What is DeFi and its Lending Platforms

The rise of DeFi has made it more likely that blockchain will be used to make financial apps. DeFi, which stands for “Decentralized Finance”, has been getting much attention lately because it has helped businesses get a lot of money.

You might be surprised that almost $20.46 billion is locked up in DeFi protocols. This shows that the use of DeFi applications has grown significantly. This has made this type of lending grow. One part of the cryptocurrency ecosystem that is growing is DeFi lending. With these types of loans, crypto holders can now lend their assets and earn a lot of interest.

In simple terms, DeFi lending is about giving crypto loans on a platform that one person doesn’t control. DeFi has the highest growth rate for lending out of all the Decentralized Applications (dApps) worldwide. It is one of the most common ways that crypto assets are locked.

What is DeFi?

DeFi is an umbrella term for moving existing financial products, like loans, to the blockchain. The idea is to use existing cryptocurrencies and smart contracts to offer financial services.

You can see how much money is locked up in these projects by taking a quick look at DeFi Pulse. At the time of writing, these projects have more than $9 billion locked in. This is up from just over $1 billion earlier in 2020.

Maker and AAVE are the two biggest lenders right now. (Read more about Decentralized Finance: What is it and How Does it Work?)

Explore DeFi Lending: Unlock the Future of Finance!

What exactly are DeFi loans?

DeFi loans are one of the parts of the cryptocurrency world that are growing the fastest. They let people with crypto assets lend them to other people and earn interest.

In short

Explore our other insights!

The Role of Metaverse and Crypto in Decentralized Finance

Metaverse and Crypto in Decentralized Finance: The financial industry is changing quickly, and the emergence of decentralised finance

Decentralized Finance (DeFi): What is it and How Does it Work?

Introduction Decentralized Finance, or DeFi for short, is a new financial system built on blockchain technology. DeFi seeks

Decentralized Finance and It’s Benefits

Introduction Decentralized Finance, which is popularly known as DeFi, is a financial technology that is based on secure

The potential for blockchain and cryptocurrencies to democratize access to financial industry tools is one of its most attractive features. DeFi, which stands for “decentralized finance”, is an umbrella term for this change in how money is made, spent, and sent.

Crypto assets are like traditional banks because they offer the same services but are not based in one place. This includes lending, borrowing, trading in the spot market, and trading with a margin.

With DeFi loans, anyone can get a loan quickly and easily without ever having to tell a third party who they are or go through the checks that traditional banks do. But there are also bad things.

We’ll talk about how a DeFi loan works, what makes it better than traditional ways of getting money, and what the future may hold for this new technology.

