Introduction

Finance runs on trust, controls, and speed. Generative AI adds a new tool to that stack. It does more than predict. It can create realistic scenarios, draft reports, and reason over messy documents. Banks, insurers, and asset managers already use it to cut review time, enrich analysis, and improve service quality. Adoption is rising because it fits where rules and paperwork dominate. The goal is not hype. The goal is safer, faster decisions with clear governance.

What is Generative AI for Finance?

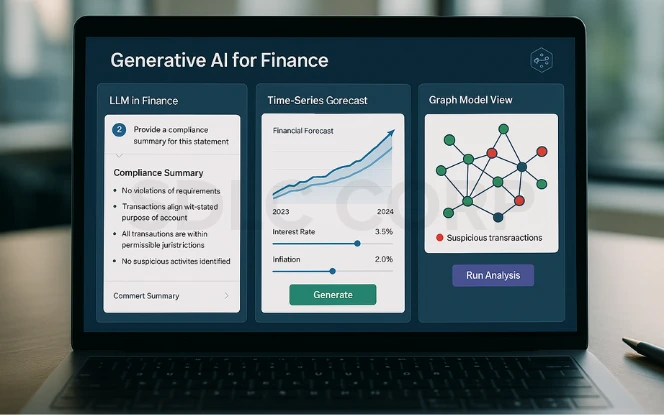

Common model types include:

- Large Language Models (LLMs): For document understanding, drafting, and dialogue.

- Time-series generators and simulators: For AI financial forecasting and scenario creation.

- Graph and sequence models: For AI fraud detection and network risk.

Good use cases for AI for finance share three traits. The task is language-heavy. The source data is unstructured. The output needs structured summaries you can audit.

Must-Have Features of AI for Finance

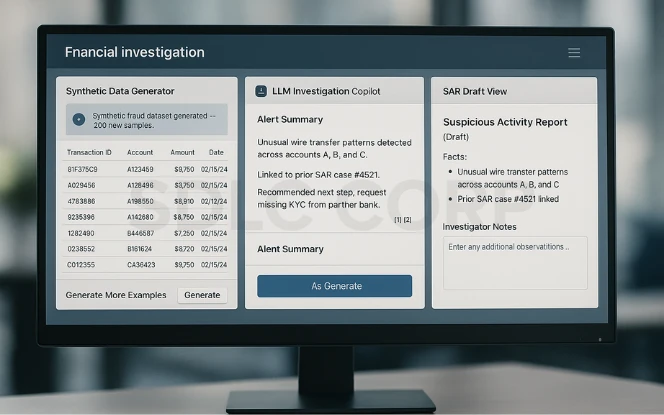

1. Fraud detection and AML investigations

Fraud patterns evolve. So should your data. Generative models help in two ways:

- Synthetic financial data: Create rare but realistic fraud examples to train detection models and reduce overfitting.

- Investigation copilots: An LLM reads transactions, KYC files, and alerts. It explains links, drafts case notes, and proposes next steps.

Practical workflow:

- Ingest transactions and alert metadata.

- Pull related KYC docs and previous SAR narratives.

- Generate an alert summary with sources cited.

- Ask the model for missing evidence, then fetch it.

- Produce a human-editable SAR draft with a fact list.

Useful metrics: reduction in alert handling time, lower false-positive rate, and improved investigator agreement.

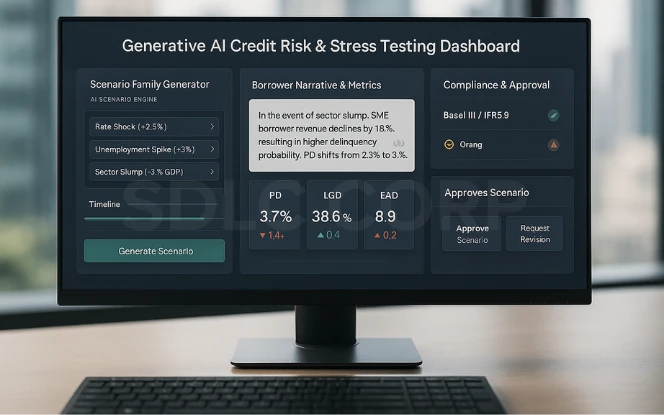

2. Credit risk and stress testing

Credit models depend on macro paths. Generative AI for Finance can create scenario families: rate shocks, unemployment spikes, or sector slumps. It generates borrower narratives that align with numbers. It also explains changes in PD, LGD, and EAD when you shift assumptions.

