How to Use Excel Accounting for Small Businesses?

Small businesses can leverage Excel for accounting, particularly in managing accounts payable, in a variety of ways. Firstly, they can establish a comprehensive vendor database within Excel, containing vital details such as vendor names, contact information, payment terms, and other relevant data. This database serves as a centralized hub for tracking and managing payables efficiently.

Secondly, Excel’s spreadsheet format is ideal for recording incoming invoices. Businesses can input invoice details like numbers, dates, due dates, amounts due, and any applicable taxes or discounts. This structured approach helps maintain a clear overview of financial obligations. Moreover, Excel’s formulas, such as SUMIF, are valuable for calculating the total payables to each vendor. These calculations provide insights into the amounts owed to different vendors, aiding in cash flow management and payment prioritization.

Furthermore, Excel can be used to track payments made to vendors, ensuring timely payments and avoiding late fees. By recording payment dates and amounts, businesses can maintain accurate records of their financial transactions. Additionally, Excel’s functionality extends to generating aging reports for accounts payable. These reports show the duration for which invoices have been outstanding, facilitating better management of payables and cash flow.

Businesses can also utilize Excel to create payment schedules, helping them plan and organize payments in advance. This proactive approach ensures that sufficient funds are available to cover upcoming payments. Lastly, Excel can be employed to analyze accounts payable trends over time. By tracking changes in accounts payable balances, businesses can identify opportunities to reduce costs and improve efficiency.

Excel’s flexibility and functionality make it a valuable tool for small businesses to manage accounts payable effectively. Whether creating databases, recording invoices, tracking payments, generating reports, or analyzing trends, Excel can significantly enhance financial management practices.

How Its Work?

Small businesses can efficiently manage their accounting using Excel, including the conversion of PDF tables into Excel format. Excel offers several tools and features that make it ideal for various accounting tasks. to convert PDF tables into Excel, businesses can use Excel’s “Insert Data from Picture” feature, which allows them to capture data from a PDF table using a smartphone or camera and convert it into an editable Excel table. Alternatively, they can use third-party software designed for converting PDF tables into Excel format, ensuring accuracy and efficiency in data conversion.

Beyond PDF conversion, Excel is a powerful tool for creating financial statements like income statements, balance sheets, and cash flow statements. These statements provide a comprehensive overview of a business’s financial performance, aiding in decision-making and financial planning. Excel is also useful for budgeting and forecasting. Small businesses can create detailed budgets, track actual expenses against budgeted amounts, and use

forecasting formulas to predict future financial outcomes. This helps in managing cash flow and ensuring financial stability. Additionally, Excel can be used for tracking expenses, managing inventory, processing payroll, tax planning, and financial analysis. Its flexibility and functionality make it a valuable tool for small businesses looking to streamline their accounting processes and improve financial management practices.

Excel is a versatile tool that can be effectively used by small businesses for various accounting tasks, including converting PDF tables into Excel format. By leveraging Excel’s features, businesses can improve efficiency, accuracy, and decision-making in their accounting processes.

