Introduction

The development process of a DeFi staking platform begins with a thorough understanding of the project requirements and goals. Initially, a detailed analysis is conducted to identify the specific features and functionalities needed for the platform. This includes defining the types of staking mechanisms, such as Delegated Proof of Stake (DPoS), Yield Farming, or Liquidity Provision.

Next, the design phase involves creating user-friendly interfaces and secure architecture. Smart contracts, which are the backbone of any DeFi platform, are then developed and rigorously tested to ensure they function as intended without vulnerabilities. Additionally, integrating a robust DeFi wallet and ensuring seamless interoperability with other blockchain networks is crucial.

The platform is subsequently subjected to extensive security audits to safeguard against potential threats. Finally, the DeFi staking platform undergoes beta testing with real users before the official launch, ensuring a smooth and reliable user experience.

Collaborating with a professional DeFi development company can streamline this process, leveraging their expertise to build a secure, efficient, and user-centric staking platform.

Explanation of How Crypto DeFi Staking Works

Crypto DeFi staking is a process where users lock up their cryptocurrency assets in a blockchain network to support its operations and security. In return for their participation, users earn rewards, typically in the form of additional cryptocurrency. This method leverages decentralized finance (DeFi) principles to offer a transparent and secure way to generate passive income.

The process begins with selecting a compatible wallet and transferring the desired amount of cryptocurrency into it. Once staked, these funds help validate transactions and maintain the network’s consensus mechanism, such as Proof of Stake (PoS) or Delegated Proof of Stake (DPoS). The amount of rewards earned depends on factors like the amount staked and the duration of staking. This approach not only benefits individual stakers but also enhances the security and efficiency of the blockchain network.

What Makes DeFi Staking Platform Development Successful?

1. Robust Security Measures

Ensuring the highest level of security is crucial for the success of any DeFi staking platform. Implementing advanced encryption, secure coding practices, and regular security audits helps protect user funds from potential threats and vulnerabilities.

2. User-Friendly Interface

A successful DeFi staking platform must offer an intuitive and user-friendly interface. Simplified navigation, clear instructions, and easy access to staking features make the platform accessible to both novice and experienced users.

3. Scalability and Performance

The platform’s ability to handle a growing number of users and transactions without compromising performance is vital. Utilizing scalable blockchain solutions and optimizing smart contracts ensure that the platform remains efficient and responsive under heavy loads.

4. Transparent and Fair Reward System

A transparent and fair reward distribution mechanism builds trust among users. Clear communication about how rewards are calculated and distributed, along with timely payouts, encourages more users to participate in staking.

5. Comprehensive Support and Education

Providing comprehensive customer support and educational resources is key to user retention and satisfaction. Tutorials, FAQs, and responsive support teams help users navigate the platform and resolve issues quickly.

6. Interoperability and Integration

Successful DeFi staking platforms often support interoperability with other DeFi services and blockchain networks. Integrating with popular wallets, exchanges, and other DeFi applications enhances the platform’s utility and attractiveness to a broader audience.