Link this to Basel III compliance or IFRS 9 staging rules. Analysts keep control. The model proposes scenarios and text; humans approve them.

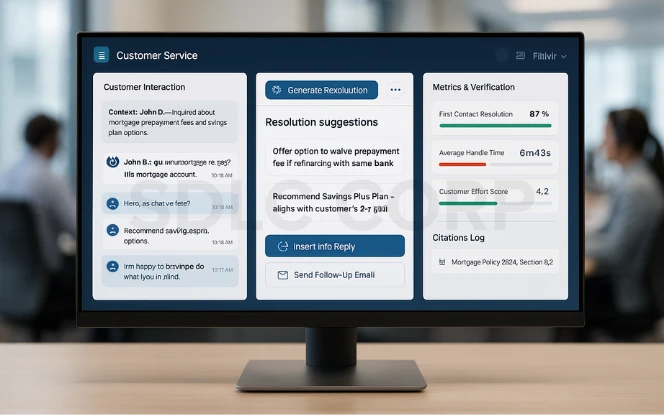

3. Customer experience and service

Contact centers sit on long call logs, emails, and chats. An LLM can summarize context, propose resolutions, and draft follow-ups. This is AI in banking that customers feel. It can simulate mortgage options, explain fees, and plan savings. Use PII redaction before retrieval.

Log citations so agents can verify each statement. Quality metrics: first-contact resolution, average handle time, and customer effort score.

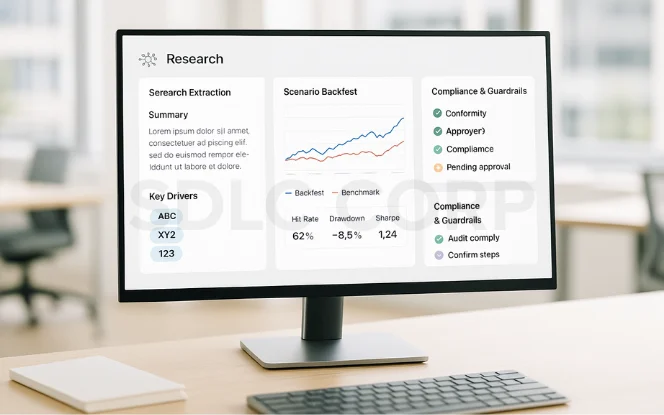

4. Trading research and portfolio analytics

Research teams filter thousands of pages. Generative AI extracts key drivers, links them to tickers, and writes a balanced note. It can also build scenario narratives for algorithmic trading backtests. Guardrails matter here.

Use a strict policy: no trade execution from model outputs, no price targets without analyst sign-off, and mandatory backtesting with clear benchmarks. Track hit rate, dra wdown, and explanation coverage.

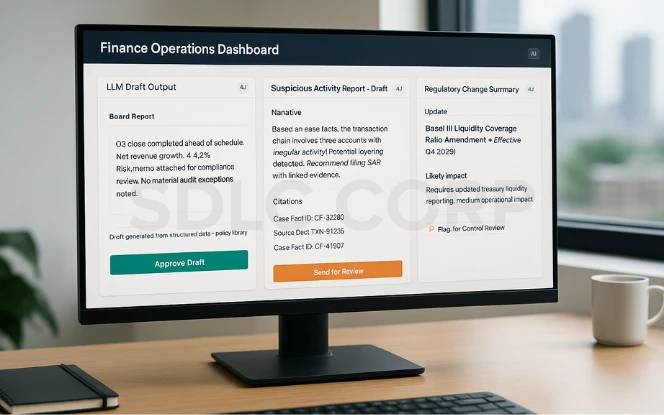

5. Finance operations and reporting

Much of finance is controlled by writing. Close packs, board books, risk memos, audit replies. LLMs can draft first versions from structured data and a policy library.

For AML, the model composes Suspicious Activity Report narratives from case facts. For regulatory change, it summarizes updates and flags likely control impacts. Gains show up in cycle time and reviewer load.

