KYC drop-off happens when users feel three things at once: too much effort, too little clarity, and low trust. So the fix is not “make KYC easier.” Instead, the fix is to make KYC clearer, faster, and measurable, while staying strict.

This guide shows how operators can improve KYC completion in the Philippines for iGaming platform development. At the same time, it keeps verification strong and audit-ready.

What Philippines KYC rules mean for betting apps

In practice, you don’t need to show laws inside your UI. However, your product flow must match the compliance reality. This is especially critical when building casino platform architecture with built-in compliance controls.

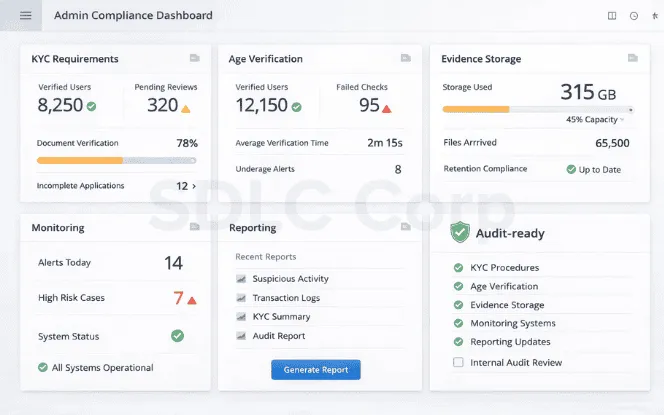

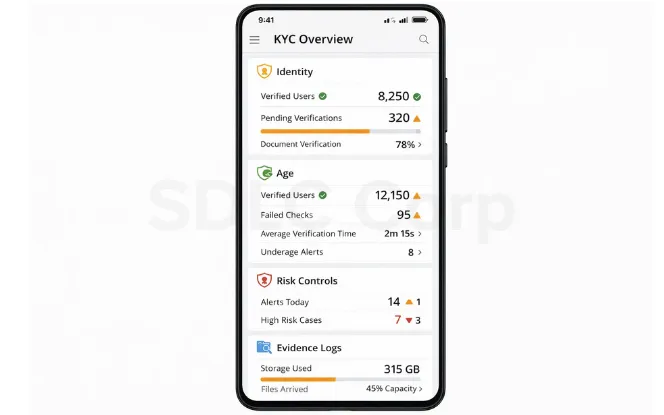

Core compliance outcomes your KYC must support

- Collect identity details and verify them using reliable checks.

- Confirm age and reduce underage access risk.

- Store KYC evidence and transaction records for audit needs.

- Support ongoing monitoring, not only “one-time” verification.

- Enable reporting workflows for high-risk or suspicious activity.

If your KYC can’t produce evidence later, disputes get worse. Also, your support team loses trust fast.

What KYC means in gambling terms

For example, in iGaming, KYC is more than “upload an ID.” Instead, it is identity, age, risk control, and traceable evidence. Because iGaming includes fast deposits and quick cashouts, risk rises. Strict verification protects both the user and the operator.

Why users drop during KYC

However, most teams blame “user patience.” However, drop-off usually comes from fixable design gaps.

Top KYC drop-off causes in betting apps

- Bad timing: you ask for heavy KYC before trust exists.

- No explanation: users don’t understand why you need their details.

- Document friction: glare, blur, expired ID, or wrong document type.

- Slow review: “pending” with no timeline kills completion.

- No safe retry: users fear a mistake means a permanent lock.

- Device reality: low light, old Philippinesones, weak networks, small storage.

- Trust gap: users worry about scams and data misuse.

Your job is to remove confusion, not controls. Also, you must add clear retries, not loopholes.

The fix: a Philippines-ready KYC flow that stays strict and converts

Use a two-layer approach:

- Layer A: low-friction risk screening in the background

- Layer B: strict identity verification with guided UX and retries

This keeps honest users moving. At the same time, it pushes high-risk users into deeper checks.

