Introduction

Top GCCs in India by revenue are reshaping the global business landscape. Over the past decade, India has moved from being a low-cost operations base to a strategic global powerhouse. Today, these Global Capability Centers (GCCs) deliver innovation, manage complex technologies, and drive digital transformation for the world’s largest corporations.

India’s Global Capability Centers now play a central role in engineering, finance, data science, and global delivery. They are not just operational units but revenue-generating entities. With multinational firms such as JP Morgan, Walmart, and Microsoft investing heavily, the India GCC revenue 2025 forecast shows accelerated growth. These centers contribute directly to global decision-making and innovation pipelines, making India an anchor in the modern enterprise ecosystem. Consequently, this evolution positions India as the world’s most dynamic GCC hub.

How a Center Qualifies as a Leader

A true Global Capability Center (GCC) leader delivers measurable results rather than focusing on cost savings alone. These centers influence corporate strategy, manage significant revenue streams, and handle large-scale global processes. Therefore, leadership in this ecosystem demands a mix of innovation, governance, and sustainability.

A GCC’s ability to lead stems from its operational discipline and its capacity to build trust with global stakeholders. Many of these centers operate as semi-autonomous business units with dedicated profit and loss visibility. They go beyond traditional outsourcing models and evolve into strategic engines of transformation. This maturity level is now a standard benchmark across the Global capability centers India ranking 2025.

Key characteristics of a leader:

- Revenue accountability:

Leading Global Capability Centers operate with financial clarity and measurable outcomes. They align operations directly with business objectives and transform cost into value through consistent performance. Consequently, their accountability strengthens trust and opens access to more complex projects. - Functional depth:

Successful GCCs diversify across engineering, analytics, and innovation. Their functions enhance resilience and create opportunities for continuous improvement, driving cross-department collaboration globally. - Strategic integration:

Integration into the corporate strategy enables GCCs to shape global decisions. When these centers participate in innovation and business planning, they move beyond delivery support to strategic value creation.

Learn more about Global Capability Centers (GCCs) and how they enable digital transformation at scale.

The Revenue Signals That Matter

Revenue strength in a Global Capability Center (GCC) depends not only on scale but also on sustainability and strategic contribution. While total income matters, the true indicator of performance is how efficiently a center turns investment into enterprise growth. Consequently, revenue signals are now essential metrics in identifying leaders for India GCC revenue 2025.

These indicators include functional ownership, technology depth, and transparency. For instance, centers that own core digital platforms consistently deliver higher returns. Additionally, those that innovate in automation and AI establish stronger competitive edges within their global networks.

Primary revenue signals:

- Global project ownership:

Centers that run end-to-end global projects build credibility faster. Their control of key deliverables ensures direct accountability, which helps strengthen the relationship between headquarters and local operations. - Automation and technology depth:

The use of intelligent automation enables scalability. Therefore, GCCs that invest in AI, data pipelines, and robotic process automation consistently outperform manual operations and drive faster decision-making. - Platform ownership and scalability:

When a Global Capability Center owns its internal systems, it enhances efficiency and agility. Moreover, it reduces dependency on third-party vendors, ensuring long-term operational stability. - Transparent governance:

Strong governance creates measurable success. GCCs that maintain transparent systems, regular audits, and compliance maturity are trusted with higher-value projects.

According to PwC, India’s GCC market is expected to grow by 11–12 percent annually until FY29. Furthermore, more than two dozen centers have already reached billion-dollar revenues, establishing India’s global dominance.

Explore how AI-first Global Capability Centers (GCCs) in the UK are shaping next-generation enterprise growth.

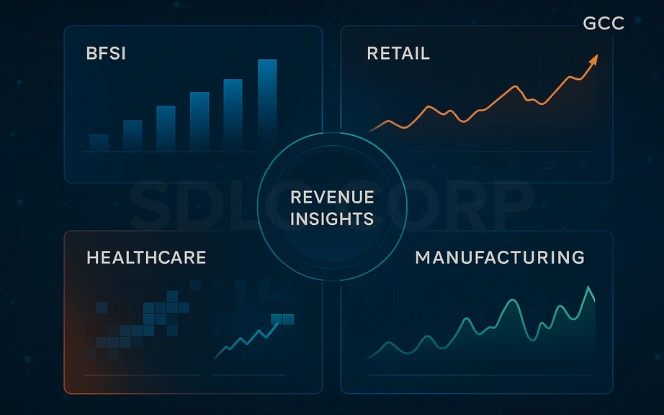

Sector Patterns and How They Drive Revenue

Every industry operates under different pressures and goals, and Global Capability Centers (GCCs) adjust accordingly. Sector-specific strategies, when executed well, directly impact the overall performance of the Top GCCs in India by revenue. The ability to create domain expertise often determines how fast a GCC matures into a strategic asset.