Reference Architecture and Data Flow

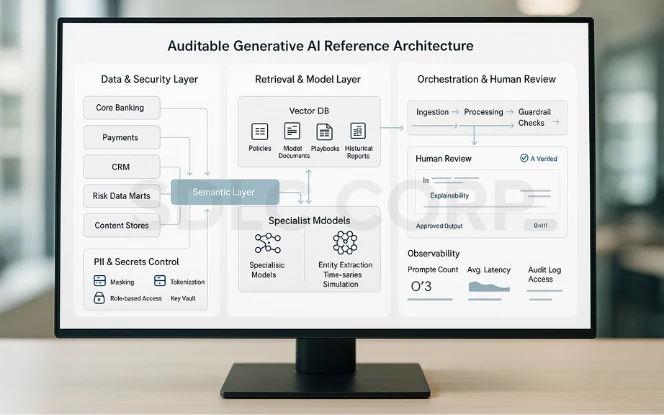

A simple, auditable stack works best:

- Data layer: Core banking, payments, CRM, risk data marts, content stores. Build a clean semantic layer.

- PII and secrets control: Masking, tokenization, and role-based access. Keep keys in a vault.

- Retrieval layer (RAG): Index policies, model documents, playbooks, and historical reports in a vector database. Store embeddings and metadata with versioning.

- Model layer:

- Hosted LLM or on-prem model for sensitive workloads.

- Smaller specialist models for classification, entity extraction, and time-series simulation.

- Hosted LLM or on-prem model for sensitive workloads.

- Orchestration: A workflow service runs steps, enforces guardrails, and logs every call.

- Human-in-the-loop UI: Review, edit, and approve outputs with inline citations.

- Observability: Capture prompts, inputs, outputs, latencies, and decisions. Keep an immutable audit trail.

Generative AI Development Services ensure that data never leaves approved boundaries. Retrieval uses only whitelisted sources, and every generated sentence links back to the evidence that supports it. This is explainable AI in practice.

Risks, Controls, and Compliance

Generative AI adds risks you must manage:

- Privacy and GDPR in finance: Run a Data Protection Impact Assessment. Apply data minimization and retention limits. Redact PII before indexing.

- Model risk management: Treat the LLM like any other model. Define purpose, inputs, limits, and failure modes. Use challenger prompts and holdout test sets. Document assumptions.

- Hallucination and factual drift: RAG with strict citation rules reduces unsupported claims. Reject answers that lack sources.

- Bias and fairness: For credit and pricing use cases, test outputs across sensitive cohorts. Compare denial rates and explanations. Keep a remediation plan.

- Security: Apply least-privilege access, network isolation, and secrets management. Red-team the model for prompt-injection and data exfiltration.

- Regulatory alignment: Map controls to Basel III, GDPR, PCI DSS for card data, SOX for reporting controls, AMLD for AML/KYC, and your local supervisory statements on model risk management. Keep a register that links each control to evidence and owners.

- AI governance: Define who approves prompts, who owns corpora, and when models get retrained. Log changes and enforce sign-offs.

Governance is not overhead. It is how you ship safely and keep the program in production.

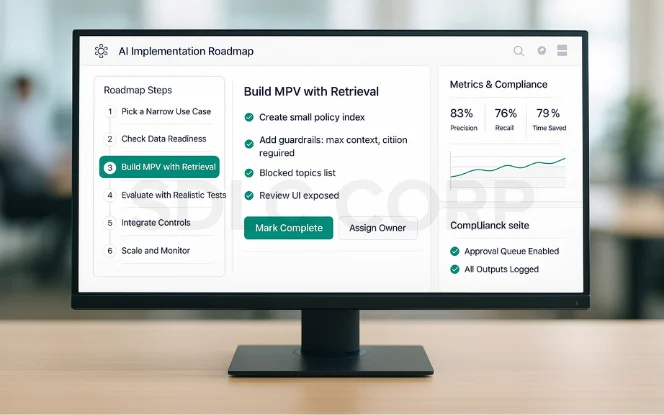

Step-by-Step Implementation Plan (6 Steps)

- Pick a narrow use case – Choose a task with measurable pain: AML alert narratives, complaint summarization, or policy Q&A. Define a clear “done” metric (e.g., 30% faster case close).

- Check data readiness – List systems of record. Clean access paths. Label sensitive fields. Add PII redaction. Confirm legal basis for processing.

- Build an MVP with retrieval – Create a small policy index. Add guardrails: max context, citation required, and blocked topics. Expose a review UI.

- Evaluate with realistic tests – Use production-like cases. Score precision, recall, time saved, and citation coverage. Add adversarial prompts to test robustness.

