Introduction

Australia is renowned for its well-structured and transparent gambling regulation. As one of the highest gambling-spending countries in the world, it has created a licensing system that balances commercial opportunities with strict player protection policies.

This guide breaks down every component you need to know from regulatory structures and license types to the step-by-step application process, compliance duties, and the evolving legal landscape.

If you’re looking to build a compliant, high-performance iGaming platform, our iGaming software development services are tailored to support operators navigating Australia’s licensing landscape.”

1. Regulatory Framework in Australia

Gambling in Australia is regulated at both federal and state or territory levels. This dual structure creates a unique legal environment that separates oversight of online and offline gambling.

1.1 Federal Oversight

At the federal level, the Interactive Gambling Act 2001 governs online gambling services. It restricts the offering of certain forms of online gambling to Australian residents, including casino-style games, online poker, and in-play sports betting.

The Act targets gambling service providers, not the end users.

It is enforced by the Australian Communications and Media Authority

1.2 State and Territory Authorities

Each of Australia’s six states and two territories operates its own regulatory body that licenses, audits, and supervises gambling activities within its jurisdiction. These bodies handle approvals for physical venues, online sportsbooks, pokies, lotteries, and more.

Northern Territory is popular for online sports betting licenses.

- Victoria, NSW, Queensland, and others manage land-based and regional licenses.

2. Types of Gambling Licenses

Australia offers different types of gambling licenses depending on the type of service being offered. It’s crucial to choose the right category based on your business model.

2.1 Casino Licenses

Casino licenses are among the most restricted. They allow operators to run physical venues with table games and gaming machines.

- Only a limited number of casinos operate legally in each state or territory.

- Casino operators must comply with extensive reporting and harm minimization obligations.

2.2 Sports and Racing Betting Licenses

These licenses are mainly issued for online and telephone betting on sports events and racing. The Northern Territory has emerged as the leading jurisdiction for national sports betting operators.

- Requires strong AML/CTF programs and responsible gambling protocols.

- Some jurisdictions allow corporate bookmakers to advertise nationally.

3. The License Application Process

Acquiring a gaming license in Australia involves detailed planning and considerable documentation. The process may take several months, depending on the jurisdiction and business type.

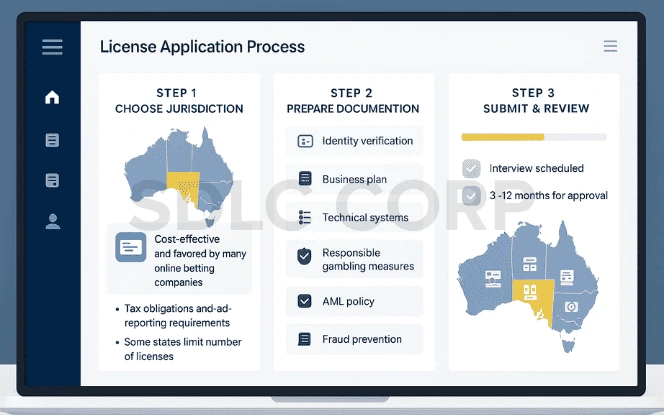

Step 1: Choose Your Jurisdiction

Different jurisdictions offer varying benefits. The Northern Territory, for instance, is cost-effective and favored by many online betting companies.

- Consider tax obligations and reporting requirements in each state.

- Some states limit the number of licenses they issue.

Step 2: Prepare Comprehensive Documentation

Applicants must demonstrate integrity, financial solvency, and technical preparedness. Documents usually include identity verification, business plans, technical systems, and responsible gambling measures.

- Directors and executives must pass background and probity checks.

- Policies for anti-money laundering and fraud prevention are mandatory.

Step 3: Submit Application and Await Review

Once submitted, the application undergoes thorough examination by the regulator. This includes checking all declarations, interviewing stakeholders, and potentially requesting additional evidence.

- Application review can take between 3 to 12 months.

- License fees vary by type and location.

- To better understand how online gambling works, read our complete guide: How Online Gambling Works: A Comprehensive Guide.

4. Compliance and Reporting Requirements

Holding a gaming license is not a one-time achievement it’s an ongoing obligation. Operators must consistently comply with various reporting and operational standards set by regulators.

Navigating compliance in the iGaming sector is becoming increasingly complex, especially in tightly regulated markets like Australia. Understanding the legal landscape is crucial for operators and developers alike. For a deeper dive into these evolving challenges,

explore our full guide on regulatory compliance in the iGaming industry.

Key Compliance Areas

Licensees are required to implement internal systems that monitor gaming behavior, detect suspicious activity, and support player welfare.

- Regular financial and compliance audits are mandatory.

- Licensees must update regulators about key changes (e.g., directors, ownership).

Responsible Gambling Measures

All licensed operators must implement harm minimization strategies, including setting player limits, self-exclusion systems, and public awareness campaigns.

- Training for customer-facing staff is often a requirement.

- Many regulators require active use of national self-exclusion registers.

