Introduction

Equity tokens are a subset of security tokens that represent ownership in a company or venture, providing holders with rights akin to traditional equity shareholders. These tokens leverage blockchain technology to offer transparency, fractional ownership, and enhanced liquidity in investment opportunities. Here’s a detailed exploration of equity tokens:

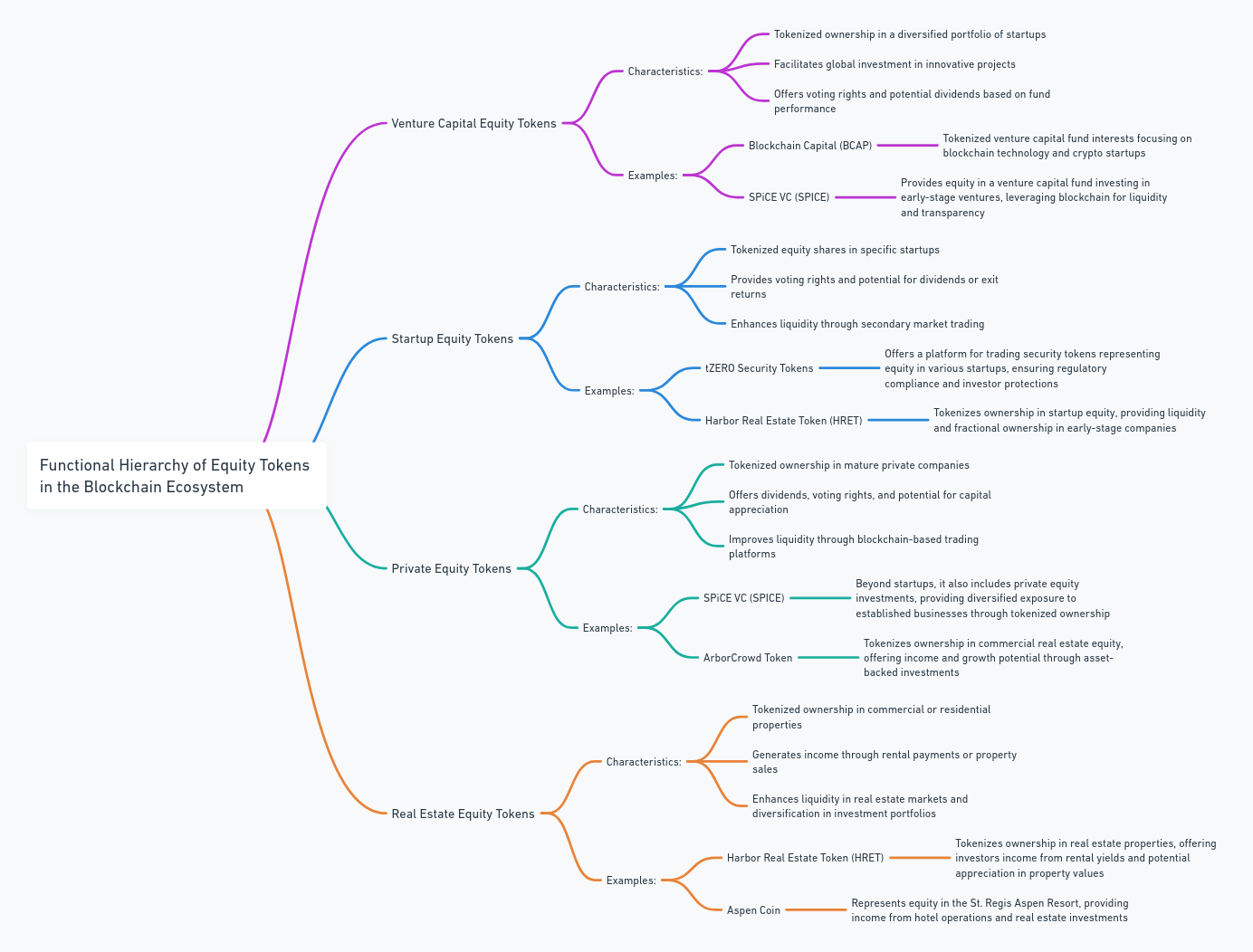

Hierarchy of Equity Tokens

The functional hierarchy of equity tokens in the blockchain ecosystem categorizes them based on their specific functions, applications, and roles within digital asset management and investment. Here’s an overview of the functional hierarchy of equity tokens:

1. Venture Capital Equity Tokens

Venture capital equity tokens represent ownership in venture capital funds that invest in startups and early-stage ventures. These tokens offer investors exposure to high-growth potential companies and opportunities for significant returns.

- Characteristics:

- Tokenized ownership in a diversified portfolio of startups.

- Facilitates global investment in innovative projects.

- Offers voting rights and potential dividends based on fund performance.

