In today’s digital age, mobile banking apps have revolutionized the way we manage our finances. Among the pioneers in this space is Chime, a neobank that has set new standards for user-centric banking solutions. For businesses aiming to venture into the fintech domain, understanding the intricacies of developing a mobile banking app similar to Chime is crucial.

Understanding Chime's Success

Chime has emerged as a leading neobank by prioritizing user-centric services, transparency, and innovative features. Key elements contributing to its success include:

- Early Direct Deposit: Allows users to access their paychecks up to two days early.

- No Hidden Fees: Eliminates common banking fees, enhancing user trust.

- Automatic Savings: Rounds up transactions to the nearest dollar, saving the difference.

- Real-Time Transaction Alerts: Keeps users informed about their account activities.

These features, combined with a sleek user interface, have positioned Chime as a preferred choice for modern banking.

Market Trends in Mobile Banking

The mobile banking sector is witnessing exponential growth. According to recent studies, over 76% of Americans have used a mobile banking app like Chime to streamline their financial activities.

The market is projected to reach $1.82 billion by 2025, expanding at an annual growth rate of 12.2%. Key trends include:

- AI-Powered Chatbots: Enhancing customer service efficiency.

- Biometric Authentication: Strengthening security measures.

- Personalized Financial Insights: Offering tailored advice based on user behavior.

- Integration with Digital Wallets: Facilitating seamless transactions.

Essential Features for a Chime-Like App

To emulate Chime’s success, consider integrating the following features:

1. User Registration and Onboarding

- Simplified KYC process using AI-powered OCR to extract data from ID documents.

- Secure OTP verification via SMS/email for user authentication.

- Multiple registration options include email, phone number, or social login (Google/Apple).

- Quick onboarding flow with intuitive UI, progress indicators, and tooltips.

- Compliance with KYC/AML regulations to ensure legal operation.

2. Account Management

- Real-time account balance updates after every transaction.

- Detailed transaction history with filters by category, date, and amount.

- Seamless fund transfers to both internal and external accounts.

- Integration with direct deposit features to show expected payment schedules.

- Support for managing multiple accounts within a single interface.

3. Budgeting Tools

- Automatic expense categorization, such as Food, Bills, and Travel.

- Visual analytics to represent spending behavior over days, weeks, or months.

- Custom savings goals with progress tracking functionality.

- Ability to set recurring budgets for routine expenses.

- AI-driven suggestions for smarter financial planning based on spending trends.

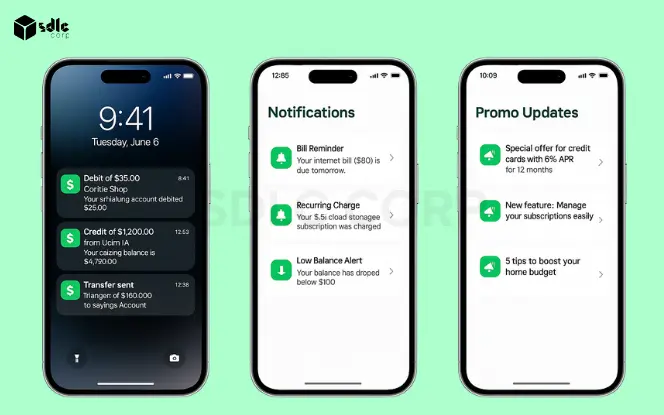

4. Push Notifications

- Instant alerts for debits, credits, and transfers.

- Reminders for upcoming bill payments and recurring charges.

- Notifications when the account balance drops below a set threshold.

- Warnings for suspicious activity or unusual login attempts.

- Optional promotional updates, including offers, product news, and financial tips.

5. ATM Locator

- A GPS-enabled locator to find nearby ATMs in real-time.

- Filtering options to show only fee-free ATM networks.

- Integrated maps for turn-by-turn directions using Google Maps or Mapbox.

- ATM availability indicators, including open/closed status and cash availability (where supported).

- Optional user-generated reviews and ratings for ATM usability and safety.

6. Security Features

- Two-factor authentication combines a password with OTP or biometrics.

- Biometric login methods include fingerprint and facial recognition.

- Data encryption in transit and at rest using industry-standard SSL/TLS protocols.

- AI-based fraud detection systems to identify and prevent unusual activity.

