Introduction

Decentralized Finance, or DeFi for short, is a new financial system built on blockchain technology. DeFi seeks to eliminate the need for intermediaries like banks or other financial institutions in favour of an open, transparent, and inclusive financial system.

In this blog post, we’ll take a closer look at what DeFi is, how it works, and why it is such a significant development in finance.

What exactly is DeFi?

Access to DeFi, which stands for Decentralized Financial Infrastructure, is considered available to anyone who can use Ethereum and has an internet connection. As a result, the markets are always open with DeFi, and there are no centralized authorities to block payments or deny you access to anything.

In addition, services previously slow and vulnerable to human error are now automatic and safer, thanks to code that anyone can inspect and scrutinize. There is a thriving crypto-economy where you can lend, borrow, long/short, earn interest, and do various other things. For example, Argentina’s crypto-savvy citizens have used DeFi to avoid crippling inflation. Companies have begun to stream their employees’ wages in real-time. Some people have even taken out and paid off multi-million dollar loans without providing any personal identification.

Explore DeFi: Revolutionize finance now!

How does DeFi work properly?

Many DeFi operations rely on a blockchain frequently based on Ethereum. Blockchains are decentralized, immutable ledgers that use cryptography to prevent data tampering, such as in financial transactions. Within a blockchain, individuals create cryptocurrencies as digital tokens that hold monetary value.

Smart contracts on an Ethereum-based blockchain make the DeFi model possible. A smart contract is a blockchain-based application using distributed ledger and cryptographic encryption capabilities. The smart contract specifies the terms and conditions for a specific operation. Instead of a central authority authorizing a transaction, a smart contract is programmed to carry out the specified financial transaction. One entity can transfer cryptocurrency assets stored in a smart contract to another entity. The terms and conditions of a transaction are also transparent and available as code with DeFi smart contracts, which means they can be audited and analyzed by others.

Furthermore, because the system operates on a peer-to-peer basis, there is no need for a central authority to enable a smart contract with DeFi. As a result, if two peers agree to execute a transaction, no third-party central authority is required. The DeFi model and its use of smart contracts place a premium on empowering the individual user. One must actively control private and public encryption keys to custody cryptocurrency assets. Individuals hold possession in the form of private cryptographic encryption keys in the decentralized approach.

