Introduction

Understanding iGaming and Online Gambling in Australia

Online gambling in Australia covers a limited range of regulated activities:

- Sports betting, race wagering, lotteries, and keno are permitted when offered under valid state or territory approval.

- Charitable gaming and certain regulator-approved skill-based games may also operate within Australia’s legal framework.

Australia does not issue a single national online gambling license. Instead:

- Gambling regulation is managed at the state and territory level, with each jurisdiction issuing and supervising approvals.

- Federal oversight focuses on enforcement and consumer protection, requiring operators to clearly understand local permissions and restrictions.

A detailed breakdown of Australian gambling approval models

can help businesses assess the most appropriate regulatory pathway.

Is Online iGaming Legal in Australia?

What the Interactive Gambling Act Allows and Prohibits

The Interactive Gambling Act (IGA) regulates online gambling in Australia based on activity type, not business registration status. Key points include:

- Only specific forms of online gambling are permitted under Australian law, while certain gambling products are prohibited regardless of where the operator is based.

- Regulatory enforcement targets operators rather than players, with approvals required at the state or territory level.

Why Australia Does Not Issue Online Casino Licenses

Australia’s regulatory framework does not support online casino operations targeting Australian residents:

- Australia does not issue licenses for online casino games that target Australian players under current gambling laws.

- Searching for an “Australia online casino license” reflects a common misconception, as such approvals are not available domestically.

- Operators offering casino-style products typically explore offshore gambling license options for non-Australian markets.

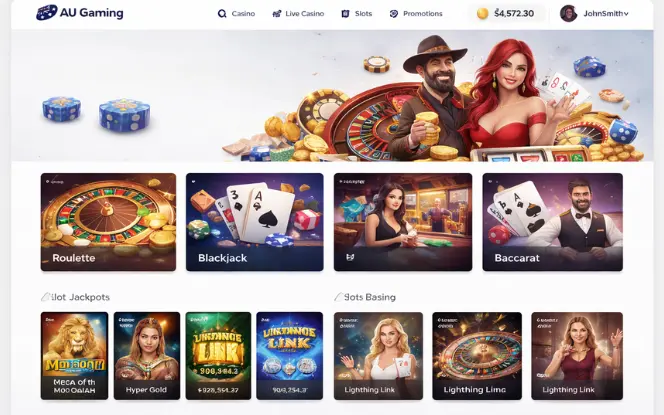

Permitted and Prohibited Online Gambling Activities

Online Gambling Activities Permitted in Australia

- Online sports betting, race wagering, lotteries, and keno are permitted when offered under valid state or territory approval.

- Charitable, not-for-profit gambling and certain regulator-approved skill-based games may also operate within Australia’s legal framework.

Online Gambling Activities Prohibited Under Australian Law

- Online casino games, including slots, roulette, blackjack, and online poker, are prohibited under Australian law.

- In-play betting and unlicensed gambling services offered to Australian residents are also not permitted.

Operators must ensure that their product offerings remain strictly within the scope of permitted activities.

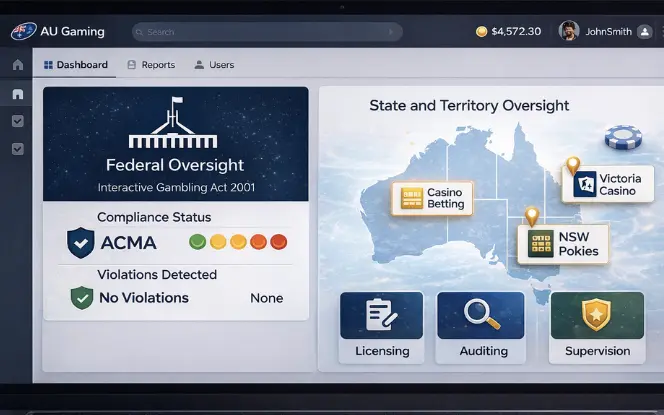

iGaming Regulation in Australia

Federal Oversight and the Role of ACMA

At the federal level, enforcement is handled by the Australian Communications and Media Authority (ACMA). ACMA is responsible for:

- Enforcing the Interactive Gambling Act and investigating illegal gambling services, including action against unlicensed operators.

- Blocking offshore gambling websites and monitoring advertising and payment compliance to protect Australian consumers.

ACMA does not issue gambling licenses.

State and Territory Gambling Regulators

Licensing authority rests with individual state and territory gambling regulators. These bodies:

- Issue gambling and betting approvals

- Conduct probity and suitability checks

- Monitor operational and financial compliance.

Types of Gambling Licenses

Australia offers multiple gambling approval categories depending on the nature of the activity, including:

- Sports betting, wagering, lottery, and keno licenses are issued for approved gambling activities under state or territory regulation.

- Gaming machine, supplier, charitable, and skill-based gaming approvals are granted based on the specific nature of the operation.

There is no universal gambling license that covers all online gambling activities. Businesses comparing jurisdictions often review Curacao vs Malta iGaming licensing comparisons to understand how international frameworks differ from Australia’s model.

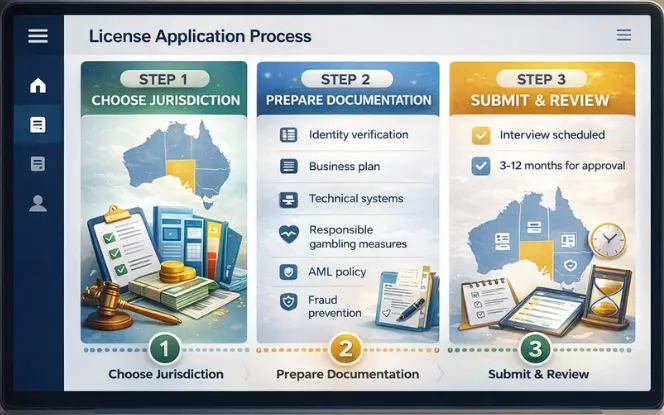

The License Application Process

Acquiring a gaming license in Australia involves detailed planning and considerable documentation. The process may take several months, depending on the jurisdiction and business type.

