Executive Summary (2025 Ranges)

Online casino software development cost 2025 comes in three tiers. Startup MVP projects cost $50,000–$100,000. Scale-Up builds cost $100,000–$300,000. Enterprise programs cost $300,000–$1,000,000. Timelines run 8–12 weeks for a pilot and 8–18 months for a global launch. Key drivers are how many GEOs you target and their data rules, your payment orchestration, your content plan (use an aggregator or build in-house games), and required certifications and audits. This guide explains the casino platform development scope, typical RNG certification cost, and the 2025 iGaming tech stack so you can choose what to build or buy and budget with confidence.

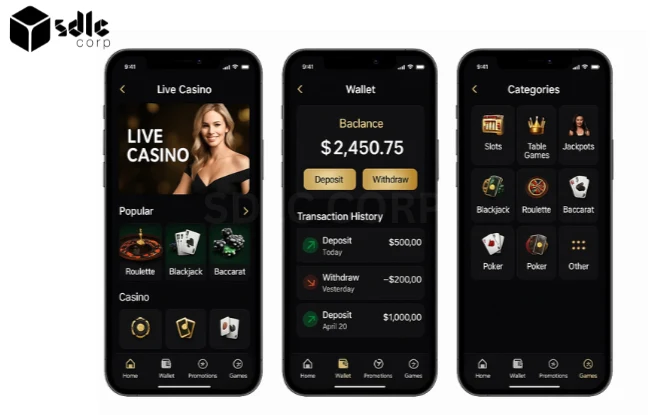

What You’re Building (Scope Map)

Core modules

Account & wallet: custody, balances, ledger, cashier, withdrawal flows.

KYC/AML: age/identity checks, sanctions screening, PEP/adverse media monitoring, ongoing monitoring.

Risk & fraud: device fingerprinting, multi-accounting/bonus-abuse defense, velocity rules, case tooling.

Bonus/loyalty/VIP: rules engine for cash/free-spin/XP, segmentation, wagering requirements.

Affiliates & tracking: attribution, multi-touch payouts, fraud controls.

Responsible-gaming (RG) tools: limits, timeouts, reality checks, self-exclusion, activity statements—these are explicit requirements in several markets. Gambling Commission

Front ends

Web & mobile web, and optionally native apps (iOS/Android) where policy permits distribution.

Back-office

CMS (promos, banners, featured tiles), CRM (campaigns, journeys), analytics/BI (cohorts, LTV), player-support tools, AML case management.

Content

In-house RNG games (math model, client, server, certification per title).

Third-party aggregation (slots, table games).

Live dealer integrations.

Compliance and testing expectations for RNG/game fairness derive from GLI standards (GLI-11/GLI-19) and national regulators (e.g., UKGC RTS).

2025 Architecture Choices That Affect Cost

Cloud-native, multi-region HA, event-driven

Multi-region active/active or active/passive for regulated GEOs.

Queues/streams for cashier events, KYC decisions, bonus triggers, and RG flags.

SLOs/error budgets to balance reliability and feature velocity (core SRE practice). sre.google+1

Data strategy

CDP pattern (real-time profiles and segmentation) vs. “BI-only” warehouse. CDP definitions emphasize a unified, persistent profile accessible to other systems—useful for CRM and RG interventions.

Privacy & retention anchored on GDPR’s storage-limitation principle—keep PII no longer than necessary; define regulator-specific retention baselines. GDPR+1

Observability & SRE maturity

Full-stack metrics, traces, logs; SLO-based alerting; runbooks/on-call; chaos/resilience testing. (Error budgets/SLOs are the standard.) sre.google+1

AI in 2025

Fraud scoring & bot/ring detection (device intelligence + ML).

Personalization (CDP-connected predictions & real-time traits).

RG pattern detection (peer-reviewed work shows ML can flag risky trajectories for early interventions).

These non-functional requirements (data, reliability, compliance) are where projects fail or succeed—and they drive both capex and OPEX.

