What Is Involved in Accounts Payable Automation?

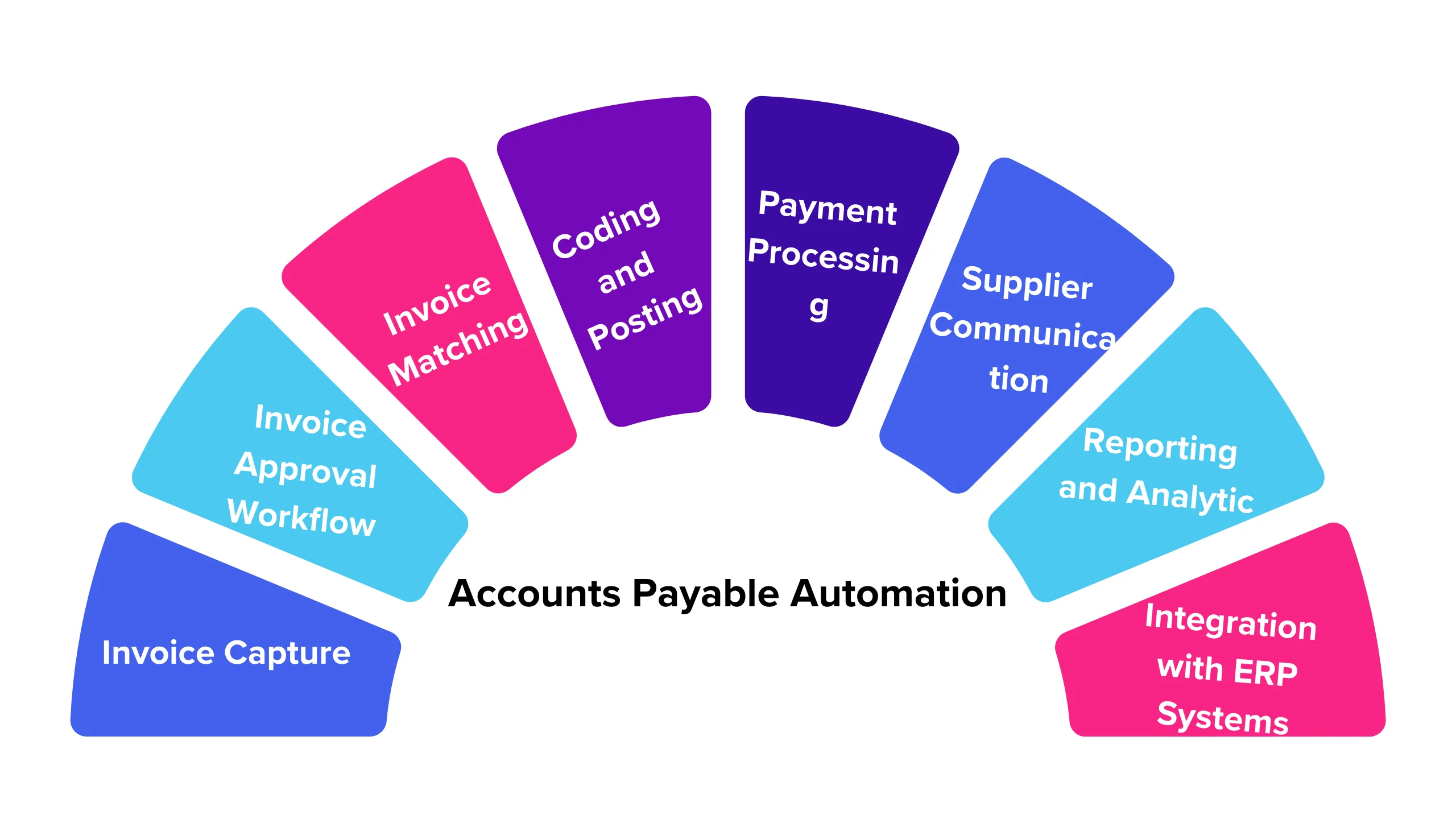

Accounts payable automation involves using software and technology to streamline and automate the process of managing and paying supplier invoices. Here are the key components and steps involved in accounts payable automation:

- Invoice Capture: Invoices are received in various formats (e.g., paper, email, PDF) and need to be digitized for processing. Automation software can use OCR (Optical Character Recognition) technology to extract data from these invoices.

