Netherlands Gambling Law and Regulatory Framework

Dutch gambling activities are governed by national legislation that defines which games are permitted, how they may be offered, and what safeguards must be in place. Netherlands gaming law applies to both land-based and online gambling, with enhanced requirements for remote gambling. Learn more about the licensing environment in Antigua and Barbuda.

Legal Basis of Dutch Gambling Regulation

Risk-Based Regulatory Approach

Dutch online gambling regulations follow a risk-based model. Higher-risk products such as online casino games and sports betting are subject to stronger player protection measures, stricter AML controls, and enhanced reporting obligations. Operators comparing multiple jurisdictions often review European licensing frameworks to understand how compliance intensity differs across markets.

Role of the Dutch Gambling Regulator (KSA)

Responsibilities of the Kansspelautoriteit

- Supervising licensed gambling operators Monitoring compliance with Dutch gambling laws

- Monitoring compliance with Dutch gambling laws

How the KSA Evaluates Compliance

KSA gambling compliance is assessed through:

- Risk-based audits and supervisory reviews

- Analysis of operational and player data

- Monitoring of advertising, AML, and duty-of-care practices

This means compliance is measured continuously, not just at fixed review points.

What Activities Fall Under the Netherlands Gaming License

Definition of Games of Chance Under Dutch Law

Types of Regulated Online Gambling Activities

- Online casino games (slots and table games)

- Betting on sporting events and outcomes

- Certain peer-to-peer and bingo formats

Operators operating across multiple jurisdictions often compare jurisdiction-specific licensing models to ensure products are structured correctly.

Core Compliance Requirements for License Holders

Governance and Internal Controls

Licensed operators must maintain:

- Clear management accountability

- Defined compliance roles and escalation processes

- Documented internal policies and procedures

Operational and Integrity Standards

Operators are expected to ensure:

- Fair and transparent gaming systems

- Integrity of betting markets

- Oversight of outsourced service providers

AML and KYC Obligations in the Netherlands Gambling Market

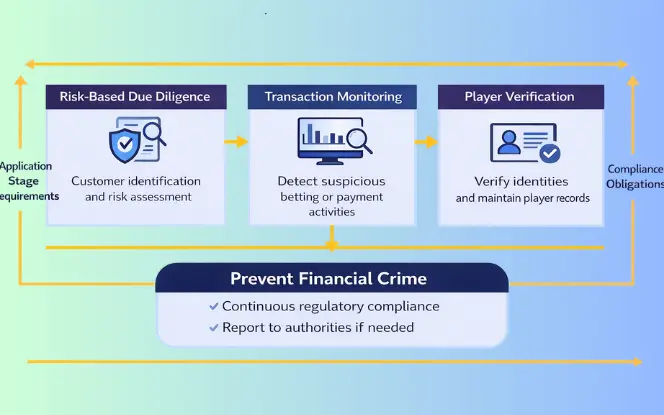

Anti-Money Laundering Requirements

AML requirements in Netherlands gambling include:

- Risk-based customer due diligence

- Continuous transaction monitoring

- Detection of unusual betting or payment patterns

KYC and Player Verification Obligations

- Verify player identities before participation

- Maintain accurate customer records

- Apply enhanced checks for high-risk players

Responsible Gambling and Duty of Care Obligations

Player Monitoring and Intervention

- Monitor player behavior continuously

- Identify indicators of excessive or harmful play

- Intervene early when risks arise

Player Protection Measures

Duty of care Netherlands gambling obligations include:

- Implementing player protection tools

- Restricting access for at-risk individuals

- Supporting national exclusion mechanisms

Advertising, Marketing, and Player Communication Rules

Advertising Restrictions in the Netherlands

- Misleading claims about winning chances

- Encouragement of excessive participation

- Aggressive or intrusive promotions

Protection of Vulnerable Groups

- Avoid targeting minors or vulnerable players

- Be factual and proportionate

- Support responsible gambling objectives

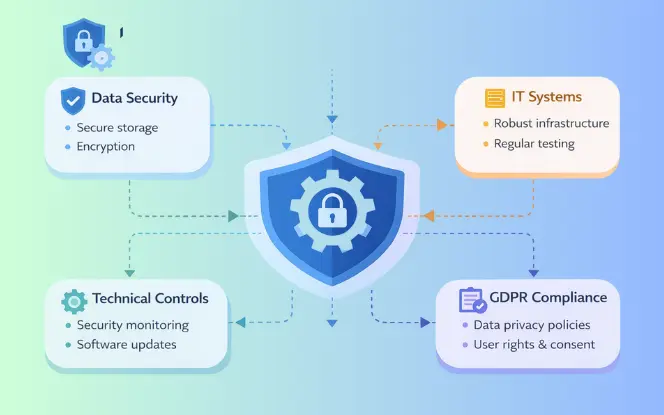

Technical, Data Protection, and IT Compliance

Gaming System and IT Security Requirements

Operators must maintain:

- Secure and auditable gaming systems

- Protection against manipulation or data breaches

- Ongoing system monitoring

GDPR and Data Protection Obligations

Data protection Netherlands gambling requirements include:

- Lawful processing of personal data

- Secure storage and access controls

- Compliance with GDPR standards

Ongoing Compliance, Monitoring, and Reporting Obligations

Common Compliance Mistakes in the Netherlands Gambling Market

- Weak AML or transaction monitoring systems

- Insufficient responsible gambling interventions

- Non-compliant advertising practices

- Failure to update policies following regulatory changes

Netherlands Gambling Compliance Checklist

- Correct classification of gambling activities

- Fully implemented AML and KYC systems

- Active duty-of-care and player protection tools

- Advertising aligned with Dutch regulations

- GDPR-compliant data protection controls

- Ongoing monitoring and reporting processes

Summary Table: Netherlands Gaming License

| Aspect | Details |

|---|---|

| Regulator | Kansspelautoriteit (KSA) |

| Legal Basis | Remote Gambling Act Netherlands |

| License Validity | 5 Years |

| Application Fee | €48,000 (approx.) |

| Tax Rate | 29.5% on Gross Gaming Revenue |

| Key Areas of Regulation | Compliance, Security, Advertising, Fairness |

| Renewal Requirement | Full audit, compliance confirmation |

Conclusion

Applying for a Malaysia Gambling License demands significant preparation, local knowledge, and a strong understanding of regulatory requirements. By navigating the legal framework carefully and maintaining compliance throughout the process, operators can build a legitimate business. To support long-term success, having a reliable technology foundation is equally important. SDLC Corp provides end-to-end assistance, from licensing and regulatory compliance to advanced iGaming software development services, enabling operators to launch, manage, and scale their gaming platforms with confidence and full regulatory alignment.

FAQs

What Is the Netherlands Gaming License?

It is a license issued by the Kansspelautoriteit that allows companies to legally operate online gambling services in the Netherlands.

Who Regulates Gambling Activities In The Netherlands?

The Dutch Gambling Authority, known as Kansspelautoriteit (KSA), oversees all gambling operations and enforces legal compliance.

What Is The Remote Gambling Act Netherlands?

This is the legislation that legalized online gambling in the Netherlands and set standards for licensing, player protection, and compliance.

Can Foreign Companies Apply For A Dutch Gambling License?

Yes, if they are established within the EEA and meet all legal and technical requirements set by the Kansspelautoriteit.

How Long Is The Netherlands Gaming License Valid?

The license is valid for five years, after which it must be renewed with updated compliance and audit documents.