Introduction

AI for FinTech integrates machine learning, automation, and data intelligence into financial services. This fusion has revolutionized how businesses analyze risk, detect fraud, personalize customer experiences, and streamline operations. As financial institutions face increasing competition and rising customer expectations, the convergence of AI and FinTech has become essential for innovation and efficiency.

With the growing adoption of AI development services and custom AI solutions, organizations are transforming how they approach digital finance, from automated credit scoring to intelligent investment strategies. According to industry research, the global AI in FinTech market is projected to exceed $61 billion by 2031, growing at a CAGR of over 20%.

Consequently, AI technologies are no longer optional but foundational for modern financial ecosystems. Startups and established banks alike are leveraging predictive analytics and automation to make smarter, faster, and more secure financial decisions. Therefore, understanding AI’s transformative role is key to staying competitive in the digital economy.

1. Why AI is a Catalyst for Fintech Innovation

Artificial Intelligence (AI) has become the driving force behind Fintech innovation, fundamentally reshaping how financial institutions operate and deliver value. By harnessing vast amounts of data, AI enables smarter, faster, and more reliable financial decisions that were once impossible through manual processes.

- Data-driven financial insights: AI empowers Fintech platforms to analyze real-time market data, customer behavior, and transactional patterns to uncover actionable insights. Moreover, this intelligence helps institutions reduce risks and identify emerging opportunities with precision.

- Automation and efficiency improvements: Repetitive and time-consuming financial tasks are increasingly automated using AI algorithms. In addition, automation streamlines operations such as loan processing, credit assessment, and compliance checks allowing businesses to focus on innovation rather than administration.

- Personalized banking experiences: AI-driven personalization tailors products and services to individual customer needs. As a result, users receive custom recommendations, proactive alerts, and adaptive financial advice that enhance engagement and satisfaction.

- Predictive analytics for better decisions: Leveraging machine learning models, Fintech firms can forecast trends, detect fraud, and optimize investment strategies. Similarly, predictive analytics transforms reactive financial management into proactive strategy formulation.

Learn More : Generative AI for Fintech

2. Top Applications of AI for Fintech

Artificial Intelligence has become the cornerstone of digital transformation in the financial sector. AI for Fintech enhances security, decision-making, and personalization, empowering institutions to deliver faster, smarter, and more secure services. Below are the most impactful applications shaping the Fintech landscape.

Fraud Detection and Cybersecurity with AI for Fintech

Fraud remains a major concern for financial organizations, but AI for Fintech combats it with real-time monitoring and intelligent pattern analysis.

- AI algorithms detect suspicious transactions using behavioral analytics and anomaly detection.

- They compare live transactions against millions of data points to identify fraud instantly.

- Adaptive models evolve as new fraud techniques emerge, improving detection accuracy.

Key Insights:

- 60% reduction in false declines has been reported with AI-powered fraud systems.

- AI enhances security through continuous learning and risk scoring models.

Consequently, Fintech firms can prevent losses while maintaining a smooth user experience. Meanwhile, AI’s predictive capability minimizes both financial and reputational risks.

Learn About : AI-Powered Fraud Detection in Fintech & Payments

Algorithmic Trading & Wealth Management

AI for Fintech plays a transformative role in algorithmic trading and investment management.

- AI trading bots analyze real-time market data, news sentiment, and price trends.

- These bots execute trades with precision and adapt strategies as market conditions change.

- Predictive analytics enable portfolio optimization and risk minimization.

Thus, AI ensures smarter and faster trading decisions. In wealth management, robo-advisors and data-driven algorithms offer customized asset allocations.

- Machine learning models continuously rebalance portfolios.

- Reinforcement learning enhances long-term return strategies.

- Investors receive personalized recommendations, once available only to professionals.

As a result, AI delivers agility, precision, and performance beyond human limitations.

AI Chatbots and Customer Support in Fintech

AI for Fintech revolutionizes customer service through chatbots and voice assistants. Using Natural Language Processing (NLP), these bots interpret user intent and respond conversationally.

Key Advantages:

- 24/7 automated assistance across mobile and web platforms.

- Resolution times reduced by over 80%.

- Personalized engagement drives higher retention and satisfaction rates.

Examples:

- Fintech giants like PayPal and Revolut employ AI chatbots handling millions of queries daily.

- Sentiment analysis tools identify customer frustration and trigger proactive solutions.