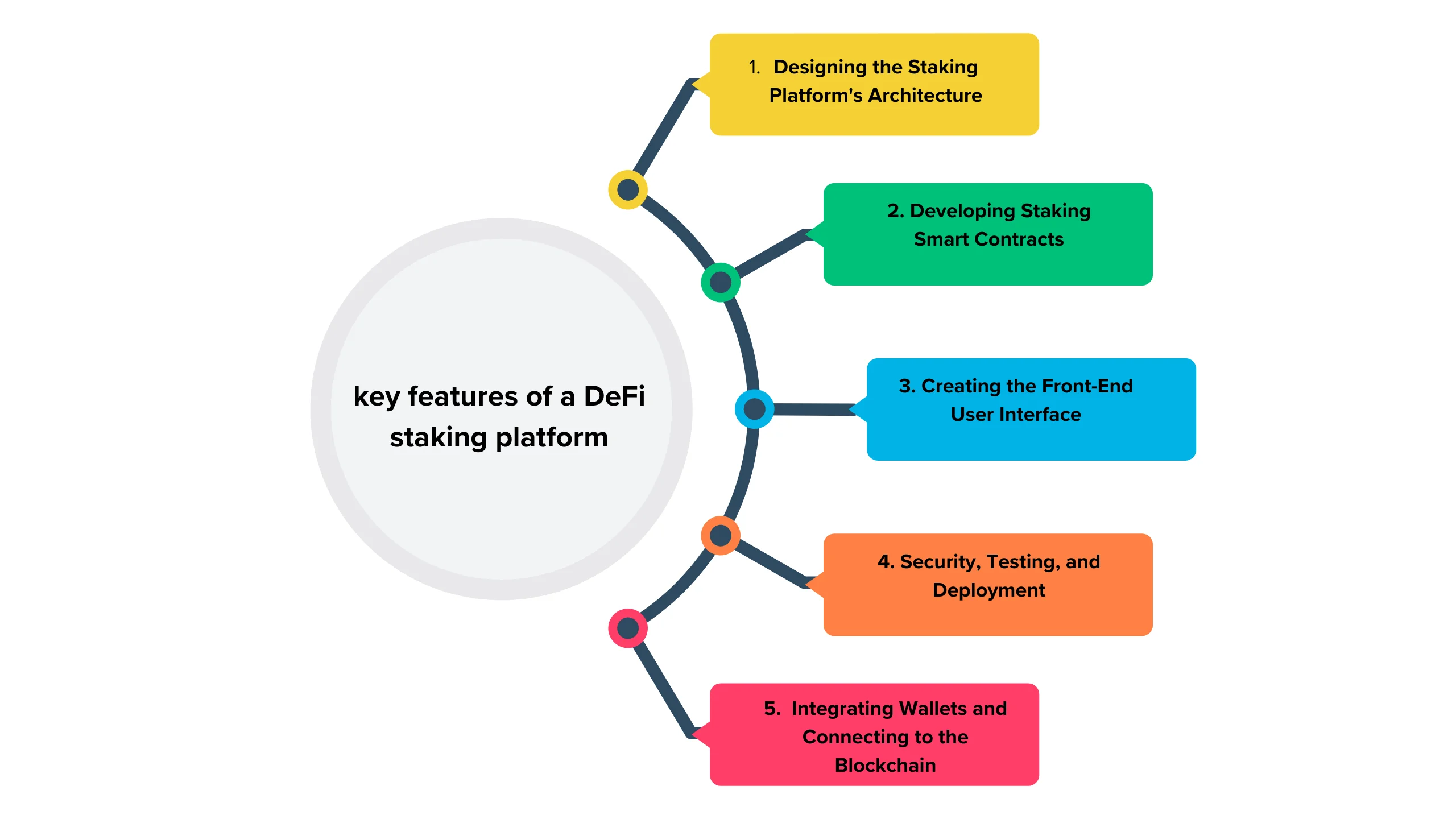

What are the key features of a DeFi staking platform?

A DeFi staking platform should feature a user-friendly interface, multiple staking options, and high security measures to protect user funds and data. Integration with smart contracts ensures transparency and efficiency, while competitive rewards and incentives, such as yield farming and liquidity mining, attract and retain users. Detailed analytics and reporting tools help users track their performance, and cross-chain compatibility supports a variety of assets. Decentralized governance allows for community-driven decision-making, and responsive customer support ensures user satisfaction. Scalability and performance are crucial to handle a large volume of transactions and users effectively.

1. Designing the Staking Platform's Architecture

Designing the architecture of a staking platform is crucial for developing a robust DeFi landing platform. It involves integrating with a reliable blockchain network, creating secure and transparent smart contracts, and ensuring a user-friendly interface for easy asset staking and reward monitoring. Additionally, implementing strong security protocols, such as multi-signature wallets and encryption, and ensuring scalability to handle increasing user and transaction volumes are vital. Efficient liquidity management mechanisms further enhance the platform’s functionality, providing a seamless and rewarding staking experience for users while fostering trust and engagement in the DeFi ecosystem.

2. Developing Staking Smart Contracts

Developing staking smart contracts is a critical aspect of creating efficient and secure Decentralized Finance (DeFi) platforms. These smart contracts are self-executing contracts with the terms of the agreement directly written into code. They manage the staking process by automating tasks such as locking funds, distributing rewards, and maintaining the network’s security and integrity.

The development process begins with defining the staking logic, including the rules for staking, reward calculations, and penalties for misconduct. Afterward, developers write the smart contract code, typically using blockchain-specific programming languages like Solidity for Ethereum. Rigorous testing and auditing are essential to ensure the contract is secure and functions as intended. Once deployed, these contracts enable users to stake their cryptocurrency in a decentralized manner, earning rewards while supporting the network.

Choosing a proficient DeFi wallet development company can significantly enhance this process. These companies offer expertise in building and integrating staking smart contracts within user-friendly wallets, ensuring seamless interaction with the DeFi ecosystem. They focus on security, scalability, and usability, providing businesses and investors with reliable solutions to participate in DeFi staking efficiently.