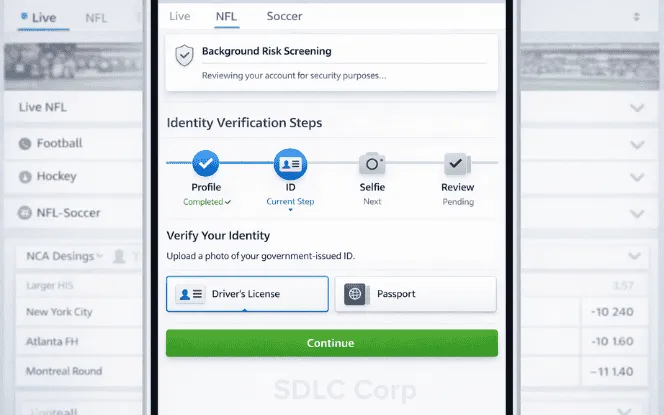

Step 1: Let users browse, but lock real-money actions

Let users enter the lobby and explore games. However, keep deposits, bonuses, and withdrawals locked behind verification. This reduces fear early. Also, it protects your money movement gates.

Step 2: Run “silent” checks before the document screen

Do these before you ask for ID:

- email and Philippinesone reuse checks

- device and IP mismatch flags

- velocity checks (many signups from one device)

- basic risk scoring from early signals

This reduces wasted KYC attempts. Therefore, users reach the ID step with higher success odds.

Step 3: Use progressive steps, not a single long form

Break KYC into small steps:

- profile basics

- choose ID type

- capture ID

- selfie or liveness

- submit and track review status

Because each step is short, users keep going. Also, progress bars reduce anxiety.

Step 4: Design for “Philippines ID reality”

Don’t assume every user has a passport ready. Instead, show your accepted IDs list before the camera opens.

Then add:

- save and resume later

- reminders that don’t feel spammy

- clear camera tips (light, corners visible, no glare)

Step 5: Build a retry path that is strict but humane

As a result, users drop when the system feels final. Design retries like a bank, not like a game.

Recommended retry model

- 2–3 retries for Philippinesoto quality issues (blur, glare, crop).

- 1 retry for user-input mismatch (name format, DOB typo).

- Manual review for edge cases, not instant bans.

- Block only for strong tampering signals.

Also, show the reason and next step. Because “try again” without guidance causes rage quits.

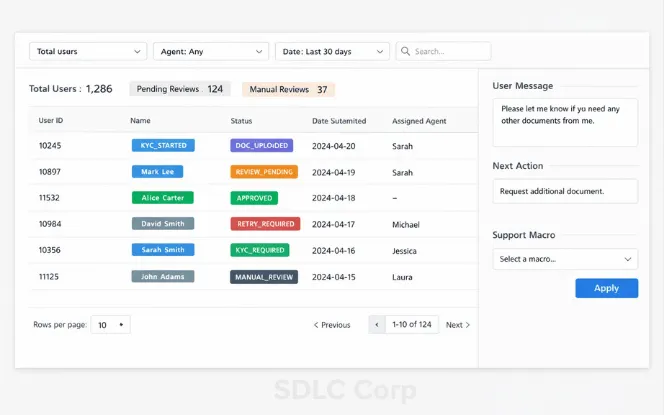

KYC status codes that reduce support tickets

At the same time, a clean status model prevents confusion. It also makes support replies consistent.

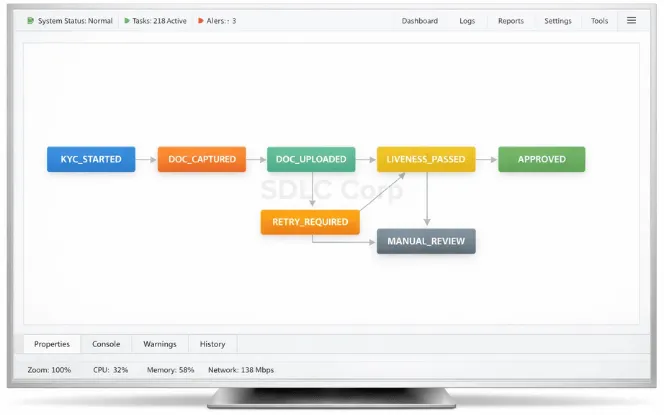

Internal KYC states (example)

- KYC_STARTED

- DOC_CAPTURED

- DOC_UPLOADED

- LIVENESS_PASSED

- REVIEW_PENDING

- APPROVED

- RETRY_REQUIRED

- MANUAL_REVIEW

- REJECTED_FINAL

For each status, define four outputs

- user-facing message

- allowed next action

- support macro reply

- audit log event name

This reduces “where is my verification?” chats. Also, it shortens dispute timelines later.

The technical build: KYC as a state machine

If you want better completion, your backend must be reliable. Treat KYC like payment orchestration.