- Examples:

- Blockchain Capital (BCAP): Tokenized venture capital fund interests focusing on blockchain technology and crypto startups.

- SPiCE VC (SPICE): Provides equity in a venture capital fund investing in early-stage ventures, leveraging blockchain for liquidity and transparency.

2. Startup Equity Tokens

Startup equity tokens represent ownership in individual startup companies, allowing investors to participate in the growth and success of entrepreneurial ventures. These tokens offer liquidity and diversification in startup investments.

- Characteristics:

- Tokenized equity shares in specific startups.

- Provides voting rights and potential for dividends or exit returns.

- Enhances liquidity through secondary market trading.

- Examples:

- tZERO Security Tokens: Offers a platform for trading security tokens representing equity in various startups, ensuring regulatory compliance and investor protections.

- Harbor Real Estate Token (HRET): Tokenizes ownership in startup equity, providing liquidity and fractional ownership in early-stage companies.

3. Private Equity Tokens

Private equity tokens represent ownership in privately held companies outside of the startup phase, offering investors exposure to established businesses with growth potential. These tokens often provide dividends and participation in company governance.

- Characteristics:

- Tokenized ownership in mature private companies.

- Offers dividends, voting rights, and potential for capital appreciation.

- Improves liquidity through blockchain-based trading platforms.

- Examples:

- SPiCE VC (SPICE): Beyond startups, it also includes private equity investments, providing diversified exposure to established businesses through tokenized ownership.

- ArborCrowd Token: Tokenizes ownership in commercial real estate equity, offering income and growth potential through asset-backed investments.

4. Real Estate Equity Tokens

Real estate equity tokens represent ownership in real estate properties, providing investors with income from rental yields, property appreciation, and liquidity through tokenization.

- Characteristics:

- Tokenized ownership in commercial or residential properties.

- Generates income through rental payments or property sales.

- Enhances liquidity in real estate markets and diversification in investment portfolios.

- Examples:

- Harbor Real Estate Token (HRET): Tokenizes ownership in real estate properties, offering investors income from rental yields and potential appreciation in property values.

Aspen Coin: Represents equity in the St. Regis Aspen Resort, providing income from hotel operations and real estate investments.

Characteristics of Equity Tokens

- Ownership Representation: Equity tokens digitally represent ownership in a company, project, or venture.

- Rights and Privileges: Holders typically receive voting rights, dividend distributions, and other benefits equivalent to traditional equity shareholders.

- Regulatory Compliance: Equity tokens comply with securities regulations in their respective jurisdictions, ensuring legal protection and investor rights.

How Equity Tokens Work

Equity tokens operate through blockchain-based smart contracts, which encode ownership rights, dividend policies, voting mechanisms, and other governance parameters. Key aspects of how they work include:

- Tokenization: Company ownership shares are tokenized, converting them into digital tokens on a blockchain ledger.

- Investment Accessibility: Enables fractional ownership, allowing investors to participate in company ownership with lower entry barriers compared to traditional equity markets.

- Transparency and Efficiency: Blockchain technology ensures transparent ownership records, automated dividend distributions, and efficient trading on secondary markets.

Functionality of Equity Tokens

- Access to Investment Opportunities: Equity tokens democratize access to investment in startups, private companies, or venture capital funds, previously limited to accredited investors.

- Liquidity Enhancement: Facilitates liquidity through secondary market trading, enabling investors to buy, sell, or trade tokens representing ownership stakes.

- Governance Participation: Token holders can participate in company decisions, such as voting on strategic initiatives, board elections, or policy changes.

Use Cases of Equity Tokens

- Startup Funding and Venture Capital: Facilitates fundraising for startups and early-stage ventures by tokenizing equity shares and attracting global investment.

- Private Company Ownership: Allows fractional ownership in privately held companies, enhancing liquidity and valuation transparency for shareholders.

- Venture Capital Investments: Provides liquidity to venture capital investments, enabling diversification and portfolio management for investors.

Examples of Equity Tokens

- Blockchain Capital (BCAP):

- Asset: Tokenized venture capital fund interests.

- Functionality: Offers ownership in a diversified portfolio of blockchain startups, complying with securities regulations and enhancing liquidity through tokenization.

- SPiCE VC (SPICE):

- Asset: Tokenized equity in early-stage ventures.

- Functionality: Represents ownership in a venture capital fund, providing global investment opportunities and liquidity through blockchain-based trading platforms.

Conclusion

Equity tokens represent a significant innovation in digital asset management, offering investors enhanced access, liquidity, and transparency in equity ownership. Their characteristics, operational mechanisms, functionalities, and use cases illustrate their potential to transform traditional capital markets by leveraging blockchain technology for efficient and inclusive investment opportunities. Understanding equity tokens helps stakeholders navigate regulatory requirements, capitalize on global investment trends, and participate in the evolving digital economy with confidence and compliance.