Introduction

Why Build an App Like Cash App?

The demand for seamless digital transactions has skyrocketed, making apps like Cash App essential in today’s financial ecosystem. Whether you’re a fintech startup or a traditional finance company, building a Cash App-like solution positions your brand at the center of the mobile payment revolution. Cash App has redefined modern Fintech app development by combining payments, crypto, and investing in a single platform.

The global mobile payment market was valued at approximately USD 88.5 billion in 2024 and is projected to grow significantly by 2030. The mobile and digital payment markets are projected to reach over $360 billion by 2030, driven by fast, secure transactions, smartphone growth, and global digital adoption trends.

- Rapidly Growing Market

The global peer-to-peer payment market is booming, with over $1 trillion in projected volume. Launching now positions your app for long-term profitability and scalable adoption across regions. - Multiple Revenue Channels

From transaction charges and instant deposit fees to crypto trading and interchange income, a Cash App clone supports diverse monetization streams without compromising on user experience or scalability. - User Convenience

Give users a frictionless experience by integrating transfers, Bitcoin, investing, and debit card features in one app eliminating the need for multiple financial tools or platforms. - Brand Loyalty

Fintech apps that offer value through seamless transactions and transparent security build high user trust, improve retention rates, and foster long-term loyalty with recurring users and referrals. - Future-Ready Business

Adopt the latest technologies like AI-driven fraud detection, blockchain for transparency, and DeFi wallets to future-proof your app and remain competitive in a rapidly evolving fintech landscape.

Key Features of an App Like Cash App

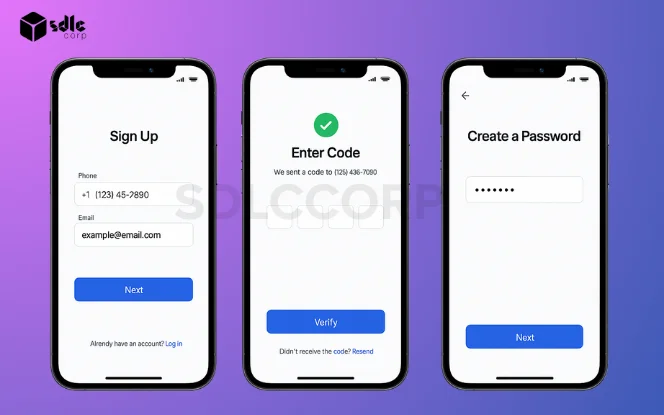

1. User Registration

- Social login integration for faster access

- Progressive onboarding with tooltips

- GDPR-compliant data handling for privacy

2. Send & Receive Money

- Ability to add payment notes or memos

- Scheduled or recurring payments

- QR code scanning for contactless transfers

3. Bank Account Linking

- In-app bank verification status tracking

- Smart suggestions for preferred payment sources

- Integration with budgeting apps or tools

4. Cryptocurrency Support

- Price alerts for market changes

- Educational tips for crypto beginners

- Cold wallet export functionality (advanced users)

5. Investing Options

- Watchlist for tracking favorite assets

- Auto-invest features for recurring deposits

- Sector-based stock categorization for learning

6. Cash Card

- Real-time spending limits per category

- In-app request for new or replacement cards

- Cashback rewards tracking interface

7. Transaction History

- Visual graphs summarizing monthly activity

- Exportable reports in PDF or Excel

- Searchable history using keyword or amount

8. Push Notifications

- Do-not-disturb scheduling for quiet hours

- Notification preferences by category (investments, deposits, offers)

- Voice-enabled alerts for accessibility

Technology Stack for Fintech App Like Cash App

Cost to Develop an App Like Cash App

| Tier | Basic MVP | Mid-Level | Full-Scale |

|---|---|---|---|

| Cost | $20K – $30K | $30K – $40K | $40K – $60K+ |

| Timeline | 2–3 months | 4–6 months | 6–10 months |

| Core Features |

|

|

|

| Compliance | Basic KYC & privacy policy | Automated KYC/AML, GDPR | PCI DSS, GDPR, ISO-readiness |

| Integrations | Stripe or PayPal only | Plaid, Coinbase API | Multi-gateway + CRM + ERP |

| Security | Standard encryption | Tokenization, 2FA | AI fraud engine, biometric login |

| AI/Analytics | Basic reporting | Spending insights, alerts | Predictive trends, ML scoring |

Compliance & Security Considerations

- PCI DSS Compliance

Ensures your app meets global standards for handling debit/credit card data securely, minimizing fraud risks and aligning with financial industry regulations for secure transaction processing. - End-to-End Data Encryption

All sensitive data is encrypted during transmission and storage, preventing unauthorized access and ensuring compliance with modern privacy and cybersecurity frameworks. - Two-Factor Authentication (2FA)

Adds a second verification layer during login or transactions, using OTPs, biometrics, or app-based codes to prevent account breaches and unauthorized access. - Fraud Detection Algorithms

AI-driven systems monitor user behavior and flag suspicious activity in real time, reducing financial fraud and helping automate risk mitigation across large-scale payment ecosystems. - KYC/AML Verification

Know Your Customer (KYC) and Anti-Money Laundering (AML) integrations verify user identities, reduce the risk of financial crime, and ensure compliance with government regulations.