- Invoice Approval Workflow: An automated workflow routes invoices to the appropriate approvers based on predefined rules and hierarchies. Approvers can review, approve, or reject invoices electronically.

- Invoice Matching: Invoices are matched against purchase orders (POs) and receiving documents to ensure accuracy and validity. Automation software can perform this matching automatically, flagging any discrepancies for review.

- Coding and Posting: Once invoices are approved, the automation software can automatically code them to the correct general ledger (GL) accounts and post them to the accounting system, eliminating manual data entry.

- Payment Processing: Automation software can facilitate electronic payments, such as ACH transfers, virtual card payments, and electronic funds transfers (EFTs), reducing the need for paper checks.

- Supplier Communication: Automated systems can send notifications and reminders to suppliers regarding invoice status, payment dates, and any issues that need to be addressed.

- Reporting and Analytics: Automation provides real-time visibility into accounts payable processes, allowing for better decision-making and monitoring of key performance indicators (KPIs).

- Integration with ERP Systems: Accounts payable automation software can integrate with existing ERP (Enterprise Resource Planning) systems to ensure seamless data flow and synchronization.

Overall, accounts payable automation can help organizations reduce manual errors, speed up processing times, improve efficiency, and save costs associated with paper-based processes.

How does automation affect accounts payable (AP)?

- Automation has a profound impact on accounts payable (AP) processes, revolutionizing how businesses manage their financial obligations. By leveraging automation, organizations can streamline invoice processing, enhance accuracy, and improve efficiency.

- One of the most significant benefits of automation is its ability to reduce manual data entry and processing errors. Automated systems can capture invoice data from various formats, such as paper, email, or PDF, using OCR technology. This eliminates the need for manual data entry, reducing the risk of errors and ensuring that invoices are processed accurately.

- Furthermore, automation simplifies the approval workflow by routing invoices to the appropriate approvers based on predefined rules and hierarchies. Approvers can review, approve, or reject invoices electronically, speeding up the approval process and reducing delays.

- Automation also enables organizations to match invoices against purchase orders (POs) and receiving documents automatically, ensuring that invoices are accurate and valid. Any discrepancies are flagged for review, allowing organizations to resolve issues promptly.

- Additionally, automation facilitates electronic payments, such as ACH transfers, virtual card payments, and electronic funds transfers (EFTs), reducing the reliance on paper checks. This not only accelerates the payment process but also reduces costs associated with check printing and mailing.

What are the ways businesses can automate accounts payable?

- Invoice Capture: Implement OCR technology to capture invoice data from various formats, such as paper, email, or PDF.

- Approval Workflow Automation: Use software to route invoices to the appropriate approvers based on predefined rules and hierarchies, enabling electronic review and approval.

- Invoice Matching: Automate the matching of invoices with purchase orders (POs) and receiving documents to ensure accuracy and validity, flagging discrepancies for review.

- Electronic Payments: Utilize electronic payment methods, such as ACH transfers, virtual card payments, and electronic funds transfers (EFTs), to accelerate the payment process and reduce reliance on paper checks.

- Reporting and Analytics: Implement automated reporting and analytics tools to gain real-time visibility into AP processes, enabling better decision-making and monitoring of key performance indicators (KPIs).

- Integration with ERP Systems: Integrate accounts payable automation software with existing ERP systems to ensure seamless data flow and synchronization, reducing manual data entry and improving overall efficiency.

Discover the benefits of accounts payable automation for your business.

How can businesses choose the right AP automation software?

Choosing the right accounts payable (AP) automation software is crucial for optimizing your AP processes. Here are some key factors to consider when selecting AP automation software:

1. Compatibility and Integration: Ensure that the software is compatible with your existing accounting or ERP system. Integration capabilities are essential for seamless data transfer and process automation.

2. Ease of Use: Look for software that is user-friendly and intuitive. It should be easy for your team to navigate and use, with minimal training required.