Compliance & Certifications You Must Plan

RNG, Game certifications & platform audits

RNG/game: GLI-11 (gaming devices) and GLI-19 (interactive systems) are widely referenced; labs do not list public price sheets—pricing is quote-based per submission/scope/jurisdiction.

UK: UKGC Remote Technical Standards (RTS) specify game fairness, reality checks, and other controls—updates continue into 2025.

Ontario: AGCO Registrar’s Standards for Internet Gaming define operator controls, including self-exclusion. AGCO+1

Curaçao (LOK): new law replaces the old sublicense model with stricter AML/RG and centralized oversight (transition into 2025).

Security

PCI DSS v4.0.1 for card data (published 2024; quick references updated 2025). Expect MFA for all access into the CDE and broader “network security controls.” PCI Security Standards Council+1

ISO/IEC 27001 or SOC 2 are common trust signals for B2B partners; cost varies by size/scope (see “Certifications/audits” line items below). (Cost ranges from industry breakdowns.) Tracy NAR+1

Market-specific requirements that influence backlog

Reality checks / session limits / financial limits (RTS 12/13 in UK). Gambling Commission+1

Centralized self-exclusion in Ontario rolling out ecosystem-wide.

Cost Drivers You Must Model

GEO count & data residency. Multiple jurisdictions ⇒ multiple wallets, content blocklists, retention schedules, and tenancy boundaries. (GDPR/UK GDPR storage-limitation impacts data lifecycle design.) GDPR

Payment orchestration complexity. Cards + APMs + open banking + vouchers ⇒ more integrations, reconciliation, dispute flows, and PCI scope. PCI Security Standards Council

Number of game providers & custom builds. Each adds integration/test effort; in-house titles add art, math, client, server, and certification per game (plus regulator testing per GEO).

Feature depth. Advanced bonus engines (stacks, ladders, shop), segmentation, and VIP tooling increase complexity.

Performance targets. Higher concurrency, lower p99s, and tighter SLAs require more infra, caching, and SRE capacity. (SLOs/error budgets formalize these trade-offs.) sre.google

Team seniority & nearshore/onshore ratios. Senior-heavy teams go faster; hybrid models reduce burn.

Build-vs-Buy Matrix (Own vs Integrate)

Own (strategic differentiation):

Wallet & ledger. Deterministic money flows, promos, and compliance reporting live here.

Bonus logic. Your promo meta is your growth muscle; owning rules and attribution enables novel mechanics.

Data pipelines. Streaming events, identity graph, and model features feed CRM, pricing, and RG interventions. (CDP-style profiles amplify this across channels.)

Buy (time-to-market & assurance):

KYC/AML screening & monitoring (sanctions, PEP, adverse media) to keep pace with regulatory changes.

Fraud/risk tooling (device intelligence, ML scoring) to curb multi-accounting and bonus abuse.

Messaging/CRM & analytics/observability components—compose rather than build undifferentiated plumbing.

Security posture accelerators (SIEM, vulnerability scanning, managed SOC).

Decision rubric

Strategic value, timeline, TCO, vendor lock-in/exit, compliance impact (auditability, evidence).

Detailed Budget by Phase (With Typical %)

Discovery & compliance planning (3–5%)

Reg mapping, target GEO shortlist, certification roadmap (GLI/BMM/eCOGRA/iTech Labs), audit scope, and risk register.UX/UI & journey modeling (5–8%)

Lobby taxonomy, cashier journeys, RG controls in flow (limits, timeouts, reality checks). Gambling CommissionBackend & services (30–40%)

Wallet, session/auth, games API, bonus engine, KYC/AML adapters, payments orchestration, event bus.Frontend (15–20%)

Responsive web app, lobby/catalog, search/filters, collection pages, game launchers, cashier.Mobile apps (10–15%)

Native shells (if permitted) or PWA hardening, push, deep links, device trust.DevOps/SRE & security (8–12%)

IaC, CI/CD, observability, SLOs/error-budget policy, WAF/bot, secrets, key management, PCI scope.QA/automation & performance testing (8–12%)

Test harnesses for game launchers, cashier, KYC flows; load tests for peak concurrency.Certifications/audits (5–10%)

RNG/game lab testing (quote-based, per submission/jurisdiction), security audits (pen-tests often $10k–$35k+ depending on scope), ISO 27001/SOC 2 prep + audit.PMO/contingency (10–15%)

Buffer for regulator queries, payment provider approvals, content go-lives.