3. Creating the Front-End User Interface

Creating an intuitive and responsive front-end user interface (UI) is essential for the success of any decentralized finance (DeFi) application. The front-end UI is the user’s gateway to interact with complex blockchain-based systems, and it needs to be designed with a focus on user experience, simplicity, and accessibility. This involves crafting visually appealing layouts, ensuring seamless navigation, and integrating interactive elements that guide users through various functionalities like staking, yield farming, and liquidity provision.

The process begins with understanding the user requirements and designing wireframes that map out the user journey. Next, developers use front-end technologies like HTML, CSS, and JavaScript frameworks such as React or Vue.js to bring the design to life. Key considerations include mobile responsiveness, fast loading times, and secure interactions. By prioritizing user-centric design principles, the front-end UI can significantly enhance user engagement and satisfaction.

4. Security, Testing, and Deployment

In the realm of Decentralized Finance (DeFi), ensuring robust security, comprehensive testing, and efficient deployment is paramount. DeFi consulting services play a crucial role in guiding projects through these critical phases. Security begins with meticulous smart contract auditing to identify and mitigate vulnerabilities. Testing is an iterative process, including unit testing, integration testing, and stress testing, ensuring all components function correctly under different scenarios. Deployment marks the transition from development to a live environment, involving infrastructure configuration, CI/CD pipeline setup, and performance monitoring. By leveraging expert DeFi consulting services, projects can navigate these complex processes with confidence, ensuring a secure, reliable, and scalable DeFi application.

5. Integrating Wallets and Connecting to the Blockchain

Integrating wallets and connecting to the blockchain is a crucial step for enabling seamless transactions and interactions within the decentralized finance (DeFi) ecosystem. By integrating digital wallets, users can securely store and manage their cryptocurrencies, enabling smooth access to various DeFi services. Connecting to the blockchain ensures that these wallets can interact with smart contracts and other decentralized applications (dApps), providing transparency, security, and efficiency in financial transactions. This integration is fundamental for applications like DeFi crowdfunding, where decentralized platforms enable individuals to raise funds without intermediaries, democratizing access to capital and fostering innovation in the financial sector.

How Much Does it Cost to Build DeFi Staking Platform

The cost of building a DeFi staking platform varies widely based on several factors such as the platform’s complexity, desired features, and the expertise of the development team. A basic DeFi staking platform may cost between $50,000 to $150,000, while a more advanced platform with additional features such as yield farming, liquidity mining, and robust security measures could range from $200,000 to $500,000 or more. Key cost drivers include smart contract development, user interface design, integration with various blockchain networks, and compliance with regulatory requirements.

Investing in a DeFi staking platform can be highly rewarding due to the growing interest in decentralized finance. By choosing a reliable DeFi crowdfunding development company, you can secure the necessary funding and resources to develop a robust and secure staking platform that meets market demands.

How Can Sdlccorp Help You?

At SDLC Corp, we specialize in providing top-notch Full Stack Development services tailored to meet your unique business needs. Our team of highly skilled developers excels in creating robust, scalable, and efficient solutions that drive your business forward. Whether you need end-to-end software development, game testing services, or expert consulting in emerging technologies like DeFi staking and blockchain integration, SDLC Corp has the expertise to deliver exceptional results. We focus on delivering high-quality code, on-time project completion, and seamless communication to ensure your project’s success. Partner with SDLC Corp to leverage our extensive experience and innovative approach, transforming your ideas into reality.

Conclusion

The conclusion of the DeFi staking platform development process highlights the importance of meticulous planning, secure smart contract implementation, and user-friendly design. It emphasizes how each phase contributes to a robust and efficient platform, enabling users to participate confidently in decentralized finance, thus fostering growth and innovation in the blockchain ecosystem.

FAQs

What are the costs involved in developing a DeFi staking platform?

Costs include development, security audits, infrastructure, and ongoing maintenance.

How do developers handle network fees in staking platforms?

Network fees, such as gas fees, are managed through efficient smart contract design and user fee policies.

What are the common challenges in DeFi staking platform development?

Challenges include ensuring security, handling scalability, and maintaining regulatory compliance.

How is community governance integrated into a staking platform?

Community governance can be integrated through voting mechanisms where stakers influence platform decisions.

What support and maintenance are required post-launch?

Ongoing support includes regular updates, security patches, user support, and performance monitoring.

Share a few details about your project, and we’ll get back to you soon.

Let's Talk About Your Project

- Free Consultation

- 24/7 Experts Support

- On-Time Delivery

- sales@sdlccorp.com

- +1(510-630-6507)