Consequently, AI humanizes digital banking experiences, creating loyalty through intelligent, consistent support.

Read Also : AI Chatbots & Virtual Assistants for Banking & Insurance

AI-Driven Credit Scoring and Lending

Traditional credit models rely on outdated criteria. AI for Fintech revolutionizes this by incorporating alternative data for fairer and faster assessments.

AI analyzes:

- Social media behavior and online transactions.

- Utility payments and digital spending patterns.

- Employment history and mobile usage metrics.

Benefits:

- Risk prediction accuracy improves by up to 40%.

- Enables inclusion for the unbanked and underbanked populations.

- Streamlines loan approval through automated verification and instant decisioning.

Thus, lenders achieve reduced defaults while expanding financial access. Consequently, AI brings both fairness and efficiency to the lending ecosystem.

AI for Fintech in Compliance (RegTech)

Compliance management especially AML (Anti-Money Laundering) and KYC (Know Your Customer) has evolved through AI for Fintech.

Key Use Cases:

- Automation: AI extracts and verifies customer identities automatically.

- Pattern recognition: Detects suspicious activities or irregular transactions.

- Continuous compliance: Monitors regulatory changes and updates processes instantly.

Benefits:

- Reduces manual effort by up to 70%.

- Minimizes compliance violations and audit errors.

- Improves transparency across financial ecosystems.

Meanwhile, AI-enabled RegTech tools ensure institutions stay compliant without compromising speed or scalability.

Personal Finance and Robo-Advisors

In the consumer space, AI for Fintech personalizes financial management through behavioral analytics and automation.

Applications:

- Robo-advisors like Wealthfront and Betterment use AI to manage portfolios and optimize taxes.

- Budgeting apps such as Mint and Cleo analyze user spending and suggest saving goals.

- Predictive insights help users anticipate expenses and manage debt.

Benefits:

- Personalized recommendations tailored to each user’s goals.

- Encourages financial literacy and proactive decision-making.

- Enhances user retention through trust and transparency.

Thus, AI empowers individuals to manage wealth intelligently while automating complex financial tasks once handled by experts.

| Core Fintech Process | Before AI | After AI for Fintech |

|---|---|---|

| Loan Approval | Manual verification | Automated risk scoring |

| Fraud Detection | Rule-based checks | Adaptive ML-driven anomaly detection |

| Customer Service | Limited human support | 24/7 AI chatbots and assistants |

| Investment Advisory | Static reports | Real-time data-driven insights |

AI thus acts as a catalyst that merges innovation with intelligence, positioning Fintech at the forefront of digital transformation.

3. Benefits of Implementing AI for Fintech Solutions

Adopting AI for Fintech solutions has become a strategic necessity for organizations aiming to thrive in today’s data-driven financial landscape. Artificial Intelligence not only automates routine operations but also enhances precision, security, and personalization across financial services.

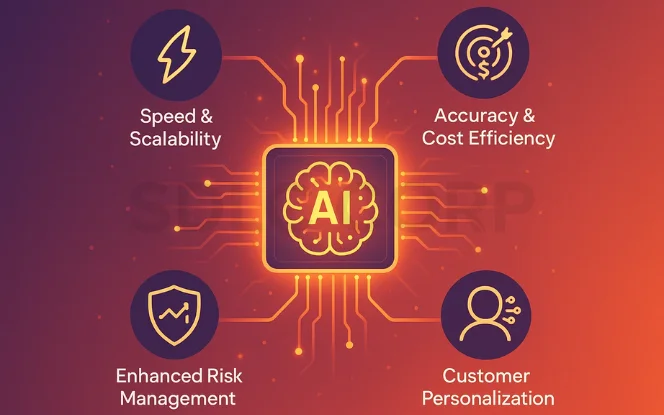

Accuracy and Cost Efficiency

AI-powered automation minimizes human error and operational costs. Machine learning models ensure accuracy in loan approvals, credit scoring, and compliance monitoring. Consequently, Fintech companies save both time and resources, allocating human talent to strategic innovation instead of manual processing. Hence, operational efficiency and profit margins improve substantially.

Explore This : The Cost of Developing a FinTech App

Enhanced Risk Management

AI’s ability to process and interpret real-time data transforms risk assessment and fraud prevention. Advanced algorithms detect anomalies within milliseconds, safeguarding transactions against potential threats. Predictive analytics forecast credit risks and market volatility, allowing proactive financial decisions. Additionally, AI-driven insights enhance portfolio stability and overall trust in digital financial systems.