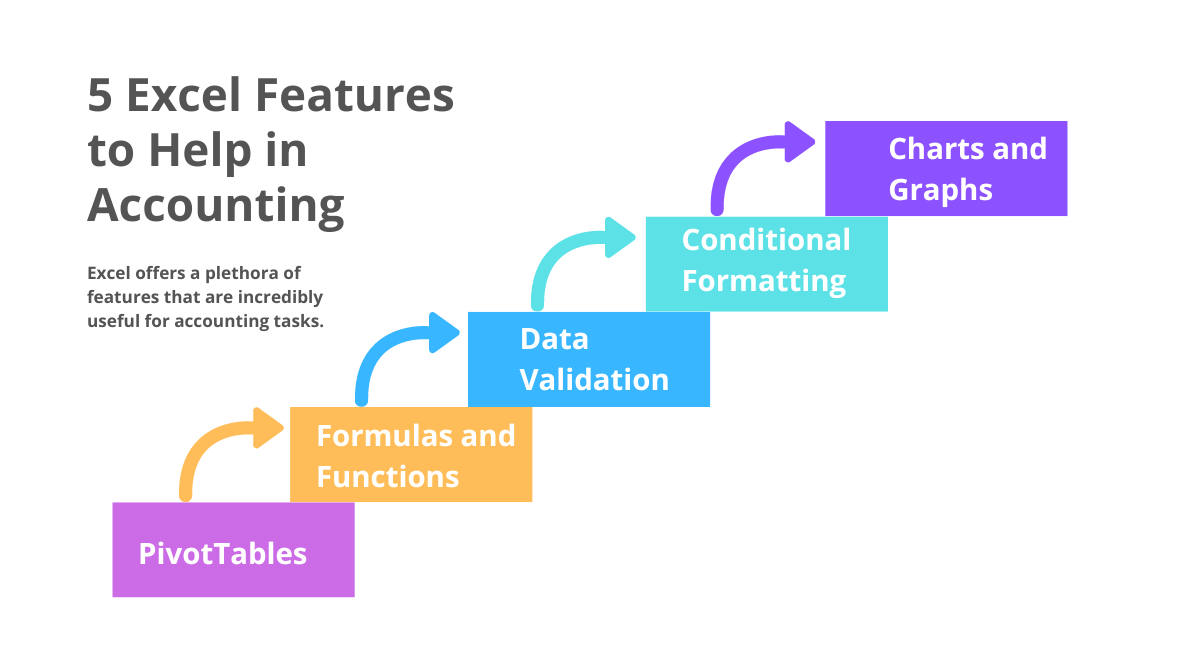

Which 5 Excel Features to Help in Accounting?

When it comes to accounting, Excel offers several powerful features that can greatly assist small businesses. Here are the top five Excel features for accounting, including the ability to import PDFs into Excel:

Importing PDFs into Excel: Excel allows users to import PDFs into Excel files, making it easier to work with financial statements, invoices, and other accounting documents. This feature saves time and reduces errors that may occur when manually entering data.

PivotTables: PivotTables are a powerful tool for summarizing and analyzing large amounts of data. In accounting, PivotTables can be used to create financial reports, analyze expenses, and track revenue streams. They allow for quick and easy exploration of data, helping businesses make informed decisions.

Formulas and Functions: Excel offers a wide range of formulas and functions that are essential for accounting tasks. Functions like SUM, AVERAGE, and IF are commonly used to calculate totals, and averages, and perform conditional calculations. These functions automate calculations and ensure accuracy in financial reports.

Data Validation: Data validation is a feature that allows users to control the type of data that can be entered into a cell. This is particularly useful in accounting, where accuracy is crucial. Data validation can be used to create drop-down lists, enforce data formats, and prevent errors in data entry.

Conditional Formatting: Conditional formatting allows users to highlight cells based on specific criteria. In accounting, this feature can be used to visually identify important trends, outliers, or errors in financial data. For example, cells with negative values can be formatted in red to indicate a loss.

Charts and Graphs: Excel offers a variety of chart types, including column charts, line charts, pie charts, and more. Charts and graphs are essential for presenting financial data in a visually appealing and easy-to-understand format. You can use them to create balance sheet visuals, income statements, cash flow analyses, and trend analyses, making complex financial information more accessible to stakeholders.

Master Excel Accounting: Learn for Small Businesses Today!

What Are the Key Features of Excel for Accounting on a Cash Basis?

Microsoft Excel is a versatile tool widely used for accounting, especially on a cash basis, and its capabilities extend to integrating data from external sources through web scraping. Here’s an updated look at the key features of Excel for cash basis accounting, incorporating web scraping:

Formulas and Functions: Excel’s strength lies in its extensive range of formulas and functions. For cash-based accounting, functions like SUM, SUMIF, VLOOKUP, and IF are particularly useful for automatically calculating totals, searching for specific data, and handling conditional operations.

Pivot Tables: These are powerful tools in Excel for summarizing, analyzing, exploring, and presenting your data. Pivot tables can be particularly useful for quickly summarizing transactions by date, category, or other criteria.

Data Validation: Excel allows you to set specific rules for data entry which helps in maintaining data integrity. For example, you can restrict entries to certain ranges or formats, reducing errors in data entry relevant to cash transactions.

Conditional Formatting: This feature can automatically change the appearance of cells based on the value they contain, which is great for quickly highlighting outliers, due dates, or important thresholds in cash flow analysis.

Charts and Graphs: Visual representations of data can help you better understand trends, cash flows, and financial status. Excel supports a variety of charts and graphs that can be linked directly to your accounting data.

Macros and Automation: For repetitive tasks, Excel allows the creation of macros. This can streamline processes such as monthly cash flow calculations, data entry, and report generation.

Integration Capabilities: Excel can be integrated with other tools and platforms, such as banking software or other Microsoft Office applications, which can simplify the data import/export process and automate data updates.

Security Features: Excel offers password protection and encryption to secure your financial data. This is crucial when handling sensitive financial information in your accounting records.

Template Availability: There are numerous pre-built templates available that can be customized for cash-based accounting. These templates can serve as a starting point to build a tailored accounting system without starting from scratch.

These features combine to make Excel a robust and flexible tool for managing finances on a cash basis, especially for small businesses or those just getting started with formal accounting practices.

How Can Excel Be Used to Format Accounting Data for Accrual Basis Reporting?