Data you must store for KYC decisions

- identity fields (as required by your policy)

- document metadata (type, expiry, issuing country)

- upload attempt IDs and timestamps

- liveness result + confidence flags

- decision result + internal reason code

- reviewer ID for manual review cases

Events to track KYC drop-off clearly

Track each step with start and success events:

- kyc_viewed

- kyc_started

- doc_upload_started / doc_upload_success / doc_upload_fail

- liveness_started / liveness_pass / liveness_fail

- review_started / review_completed

- decision_approved / decision_retry / decision_reject

Also track failure reasons. Then segment by device, network type, and OS version.

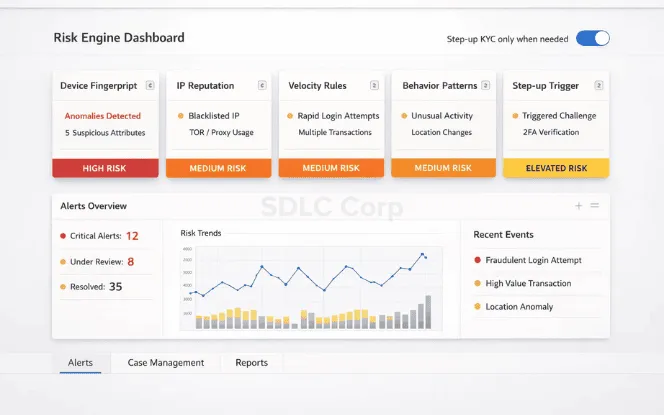

Don’t add steps—add smarter signals behind the scenes

Many operators add more screens when fraud rises. However, you often need better signals, not more friction.

Low-friction signals that reduce fraud without hurting UX

- device fingerprint and device change history

- IP reputation and location mismatch

- velocity rules for signup, deposits, withdrawals

- session behavior patterns (fast switching, bot-like actions)

- rule engine that triggers “step-up KYC” only when needed

Then apply step-up checks at the right moment. For example, trigger deeper checks before large withdrawals.

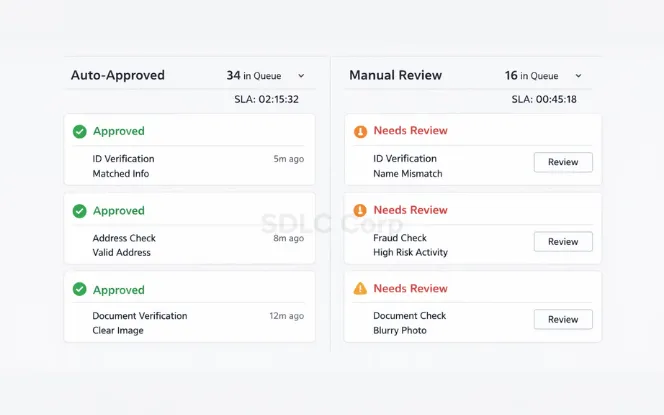

Hybrid verification is now the safe default

Deepfakes and spoof attempts are real. So teams mix automation with human review.

Hybrid model that works in practice

- automation handles most clean cases

- manual review handles edge cases and high-risk patterns

- review queues use SLAs and escalation rules

- decisions store evidence and reason codes

This reduces false rejects. Also, it keeps strict verification intact.

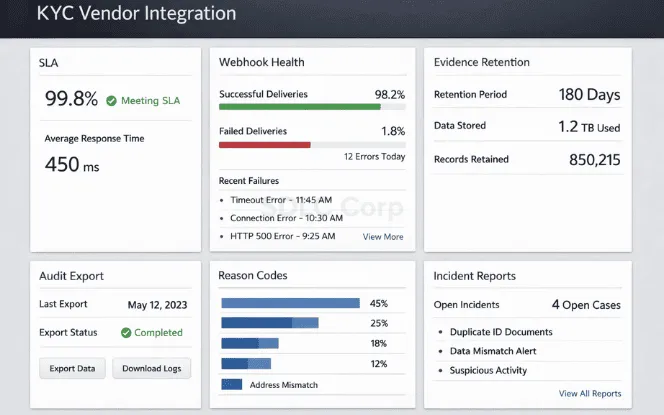

Third-party KYC and outsourcing: do it safely

Vendors can speed up verification. However, you still own the compliance outcome.

What you must lock before integrating a vendor

- written SLA (uptime, latency, incident reporting)

- training plan for review teams

- evidence retention requirements

- audit log export format

- clear retry controls and reason codes

- annual vendor performance review process

This protects you when disputes happen. Also, it prevents vendor gaps from becoming your support nightmare.