- Integrate controls – Route outputs through approval queues. Store all inputs and outputs. Add model cards and user training. Align with AI compliance in finance standards.

- Scale and monitor – Expand to new document sets. Track drift and costs. Rotate keys, update prompts, and retrain retrieval embeddings on a schedule.

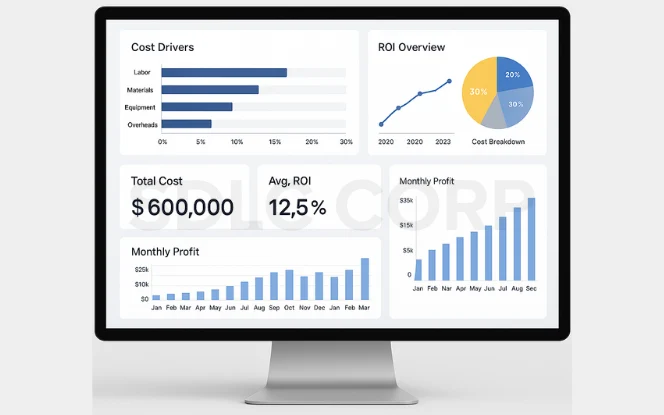

Understanding Cost Drivers and ROI

Main cost buckets:

- Model usage: Token or compute costs for LLM calls or on-prem GPUs.

- Retrieval infra: Vector database, storage, and indexing jobs.

- Engineering and compliance: Data work, guardrails, red-teaming, and audits.

- Human review time: Fewer hours over time as quality improves.

A simple ROI view:

- Savings: (Hours saved per case × cases per month × loaded hourly rate) + avoided vendor data costs.

- Revenue lift: Conversion gains from faster decisions or better cross-sell, if applicable.

- Net ROI: (Savings + lift − (model + infra + staff)) / (model + infra + staff).

Run this per use case. Keep assumptions modest. Validate over a quarter before scaling.

Future Outlook

The future of AI in finance will focus on stronger governance, broader adoption, and integration with emerging technologies. Firms that adapt early will gain a lasting competitive edge.

Three trends are shaping generative AI applications in finance:

- Smaller, domain-tuned models: Lower cost and tighter control for on-prem workloads.

- Agentic workflows with strong guardrails: Chained tools for retrieval, calculation, and drafting, each with a policy check.

- Deeper explainability: Token-level attributions, evidence graphs, and standardized audit packages for regulators.

Expect stricter rules on transparency and data lineage. Expect better tooling to meet them.

Integration with Core Financial Platforms

Generative AI tools often integrate with core banking systems, trading platforms, and analytics engines. Successful integration requires stable infrastructure and secure data flows. Financial institutions may rely on AI development services to connect generative models with existing platforms while maintaining data integrity and operational continuity.

Ongoing Development and Model Oversight

Financial products, regulations, and market conditions evolve over time. Generative AI systems must adapt accordingly. Some organisations choose to hire generative AI developers to maintain models, update integrations, and ensure systems remain aligned with financial rules and operational requirements.

Conclusion

Generative AI Consulting Services are practical in finance today when scoped and governed well. Start with language-heavy work where evidence exists. Use retrieval, enforce citations, and keep humans in the loop. Measure results with clear metrics. Link controls to regulations. If you do that, you cut cycle time, improve clarity, and keep risk within policy. That is the path to durable value with AI in banking.

FAQ's

What is Generative AI in finance?

Generative AI in finance refers to AI systems that create new outputs such as reports, forecasts, or synthetic data, based on existing financial data and models.

How is Generative AI different from traditional AI?

Traditional AI often predicts outcomes using past data, while generative AI can create new scenarios, simulate market conditions, and produce auditable summaries.

What are the main use cases of Generative AI in finance?

Key uses include fraud detection, credit risk analysis, financial forecasting, customer service automation, and regulatory reporting.

Is Generative AI safe to use in regulated industries like banking?

Yes, when implemented with controls such as data masking, role-based access, human oversight, and compliance with regulations like Basel III or GDPR.

How can financial institutions measure ROI from Generative AI?

ROI can be tracked through reduced operational costs, faster report cycles, improved risk detection, and higher decision-making accuracy.

What challenges should be considered before adopting Generative AI in finance?

Challenges include ensuring data quality, avoiding model bias, meeting strict compliance standards, and preventing overreliance on automated outputs.