Microsoft Excel is a powerful tool for formatting and managing accounting data under accrual basis accounting. This method involves recognizing revenue when it is earned and expenses when they are incurred, regardless of when cash transactions occur. Here’s how Excel can be effectively used to manage and format data for accrual basis accounting:

Date and Time Functions: Use Excel’s date and time functions to accurately record the timing of revenue and expenses, which is crucial for accrual accounting. Functions like DATE(), TODAY(), and EOMONTH() can help manage and track the periods in which revenues and expenses are recognized.

Adjusting Entries: Excel can be used to make necessary adjusting entries at the end of an accounting period. These might include adjustments for prepaid expenses, unearned revenue, depreciation, and accrued expenses. Formulas in Excel make it easy to adjust these balances automatically.

Complex Formulas and Functions: Functions such as SUMIFS(), COUNTIFS(), and AVERAGEIFS() allow for sophisticated calculations that depend on multiple conditions. These are particularly useful for accrual accounting, where you might need to match revenues with their related expenses in the same period.

Pivot Tables: These are excellent for summarizing large sets of accounting data and can be particularly useful for viewing financial data in various ways without altering the data. For example, you can create monthly or quarterly financial reports and segment data by category or department.

Templates for Accrual Accounting: Excel offers several templates specifically designed for accrual-based accounting. These templates often include integrated balance sheets, income statements, and cash flow statements that automatically update as new data is entered.

Linking Sheets: You can link multiple worksheets or workbooks in Excel. This is particularly useful in accrual accounting where you can link related entries across different financial statements—for instance, linking accrued expenses recorded in the journal to adjustments in financial statements.

Conditional Formatting: This feature can be used to highlight entries that don’t follow typical patterns, such as expenses that seem unusually high or revenues that haven’t been matched with their corresponding cash receipts yet.

Graphs and Charts: Visual representations created from your data can help in analyzing trends over time, comparing income and expenses, and presenting financial results in an understandable way. This is helpful for internal management as well as for external reporting purposes.

Security Features: Excel’s security features, such as password protection and the ability to lock cells, prevent unauthorized access or alterations to the financial data, and maintain the integrity of the financial information.

Macros and Automation: Automate repetitive tasks, such as monthly closing entries, through macros. This saves time and ensures consistency in how transactions are recorded and reported each period.

Use Excel’s data validation tools to ensure that data entered follows predefined rules, which is critical to maintain accuracy in accrual basis accounting.

Empower Your Business: Learn Excel Accounting Now!

How Can Financial Statements Be Created Using Excel?

Creating financial statements using Microsoft Excel is common for businesses of all sizes due to Excel’s flexibility and powerful features. Here’s a step-by-step guide on how to create the three core financial statements—Income Statement, Balance Sheet, and Cash Flow Statement—using Excel:

1. Gather and Input Data

Gather all necessary financial data, including revenues, expenses, assets, liabilities, and equity. Input this data into Excel in a structured manner. You can use separate worksheets for different data types (e.g., one sheet for income and expenses, another for assets and liabilities).

2. Set Up the Income Statement

The Income Statement, commonly known as the Profit and Loss Statement, details the company’s revenues and expenses over a specified period. Here’s a guide on how to set it up:

Header: Include your company name, the title of the document (Income Statement), and the period covered.

Revenues: List all revenue sources and sum them to get total revenue.

Expenses: List all expenses, categorized appropriately (e.g., cost of goods sold, administrative expenses, marketing expenses).

Net Income Calculation: Subtract total expenses from total revenues to calculate the net income or loss for the period.

Use Excel formulas like SUM() to automatically calculate totals.

3. Create the Balance Sheet

The Balance Sheet presents a glimpse of the company’s assets, liabilities, and equity at a distinct moment in time.

Header: Include your company name, the title of the document (Balance Sheet), and the date.

Assets: List all assets, starting with current assets (like cash and inventory) followed by long-term assets (like property and equipment). Use SUM() to get total assets.

Liabilities: List all liabilities, starting with current liabilities and then long-term liabilities. Sum them to find total liabilities.

Equity: List all equity components, including retained earnings and contributed capital.

Balancing: Ensure that the equation Assets = Liabilities + Equity holds true.

4. Develop the Cash Flow Statement

The Cash Flow Statement monitors cash movements into and out of the business, and it is segmented into three categories: operations, investing, and financing:

Header: Include your company name, the title of the document (Cash Flow Statement), and the period.

Operating Activities: Adjust net income for non-cash transactions and changes in working capital.

Investing Activities: Record cash used for or generated from investing activities like purchasing or selling assets.

Financing Activities: Record cash used for or generated from financing activities like loans and dividends.

Net Increase in Cash: Sum the cash flows from operating, investing, and financing activities to find the net increase or decrease in cash during the period.