Note on RNG certification cost: labs (GLI, BMM, eCOGRA, iTech Labs) quote per submission against jurisdictional requirements; scope includes statistical batteries and environment equivalence. Budget as a distinct line item per RNG system and per GEO where required. Gaming Labs International+1

Three Budget Scenarios

1) Startup MVP — single GEO, aggregation only

Scope: wallet, KYC/AML vendor, 2–4 payment methods, aggregator integration (slots/table), basic bonus, RG controls, support tools, analytics baseline.

Timeline: ~6–9 months to soft-launch (assuming favorable regulator path).

Ballpark: $50,000–$100,000 capex; OPEX below.

Risks: payment approvals, content certs, early SRE maturity.

2) Scale-Up — multi-GEO, live dealer, rich CRM

Scope: above + multi-region tenancy, live dealer, VIP tooling, advanced promos, CDP-style profiles, on-site personalization, expanded payments & reconciliation, deeper RG analytics.

Timeline: ~9–14 months phased by GEOs.

Ballpark: $100,000–$300,000 capex.

Risks: data residency, concurrency scaling, parallel certifications.

3) Enterprise — global, multi-brand, multi-region, data platform

Scope: multi-brand architecture, multi-region active/active, in-house titles pipeline, BI lakehouse + CDP, marketing automation, full SRE program, SOC/ISO path, penetration testing cadence, bug bounty.

Timeline: ~12–18 months with multiple tracks.

Ballpark: $300,000–$1,000,000 capex.

Risks: complex audit stack (RTS/AGCO/LOK), vendor lock-in, organization change.

Ongoing Costs Post-Launch (OPEX)

Cloud & CDN: compute/storage, multi-region data transfer, edge caching.

Observability: metrics/traces/logs, log retention.

Data warehousing & CDP: storage, streaming, ML feature store.

SecOps: PCI DSS v4.x upkeep, vulnerability scanning, pen-tests (annual/after major changes), optional bug bounty. PCI Security Standards Council+1

Compliance: regulator fees, system reviews/audits (e.g., MGA System Review after license issuance).

Live-ops/content ops: catalog curation, promos, A/B tests, release management.

Player support/Payments ops: chargebacks, AML cases, VIP management.

Feature velocity: keep ~20–30% of burn for continuous development.

Team & Rates (Role Map)

Product/delivery: Product Lead, PM, BA, Solutions Architect

Engineering: Backend, Frontend, Mobile, DevOps/Platform, SRE, Security, Data/Analytics, QA/Automation

Indicative blended rates (USD/hr):

- US/Canada/Western EU ~$90–$180+;

- Eastern EU $40–$90;

- LatAm $35–$80;

- India/SEA $25–$60

Security/compliance references: plan pen-tests; PCI evidence cycles; ISO/SOC audits (Type I/II) as programs, not events.

Timeline & Critical Path

Reference path:

Regulatory discovery

Architecture & SLOs

Core wallet & account

Payments

Content integrations

Compliance testing/audits

Soft launch.

Allocating SLOs/error budgets early helps keep scope/data-loss risks visible and avoid late reliability surprises. sre.google

Parallelization to compress time

Run frontend, wallet, KYC/payments, observability, and RG controls as parallel tracks.

Start RNG/game testing prep once your math and client/server protocols stabilize; labs need production-equivalent environments and data capture.

Pre-book pen-tests and audit windows; many providers have lead times, and costs rise for rush jobs.