Customer Personalization

AI empowers Fintech firms to deliver hyper-personalized experiences. By analyzing behavioral patterns, purchase histories, and engagement data, AI can recommend tailored products and services. For instance, users receive customized investment advice, credit offers, or savings plans that align with their financial goals. Consequently, personalization boosts customer satisfaction, loyalty, and lifetime value.

| Benefit | Impact on Fintech Operations | Example |

|---|---|---|

| Efficiency | Faster loan processing | AI-based underwriting |

| Security | Fraud prevention | ML-based transaction screening |

| Accuracy | Fewer manual errors | Automated compliance checks |

| Personalization | Better customer engagement | Predictive financial recommendations |

4. Challenges in Implementing AI for Fintech

While AI for Fintech offers transformative opportunities, its adoption comes with a range of technical, ethical, and organizational challenges. Financial institutions must navigate complex issues around data governance, fairness, and infrastructure modernization to achieve sustainable success.

Data Privacy and Compliance Constraints

AI use in fintech is closely tied to regulatory compliance and consumer protection. Governance frameworks define acceptable model behavior, data usage, and accountability. An AI consulting company may assist fintech organizations in aligning AI strategies with regulatory and risk management requirements.

Financial organizations handle vast amounts of sensitive data, making compliance a critical concern.

- AI systems must comply with GDPR, PCI DSS, and regional data protection laws.

- Maintaining data transparency, consent, and customer trust is often difficult.

- However, inconsistent governance and fragmented data sources increase regulatory risks.

- Financial firms must implement robust encryption, access controls, and compliance audits to prevent breaches.

Consequently, the balance between innovation and regulation remains a constant struggle.

Algorithmic Bias and Fairness Concerns

AI models are only as fair as the data they are trained on.

- On the other hand, historical financial data often reflects human or systemic bias.

- Biased AI can result in unfair loan approvals or discriminatory credit scoring.

- Continuous bias detection and model retraining are vital to maintain fairness.

- Transparent algorithms and regular ethics reviews can minimize reputational damage.

Despite this, achieving complete algorithmic neutrality remains an ongoing challenge.

Integration with Legacy Infrastructure

Legacy systems pose significant barriers to AI adoption.

- Outdated IT frameworks lack the flexibility to handle AI workloads.

- Integration often demands high capital investment and system overhauls.

- Nevertheless, without modernization, AI-driven automation cannot reach its full potential.

Shortage of AI-Skilled Professionals

- The Fintech sector faces an acute shortage of AI engineers, data scientists, and cybersecurity specialists.

- Talent gaps delay implementation and increase operational costs.

- However, partnerships with tech firms and training programs can mitigate this skill deficit.

Overcoming these barriers requires ethical governance, modern infrastructure, and continuous workforce development.

Know About : How Odoo ERP Solutions Can Transform Fintech Companies

5. Future Trends and Emerging Technologies in AI for Fintech

As financial technology continues to evolve, AI for Fintech is set to become even more transformative. The next decade will witness innovations that merge automation, intelligence, and decentralization—reshaping how finance operates globally. Looking ahead, several emerging trends are redefining the future of this industry.

Rise of Generative AI and Autonomous Financial Agents

Generative AI is no longer confined to text or art it’s revolutionizing financial modeling and advisory services.

- AI-driven autonomous agents can analyze portfolios, simulate market outcomes, and execute strategies automatically.

- In the near future, virtual financial assistants will make investment recommendations with human-like reasoning.

- Generative models will craft dynamic financial reports, forecast market trends, and design custom financial products in real time.

Consequently, businesses will gain a competitive edge through faster decision-making and improved risk intelligence.

AI for Decentralized Finance (DeFi)

AI for Fintech is now intersecting with blockchain-based DeFi ecosystems.

- AI enhances smart contract auditing and fraud detection across decentralized platforms.

- Predictive analytics will optimize liquidity pools and yield farming strategies.

- Furthermore, AI can detect network anomalies to prevent cyber threats in DeFi exchanges.

Looking ahead, the combination of AI and DeFi will create a secure, self-regulating financial environment.

Hyper-Personalization through Predictive AI

Fintech companies are embracing predictive AI to deliver ultra-personalized services.

