Why is blockchain technology important in the context of ICOs?

The Role of Blockchain in ICOs

Introduction

In the ever-evolving landscape of fundraising, Initial Coin Offerings (ICOs) have emerged as a revolutionary mechanism for blockchain projects to raise capital. At the heart of this innovation lies blockchain technology, which serves as the underlying infrastructure for ICOs. Blockchain’s decentralized, transparent, and immutable nature plays a crucial role in facilitating ICOs, enabling secure token issuance, transparent fundraising, and decentralized governance. Join me as we delve into the multifaceted role of blockchain in ICOs, exploring its impact on fundraising, investor participation, regulatory compliance, and project governance.

The Fundamentals of Blockchain

Before delving into the role of blockchain in ICOs, it’s essential to understand the fundamentals of blockchain technology. At its core, blockchain is a distributed ledger technology that records transactions across multiple computers in a transparent and tamper-proof manner. Each transaction is cryptographically linked to previous transactions, creating a chain of blocks that form a secure and immutable record of data. Blockchain operates on principles of decentralization, consensus, and cryptographic security, enabling trustless transactions and eliminating the need for intermediaries.

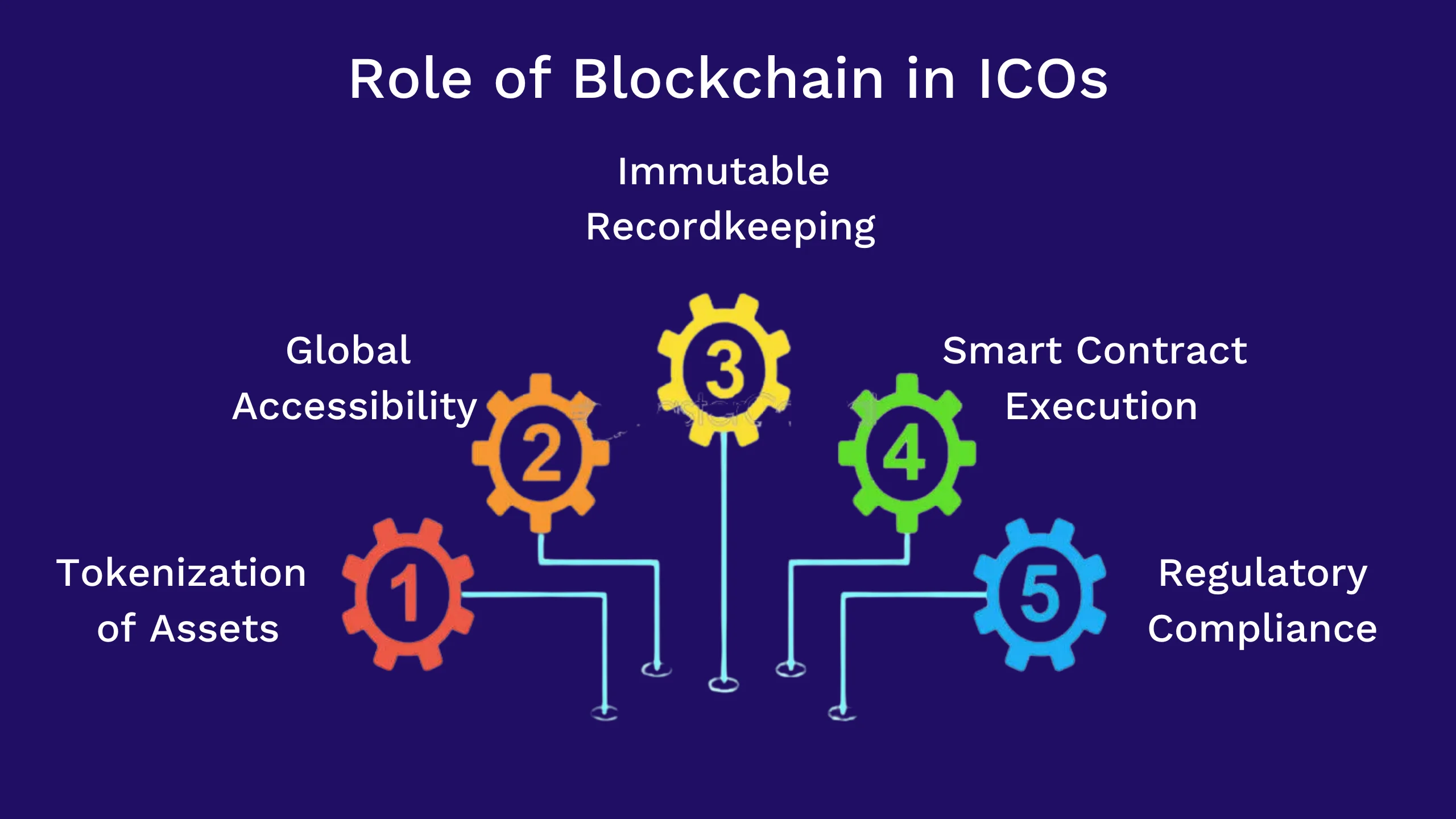

What is the Role of Blockchain in ICOs

1. Tokenization of Assets

- Blockchain enables the tokenization of assets, allowing ICO issuers to represent various assets, such as real estate, equity, or commodities, as digital tokens on a decentralized ledger.

