Introduction

Cryptocurrencies have dramatically evolved over the last decade, transforming from an obscure concept into a global financial phenomenon. As we analyze this growth, it is essential to examine the trends that have shaped the crypto industry from 2013 to 2024. This blog explores key metrics, technology advancements, and business opportunities in the crypto ecosystem, focusing on cryptocurrency prices, market trends, and technological innovations such as centralized exchange development, arbitrage trading bots, and white-label cryptocurrency exchange solutions.

Build your custom token with expert developers!

Partner with a leading token development company to create secure, scalable tokens for ICOs, DeFi, NFTs, and blockchain-based solutions.

1. The Genesis of Cryptocurrency Growth (2013-2016)

From Bitcoin’s humble beginnings in 2009, cryptocurrency truly began to capture global attention in 2013. Bitcoin prices soared past $1,000 for the first time, driven by speculative interest and a small but burgeoning user base. This period marked the inception of the crypto revolution, characterized by early adoption and skepticism.

Key Developments:

- Bitcoin Dominance: Bitcoin dominated the market, accounting for over 90% of the total market capitalization.

- Emergence of Altcoins: Litecoin, Ethereum, and Ripple began to challenge Bitcoin’s supremacy, offering diverse solutions such as faster transaction times and smart contracts.

- Nascent Crypto Exchange Solutions: Platforms like Mt. Gox handled the majority of trading volume, although their lack of security led to notable scandals, including Mt. Gox’s infamous collapse in 2014.

By 2016, developers and entrepreneurs recognized the need for secure, scalable platforms. The demand for cryptocurrency exchange development services increased, prompting companies to explore white-label cryptocurrency exchange software development to enter the market swiftly and cost-effectively.

2. Mainstream Adoption and Market Volatility (2017-2020)

The year 2017 marked a turning point for cryptocurrencies, ushering in mainstream adoption and unprecedented volatility. Bitcoin prices skyrocketed to nearly $20,000 in December, fueled by retail FOMO (fear of missing out). Altcoins like Ethereum and Litecoin also witnessed significant price surges, and the crypto market’s total capitalization exceeded $600 billion.

Factors Driving Growth:

- Initial Coin Offerings (ICOs): The ICO boom of 2017 enabled startups to raise funds by issuing tokens, fueling innovation and expanding market participation.

- Centralized Exchanges: Companies specializing in centralized exchange development began creating robust trading platforms to cater to growing demand. Exchanges like Binance and Coinbase emerged as industry leaders.

- Increased Regulation: Governments worldwide started scrutinizing crypto activities, introducing compliance frameworks to protect investors while curbing illegal activities.

By 2020, decentralized finance (DeFi) platforms disrupted the status quo, enabling peer-to-peer lending and yield farming without intermediaries. Simultaneously, crypto derivatives exchange development allowed traders to hedge risks and speculate using advanced financial instruments such as futures and options.

3. Accelerated Growth Amidst Global Challenges (2021-2023)

Despite the economic uncertainties brought on by the COVID-19 pandemic, cryptocurrencies flourished. Bitcoin surged past $60,000 in 2021, fueled by institutional investments and growing recognition as a hedge against inflation. Ethereum, riding the wave of DeFi and NFTs, also achieved all-time highs.

Market Highlights:

- Institutional Adoption: Companies like Tesla and MicroStrategy added Bitcoin to their balance sheets, legitimizing cryptocurrencies as a store of value.

- Crypto Exchange Clones: With surging demand, entrepreneurs leveraged cryptocurrency exchange clone scripts to replicate the success of established platforms. These scripts offered scalability, security, and faster deployment, attracting startups aiming to tap into the growing market.

- Arbitrage Trading Bots: Automated trading tools became increasingly popular for exploiting price discrepancies across exchanges. These bots enhanced market efficiency while providing users with lucrative opportunities.

Technological Innovations:

- White-Label Solutions: To reduce development time and costs, businesses turned to white-label cryptocurrency exchange software development. These ready-made solutions empowered startups to launch customized platforms with advanced features like multi-signature wallets, liquidity integration, and real-time analytics.

- Smart Contracts and Layer 2 Scaling: Ethereum’s network upgrades, combined with Layer 2 solutions, enhanced transaction speed and scalability, benefiting the broader ecosystem.

4. The State of Cryptocurrencies in 2024

As we move through 2024, the cryptocurrency market continues to evolve, albeit with reduced volatility compared to previous years. With a market capitalization exceeding $2 trillion, cryptocurrencies are no longer niche assets but integral components of the global financial system.

Key Trends:

- Regulatory Clarity: Governments in major economies, such as the U.S., the EU, and India, have implemented clear regulations, boosting investor confidence.

- Institutional Growth: Financial giants have developed crypto products for retail and institutional clients, solidifying the asset class’s legitimacy.

- Advanced Exchange Solutions: Companies offering crypto exchange solutions now integrate cutting-edge technologies like artificial intelligence, blockchain interoperability, and decentralized identity verification.

- Derivatives Expansion: The popularity of crypto derivatives has soared, with exchanges innovating in perpetual contracts, options, and structured products.

Business Opportunities:

The industry presents immense opportunities for businesses aiming to enter the space:

- Cryptocurrency Exchange Development Companies: These firms provide end-to-end solutions, enabling entrepreneurs to create secure and scalable platforms.