- Behavioral analytics predict spending habits, savings goals, and investment preferences.

- AI recommends tailored financial plans in real time.

- Customer engagement is enhanced through emotion-aware chatbots and proactive insights.

Consequently, users experience a hyper-personalized, intuitive approach to finance that builds loyalty and trust.

Integration with IoT and Edge Computing

The convergence of AI for Fintech with the Internet of Things (IoT) is enabling real-time, data-rich decision-making.

- IoT devices collect instant financial and transactional data.

- Edge computing processes this data locally, reducing latency and improving security.

- For instance, wearable payment devices and smart POS systems will leverage AI to detect fraud or automate micro-transactions instantly.

In the near future, this synergy will make financial operations faster, safer, and more adaptive to customer behavior.

By embracing these trends, Fintech companies can harness AI-driven innovation to stay competitive, scalable, and future-ready in the ever-evolving digital economy.

6. Strategic Recommendations for Fintech Companies

As AI for Fintech continues to redefine financial ecosystems, companies must adopt strategic, responsible, and scalable approaches to implementation. To summarize, success lies in blending innovation with governance and long-term adaptability.

- Start small, scale gradually: Begin with focused AI pilots—such as fraud detection or chatbots—before expanding across business functions. This minimizes risk while allowing teams to refine models and workflows.

- Prioritize explainable AI (XAI): Transparency is key. Fintech companies should adopt AI models that clearly justify their decisions, especially in lending, compliance, and risk assessment. This builds customer trust and satisfies regulators.

- Combine AI innovation with ethical governance: Implement robust data governance frameworks to ensure fairness, accuracy, and accountability. Ethical oversight committees can help align AI projects with organizational values.

- Encourage cross-functional collaboration: Integrate expertise from data science, compliance, and finance teams. Collaborative decision-making fosters innovation while reducing operational blind spots.

Therefore, a strategic approach balances experimentation with responsibility, ensuring AI deployment enhances both business performance and user trust. Ultimately, Fintech companies that combine agility with ethical intelligence will lead the next wave of financial transformation.

Read About : Explained: What are Stablecoins – The Holy Grail of Fintech

Enterprise-Scale AI Platforms for Fintech Operations

Large fintech organizations operate across multiple products, markets, and regulatory environments. Enterprise-scale AI platforms centralize analytics and monitoring while supporting localized compliance needs. Architectural approaches used by an enterprise AI development company are often referenced when designing scalable fintech AI systems.

Conclusion

AI for FinTech is reshaping the global financial landscape by bridging innovation, security, and accessibility. Through automation, advanced analytics, and personalization, AI empowers institutions to deliver faster, smarter, and more secure financial services. With AI development services, organizations can build scalable, data-driven solutions that boost efficiency and strengthen decision-making.

To stay competitive, FinTech leaders must adopt ethical and transparent AI systems that balance innovation with accountability. By embracing responsible, explainable, and scalable AI, businesses can drive digital transformation and shape a smarter, more trustworthy future for finance.

FAQs

1. What is AI for Fintech?

AI for Fintech refers to the integration of artificial intelligence technologies such as machine learning, predictive analytics, and automation into financial services. It helps institutions improve decision-making, detect fraud, personalize customer experiences, and enhance operational efficiency.

2. How does AI improve fraud detection in Fintech?

AI systems analyze massive datasets in real time to identify unusual transaction patterns or anomalies. Machine learning models adapt to new fraud tactics continuously, reducing false declines by up to 60% and enhancing transaction security for both customers and institutions.

3. What are the main benefits of implementing AI in Fintech?

- Faster and more accurate processing.

- Cost reduction through automation.

- Real-time risk assessment and fraud prevention.

- Personalized banking and investment recommendations.

- Enhanced compliance and data management.

4. What challenges do Fintech companies face when adopting AI?

Common challenges include data privacy regulations, algorithmic bias, legacy system integration, and a shortage of skilled AI professionals. Overcoming these requires ethical governance, explainable AI, and continuous staff training.

5. What does the future hold for AI in Fintech?

Looking ahead, AI will merge with emerging technologies like DeFi, IoT, and generative AI, enabling autonomous financial agents, hyper-personalized banking, and decentralized, intelligent ecosystems. The future of Fintech lies in responsible, transparent, and adaptive AI innovation.