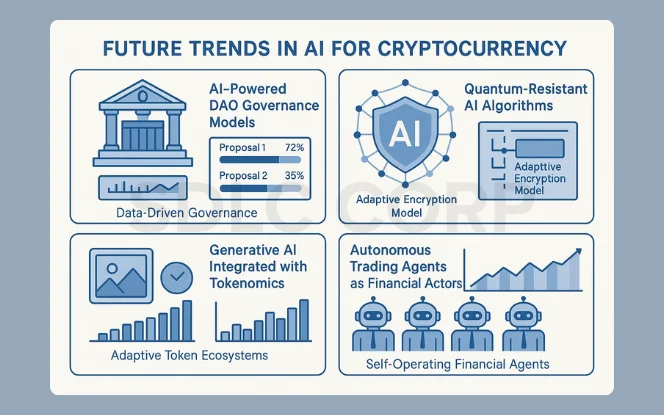

7. Future Trends in AI for Cryptocurrency

The future of AI for cryptocurrency promises groundbreaking transformations that will reshape governance, security, and decentralized finance. Emerging innovations suggest a shift toward intelligent, autonomous, and highly adaptive crypto ecosystems.

AI-Powered DAO Governance Models

Decentralized Autonomous Organizations (DAOs) increasingly adopt AI to strengthen decision-making processes.

- AI models analyze community proposals for fairness and sustainability.

- Predictive governance tools simulate long-term outcomes before implementation.

- Automated voting systems reduce manipulation and bias.

This integration creates transparent, data-driven governance, positioning DAOs as intelligent, self-correcting organizations.

Quantum-Resistant AI Algorithms

The rise of quantum computing introduces risks for blockchain security. AI plays a vital role in developing quantum-resistant algorithms.

- AI models identify cryptographic vulnerabilities faster than manual audits.

- Reinforcement learning supports the design of adaptive encryption methods.

- Quantum-safe frameworks protect blockchain networks from future cyber threats.

By combining AI with quantum-resilient cryptography, the industry prepares for a secure post-quantum blockchain era.

Generative AI Integrated with Tokenomics

Generative AI opens new opportunities for token design and value creation in decentralized economies.

- AI models create adaptive tokenomics that evolve with market conditions.

- Generative systems design NFTs, synthetic assets, and novel yield mechanisms.

- Dynamic token distribution strategies ensure long-term sustainability.

As a result, token ecosystems become creative, resilient, and adaptive to shifting investor demands.

Autonomous Trading Agents as Financial Actors

The next frontier is the emergence of autonomous AI agents acting as independent participants in crypto markets.

- Agents negotiate trades, lending, and liquidity without human oversight.

- Reinforcement learning enables continuous adaptation to new conditions.

- Smart contract integration allows agents to function as decentralized financial actors.

These autonomous entities redefine what it means to participate in markets, leading to truly self-operating digital economies.

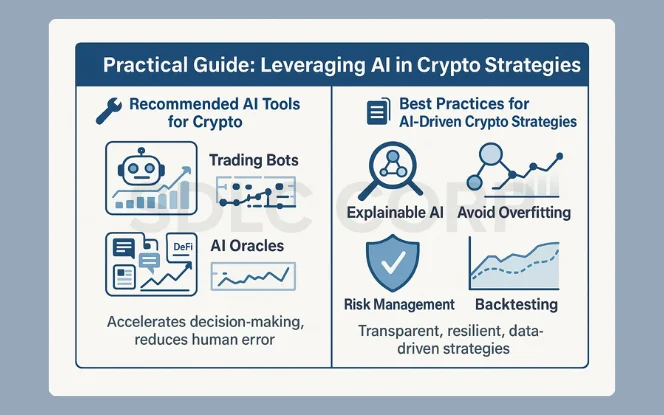

8. Practical Guide: Leveraging AI in Crypto Strategies

Applying AI for cryptocurrency strategies requires the right tools and disciplined practices. Traders, investors, and DeFi participants can strengthen performance by integrating AI-driven systems while ensuring transparency and sustainability.

Recommended AI Tools for Crypto

Several tools make AI adoption accessible in the crypto ecosystem:

- Trading Bots (3Commas, Cryptohopper): Automate portfolio management, execute predictive trades, and optimize risk allocation.

- AI Oracles: Deliver real-time data insights for DeFi protocols, ensuring accurate yield predictions and market adjustments.

- Sentiment Analysis Platforms: Monitor social media and news signals to capture shifts in market confidence.

These tools accelerate decision-making and reduce exposure to human error, especially in fast-moving markets.

Best Practices for AI-Driven Crypto Strategies

Using AI effectively requires balancing innovation with responsible practices:

- Adopt Explainable AI (XAI): Ensure trading models remain interpretable so investors can validate decision-making logic.

- Avoid Overfitting: Train predictive models on diverse datasets to prevent biased results and unreliable forecasts.

- Integrate Risk Management: Combine AI forecasts with stop-loss mechanisms and liquidity safeguards.

- Test Before Deployment: Backtest AI algorithms extensively before applying them in live trading or DeFi environments.

By following these practices, traders create transparent, resilient, and data-driven strategies that align with both market efficiency and ethical standards.

Enterprise-Scale AI Platforms for Cryptocurrency Operations

Large exchanges and blockchain organizations manage AI workloads across trading, compliance, and infrastructure monitoring. Enterprise-scale platforms centralize analytics while supporting distributed operations. Architectural approaches used by an enterprise AI development company are often referenced when designing scalable crypto AI systems.

Conclusion

The synergy between AI and cryptocurrency is one of the most transformative forces in digital finance. AI enhances blockchain networks by improving forecasting, securing transactions, and enabling adaptive smart contracts, while cryptocurrency provides the decentralized foundation for scalable and transparent systems. However, this progress demands ethical caution and regulatory balance. Challenges such as AI’s black-box decision-making, privacy in transparent ledgers, and risks of monopolization in DeFi highlight the need for accountability and oversight.

Ultimately, AI for Cryptocurrency is not just reshaping markets it is building a new paradigm for intelligent finance and decentralized trust. By merging adaptive intelligence with blockchain transparency, AI is laying the groundwork for secure, inclusive, and autonomous future economies. Learn more about our AI Development Solutions.

FAQs

What is the role of AI in cryptocurrency markets?

AI improves forecasting, automates trading, strengthens fraud detection, and enhances decision-making in decentralized finance (DeFi).

How does AI enhance security in blockchain networks?

AI uses anomaly detection, behavioral analytics, and compliance monitoring to reduce hacks, prevent fraud, and improve AML/KYC checks.

Which crypto projects are using AI effectively?

Notable projects include SingularityNET (AGIX), Fetch.ai (FET), Ocean Protocol (OCEAN), and Numerai (NMR)—each combining AI with blockchain for unique applications.

What are the ethical risks of AI in crypto?

Challenges include the black-box problem of AI decision-making, data privacy conflicts with blockchain transparency, and risks of monopolization in DeFi..

How can traders leverage AI for crypto strategies?

They can use trading bots (e.g., 3Commas, Cryptohopper), AI oracles, and sentiment analysis tools—while following best practices such as Explainable AI and risk management.