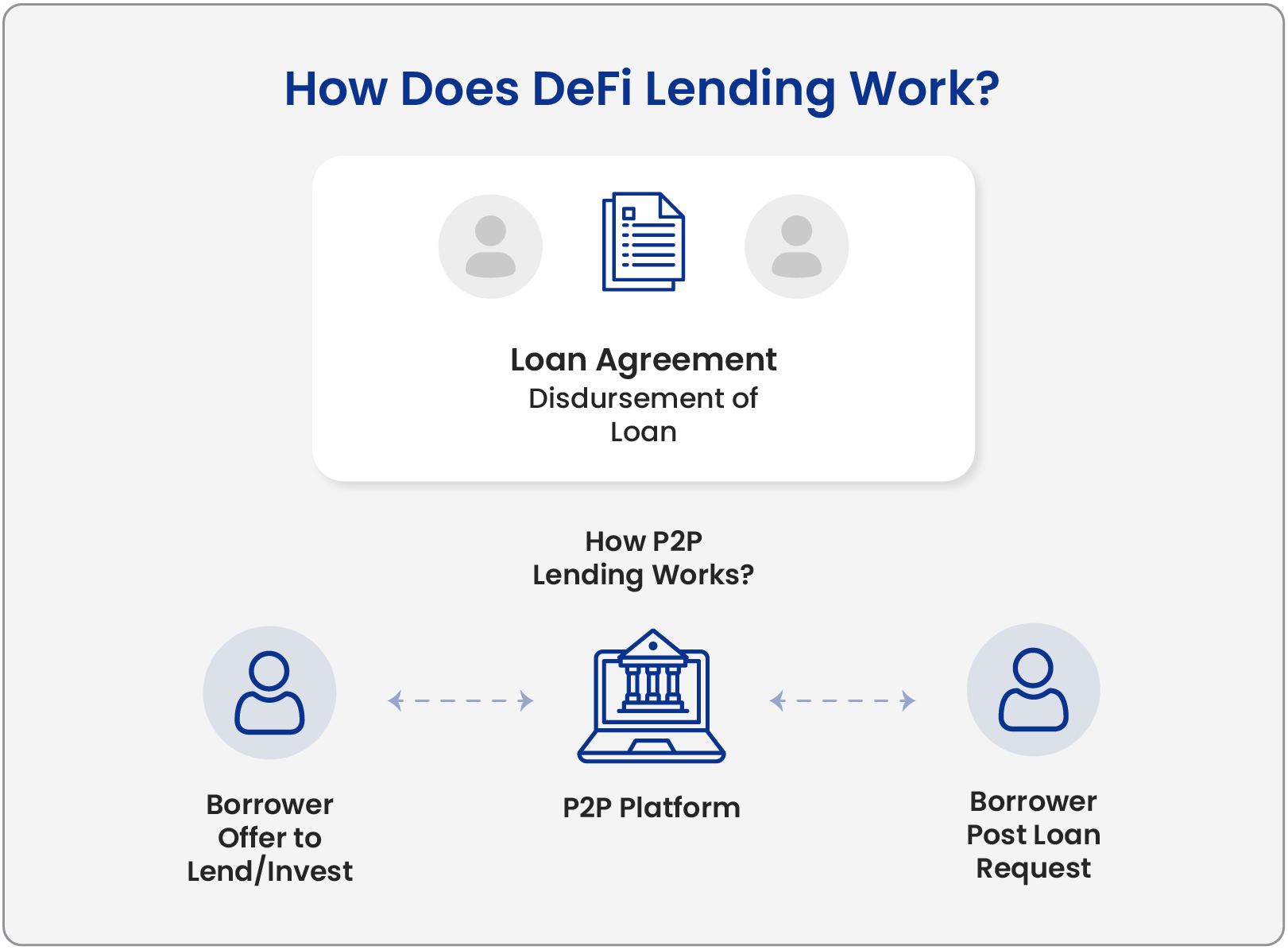

How Do DeFi Loans Work?

Crypto assets don’t earn interest while they’re in a wallet. The underlying asset’s value may go up or down, but holding that particular cryptocurrency doesn’t make you anything. DeFi loans can help with this.

Consider the possibility of lending your cryptocurrency out and receiving interest payments in return. This is how banks function, but only a select few have access to them. Anyone can rise to the top in DeFi.

Lending your cryptocurrency to others is a great way to make extra money. There are many ways to do this, but lending pools are the most common. These are what a traditional bank’s loan offices look like.

What Kind of Advantages Does DeFi Lending Offer it's Customers?