Sector trends defining growth:

- Banking and financial services:

BFSI GCCs manage analytics, compliance, and risk modeling. Because financial institutions depend on accuracy and security, these centers handle sensitive global systems, thereby becoming irreplaceable. - Retail and e-commerce:

Retail GCCs focus on personalization, logistics, and omnichannel integration. They use real-time data to drive operational decisions and customer insights, making them key to customer experience transformation. - Automotive and manufacturing:

Automotive GCCs are now essential to building connected, software-defined vehicles. They lead predictive maintenance, component digitization, and manufacturing optimization across global operations. - Healthcare and life sciences:

Healthcare GCCs manage large datasets, drug discovery pipelines, and compliance systems. Their ability to integrate analytics with medical expertise supports breakthrough innovations.

These diverse functions reveal why India’s ecosystem is flexible across sectors. Moreover, domain maturity ensures that even in volatile markets, these GCCs remain growth pillars.

Learn more about industry evolution in our guide – What is GCC?.

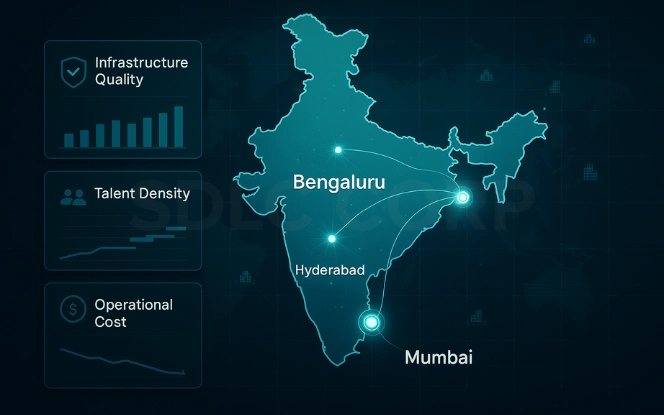

Geography Still Plays a Role

Geography continues to influence success despite virtual operations. The India GCC hubs Bengaluru Hyderabad Mumbai remain the strongest locations, attracting more than half of all global centers in India. These cities offer a mix of skilled talent, policy support, and innovation-driven infrastructure.

Why these cities lead:

- Bengaluru – The innovation capital:

Bengaluru houses the largest cluster of Global Capability Centers in India. It has a mature technology ecosystem supported by global partnerships and universities. Therefore, it remains the primary destination for engineering and product innovation. - Hyderabad – The balanced growth hub:

Hyderabad combines cost competitiveness with deep technical expertise. Its policies and public-private initiatives make it a strategic expansion point for global corporations. - Mumbai – The financial backbone:

Mumbai continues to anchor BFSI operations. Its connectivity with global banking institutions and access to skilled professionals make it ideal for global finance management.

Because of these locational strengths, India continues to attract new GCC investments every quarter. In addition, emerging Tier 2 cities like Pune, Chennai, and Noida are strengthening the ecosystem by providing cost-efficient scalability.

Discover how to build a high-performance Global Capability Center (GCC) in the UAE to scale internationally.

Operating Models That Unlock Scale

The sustainability of a Global Capability Center (GCC) depends on how well its operating model balances flexibility and governance. Scalable models allow centers to evolve from cost-saving entities to innovation-driven organizations. The GCC growth India FY24-25 trend clearly supports this evolution.

Core components of scalable models:

- Shared platform architecture:

Unified systems reduce duplication and streamline workflows. This model ensures consistent standards and better quality, resulting in higher customer satisfaction globally. - Financial transparency through charge-backs:

Charge-back mechanisms create accountability. They tie investments to measurable deliverables, encouraging prudent resource allocation and optimizing costs. - Empowered, cross-functional teams:

Cross-functional ownership drives faster execution. Teams that manage projects end-to-end build institutional knowledge, improving efficiency and collaboration. - Compliance-first workflows:

Integrated compliance improves data security and governance. Moreover, it prepares GCCs to meet global regulatory standards without delays or penalties.

As a result of these practices, scalable GCCs in India achieve higher profitability and improved risk control.

Explore strategies for a high-performance Global Capability Center (GCC) in the US.