- Session timeout and auto-lock features to prevent unauthorized access.

7. Customer Support

- In-app live chat is supported by AI chatbots and human agents.

- Comprehensive FAQ section to address frequently asked questions.

- Built-in ticketing system for users to raise and track issues.

- Option for users to request a callback or schedule phone support.

- Multilingual support for global audiences, ensuring better accessibility.

Cost to Develop an App Like Chime?

Developing a shopping app like InstaShop can cost between $20,000 and $100,000+, depending on features, complexity, and location. This includes the full development cycle design, development, testing, and deployment. App development costs vary based on the scope and complexity of the app. Here’s a breakdown:

| Tier | Basic MVP | Mid-Level | Full-Scale |

|---|---|---|---|

| Cost | $20K – $30K | $40K – $60K | $60K – $100K+ |

| Timeline | 4-6 weeks | 10-12 weeks | 20-24 weeks |

| Core Features |

|

|

|

| Compliance | KYC basic (manual) |

|

|

| Integrations | 1 Payment API |

|

|

| Security | Standard encryption | Tokenization |

|

| AI/Analytics | — |

|

|

Explore new blog on – Cost to Develop a Mobile Banking App Like Monzo (2025 Guide)

Monetization Strategies

Monetizing a Chime-like mobile banking app involves implementing scalable revenue models without compromising user experience. From freemium upgrades to data-driven partnerships, each strategy supports sustainable financial growth.

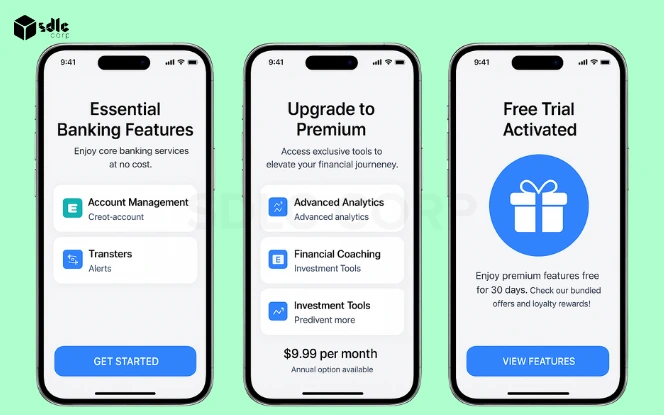

1. Freemium Model

- Provide essential banking features such as account management, transfers, and alerts for free.

- Unlock premium services like advanced analytics, financial coaching, or investment tools for a monthly or yearly subscription.

- Encourage upgrades with free trials, bundled offers, or loyalty rewards.

- Helps in user acquisition while generating recurring revenue from power users.

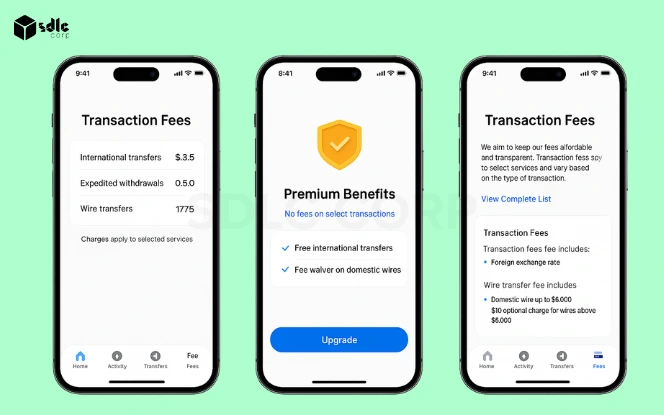

2. Transaction Fees

- Implement minimal charges on services like international transfers, expedited withdrawals, or wire transfers.

- Offer a fee waiver on select services for premium users or high-volume customers.

- Communicate all fee structures to maintain user trust and transparency.

- Can be a steady revenue stream with increased transaction volume.

3. Affiliate Marketing

- Collaborate with credit card companies, insurance providers, or loan agencies.

- Display targeted third-party product offers within the app based on user behavior and preferences.

- Earn commissions on each referral, click, or conversion.

- Enhance user experience by offering relevant financial products within a trusted app environment.

4. Data Analytics Services

- Offer aggregated, anonymized financial data to research firms, banks, or retail partners.

- Derive trends, spending behavior, and demographic insights without compromising user privacy.