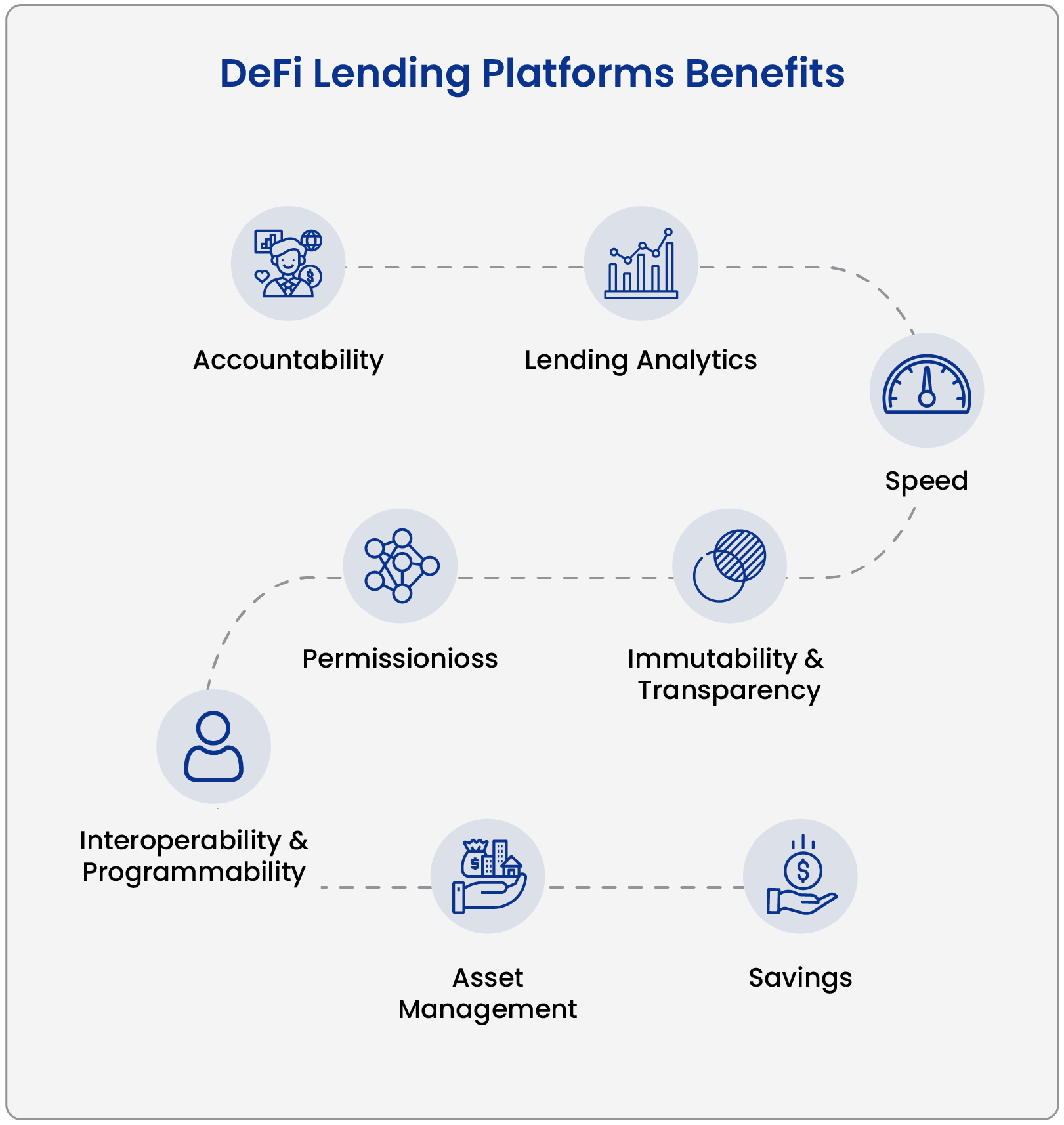

DeFi lending works primarily by encouraging participants to contribute funds by depositing them at interest. These interest rates are higher than those offered by traditional banks. Aside from that, there are numerous advantages to DeFi lending over the conventional lending system. These are some examples:

Accountability

DeFi lending’s emphasis on responsibility is one of its main benefits. Blockchain is a public ledger that can provide on-demand records of all DeFi loans and the policies and rules that approved those loans. When a DeFi loan is granted, the public distributed ledger primarily serves as proof of all financial transactions.

Analytics for Lending

Having a fully digital lending process primarily aids in the assessment and monitoring of the borrowing and lending market. Another significant advantage of the DeFi lending process is lending analytics. Lending analytics can be used to optimize funds. It also enables various DeFi lending platforms to gain insights into loan sources, which can help them improve loan performance.

Speed

DeFi loans are processed quickly, and the loan amount is available immediately after approval. DeFi loans are processed more rapidly because DeFi lending platforms are powered by cloud services that aid in the detection of fraud and other DeFi lending risks.

Transparency and Immutability

Any user in the network can easily verify the blockchain. In addition, Defi lending ensures transparency because the blockchain’s decentralized nature ensures that all transactions are genuine.

Permissionless

Anyone with a DeFi crypto loan wallet has permissionless and open access to decentralized lending. Regardless of the presence of their fund or geographical location, anyone can easily access the DeFi applications built on blockchain networks.

Programmability and Interoperability

The interconnected software stack ensures that the DeFi lending protocols complement and integrate. Furthermore, smart contracts are highly programmable, allowing for the creation of financial instruments and digital assets.

Asset Administration

Users can be the sole custodians of their crypto assets using crypto wallets and DeFi lending protocols such as Metamask, Gnosis Safe, and Argent. It also enables users to securely interact with decentralized applications and use services such as selling, buying, earning interest on investments, and transferring cryptocurrency.

Savings

Defi dapp development services are now developing innovative saving methods through Defi lending apps. As a result, users can maximize their earnings and access interest-bearing accounts by connecting to various lending platforms.