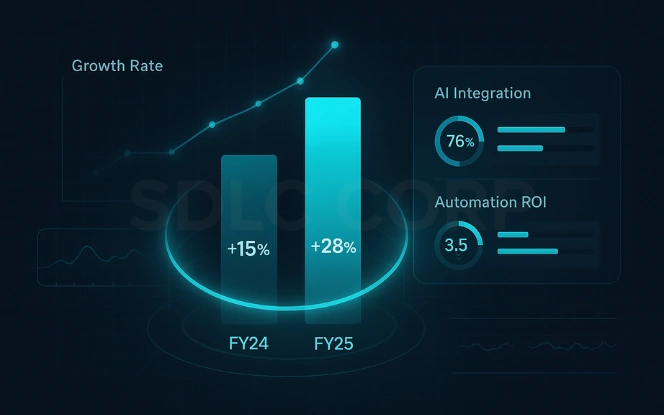

Growth Sorters and the FY24-25 Inflection

FY24-25 brought fundamental transformation for Global Capability Centers (GCCs) in India. The focus shifted from operational efficiency to strategic influence. Consequently, the India GCC revenue 2025 trajectory indicates a sharp upward curve, emphasizing innovation over volume.

Major catalysts driving change:

- AI and automation adoption:

Centers integrated automation and AI into daily workflows. These technologies reduced dependency on manual processes while improving accuracy and scalability. - Data accessibility and governance:

Data democratization gave teams autonomy. With improved analytics tools, decision-making became faster and more transparent, strengthening business confidence. - Leadership localization:

Locally based leaders aligned strategies with regional realities, creating synergy between global objectives and local execution. - Global KPI integration:

The connection between local results and global metrics improved accountability. This alignment made performance measurable and visible to headquarters.

Because of these catalysts, GCCs now drive enterprise strategy, not just support it.

Find out how much it costs to set up a Global Capability Center.

Billion-Dollar Clubs: A Marker of Maturity

The emergence of billion-dollar Global Capability Centers (GCCs) represents a major shift in India’s technology and business landscape. Once seen primarily as a cost-efficient outsourcing destination, India has evolved into a global innovation powerhouse. Centers that have reached or surpassed the billion-dollar milestone embody resilience, scalability, and strategic foresight. They no longer act as support functions but as core business enablers driving enterprise transformation, digital innovation, and global revenue growth.

Traits of billion-dollar centers:

Full-stack ownership:

Billion-dollar GCCs manage end-to-end operations across geographies and functions, encompassing product engineering, data analytics, cybersecurity, and customer experience. This ownership gives them control over the entire value chain-from concept to delivery.

Strategic leadership and governance:

These GCCs have strong governance models and leadership teams that align local operations with global strategies. Their leaders drive innovation agendas, influence enterprise-level decision-making, and shape corporate goals.

Multi-domain expertise:

Billion-dollar GCCs serve multiple industries, including BFSI, retail, automotive, healthcare, and telecommunications. This cross-sector expertise helps them build robust and adaptable frameworks capable of handling market volatility. It encourages cross-pollination of ideas, leading to faster innovation cycles and more resilient business models.

Continuous innovation investment:

Leading GCCs reinvest heavily in R&D, AI, and digital transformation. This continuous investment sustains competitiveness, accelerates modernization, and drives enterprise-wide innovation.

With more than 24 billion-dollar GCCs already operating in India, this segment showcases how operational maturity, innovation, and strategic alignment convert into measurable financial success and lasting global influence.

How to Interpret Ranking Lists

While rankings offer a quick snapshot of performance, context determines their true accuracy and meaning. The Global Capability Centers India Ranking 2025 goes beyond traditional financial metrics. It incorporates multiple dimensions such as innovation capacity, governance quality, leadership maturity, and talent density. These factors together create a holistic picture of a GCC’s actual strategic contribution.

How to analyze rankings:

Understand the evaluation criteria:

Revenue size remains an important indicator, but it no longer defines success on its own. Modern evaluations give equal weight to factors like innovation depth, operational maturity, and strategic alignment. Centers that influence global decisions, drive enterprise transformation, and deliver intellectual property command higher credibility and recognition.

Evaluate the scope of control:

The degree of ownership matters significantly. GCCs that design, develop, and manage entire global product portfolios or end to end business processes create measurable strategic value. Their ability to control critical functions from ideation to deployment reflects their contribution beyond cost efficiency, positioning them as growth partners in the parent enterprise’s ecosystem.

Assess innovation depth:

Centers that lead in artificial intelligence, design thinking, automation, and advanced analytics consistently outperform peers. Their capacity to translate innovation into tangible outcomes such as patents, new revenue streams, and enhanced customer experiences serves as a key differentiator.

These parameters reveal that scale alone cannot determine true success. A billion dollar valuation without innovation or leadership depth offers limited long term impact. Ultimately, the right context, contribution, and continuous evolution define a GCC’s real standing in the global hierarchy.