Explore best practices for securing crypto exchanges and protecting user assets in our in-depth security guide.

Monetization Strategies

- Transaction Fees

Charge a small fee for money transfers, especially for business accounts or high-value transactions. This provides a steady income while maintaining a seamless user experience for personal transfers. - Bitcoin Sale Margins

Profit from the spread between buy and sell prices of Bitcoin. The app can act as a broker, allowing users to trade crypto while you earn from transaction differentials. - Instant Deposit Charges

Offer users instant bank withdrawals for a small percentage fee. Most users opt for speed over free standard deposits, generating a consistent cash flow for your app. - Interchange Fees on Cash Cards

Earn interchange fees whenever users make purchases using your branded debit card. These come from merchants and are an excellent passive revenue stream tied to user spending habits. - In-App Ads

Display native ads in a non-intrusive manner such as banners or rewards-based formats. This suits freemium models and provides revenue from third-party advertisers or affiliate networks. - Subscription Plans

Introduce premium features via monthly or yearly subscriptions—like higher limits, priority support, or exclusive investing tools. This encourages long-term user retention and predictable revenue flow. - Partnered Promotions

Collaborate with fintech or retail brands to offer exclusive deals, cashback, or rewards. Sponsored promotions benefit both users and partners while increasing app engagement and brand exposure.

Explore monetization models in our strategy guide for apps and games from in-app purchases to ad-based income.

Development Process & Timeline

- Requirement Gathering – 1–2 Weeks

Define app goals, user flows, compliance needs, and technical requirements. This phase sets the foundation for the entire project and ensures stakeholder alignment before development begins. - Wireframing & UI Design – 2–3 Weeks

Create low/high-fidelity wireframes followed by interactive UI mockups. Focus on intuitive user experiences, branding consistency, and layout for both Android and iOS platforms. - Development & API Integration – 8–14 Weeks

Build frontend and backend modules using secure frameworks. Integrate payment APIs, authentication, real-time messaging, and crypto tools based on defined app architecture. - QA & Launch – 2–3 Weeks

Test features, load performance, and security across devices. Fix bugs, optimize speed, and prepare app store submissions for a smooth go-live experience. - Post-Launch Support – Ongoing

Handle updates, security patches, user feedback, and feature enhancements. Ongoing support ensures app stability and a seamless user experience after deployment.

Explore our detailed guide on budgeting for mobile app development and learn how timeframes shift from MVPs to full-scale builds.

Future Trends in Payment App Development

- Crypto Integration

Support for Bitcoin, Ethereum, and altcoins is becoming standard. Users expect the ability to buy, sell, and store cryptocurrencies directly within the app through secure blockchain APIs. - Voice-Powered Transactions

Voice-based commands streamline transfers and balance checks, improving accessibility for all users. It’s hands-free banking that increases app convenience through smart assistants like Siri and Google Assistant. - Biometric Verification

Facial recognition, fingerprint scanning, and retina ID are replacing passwords. Biometrics offer high-level authentication for transactions and login, reducing fraud and enhancing app security. - AI for Fraud Detection

AI models detect unusual user behavior, flagging fraud in real time. Machine learning enhances transaction monitoring and auto-blocks suspicious patterns without disrupting legitimate users. - DeFi Wallet Integrations

Integrate decentralized finance wallets to allow staking, lending, and yield farming. This appeals to crypto-savvy users who want control over assets beyond traditional bank-linked solutions.

Explore the Top AI and ML Trends Reshaping the Future to see how smart algorithms are redefining fintech innovation.

Conclusion

Creating a Cash App like solution involves more than adding standard features it requires thoughtful execution, robust security, regulatory compliance, and a user-first design approach. In today’s competitive fintech landscape, success is defined by how well your app performs, scales, and earns user trust. Choosing the right Mobile App Development Company is critical to achieving these goals efficiently and strategically.

At SDLC CORP, we specialize in building secure, scalable, and future-ready fintech applications tailored to your business needs.