Introduction

The sales order to cash process, also known as order to cash (O2C), encompasses the entire lifecycle of a customer order, from the initial sale to the receipt of payment. It begins with the generation of a sales order, detailing the customer’s request for goods or services. This order is then confirmed, ensuring the availability of stock and accuracy of details, before proceeding to the next stage.

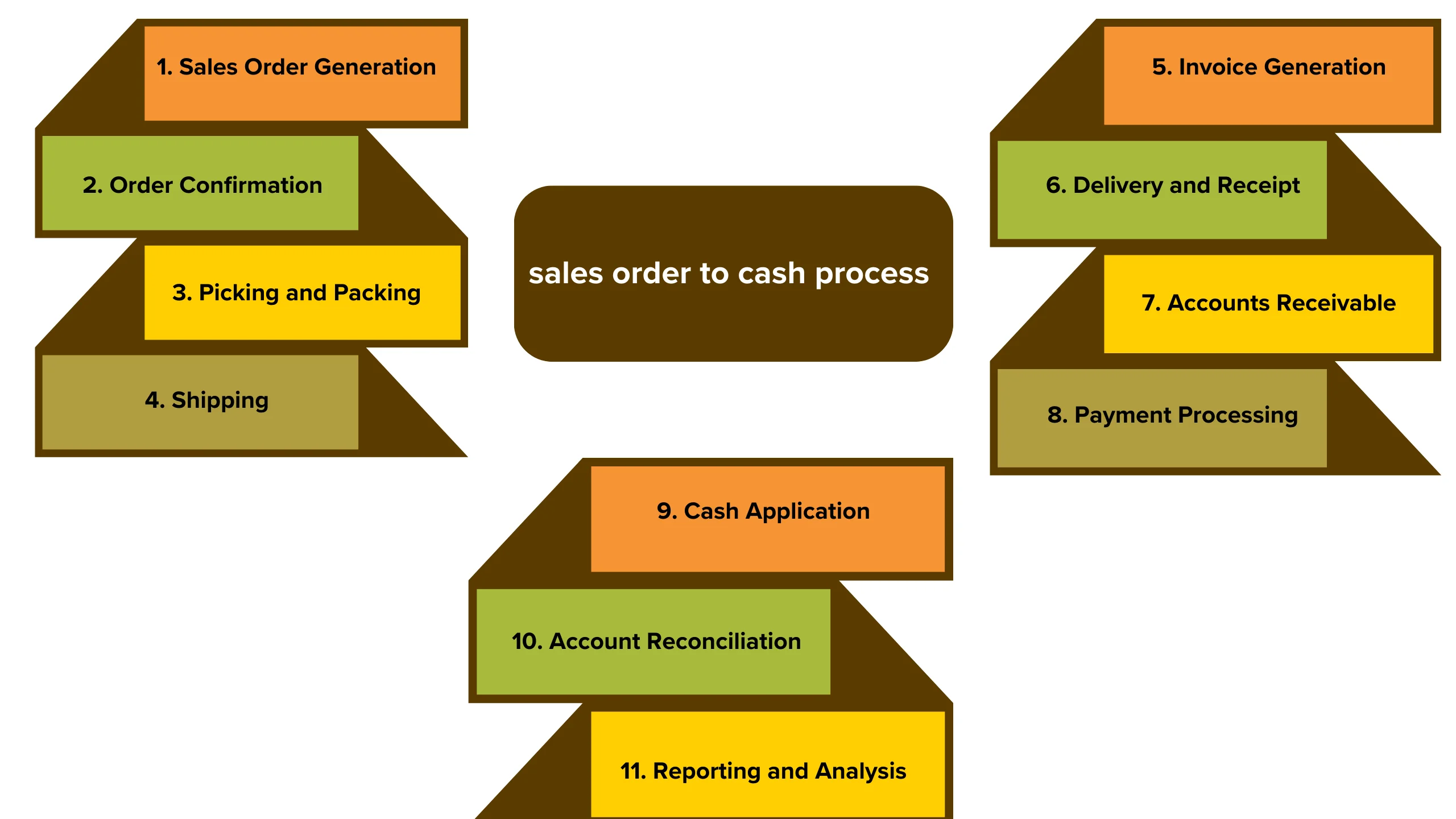

involves several steps from the initial sale to receiving payment. Here’s a general overview:

1. Sales Order Generation

The process begins when a customer places an order for goods or services. A sales order is created detailing the items, quantities, prices, and delivery terms.

2. Order Confirmation

The sales order is reviewed for accuracy and availability of stock. Once confirmed, the order is accepted, and a confirmation is sent to the customer.

3. Picking and Packing

The warehouse receives the order, picks the items from inventory, and packs them for shipment. The packing slip is often included in the shipment.

4. Shipping

The packed goods are shipped to the customer using a chosen carrier. A shipping notification with tracking details may be sent to the customer.

5. Invoice Generation

After shipping, an invoice is generated based on the sales order. The invoice includes details such as the items sold, prices, taxes, and any discounts.