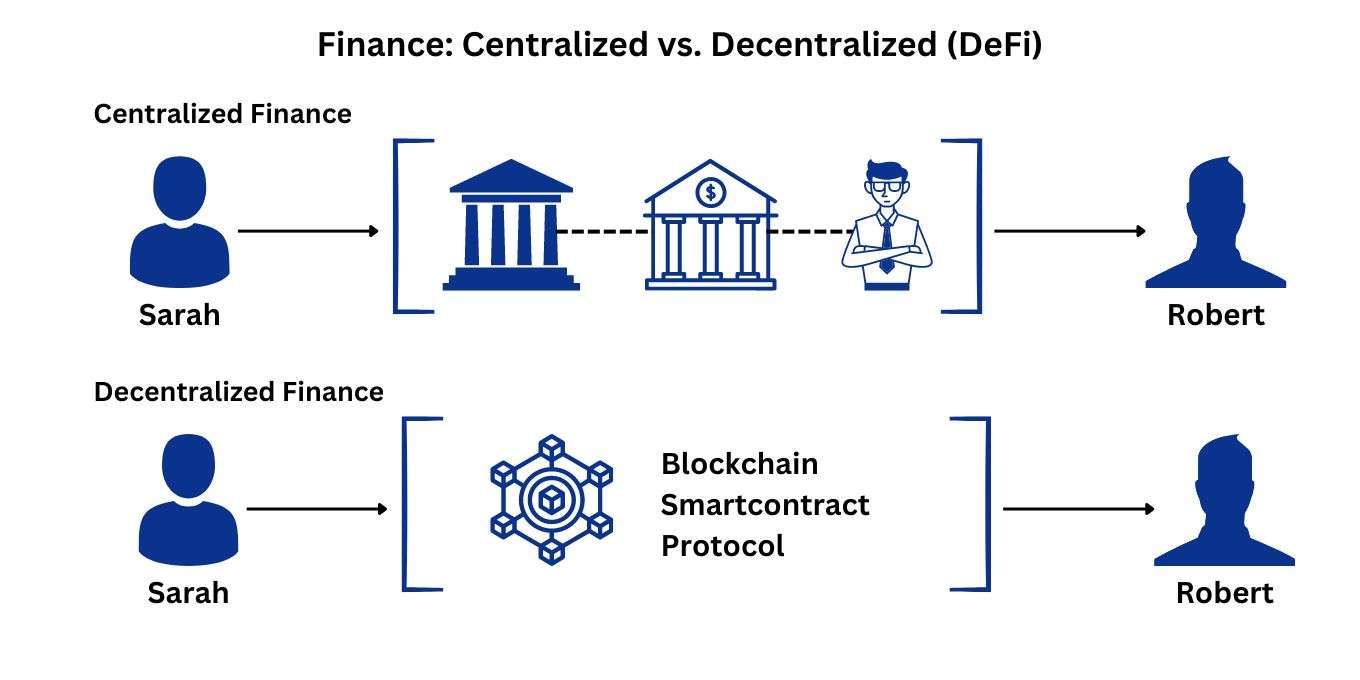

Finance: Centralized vs. Decentralized (DeFi)

Traditional, centralized financial institutions and banking are different from decentralized finance.

Centralized Finance

Banks and other third parties hold money and facilitate the movement of funds between parties in centralized finance. Each of these parties charges a fee for their services. The merchant initiates a credit card charge and transfers it to an acquiring bank account, forwarding the card information to the credit card network.

The network clears the charge and asks the bank for payment. Because merchants must pay for credit and debit cards, each entity in the chain receives compensation for its services. Centralized finance oversees all financial transactions, from loan applications to the services of a local bank.

Decentralized Finance

Decentralized finance eliminates go-betweens by enabling individuals, merchants, and businesses to conduct financial transactions using emerging technology. DeFi employs security protocols, connectivity, software, and hardware advancements via peer-to-peer financial networks. Anywhere there is an internet connection, people can lend, trade, and borrow using software that logs and verifies financial transactions in distributed financial databases.

A distributed database is accessible from multiple locations because it collects and aggregates data from all users and verifies it using a consensus mechanism. By enabling anyone to use financial services wherever they are, regardless of who they are or where they are, decentralized finance eliminates the need for a centralized finance model. In addition, through personal wallets and trading services tailored to individuals, DeFi applications give users more control over their money.

Explore DeFi: Revolutionize finance now!

Explore our other insights!

How to Develop Own DeFi NFT Staking Protocol?

Introduction Developing your own DeFi NFT staking protocol can open doors to a range of exciting opportunities in

DeFi NFT Social Media Platform Development

Introduction The rise of decentralized finance (DeFi) and non-fungible tokens (NFTs) is reshaping the digital landscape, creating new

What is DeFi (Decentralized Finance) and it’s Lending Platforms

What is DeFi and its Lending Platforms The rise of DeFi has made it more likely that blockchain