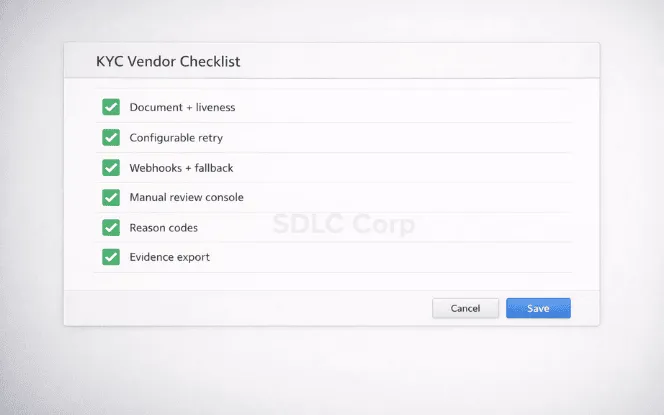

KYC vendor checklist (commercial investigation)

Don’t choose vendors by marketing claims. Instead, test them against your real funnel.

Must-have capabilities

- document verification + liveness

- configurable retry logic

- webhooks and fallback polling

- manual review console and queues

- decision explainability (reason codes)

- fraud signals support (device, velocity, behavior)

Questions to ask in demos

- Can we control “retry vs final reject” by reason category?

- Can we localize instructions and error text?

- How do you perform on low-end Android Philippines ones?

- What happens if webhooks fail for 10 minutes?

- Can we export a full evidence packet per decision?

Copy that increases completion without weakening KYC

Users don’t hate KYC. They hate uncertainty.

Paste-ready UI copy

Before KYC starts

- Title: Verify your account

- Body: This protects your wallet and withdrawals. It takes about 2–4 minutes.

- Note: You can retry if your Philippinesoto is unclear.

When review is pending

- Title: Under review

- Body: Most checks finish quickly. Sometimes it takes longer.

- CTA: We’ll notify you in the app.

If the Philippinesoto fails

- Title: Philippinesoto unclear

- Body: Use bright light. Keep all corners visible. Avoid glare.

- CTA: Retake Philippinesoto

In case manual review is needed

- Title: Extra check needed

- Body: We need a short review to keep accounts safe.

- CTA: Continue

A 14-day rollout plan to lift KYC completion

Days 1–3: Instrumentation

- add step-level events

- add error taxonomy (camera, network, provider, user input)

- add KYC state machine

Days 4–7: UX fixes

- progressive steps + progress bar

- accepted ID list before upload

- save/resume + reminder flow

- clear reason messages and next steps

Days 8–10: Risk routing

- silent pre-checks before document upload

- step-up checks only for medium/high risk

- manual review lane for edge cases

- strict retry policy with guardrails

Days 11–14: Evidence + governance

- audit log export package

- review SLA dashboard

- vendor monitoring checklist

- weekly reject reason review meeting

Conclusion

KYC drop-off happens when the flow feels slow, unclear, or unsafe. The fix is not weaker verification it’s a clear, guided, Philippines-ready KYC journey with strong retries and transparent status updates.

Use risk-based routing, progressive steps, strict-but-humane retry rules, and SLAs + reason codes. Back it with a state-machine backend, step-level tracking, and audit-ready logs. When KYC becomes predictable and measurable, completion rises, support tickets drop, and verification stays strict.

FAQs

What is the KYC policy for casinos?

KYC is the identity verification process that supports AML controls, safer play, and evidence-ready decisions.

What is the process of KYC in the Philippines?

Most flows collect identity details, capture an ID, verify authenticity, then monitor risk over time.

What does KYC mean in gambling terms?

It means confirming who the player is, and reducing fraud and underage access risk.

How to know if an online casino is legit in the Philippines?

Check licensing and operator transparency, then look for clear KYC, support access, and safe payments.

Are betting sites legal in the Philippines?

That depends on licensing and authorization. Avoid assuming legality without checking the operator’s status.

What is KYC in sports betting?

It is identity verification that unlocks deposits and withdrawals, while preventing fraud and abuse.

Can I use Bet365 in the Philippines?

Availability can change. Check the operator’s access rules and licensing signals before registering.

(Also, don’t rely on random lists.)

What is the best betting app in the Philippines?

“Best” depends on safety: clear KYC, reliable deposits, fast withdrawals, and responsive support.

What is the penalty for illegal gambling in the Philippines?

Penalties vary by law and role. Avoid unlicensed operations, because enforcement risk is real.