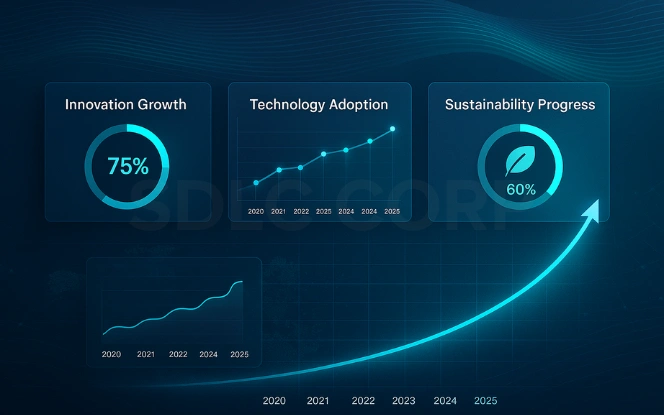

Outlook to 2025 and Beyond

India’s Global Capability Center (GCC) network is entering a transformative decade. With more than 2000 centers projected by FY28, the ecosystem is becoming a foundation for digital innovation worldwide. Furthermore, this expansion enhances India’s reputation as a trusted global technology partner.

Emerging trends for the future:

- AI-native operations:

Centers focusing on AI-driven systems will lead innovation cycles. They will also reduce turnaround times through intelligent automation. - Broader functional diversification:

Future GCCs will expand into climate analytics, sustainability, and product design. This expansion will add resilience and align with ESG goals. - Public-private ecosystem:

Enhanced cooperation between industries and government will foster growth. New incentive programs and digital parks will further strengthen India’s advantage. - Global leadership presence:

The increasing relocation of executives to India strengthens collaboration. As a result, decision-making becomes more responsive and locally informed.

These patterns affirm India’s position as the global headquarters for capability centers.

Strategic Takeaways for Business Leaders

For leaders, the transition from operational focus to strategic leadership is critical. Each Global Capability Center (GCC) must aim to build measurable outcomes that align with enterprise-wide transformation.

Key actions for leaders:

- Map your GCC’s value contribution:

Review existing roles and link them to revenue outcomes. This process identifies areas for improvement and high-value opportunities. - Promote full ownership:

End-to-end responsibility ensures consistency. Therefore, fostering ownership culture boosts innovation and reduces dependency. - Invest in transparent governance:

Transparent governance promotes trust. Dashboards that visualize performance help senior leadership monitor results effectively. - Develop future-ready talent:

Upskilling in AI, cybersecurity, and analytics ensures workforce readiness. Adaptable talent drives sustainable growth. - Leverage regional strengths:

Use strengths from India GCC hubs Bengaluru Hyderabad Mumbai to access diverse talent and innovation capabilities.

When executed effectively, these strategies secure long-term growth and reinforce India’s leadership in global transformation.

Conclusion

India’s rise as the world’s GCC hub is now undeniable. The Top GCCs in India by revenue combine operational scale with innovation and governance excellence. They showcase how the Global Capability Center (GCC) model has evolved from a support unit to a strategic powerhouse.

The continued rise of India GCC hubs Bengaluru Hyderabad Mumbai and the success of India GCCs billion-dollar clubs underline India’s strength in technology, governance, and execution. As 2025 unfolds, these centers will define global standards for capability, efficiency, and trust.

To explore how your organization can join this growth journey or build a high-performance GCC aligned with global benchmarks, Contact us SDLC Corp.

FAQs

What Are The Top GCCs In India By Revenue In 2025?

The Top GCCs in India by revenue in 2025 include leading Global Capability Centers from sectors such as banking, retail, and technology. Companies like JP Morgan, Walmart, and Microsoft operate billion-dollar GCCs that drive AI, automation, and innovation for their global operations.

How Are Global Capability Centers In India Ranked?

The Global capability centers India ranking 2025 considers factors like total revenue, scope of global work, and innovation depth. Rankings also evaluate governance maturity and strategic contribution, ensuring that only the most impactful GCCs secure the top positions.

Which Indian Cities Host The Largest GCC Hubs?

The largest India GCC hubs Bengaluru Hyderabad Mumbai dominate India’s GCC ecosystem. Bengaluru excels in product and R&D, Hyderabad specializes in AI and analytics, and Mumbai leads in finance and regulatory operations.

What Drives GCC Growth In India Between FY24 And FY25?

The GCC growth India FY24-25 surge comes from automation, AI adoption, and leadership localization. Global Capability Centers now align with corporate KPIs and run high-value platforms that increase both productivity and revenue.

What Is The Future Of GCCs In India Beyond 2025?

The India GCC revenue 2025 forecast shows continued expansion. More than 2000 Global Capability Centers are expected by FY28, focusing on sustainability, ESG analytics, and AI-driven efficiency to maintain India’s leadership position.