6. Delivery and Receipt

The customer receives the shipment and verifies the contents against the packing slip. This step may involve accepting the delivery or signing off on receipt.

7. Accounts Receivable

The customer is billed for the order, and the invoice is recorded as an account receivable (AR) in the company’s books.

8. Payment Processing

The customer pays the invoice, either immediately or within the agreed-upon payment terms. Payment can be made through various methods like cash, check, credit card, or electronic transfer.

9. Cash Application

The payment received is matched to the corresponding invoice in the accounting system, marking the invoice as paid.

10. Account Reconciliation

Regular reconciliation of accounts receivable is performed to ensure that all invoices are accounted for and payments are properly recorded.

11. Reporting and Analysis

Various reports and analysis are conducted to monitor the O2C process’s efficiency and identify areas for improvement.

This process can vary depending on the organization’s size, industry, and specific requirements, but these steps provide a general outline of how the sales order to cash process typically works.

How sales order automation work?

Sales order automation involves the use of technology to streamline and simplify the process of creating, processing, and managing sales orders. Here’s how it works:

1. Order Creation

Sales orders can be automatically generated based on various triggers, such as customer requests, online orders, or sales team inputs. This eliminates the need for manual order entry, reducing errors and saving time.

2. Order Processing

Automated systems can process orders quickly and accurately by checking inventory levels, pricing, and customer information. Orders can be routed automatically to the appropriate departments for fulfillment.

3. Inventory Management

Automation can keep track of inventory levels in real-time, ensuring that orders are only accepted if the items are in stock. This helps prevent stockouts and backorders.

4. Order Fulfillment

Once an order is processed, automation can generate picking lists, packing slips, and shipping labels. This streamlines the fulfillment process and reduces the risk of errors.

5. Invoicing and Payment Processing

Automation can generate invoices automatically and send them to customers electronically. It can also track payments and send reminders for overdue invoices.

6. Integration with CRM and ERP Systems

Sales order automation systems can integrate with customer relationship management (CRM) and enterprise resource planning (ERP) systems to streamline data sharing and ensure consistency across the organization.

7. Reporting and Analytics

Boost Efficiency Today!

How can the Order-to-Cash process be improved?

The Order-to-Cash (O2C) process can be improved through several strategies aimed at enhancing efficiency, reducing errors, and increasing customer satisfaction. Here are some key areas for improvement:

1. Automation

Implement automation tools to streamline manual tasks such as order processing, invoicing, and payment processing. This can reduce errors, improve speed, and free up staff for more strategic activities.

2. Integration

Integrate systems across departments (e.g., sales, inventory, finance) to improve visibility and communication. This can help in better forecasting, inventory management, and order fulfillment.

3. Standardization

Establish standardized processes and documentation to ensure consistency and reduce confusion. This includes standardizing order forms, invoicing procedures, and payment terms.

4. Customer Communication

Enhance communication with customers throughout the O2C process. Provide real-time updates on order status, shipping details, and payment information to improve transparency and satisfaction.

5. Streamlined Returns Process

Simplify the returns process to make it easier for customers to return products and for your team to process returns. This can reduce disputes and improve customer loyalty.

6. Performance Metrics

Establish key performance indicators (KPIs) to measure the efficiency and effectiveness of the O2C process. Use these metrics to identify bottlenecks and areas for improvement.

7. Training and Development

Invest in training programs to enhance the skills of employees involved in the O2C process. This can improve accuracy, reduce errors, and boost productivity.

8. Supplier Collaboration

Collaborate with suppliers to improve lead times, reduce costs, and enhance product quality. This can lead to a more efficient O2C process overall.

9. Continuous Improvement

Implement a culture of continuous improvement, where feedback is regularly gathered from employees and customers to identify areas for enhancement.

10. Technology Adoption

Embrace new technologies such as artificial intelligence (AI), machine learning (ML), and blockchain to further streamline the O2C process and improve decision-making.

By focusing on these areas, businesses can enhance their O2C process, leading to improved efficiency, cost savings, and customer satisfaction.

What is sales order-to-cash and where does this fit in the cash cycle?

1. Sales Order-to-Cash Process

- Sales Order Generation: Initiated when a customer places an order for goods/services.

- Order Confirmation: Order is confirmed, ensuring accuracy and stock availability.

- Picking and Packing: Items are picked from inventory, packed, and prepared for shipment.

- Shipping: Goods are shipped to the customer, often with a packing slip.

- Invoice Generation: An invoice is created based on the sales order details.

- Delivery and Receipt: Customer receives the shipment and verifies contents.

- Accounts Receivable: Customer is billed, and the invoice is recorded as an account receivable.

2. Fit in the Cash Cycle:

- Part of Working Capital Management: O2C is crucial for managing working capital, as it involves converting sales into cash.

- Starting Point for Cash Inflow: The process starts with a customer placing an order, which eventually leads to cash inflow.