5. Cost of Licensing and Tax Obligations

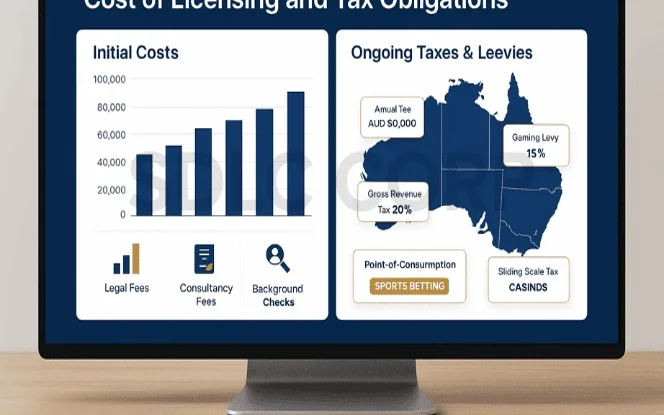

The financial cost of acquiring and maintaining a gaming license in Australia can vary significantly depending on jurisdiction and license type.

Initial Costs

Application fees, processing charges, and background checks contribute to the initial cost of applying. These fees are non-refundable even if the license is not approved.

- Application fees may range from AUD 20,000 to AUD 100,000.

- Legal and consultancy fees are additional.

Ongoing Taxes and Levies

Operators are subject to annual fees, gaming levies, and gross revenue taxes, which differ in each state or territory.

- Sports betting operators may pay a point-of-consumption tax.

- Casino revenues may be taxed on a sliding scale.

6. Recent Developments and Legal Reforms

The gambling industry in Australia is continually evolving. Regulatory changes in recent years have focused on transparency, harm reduction, and better oversight of online operators—driving increased demand for specialized iGaming development services to ensure compliance and innovation in the digital gaming space.

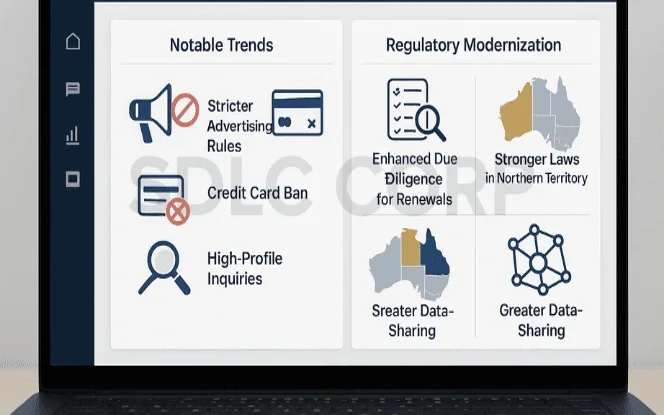

Notable Trends

Several high-profile inquiries and reforms have emerged in response to public pressure and technological changes.

- Stricter advertising rules now limit promotional tactics.

- The use of credit cards for online gambling has been banned in some jurisdictions.

Regulatory Modernization

States like the Northern Territory have introduced stronger laws to manage license holder conduct and resolve conflicts of interest among regulators.

- Enhanced due diligence for license renewals is becoming standard.

- Greater data-sharing between states is improving cross-border enforcement.

7. Challenges for New Entrants

While the Australian market offers lucrative opportunities, it is not without its challenges particularly for new or foreign entrants.

Common Barriers

Applicants often underestimate the complexity of compliance or the time required to obtain a license.

- Preparing robust AML and responsible gambling systems is time-intensive.

- Local representation and legal expertise are often necessary.

Competitive Market

With a few major players dominating sports betting and lotteries, smaller operators must innovate to gain market share.

- Brand differentiation and tech innovation are key.

- Regional marketing restrictions can impact growth strategies.

Conclusion

Securing a gambling license in Australia requires more than just paperwork—it demands a strong understanding of the legal framework, a long-term compliance strategy, and a commitment to responsible gambling. With each state and territory maintaining unique laws and expectations, successful licensing depends on careful planning, expert legal support, and ongoing dedication to regulatory standards.

“Whether you’re starting a new venture or upgrading your existing platform, our team can help. Get started with our iGaming software development services to meet Australia’s regulatory standards.”

FAQ'S

Can foreign companies apply for a gaming license in Australia?

Yes, but they must establish a local business entity and comply with all national and regional regulations, including AML/CTF laws and responsible gambling frameworks.

Which is the best state for an online sports betting license?

The Northern Territory is the most popular due to its favorable licensing structure and acceptance for national operation.

How long does it take to get a gambling license in Australia?

The timeframe varies by jurisdiction and license type but typically ranges from 3 to 12 months.

Are online casinos allowed in Australia?

No. Online casinos and poker games are banned under the Interactive Gambling Act 2001. Only certain online services, like sports and race betting, are permitted with a license.

What happens if I operate without a license?

Unlicensed operations are illegal and can result in significant fines, criminal charges, and permanent bans from acquiring future licenses.