- This tokenization process facilitates fractional ownership, liquidity, and transferability of assets, unlocking new possibilities for asset-backed ICOs and expanding investment opportunities for investors.

2. Global Accessibility

- Blockchain technology transcends geographical boundaries, enabling ICOs to reach a global audience of investors without the constraints of traditional fundraising methods.

- ICOs leverage blockchain’s decentralized nature to democratize access to capital, enabling startups and entrepreneurs from any corner of the world to raise funds and pursue their vision.

3. Immutable Recordkeeping

- Blockchain provides immutable recordkeeping capabilities, ensuring that all transactions related to ICOs are recorded transparently and cannot be altered or tampered with.

- This transparency and immutability instill trust and confidence in ICO participants, as they can verify the authenticity and integrity of token sales, transaction histories, and fundraising activities.

4. Smart Contract Execution

- Smart contracts serve as the backbone of ICOs, automating key processes and functionalities, such as token issuance, distribution, fundraising, and investor relations.

- Through blockchain-based smart contracts, ICO issuers can enforce predefined rules, conditions, and agreements, facilitating trustless and transparent execution of transactions without the need for intermediaries.

5. Regulatory Compliance

- Smart contracts can be programmed to enforce regulatory compliance. For instance, they can restrict token sales to certain jurisdictions or to accredited investors, ensuring that the ICO adheres to legal requirements.

Blockchain’s transparency and immutability allow for easy auditing and verification by regulatory bodies. This transparency helps maintain compliance with financial regulations, reduces the risk of fraud, and enhances investor protection.

5. Decentralized Governance

- Blockchain enables decentralized governance structures for ICO projects, empowering token holders to participate in decision-making processes, such as protocol upgrades, token distributions, and community initiatives.

- Through blockchain-based voting mechanisms and governance models, investors can contribute to project development, shape project direction, and hold project teams accountable for their actions.

6. Enhanced Security

- Blockchain enhances security in ICOs by leveraging cryptographic algorithms and decentralized consensus mechanisms to protect against fraud, hacking, and unauthorized access.

- The use of cryptographic signatures and private keys ensures that only authorized parties can access and transact with ICO tokens, reducing the risk of theft or manipulation.

7. Reduced Costs and Intermediaries

- Blockchain reduces costs and eliminates the need for intermediaries in ICOs by facilitating peer-to-peer transactions and automating key processes through smart contracts.

- By removing intermediaries, such as banks, lawyers, and brokers, blockchain streamlines fundraising operations, reduces administrative overhead, and enhances efficiency in the token sale process.

8. Transparent Fund Utilization

- Blockchain provides transparency and accountability in fund utilization for ICO projects, as all transactions related to fundraising are recorded on a decentralized ledger that is publicly accessible and auditable.

- ICO issuers can demonstrate transparency in fund allocation, expenditure, and project milestones, fostering trust and confidence among investors and stakeholders.

9. Innovative Fundraising Models

- Blockchain enables innovative fundraising models, such as token sales, token swaps, airdrops, and staking, that offer unique value propositions and incentives for investors.

- These innovative fundraising models leverage blockchain’s programmability and flexibility to create diverse investment opportunities and align incentives between ICO issuers and investors.

10. Market Liquidity and Secondary Trading

- Blockchain enhances market liquidity and secondary trading for ICO tokens by enabling seamless peer-to-peer transactions on decentralized exchanges (DEXs) and secondary trading platforms.

- ICO tokens can be traded 24/7 on global exchanges, providing investors with liquidity and price discovery, while also fostering market efficiency and price stability.

Evidence and Statistics

- According to data from CoinDesk, ICOs raised over $7.8 billion in 2018, showcasing the significant role of blockchain in facilitating fundraising for blockchain projects worldwide.

- A report by PwC and Crypto Valley Association revealed that ICOs raised over $19 billion in funding between 2016 and 2018, highlighting the growing popularity and adoption of blockchain-based fundraising mechanisms.

- Research by TokenData found that the number of ICO projects launched per month peaked in January 2018, with over 300 projects raising capital through token sales, underscoring the role of blockchain in enabling widespread access to capital for startups and entrepreneurs.

Conclusion

In conclusion, blockchain technology plays a multifaceted role in ICOs, serving as the foundation for token issuance, transparency, decentralization, and automation in the fundraising process. By leveraging blockchain’s decentralized, transparent, and immutable properties, ICOs enable startups and entrepreneurs to access capital, engage with investors, and pursue innovation on a global scale. As the blockchain ecosystem continues to evolve, ICOs will remain a cornerstone of blockchain-based fundraising, driving innovation, democratizing access to capital, and shaping the future of decentralized finance.

Contact Us

File a form and let us know more about you and your project.

Let's Talk About Your Project

- Free Consultation

- 24/7 Experts Support

- On-Time Delivery

- sales@sdlccorp.com

- +1(510-630-6507)