Decentralized Lending Constraints

Several prominent discussions about decentralized finance center primarily on the advantages of DeFi lending. However, it is equally important to highlight the disadvantages to analyze its potential effectively. Here is a list of critical drawbacks that you may face soon after implementing DeFi lending:

Uncertainty

If there is instability while hosting a blockchain in a DeFi lending process, the process can inherit instability directly from the host blockchain. The Ethereum blockchain is currently undergoing several changes. For example, mistakes made during the PoW consensus transition to the new Ethereum 2.0 POS system could put the system at risk.

Scalability

DeFi lending may face difficulties maintaining scalability for the host blockchain due to various factors. DeFi transactions, for example, require more time for confirmation. During the congestion period, DeFi protocol transactions may become more expensive. Overall, this has an impact on scalability.

Responsibilities are shared

Among all the drawbacks, the shared responsibility factor has the opposite effect on users. If you make a mistake, the DeFi projects will not accept responsibility. Instead, they remove the intermediaries, leaving only the user responsible for their assets and funds. As a result, the DeFi lending process necessitates the use of tools that can eliminate the possibility of human errors or mistakes.

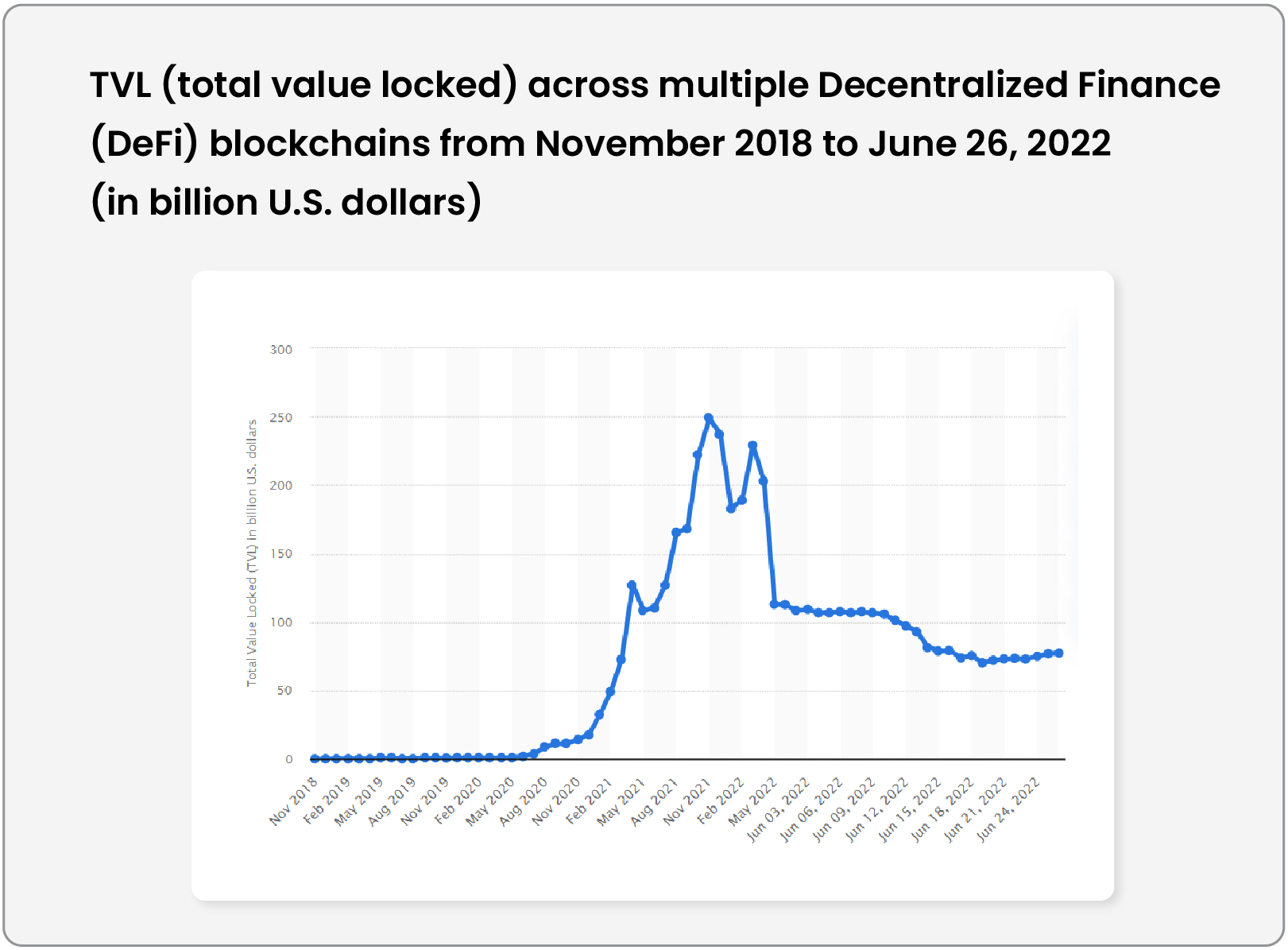

Liquidity

Another critical factor in blockchain protocols and DeFi-based lending is liquidity. The total value locked in the DeFi project as of June 2022 was approximately 77.29 billion US dollars. Refer to the infographic below for a better understanding of the current TVL of the DeFi market:

Since June 2022, the market value of DeFi has fallen to less than 80 billion US dollars. The crash for Terra (LUNA) and its stablecoin Terra USD (UST) on May 22, when coins such as USDD lost their peg to the US dollar, had a significant impact on the DeFi market.

A declining crypto market has also impacted the DeFi lending process. As a result, the DeFi market is less trustworthy and as large as traditional financial systems. As a result, putting your trust in a sector with liquidity concerns can take time and effort.

Dive into DeFi: Discover Lending Platforms Now!

What Makes it so Unique?

DeFi provides the same products as traditional financial institutions (lending, borrowing, trading, investing, and so on) but with added benefits:

DeFi is decentralized and anonymous. Therefore, you can earn interest by lending your crypto assets to others. Lending pools are the most common way to make interest in crypto-assets.

Borrowers are typically required to over-collateralize their loans to protect themselves against sudden drops in collateral value, which would result in penalties, making it a safer option for lenders.

How Do Loans Get Made?