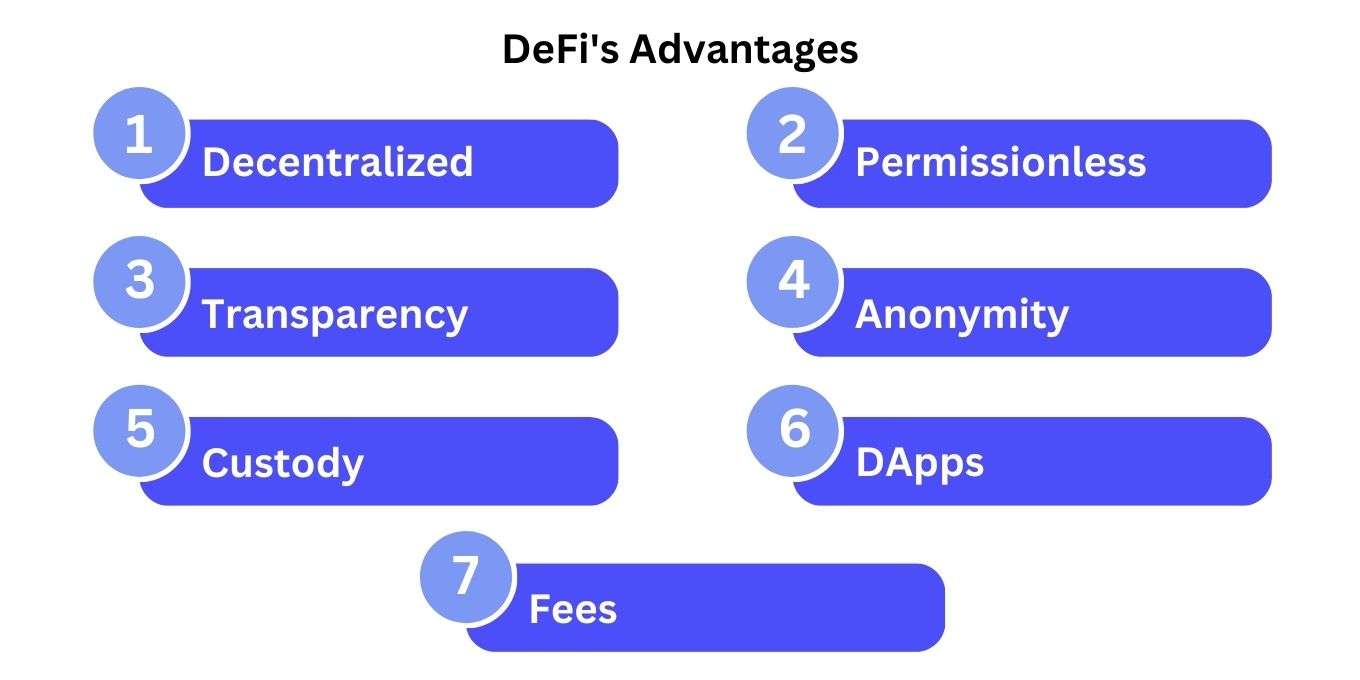

DeFi's Advantages

DeFi provides users with many advantages that can help boost confidence, security, and trust in cryptocurrency-based transactions and applications, including the following:

Decentralized –

DeFi, because it is decentralized, is not subject to the inherent risks associated with CeFi, where the failure of an exchange can result in a complete collapse and loss of user funds and accounts.

Permissionless –

A central authority is not required to approve or enable a transaction in a decentralized model. Instead, the model is permissionless because smart contracts’ programmatic logic defines what is possible.

Transparency –

Using the smart contract model, users can understand the terms and logic of a transaction in a transparent model without hidden code.

Anonymity –

Smart contracts on the blockchain can offer transparency, but they do not require the identification of the users. Know Your Client requirements, standard in centralized and regulated models, do not apply specifically to DeFi.

Custody –

Users control assets in DeFi, and the user possesses the cryptographic private key for cryptocurrency tokens.

DApps –

DeFi supports dApps, which allow users to benefit from financial services applications and other use cases like gaming and social media.

Fees –

DeFi, because it lacks a centralized authority, promises users lower transaction fees than the CeFi model.

What are the Disadvantages of Defi?

• Active trading on the Ethereum blockchain can become costly due to fluctuating transaction rates.

• Because this is a new technology, your investment may experience high volatility depending on which dApps you use and how you use them.

• You must keep your records for tax purposes. Regulations can differ from one region to the next.

DeFi Challenges

While DeFi has its advantages, it also has several potential drawbacks, including the following:

Complexity –

The perceived complexity of DeFi is likely the model’s most difficult challenge. DeFi operates in a peer-to-peer model, with smart contracts and sophisticated algorithms that can be difficult to understand fully.

Understandable to the Uninitiated –

This complexity can also lead to misunderstandings about a service or application’s operation.

Customer Care –

Customer service with DeFi can be complex because there needs to be a central authority or service to turn to for assistance.

Volatility –

Because there is no moderating central authority to control or limit transaction or market momentum, DeFi approaches may be more volatile.