Risks & mitigations

Certification delays : freeze interfaces, provide deterministic test harnesses, and keep dev/test env parity.

Payment approvals : run staged go-lives with fallback tender routing.

Content bottlenecks : prioritize top 10 providers by share; certify in waves.

RFP Checklist (Partner Selection)

Prior audits/certs experience (GLI/UKGC/AGCO/MGA/LOK; PCI/SOC/ISO). Chambers & Co+3Gambling Commission+3iGaming Ontario+3

Referenceable launches in regulated markets; multi-GEO architecture.

Data ownership & access (event schemas, CDP/warehouse integration, export SLAs).

SRE maturity (SLOs, incident process, on-call model).

Handover & documentation (runbooks, ADRs, audit evidence).

Knowledge transfer (promotions ops, catalog ops, SRE routines).

Conclusion: Launch Fast, Then Grow on Your Terms

If you need speed and lower upfront spend, start with our White Label Casino Solution—it gets you live in weeks with aggregator content, live dealer, payments, and compliance handled.

If your strategy is long-term differentiation—owning wallet/ledger, bonus logic, data, and unique titles—go custom with Casino Game Development. We’ll design the platform and game roadmap around your GEOs, SLAs, and growth targets.

Not sure which path fits your budget and timeline? We can map a phased plan: launch on white-label now, then migrate features to custom as ROI and scale demand.

FAQ's

How much does it cost to build an online casino in 2025?

$50,000–$100,000 for a Startup MVP (single GEO, aggregator), $100,000–$300,000 for Scale-Up (multi-GEO, live dealer), and $300,000–$1,000,000 for Enterprise (multi-brand/multi-region). Ranges depend on markets, payments, content, and audits.

How long does development take?

Plan 8–12 weeks for a pilot, 12–20 weeks for a lean MVP, 20–36 weeks for Scale-Up, and 32–72 weeks for Enterprise. Regulator approvals and lab calendars can extend the overall timeline.

What’s the minimal compliant MVP for one regulated market?

Wallet/cashier, KYC/AML checks, responsible-gaming controls (limits, timeouts, self-exclusion), basic fraud/risk, observability, at least one game aggregator, and audit evidence (security + game fairness). Add payments your GEO requires.

What are the biggest cost drivers?

(1) GEO count & data residency

(2) payment orchestration and reconciliations

(3) content mix (aggregator, live dealer, in-house titles),

(4) feature depth in bonus/VIP/CRM, and

(5) SLA targets (latency, concurrency, uptime).

White-label or custom build—how do I choose?

Pick white-label to launch quickly with lower capex and managed compliance: White-Label Casino Solution.

Choose custom when you need unique promos, data ownership, multi-brand scale, or in-house games: Casino Game Development. Many clients start white-label and phase into custom.

What is RNG certification and how much does it cost?

Labs certify fairness for RNG/games and validate parts of the platform. Pricing is quote-based by scope and jurisdiction; plan it as a separate line item per RNG system and per market. Scheduling typically takes several weeks once artifacts are stable.

How large is the team and what rates should I expect?

A lean MVP often runs 8–12 FTEs; Scale-Up 12–20; Enterprise 18–30. Blended rates vary by region: roughly $25–$180+/hour depending on geography and seniority.

Do I need native mobile apps to launch?

Not necessarily. Most teams ship responsive web/PWA first for speed and coverage, then add native iOS/Android if app-store distribution or device features justify it.

What are typical ongoing monthly costs (OPEX)?

Cloud/CDN, observability, data warehousing, KYC/fraud vendors, security (scans, pen-tests cadence), regulator/audit fees, payments ops/chargebacks, live-ops, and continuous development. Expect five-figure monthly spend for active sites, scaling with traffic and GEOs.

How do we manage compliance across markets?

Create a compliance roadmap per GEO (RG features, reporting, data retention), maintain evidence packs for audits, and schedule lab tests/pen-tests in advance. Abstract vendors (KYC, payments, fraud) so you can swap tools as rules change.