Introduction

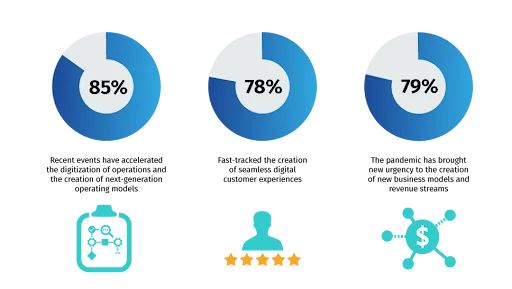

The insurance industry faces numerous challenges, including high operational costs, inefficiencies, and the increasing demand for personalized customer experiences. Automation offers a solution by transforming traditional processes and enabling insurers to stay competitive in a dynamic market.

Benefits of Insurance Automation

A. Enhanced Customer Experience

Automation enables faster response times and personalized interactions. Chatbots and virtual assistants, such as those used by Allstate, handle customer inquiries 24/7, providing immediate support and improving overall customer satisfaction. These tools can handle simple queries and transactions, allowing human agents to focus on more complex customer needs.

B. Improved Accuracy

Automated systems ensure that data is processed accurately and consistently. In claims processing, this accuracy is crucial for customer satisfaction and compliance. A case study from Lemonade Insurance shows how AI-driven claims processing can achieve a 94% accuracy rate, ensuring fair and quick settlements and reducing the likelihood of disputes. Additionally, the use of RPA in the insurance industry has further enhanced these processes by automating repetitive tasks, improving efficiency, and minimizing human error. This integration of RPA not only accelerates claims processing but also ensures that each claim is handled with the highest level of precision and compliance.

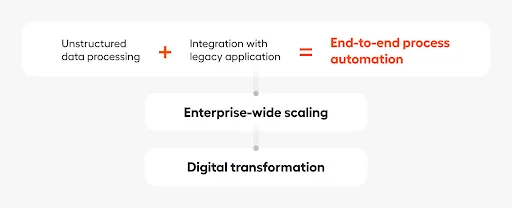

C. Efficiency and Productivity

Automation significantly reduces the time spent on repetitive tasks such as data entry, policy management, and claims processing. For instance, Robotic Process Automation (RPA) for the insurance industry can handle high-volume tasks, freeing employees to focus on more strategic activities. This allows insurance companies to process more policies and claims without proportionally increasing their workforce. By leveraging RPA for the insurance industry, companies can enhance efficiency, reduce errors, and improve overall customer satisfaction.

D. Data-Driven Insights

Automation significantly reduces the time spent on repetitive tasks such as data entry, policy management, and claims processing. For instance, Robotic Process Automation (RPA) for the insurance industry can handle high-volume tasks, freeing employees to focus on more strategic activities. This allows insurance companies to process more policies and claims without proportionally increasing their workforce. By leveraging RPA for the insurance industry, companies can enhance efficiency, reduce errors, and improve overall customer satisfaction.

E. Cost Reduction

Robotic Process Automation (RPA) in the insurance industry streamlines operations by automating repetitive tasks like claims processing and policy management. It boosts efficiency, minimizes errors, and allows employees to focus on strategic activities, enabling insurers to handle more policies and claims without expanding their workforce proportionally.

"See Automation in Action: Transform Your Insurance Processes Now!"

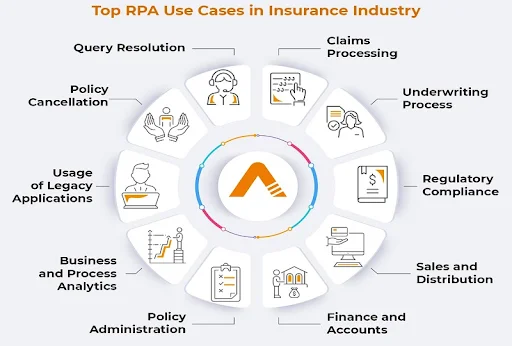

Use Cases of Insurance Automation

1. Claims Processing

Insurance claim automation revolutionizes the claims process, handling everything from data collection to settlement swiftly and consistently. Progressive Insurance, for example, employs AI to process claims in under three minutes, enhancing customer satisfaction with rapid resolutions and reducing administrative costs. This transformative technology streamlines operations, ensuring efficiency and accuracy while improving the overall insurance experience.

2. Underwriting

AI-powered underwriting systems evaluate risks and determine policy terms more accurately than manual methods. This leads to more competitive pricing and better risk management. Companies like Zurich Insurance have implemented AI to improve their underwriting efficiency by 20%, enabling faster policy issuance and improved customer satisfaction.

3. Fraud Detection

Machine learning algorithms detect unusual patterns and flag potentially fraudulent activities. This proactive approach helps minimize fraud-related losses. For instance, Shift Technology uses AI to detect fraud, reducing false positives by 75%, which allows insurers to focus on genuine cases and reduce operational costs associated with fraud investigations.

4. Policy Management

QTP Insurance leverages advanced automation techniques, such as Robotic Process Automation (RPA), to streamline policy management tasks like renewals, cancellations, and updates. By integrating RPA into its operations, QTP Insurance achieves a 50% reduction in processing times, enhancing operational efficiency and ensuring timely policy updates and renewals for improved customer satisfaction.

"Unlock Efficiency and Innovation in Insurance with Automation – Learn How!"

Future Prospects of Insurance Automation

The future of insurance automation looks promising with continuous advancements in AI and ML. Here are some trends to watch:

a. Predictive Analytics

Insurers will increasingly use predictive analytics to anticipate customer needs and tailor products accordingly, enhancing customer satisfaction and loyalty. Companies like John Hancock already use predictive analytics to offer personalized health insurance plans, providing coverage that adapts to individual health metrics and lifestyle changes.

b. Blockchain Technology

Blockchain can streamline claims processing and policy management by providing a secure and transparent ledger of transactions. For example, Nationwide Insurance is exploring blockchain for faster claims settlement, ensuring that all parties have a transparent view of the claims process and reducing the potential for disputes.

c. Advanced Fraud Detection

Enhanced AI algorithms will improve the accuracy and efficiency of fraud detection, reducing losses and ensuring fair claims settlements. Companies like AIG are investing in AI to boost their fraud detection capabilities, leveraging advanced machine learning models to identify suspicious patterns and transactions in real-time.

d. Personalized Insurance Products

Automation will enable the creation of highly personalized insurance products that cater to the specific needs of individual customers. Insurtech startups like Trov lead the way with on-demand, usage-based insurance models, offering flexibility and customization that traditional policies often lack. This approach can cater to niche markets and evolving customer preferences.

Contact Us

Share a few details about your project, and we’ll get back to you soon.

Let's Talk About Your Project

- Free Consultation

- 24/7 Experts Support

- On-Time Delivery

- sales@sdlccorp.com

- +1(510-630-6507)