- Must comply with GDPR, CCPA, and other data protection laws.

- Provides high-margin income opportunities from enterprise clients.

Technology Stack Recommendations For an App Like Chime

Choosing the right tech stack is critical for performance, scalability, and maintenance.

1. Frontend Technologies

React Native (Ideal for cross-platform mobile app development)

2. Backend Technologies

Python (Powerful for handling business logic and API integrations)

3. Database Options

MongoDB

PostgreSQL (Support for both structured and flexible data storage)

4. Payment Gateways & APIs

Stripe

Razorpay

Tabby API (Facilitate seamless checkout and split payments)

5. KYC/AML Verification Tools

Onfido

ShuftiPro (Used for automated identity checks and compliance requirements)

Security Measures

- Implements AES-256 encryption for data at rest and TLS/SSL for data in transit.

- Ensures sensitive information like account details and transaction data is inaccessible to unauthorized parties.

- Enables login and transaction authorization via fingerprint scanning or facial recognition.

- Reduces dependence on traditional passwords, which can be forgotten or compromised.

- Requires users to verify their identity through an additional factor beyond a password typically OTP via SMS or email.

- Offers optional 2FA methods using authenticator apps such as Google Authenticator or Authy.

- Enhances security during high-risk actions like fund transfers, password changes, or device login.

Conclusion

Developing a mobile banking app like Chime is a multifaceted endeavor that requires meticulous planning, a user-centric approach, and adherence to regulatory standards. By focusing on delivering value, ensuring security, and staying abreast of market trends, businesses can carve a niche in the burgeoning fintech landscape.

Looking to launch your own App Like Chime?

Talk to our experts at SDLC CORP and take your first step toward building a market-dominating eCommerce app.

Also Read Our New Blogs On.

How to Build an App like Brigit

How to Build an App Like DubaiNow

Cost to Build an App Like Tabby [Complete Breakdown for 2025]

Why Choose SDLC CORP for Mobile Banking App Development?

At SDLC CORP, we specialize in building custom mobile banking apps tailored for security, scale, and success.

Here’s what sets us apart

- Experience: 20+ Mobile Banking App solutions across the globe

- Security-first approach: PCI DSS, GDPR, PSD2 compliance

- Custom UI/UX: Engaging, intuitive designs

- DevOps & Post-launch Support: CI/CD pipelines, 24/7 monitoring

- Agile Delivery: Rapid MVP to scale journey

Whether you’re a startup or scaling enterprise, we help you design, develop, and grow a app like Chime with the perfect balance of performance and budget.

Explore SDLC CORP top notch services:

Mobile App Development Services

FAQ's

What is the best tech stack for developing a Chime-like mobile banking app?

A robust stack includes React Native or Flutter for frontend, Node.js or Django for backend, PostgreSQL or MongoDB for databases, and AWS/GCP for cloud hosting. For security and KYC, integrate Plaid, Onfido, or ShuftiPro.

How long does it take to build a Chime-style banking app?

The development time varies by complexity:

MVP: 4–6 weeks

Mid-level app: 10–12 weeks

Full-featured app: 20–24+ weeks

How is user data secured in a mobile banking app?

By using end-to-end encryption, biometric authentication, tokenization, 2FA, and PCI DSS compliance to ensure that all user and transaction data is protected.

Can the app support scalability for millions of users?

Yes, by using microservices architecture, containerized deployment with Docker/Kubernetes, and cloud auto-scaling features from AWS or GCP to handle peak loads and regional distribution.

How much does it cost to develop an app like Chime?

Depending on complexity, location, and features, the cost ranges from $20,000 to $1000,000+.

Basic app: $20K–$30K

Mid-level app: $40K–$60K

Full-scale app: $60K–$100K+

Do I need to follow legal or financial regulations to launch the app?

Yes. You must comply with KYC, AML, PCI DSS, and data protection laws like GDPR (Europe) or CCPA (USA) depending on your operating region.

Can I monetize the banking app beyond core financial services?

Yes, via freemium subscriptions, affiliate marketing, transaction fees, or data analytics partnerships, all while maintaining user trust and privacy.

Is it necessary to launch the app with all features at once?

No. Start with a Minimum Viable Product (MVP) to validate user demand and improve the app based on feedback. Features can be rolled out incrementally.