Security –

Attackers have increasingly targeted DeFi platforms in recent years. For example, in August 2022, the Federal Bureau of Investigation issued an alert warning that over $1 billion in assets had been stolen in just three months.

DeFi Development Company

DeFi's Uses

One of the fundamental premises underlying DeFi is peer-to-peer (P2P) financial transactions. When two parties agree to exchange cryptocurrency for goods or services without the help of a third party, this is known as a P2P DeFi transaction.

P2P can meet an individual’s loan needs in DeFi, and an algorithm will match peers who agree on the lender’s terms, and a loan will be issued. Payments from P2P are made through a decentralized application, or dApp, and are recorded in the blockchain in the same way.

Using DeFi Allows:

Accessibility –

Anyone with an internet connection can use a DeFi platform, and transactions can occur anywhere.

Low Fees and High-Interest Rates –

DeFi networks allow parties to negotiate interest rates and lend money directly.

Security and Transparency –

Smart contracts published on a blockchain and records of completed transactions are open to the public but do not reveal your identity. Blockchains are immutable, which means they cannot be altered.

Independence –

DeFi platforms are not reliant on centralized financial institutions and are not vulnerable to adversity or bankruptcy. Much of this risk is mitigated by the decentralized nature of DeFi protocols.

The DeFi Future

Decentralized finance is constantly changing. But unfortunately, it is unregulated, and its ecosystem is riddled with mishaps, hacks, and scams. Current legislation is based on distinct financial jurisdictions with laws and rules. Therefore, the ability of DeFi to conduct borderless transactions raises critical issues for this type of regulation.

Who is in charge of investigating financial crimes across borders, protocols, and DeFi apps? Who would enforce the rules, and how would they be implemented? Other issues to consider are system stability, energy consumption, carbon footprint, system upgrades, system maintenance, and hardware failures.

The Bottom Line

DeFi is a rapidly growing movement changing how we think about finance. By leveraging blockchain technology, DeFi offers a more accessible, transparent, and decentralized financial system accessible to anyone with an internet connection. With new DeFi applications being developed every day, the future of finance looks brighter than ever.

How SDLC CORP Can Help in DeFi Services

Decentralized Finance (DeFi) is transforming the financial landscape with innovative blockchain solutions. SDLC CORP offers a range of specialized DeFi services to empower your project and navigate the complexities of decentralized finance.

Explore our DeFi services:

- DeFi Exchange Development Company

- DeFi Staking Platform

- DeFi Token Development Company

- DeFi Consulting Services

- DeFi Crowdfunding Platform Development Company

- DeFi Development Company

- P2P Lending Platform

- DeFi Yield Farming Development Company

- DeFi Wallet Development Company

- DeFi Lending Platform

Partner with SDLC CORP to leverage the full potential of DeFi and revolutionize your financial services with blockchain technology.

FAQs

1. What are some examples of DeFi applications?

There are several DeFi applications, including:

• Decentralized exchanges (DEXs) for trading cryptocurrencies and other digital assets

• Decentralized lending and borrowing platforms where users can lend or borrow digital assets without intermediaries

• Stablecoins, which are cryptocurrencies pegged to the value of a stable asset like the US dollar

• Automated market makers (AMMs) that use algorithms to set prices for trading pairs on DEXs

• Prediction markets that allow users to bet on the outcome of future events

2. What are the risks associated with DeFi?

Like any new and emerging technology, DeFi has its own set of risks, including:

• Smart contract vulnerabilities can lead to hacks and loss of funds

• Liquidity risks on decentralized exchanges

• Regulatory risks as governments may seek to regulate DeFi

• Volatility risks as DeFi products are often based on volatile cryptocurrencies

3. How can I get started with DeFi?

To start with DeFi, you will need a cryptocurrency wallet, some cryptocurrency, and an understanding of how to use DeFi applications. You can begin by researching DeFi applications and understanding how they work.

You can then use a decentralized exchange to trade cryptocurrencies, lend or borrow digital assets on a decentralized lending platform, or participate in a prediction market.