- Direct Impact on Cash Flow: Efficient O2C processes can speed up cash collection, positively impacting cash flow.

- Integration with Cash Management: O2C is integrated with cash management practices to ensure timely payments and optimize cash flow.

- Affects Cash Conversion Cycle: The speed and efficiency of O2C directly impact the cash conversion cycle, which measures how quickly a business can convert its products into cash.

Overall, the sales order-to-cash process is a critical component of the cash cycle, as it directly impacts the flow of cash within a business, from the point of sale to the receipt of payment.

What are the benefits of optimising the sales order-to-cash process?

Optimising the sales order-to-cash (O2C) process offers several key benefits for businesses

1. Improved Efficiency

Streamlining the O2C process reduces manual intervention, eliminates redundant tasks, and minimises errors, leading to faster order processing and invoicing.

2. Enhanced Cash Flow

By reducing the time between order placement and payment receipt, businesses can improve their cash flow, enabling better management of working capital and financial obligations.

3. Better Customer Satisfaction

A more efficient O2C process results in faster order fulfillment and invoicing, leading to improved customer satisfaction and loyalty.

4. Reduced Operating Costs

Automation and streamlining of the O2C process can lead to cost savings through reduced labor costs, fewer errors, and improved resource allocation

5. Increased Visibility and Control

Optimizing the O2C process provides greater visibility into order status, inventory levels, and payment collections, allowing for better decision-making and control over the process.

6. Faster Revenue Recognition

By accelerating the invoicing and payment collection process, businesses can recognize revenue more quickly, leading to improved financial reporting and planning.

7. Compliance and Risk Management

A well-optimized O2C process helps ensure compliance with regulations and reduces the risk of errors, fraud, and disputes.

8. Enhanced Collaboration

Integration of systems and processes across departments improves collaboration between sales, finance, and operations, leading to smoother order processing and fulfillment.

Overall, optimizing the sales order-to-cash process can lead to significant benefits for businesses, including improved efficiency, cash flow, customer satisfaction, and cost savings.

How can you optimise the sales order-to-cash process with automation?

Optimizing the sales order-to-cash (O2C) process with automation involves leveraging technology to streamline and improve efficiency. Here are several ways to achieve this:

1. Automated Order Processing

Use software to automatically process incoming sales orders, reducing manual data entry and processing time.

2. Inventory Management

Implement automated inventory management systems to ensure real-time visibility of stock levels and prevent stockouts or overstocking.

3. Electronic Invoicing (e-Invoicing)

Send invoices electronically to customers, reducing paper-based processes and speeding up invoicing and payment collection.

4. Automated Payment Processing

Use automated payment processing systems to collect payments from customers, reducing manual intervention and improving cash flow.

5. Integration of Systems

Integrate your sales, inventory, and accounting systems to enable seamless data flow and reduce errors.

6. Customer Self-Service Portals

Provide customers with self-service portals where they can place orders, track shipments, and make payments, reducing the need for manual intervention.

7. Workflow Automation

Implement workflow automation tools to streamline approval processes, reducing bottlenecks and speeding up order processing.

8. Analytics and Reporting

Use analytics and reporting tools to gain insights into the O2C process, identify areas for improvement, and make data-driven decisions.

9. Compliance Automation

Say Goodbye to Manual Errors!

Conclusion

The sales order-to-cash (O2C) process is a critical business workflow that begins with a customer placing an order and ends with the company receiving payment for the goods or services provided. The process typically includes several key steps, starting with the creation of a sales order and confirmation of the order’s details. After the order is confirmed, the goods are picked, packed, and shipped to the customer. An invoice is then generated based on the sales order, and the customer receives the shipment along with the invoice. The customer is billed for the order, and upon payment, the cash is applied to the invoice, completing the O2C process. This process is essential for ensuring efficient order processing, timely payment collection, and ultimately, customer satisfaction. Proper management and optimization of the O2C process can lead to improved cash flow, reduced operational costs, and enhanced customer relationships.

FAQS

1.What are some common challenges in the O2C process?

Common challenges include order errors, inventory shortages, delayed shipments, invoicing mistakes, and payment delays.

2. How can businesses improve the O2C process?

Businesses can improve the O2C process by implementing automation, integrating systems, training employees, and monitoring key performance indicators.

3.What are the benefits of a well-optimized O2C process?

Benefits include improved efficiency, reduced costs, better customer satisfaction, and enhanced cash flow management.

4. How can businesses measure the effectiveness of their O2C process?

Key performance indicators (KPIs) such as order processing time, order accuracy, invoice accuracy, and DSO (Days Sales Outstanding) can be used to measure O2C performance.

5. What is the purpose of these documents in the business ?

Best practices include setting clear policies and procedures, ensuring data accuracy, providing regular training, and continuously monitoring and improving the process.

Share a few details about your project, and we’ll get back to you soon.

Let's Talk About Your Project

- Free Consultation

- 24/7 Experts Support

- On-Time Delivery

- sales@sdlccorp.com

- +1(510-630-6507)