Step 1: Choose Your Jurisdiction

Different jurisdictions offer varying benefits. The Northern Territory, for instance, is cost-effective and favored by many online betting companies.

- Consider tax obligations and reporting requirements in each state, as rates and compliance standards differ across jurisdictions.

- Some states limit the number of licenses they issue, which can affect approval timelines and market access.

Step 2: Prepare Comprehensive Documentation

Applicants must demonstrate integrity, financial solvency, and technical preparedness. Documents usually include identity verification, business plans, technical systems, and responsible gambling measures.

- Directors and executives must pass background and probity checks to confirm suitability and regulatory fitness.

- Policies for anti-money laundering and fraud prevention are mandatory to meet ongoing compliance and monitoring requirements.

Step 3: Submit Application and Await Review

Once submitted, the application undergoes thorough examination by the regulator. This includes checking all declarations, interviewing stakeholders, and potentially requesting additional evidence.

- Application review can take between 3 to 12 months.

- License fees vary by type and location.

- To better understand how online gambling works, read our complete guide: How Online Gambling Works: A Comprehensive Guide.

Ongoing Compliance Obligations for Licensed Operators

AML, KYC, and AUSTRAC Reporting Requirements

Licensed operators must comply with Australia’s anti-money laundering and counter-terrorism financing framework, including:

- Customer identity verification to confirm player details before account access.

- Transaction monitoring to detect unusual or suspicious gambling activity.

- Reporting obligations to AUSTRAC to ensure timely submission of required financial and compliance reports.

Responsible Gambling and Advertising Controls

Operators must implement harm-minimization measures, including:

- Responsible gambling tools to help players manage spending and playing time.

- Advertising restrictions to ensure promotions are fair, transparent, and compliant.

- Player protection policies to safeguard vulnerable users and promote safe play.

Consequences of Regulatory Non-Compliance

Failure to meet compliance obligations can result in:

- Significant financial penalties may be imposed for breaches of gambling or compliance regulations. These fines can increase based on the severity of the violation.

- License suspension or permanent revocation can occur in cases of serious or repeated non-compliance. Such actions may permanently restrict an operator from the Australian market.

Regulatory Fees, Taxes, and Approval Timelines (Overview)

Typical Cost Components for Gambling Operators

- Application and approval fees

- Ongoing regulatory charges

- Gambling taxes and duties

- Audit and compliance costs

General Approval Timeframes

Approval timelines vary based on:

- License type

- Jurisdiction

- Application complexity

- Probity assessment scope

Most approvals require several months to complete.

Considerations for Foreign iGaming Operators

Local Presence and Management Requirements

- Foreign operators may need to establish an Australian subsidiary or local office to meet regulatory presence requirements.

- Local management appointments and Australian banking arrangements are often required to support compliance and reporting.

Compliance Expectations for Offshore Businesses

- International operators face the same regulatory and reporting standards, often with closer oversight.

- Many businesses compare poker platform licensing jurisdictions

before choosing Australia. - Australia favors long-term, compliance-focused operators, not rapid market entry.

Is Australia the Right Jurisdiction for Your iGaming Business?

When Australia Is a Strong Fit

- Sports betting and wagering platforms

- Lottery and keno operators

- B2B gambling technology providers

When Other Jurisdictions May Be More Suitable

- Online casino platforms

- Online poker operators

- High-risk or lightly regulated gambling products

Businesses that succeed in Australia are those that prioritize compliance, transparency, and regulatory alignment.

Challenges for New Entrants

While the Australian market offers lucrative opportunities, it is not without its challenges particularly for new or foreign entrants.

Common Barriers

Applicants often underestimate the complexity of compliance or the time required to obtain a license.

- Preparing robust AML and responsible gambling systems is time-intensive.

- Local representation and legal expertise are often necessary.

Competitive Market

With a few major players dominating sports betting and lotteries, smaller operators must innovate to gain market share.

- Brand differentiation and tech innovation are key.

- Regional marketing restrictions can impact growth strategies.

Conclusion

Securing a gambling license in Australia requires more than just paperwork—it demands a strong understanding of the legal framework, a long-term compliance strategy, and a commitment to responsible gambling. With each state and territory maintaining unique laws and expectations, successful licensing depends on careful planning, expert legal support, and ongoing dedication to regulatory standards.

“Whether you’re starting a new venture or upgrading your existing platform, our team can help. Get started with our iGaming software development services to meet Australia’s regulatory standards.”

FAQ'S

Can foreign companies apply for a gaming license in Australia?

Yes, but they must establish a local business entity and comply with all national and regional regulations, including AML/CTF laws and responsible gambling frameworks.

Which is the best state for an online sports betting license?

The Northern Territory is the most popular due to its favorable licensing structure and acceptance for national operation.

How long does it take to get a gambling license in Australia?

The timeframe varies by jurisdiction and license type but typically ranges from 3 to 12 months.

Are online casinos allowed in Australia?

No. Online casinos and poker games are banned under the Interactive Gambling Act 2001. Only certain online services, like sports and race betting, are permitted with a license.

What happens if I operate without a license?

Unlicensed operations are illegal and can result in significant fines, criminal charges, and permanent bans from acquiring future licenses.

How can SDLC Corp help with a Australia Gambling License?

Unlicensed operations are illegal and can result in significant fines, criminal charges, and permanent bans from acquiring future licenses.