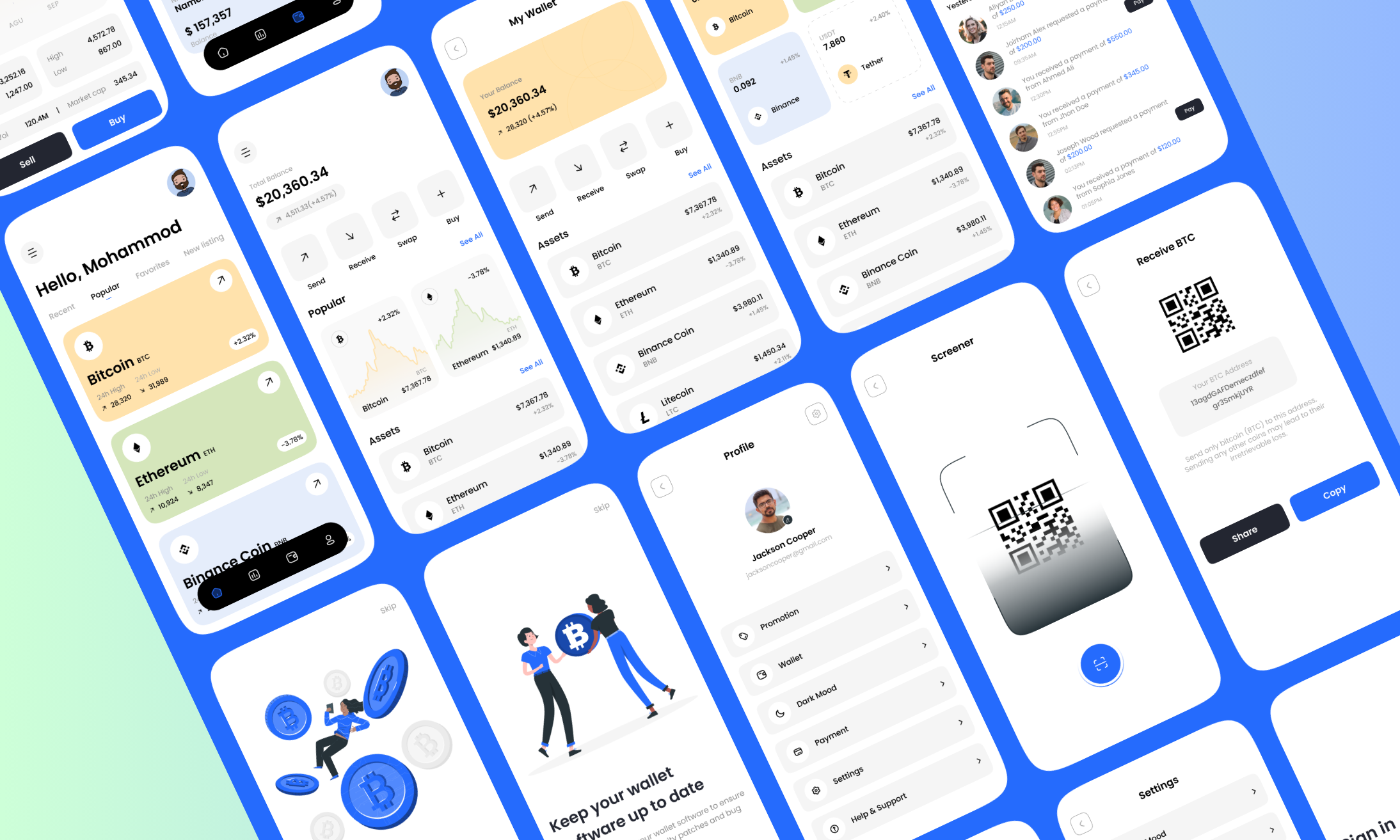

DEFI crowdfunding platform development company

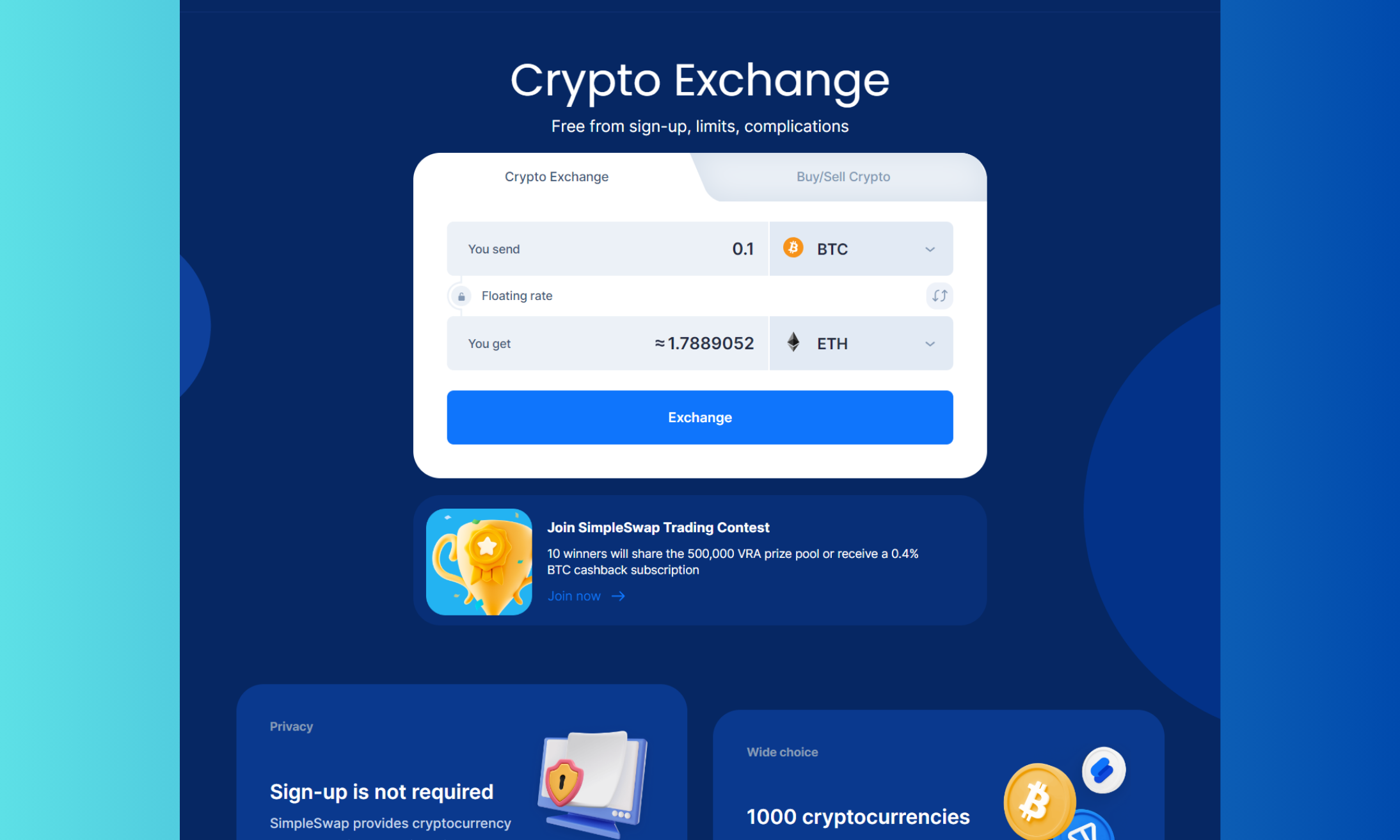

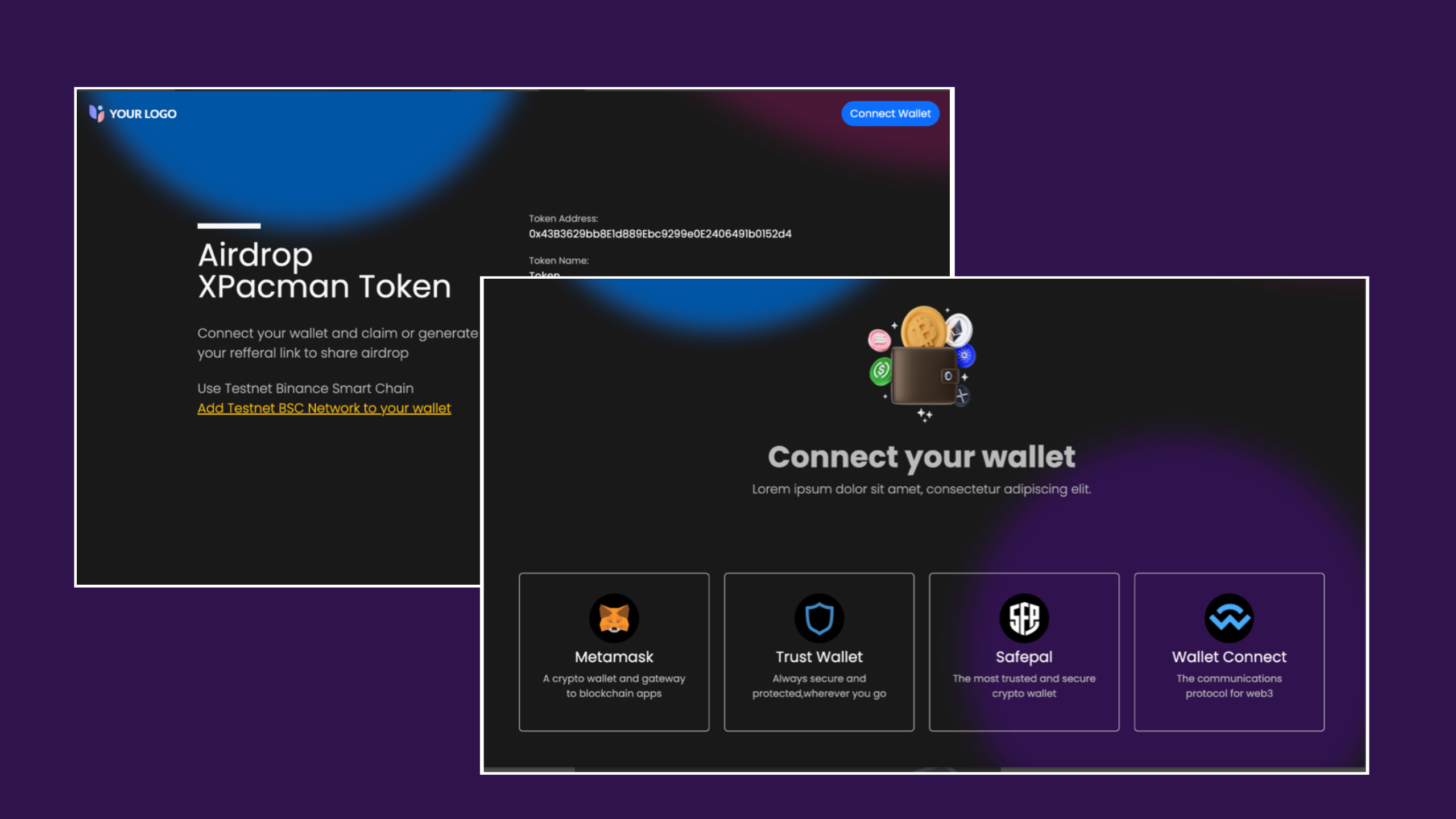

Welcome to the forefront of decentralized finance (DeFi) innovation with our pioneering DeFi crowdfunding platform development company, where we merge expertise in DeFi token development with cutting-edge solutions for democratizing fundraising and investment opportunities globally.

Our integrated approach empowers businesses and individuals to leverage blockchain technology, smart contracts, and decentralized protocols, ensuring transparent, secure, and efficient fundraising campaigns. With a commitment to driving financial inclusivity and innovation, we offer bespoke solutions tailored to the unique needs of startups and enterprises alike, shaping the future of finance through decentralized crowdfunding and tokenization.