- Crypto Derivatives Platforms: Offering advanced trading features appeals to institutional and retail traders alike.

- Arbitrage Bots: As competition intensifies, arbitrage trading bots have become essential tools for maximizing profitability and liquidity.

Optimize your project's value with expert tokenomics!

Expert tokenomics consulting services to design, optimize, and implement sustainable token economies for blockchain projects and startups.

5. Challenges and Opportunities in the Crypto Ecosystem

While cryptocurrencies have achieved remarkable milestones, challenges persist. Volatility remains a concern, particularly for new investors. Additionally, issues such as scalability, interoperability, and regulatory fragmentation require ongoing innovation and collaboration.

Overcoming Challenges:

- Interoperability Solutions: Protocols enabling seamless interaction between blockchains, such as Polkadot and Cosmos, have gained traction.

- Centralized vs. Decentralized Platforms: Both centralized and decentralized exchange models offer unique benefits, driving demand for hybrid solutions developed by leading cryptocurrency exchange development companies.

- Security Enhancements: From multi-signature wallets to biometric authentication, platforms prioritize user protection to maintain trust.

6. The Role of Technology in Shaping the Future

Technology is at the heart of cryptocurrency innovation, and its continued development will determine the market’s trajectory. Blockchain advancements, smart contract upgrades, and AI-driven analytics are some of the pivotal areas that will shape the next decade.

Emerging Technologies:

- AI and Machine Learning: These technologies optimize trading strategies, enhance fraud detection, and improve user experiences.

- Metaverse Integration: Cryptocurrencies are set to play a crucial role in the metaverse, facilitating virtual transactions and ownership.

- Scalable Solutions: Blockchain architectures like sharding and rollups promise to enhance throughput, addressing network congestion and high fees.

Businesses leveraging technologies such as crypto exchange solutions and arbitrage trading bots are well-positioned to capitalize on these trends, catering to a diverse user base.

Launch Your DeFi Token with Expert Developers!

Partner with a leading DeFi token development company to create secure, scalable tokens tailored for decentralized finance solutions.

Conclusion

The growth of cryptocurrencies from 2013 to 2024 reflects the industry’s resilience, adaptability, and transformative potential. From early skepticism to global recognition, the journey has been marked by milestones in technology, regulation, and adoption.

For entrepreneurs, the crypto space offers unparalleled opportunities. Solutions like white-label cryptocurrency exchange software development and cryptocurrency exchange clone scripts enable rapid market entry, while innovations in crypto derivatives exchange development and arbitrage bots unlock new revenue streams.

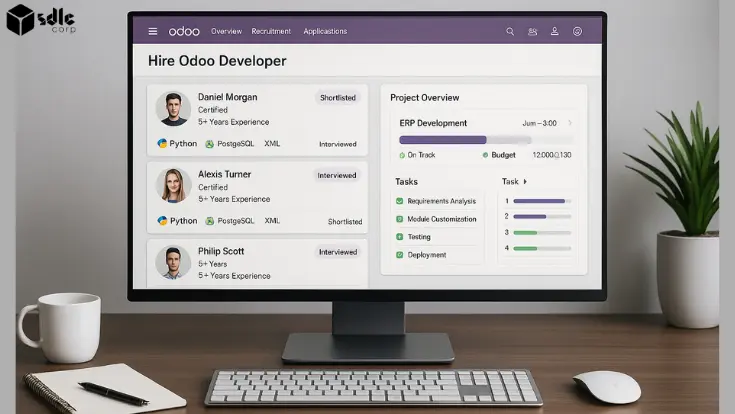

How SDLC CORP Can Help with Token Development?

SDLC CORP can assist with token development by providing end-to-end solutions, from conceptualization to deployment. Their team can help design custom tokens tailored to your project’s goals, ensuring they align with blockchain standards and regulatory requirements. They offer expertise in smart contract development, ensuring security and scalability. With their deep understanding of decentralized ecosystems, SDLC CORP can integrate tokens seamlessly into existing platforms. They also provide auditing and testing services to ensure the token’s performance and security. Their agile development process ensures timely delivery and adaptation to evolving market demands. Lastly, SDLC CORP offers post-launch support, including updates and troubleshooting, to ensure long-term success.

| Services | Description |

|---|---|

| Token Development Company | A leading firm specializing in the creation and deployment of custom tokens, tailored to business needs and blockchain ecosystems. |

| Security Token Offering Services | Services that facilitate the issuance of security tokens to raise capital while ensuring compliance with regulatory frameworks. |

| Tokenomics Consulting Services | Expert consulting services focused on the design of token economics to ensure sustainable and profitable token models. |

| NFT Token Development Company | A company specializing in the development of Non-Fungible Tokens (NFTs) that represent unique assets on the blockchain. |

| DeFi Token Development Company | Services that help create tokens for decentralized finance (DeFi) applications, enabling more efficient and secure financial transactions. |

| Centralized Crypto Exchange Development | Development of centralized cryptocurrency exchanges where users can trade digital assets in a secure, regulated environment. |

| Cryptocurrency Exchange Development Company | A company specializing in building cryptocurrency exchanges with advanced features for buying, selling, and trading digital currencies. |