The Best DeFi Lending Platforms

DeFi lending platforms provide loans to businesses or the general public without intermediaries. DeFi lending protocols allow people to earn interest on cryptocurrency while providing stablecoins. The following are the top DeFi lending platforms:

Compound

The compound is a type of DeFi lending rates protocol that is used for open financial applications. For example, users can earn a passive income directly by depositing cryptocurrency via borrowing and interest crypto.

Holders of the Compound have the right to vote on certain decisions, such as technology platform upgrades and the addition of new assets. As a crypto lender, you will receive a token in proportion to the amount you contributed to the liquidity pool. A CToken is unique to the digital assets available in the liquidity pool. These tokens will earn interest based on the interest rate of the liquidity pool. USDC, ETH, and DAI are the top three markets on Compound.

Aave

Aave is a popular DeFi lending platform that debuted in 2020. It is a non-custodial liquidity protocol that is open source. Aave allows its users to deposit cryptocurrency in the liquidity pool and immediately receive the same amount of tokens.

An embedded algorithm adjusts interest rates based on current demand and supply in a given liquidity pool. As a result, the interest Defi lending rates rise as the number of AToken holders grows. To learn more about asset tokenization in blockchain, read this blog.

YouHodler

YouHodler is another hybrid platform that offers crypto-backed lending in the form of stablecoins and fiat loans. YouHodler’s mission is to assist people in transitioning from passive holding (buy-and-hold strategy) to fully utilizing crypto assets. YouHodler, based in Switzerland, also has an exchange policy.

The exchange accepts fiat, cryptocurrency, and stablecoins. When compared to other lending platforms, YouHodler has lower interest rates. The current interest rate is 12.3%, lower than the rates offered by different lending platforms such as crypto.com, Binance, Celsius Network, and BlockFi.

Uniswap

MakerDAO

MakerDAO is a decentralized lending platform that only lends DAI tokens. DAI is a stablecoin that is backed by the US dollar. You can easily borrow DAI using Maker while providing collateral such as BAT or ETH.

MakerDAO users are encouraged to participate in the operational earnings, which are the network’s interest rates. DAI can be borrowed up to 66% of the collateral value by users.

The Future

As DeFi evolves, we’ll see decentralized systems attempt to make all these services as good as their brick-and-mortar counterparts. After all, these services are accessible to anyone with an internet connection, meaning anyone can buy and lend cryptocurrency.

However, as with anything crypto-related, it can be a roller coaster ride, so research before deciding whether a crypto loan is right for you.