Use Excel Features for Efficiency

Formulas and Functions: Automate calculations using formulas (SUM, SUBTOTAL, VLOOKUP, etc.).

Pivot Tables: Use to summarize data or to create detailed reports dynamically.

Charts and Graphs: Visualize data trends and financial ratios.

Macros: Automate repetitive tasks, like monthly statement generation.

Templates: Use or modify existing financial statement templates available in Excel or online to save time.

6. Formatting and Review

Make sure your financial statements are well-formatted, clear, and accurate. Verify all formulas and data entries for correctness. Utilizing formatting features such as bold headings, borders, and cell colors can enhance the readability of the documents. Employing Excel to construct financial statements offers extensive customization options and can manage intricate financial data effectively, establishing it as a robust instrument for financial analysis and reporting.

What Are the Benefits of Small Businesses Using Accounting in Excel?

Cost-effectiveness: Excel often presents a more budget-friendly alternative compared to specialized accounting software, which makes it appealing for small businesses operating with constrained budgets.

Flexibility: Excel allows for customizable spreadsheets, enabling businesses to tailor their accounting systems to their specific needs and preferences.

Ease of Use: Excel’s user-friendly interface and familiarity with many users make it relatively easy for small business owners and employees to learn and navigate.

Accessibility: Excel is widely available and compatible with various devices, allowing businesses to access their accounting data from anywhere with an internet connection.

Versatility: Excel can handle various accounting tasks, from basic bookkeeping to complex financial analysis, making it suitable for various business needs.

Integration: Excel can integrate with other Microsoft Office applications and third-party tools, streamlining data import/export and enhancing workflow efficiency.

Scalability: Excel can adapt to the expansion of small businesses by adjusting its capabilities as necessary, without the need for substantial investments in new software.

Real-time Analysis: Excel’s calculation features enable small businesses to perform real-time financial analysis, helping them make informed decisions quickly.

Custom Reporting: Excel allows businesses to create customized reports and financial statements tailored to their requirements, enhancing transparency and decision-making.

Data Security: Excel offers built-in security features such as password protection and encryption, helping to keep sensitive financial data safe from unauthorized access.

Small businesses can benefit greatly from using Excel for accounting due to its affordability, flexibility, ease of use, accessibility, versatility, integration capabilities, scalability, real-time analysis, custom reporting options, and data security features.

Looking to automate accounts payable at your organisation ?

Conclusion

In conclusion, utilizing Excel for accounting can offer small businesses numerous advantages. Its cost-effectiveness and accessibility make it an attractive option, especially for those with limited resources or accounting expertise. The flexibility of Excel allows businesses to tailor their accounting processes to their specific needs, helping them track and manage their finances more efficiently. Additionally, Excel’s range of formulas, functions, and charting tools enable businesses to analyze their financial data effectively, gaining valuable insights for decision-making. Overall, Excel provides small businesses with a powerful yet user-friendly platform for managing their accounting needs.

Excel serves as a versatile and cost-effective accounting solution for small businesses, providing the tools and capabilities necessary to manage financial data efficiently, support decision-making, and adapt to changing business needs. By leveraging Excel’s features, small businesses can streamline their accounting processes, improve accuracy and efficiency, and position themselves for long-term success and growth.

FAQs

1. How can Excel help small businesses with their accounting needs?

Excel can help small businesses by organizing financial data, performing calculations, and generating reports efficiently. Its customizable features allow businesses to tailor spreadsheets to their specific accounting needs, aiding in budgeting, forecasting, and decision-making.

2. What are the key features of Excel that make it suitable for small business accounting?

Excel’s key features for small business accounting include its ability to organize data, perform calculations, and generate reports. Its flexibility allows for customization to meet specific accounting needs, making tasks like budgeting, forecasting, and financial analysis more efficient.

3. Can Excel be used for more than just basic accounting tasks?

Yes, Excel can be used for advanced accounting tasks such as financial modeling, complex data analysis, and creating interactive dashboards. Its robust features make it suitable for a wide range of accounting and financial management needs beyond basic tasks.

4.What are some tips for effectively using Excel for small business accounting?

Some tips for effective Excel use in small business accounting include using consistent formatting, organizing data logically, and utilizing Excel’s functions and formulas efficiently. Additionally, regularly backing up data and keeping formulas simple can help avoid errors and streamline accounting processes.

5. Are there any limitations to using Excel for small business accounting, and how can they be overcome?

Yes, limitations include potential errors in complex calculations and difficulties in managing large datasets. These can be overcome by using validation tools, breaking down complex tasks into smaller steps, and periodically reviewing and auditing data.

Contact Us

Let's Talk About Your Project

- Free Consultation

- 24/7 Experts Support

- On-Time Delivery

- sales@sdlccorp.com

- +1(510-630-6507)