3. Scalability: Choose a solution that can grow with your business. Consider your future needs and select software that can accommodate increased transaction volumes and complexity.

4. Features and Functionality: Assess the features offered by the software, such as invoice processing, approval workflows, payment options, reporting, and analytics. Ensure that the software meets your specific AP automation requirements.

5. Security and Compliance: Security is paramount when it comes to financial data. Ensure that the software complies with relevant data protection regulations and offers robust security features, such as encryption and access controls.

6. Cost: Consider the cost of the software, including any upfront fees, subscription costs, and additional charges for extra features or services. Ensure that the software provides a good return on investment (ROI) for your business.

7. Support and Training: Check the level of customer support offered by the software provider. Ensure that they provide adequate training and support to help you maximise the benefits of the software.

8. Reviews and Reputation: Research the software provider’s reputation and read reviews from other users. This can give you valuable insights into the software’s performance and reliability.

Streamline your invoice processing with accounts payable automation.

What are the benefits of accounts payable automation?

Accounts payable (AP) automation offers several benefits for organizations looking to streamline their financial processes. Some of the key benefits include:

1. Efficiency: AP automation reduces the time and effort required for manual tasks such as data entry, invoice routing, and payment processing. This frees up staff to focus on more strategic activities.

2. Cost Savings: By eliminating manual processes, AP automation reduces the costs associated with paper-based invoicing, such as printing, mailing, and storage. It can also help capture early payment discounts and avoid late payment fees.

3. Improved Accuracy: Automation reduces the risk of errors that can occur with manual data entry, ensuring that invoices are processed correctly and payments are made accurately.

4. Faster Processing: Automated workflows speed up the processing of invoices and payments, reducing the time it takes to complete these tasks and improving cash flow management.

5. Better Visibility and Control: AP automation provides real-time visibility into the status of invoices and payments, allowing for better tracking and management of cash flow. It also improves control over the AP process, with features such as automated approval workflows and audit trails.

6. Enhanced Supplier Relationships: Automation can lead to faster and more consistent payments, improving relationships with suppliers. It can also provide insights into supplier performance and payment history.

7. Compliance and Security: AP automation helps ensure compliance with regulatory requirements and internal policies. It also enhances security by reducing the risk of fraud and unauthorized access to sensitive financial information.

Overall, accounts payable automation can help organizations save time and money, improve accuracy and efficiency, and enhance visibility and control over their financial processes.

Conclusion:

In conclusion, automating accounts payable processes can significantly streamline operations, reduce errors, improve efficiency, and enhance the overall financial health of an organization. By leveraging technology such as AI and machine learning, businesses can automate repetitive tasks, gain better insights into their payables, and ultimately save time and money while increasing accuracy and compliance. Embracing accounts payable automation is not just about modernizing processes but also about empowering teams to focus on more strategic, value-added activities that drive business growth.

Automate your accounts payable process to save time and reduce errors.

FAQS

1. What are some key components of accounts payable automation?

Key components of accounts payable automation include invoice capture, approval workflow automation, invoice matching, payment processing, supplier communication, reporting, and integration with ERP systems.

2. How can businesses choose the right accounts payable automation software?

Businesses can choose the right accounts payable automation software by considering factors such as compatibility and integration, ease of use, scalability, features and functionality, security and compliance, cost, support and training, and reviews and reputation.

3. What are some best practices for implementing accounts payable automation?

Some best practices for implementing accounts payable automation include defining clear goals and objectives, involving stakeholders early in the process, ensuring data accuracy and integrity, providing adequate training, and regularly reviewing and optimizing processes.

4. What are some common challenges of accounts payable automation?

Common challenges of accounts payable automation include resistance to change, data quality issues, integration complexities, and the need for ongoing maintenance and updates.

5. How can businesses measure the success of their accounts payable automation efforts?

Businesses can measure the success of their accounts payable automation efforts by tracking key performance indicators (KPIs) such as processing times, error rates, cost savings, and supplier satisfaction.

Contact Us

Let's Talk About Your Project

- Free Consultation

- 24/7 Experts Support

- On-Time Delivery

- sales@sdlccorp.com

- +1(510-630-6507)