Introduction

The insurance industry has always relied on data and probabilities to manage risk. For decades, actuarial models shaped how policies were designed and priced. But rising challenges such as climate change, cyber threats, and customer expectations are making traditional methods less effective.

Generative AI in Insurance is reshaping the landscape. Unlike predictive analytics, which only estimate outcomes, generative AI can create outputs such as claims summaries, risk scenarios, customer conversations, and policy drafts. It delivers faster processing, greater accuracy, and new opportunities for innovation.

The role of AI for Insurance Industry solutions is not to replace people but to enhance their decision-making. From Insurance Automation with AI in underwriting to AI-powered Risk Assessment and Machine Learning for Insurance, insurers are beginning to transform how they work.

Role of Generative AI in Insurance Systems

Insurance platforms manage data across underwriting, claims, customer service, and compliance. Generative AI can support these systems by summarising policy documents, analysing claim narratives, and assisting with internal knowledge management.

Many organisations explore Generative AI development services to build models that work with structured policy data and unstructured text while supporting accuracy and traceability.

The Insurance Landscape

Insurance is facing new challenges such as climate-related events that cause rising claims, stricter regulators, and customers demanding instant service. At the same time, technology has matured to the point where insurers can implement AI at scale, not just in pilots.

The role of Artificial Intelligence in Insurance today is transformation across the value chain. It reduces claims cycle times, enables faster underwriting, and personalizes coverage in real time. Adoption is not uniform. Some insurers are experimenting with generative models, while others are already deploying them in underwriting and fraud detection.

Understanding this context is crucial because the winners of tomorrow will be the ones that act decisively today.

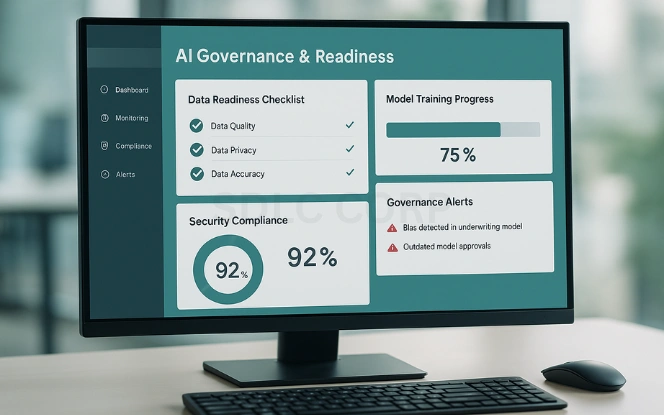

Building the Right Foundations

Generative AI is only as effective as the systems it connects to. Before launching any use case, insurers must evaluate their foundations. Poor data quality, weak governance, and a lack of security controls can lead to inaccurate outputs or regulatory problems.

Preparing involves several key steps:

- Data readiness: Claims data often contains gaps or inconsistencies. Cleaning and structuring it is essential.

- Governance: Generative models can “hallucinate.” Strong oversight ensures outputs remain reliable and explainable.

- Model strategy: Insurers must choose between vendor platforms, in-house builds, or hybrid strategies.

- Controls: Tools like red-teaming, bias audits, and prompt monitoring prevent misuse.

This preparation phase may seem like overhead, but it directly impacts the long-term value of Insurance Automation with AI.

Use Case Playbooks

The real power of generative AI emerges in daily applications. Instead of broad promises, insurers benefit from concrete use-case playbooks. Each use case combines automation, better risk insights, and improved customer engagement.

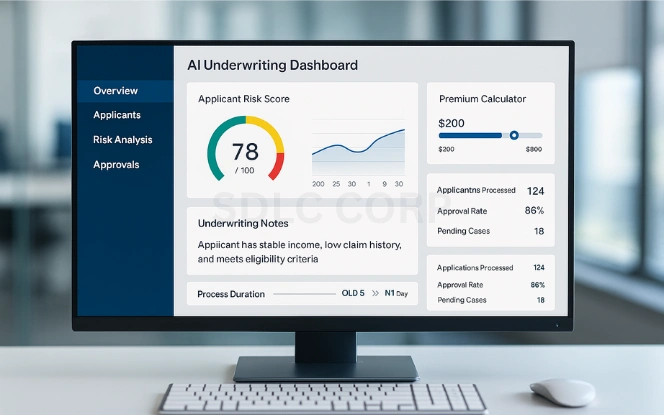

Underwriting Automation

Underwriting has always been data-intensive. Generative AI can draft risk summaries, write plain-language policies, and analyze applicant histories in minutes. By generating alternative risk scenarios, underwriters can price policies with greater accuracy.

This is where Insurance Automation with AI delivers value through faster processing, fewer errors, and stronger customer trust.

KPI Targets:

- Turnaround time: reduced from 5 days to 1 day

- Underwriting costs: reduced by 20 percent within 12 months

Claims Processing & FNOL

Claims are the “moment of truth” in insurance. Customers judge insurers not when they buy policies but when they file claims. Generative AI helps automate first-notice-of-loss (FNOL) summaries, draft claim decision letters, and provide clear explanations of coverage.

This reduces friction, ensures faster resolution, and improves customer satisfaction. Here, AI-powered Risk Assessment ensures claims are evaluated consistently and fairly.

KPI Targets:

- Claim cycle time: reduced by 30 percent

- Customer satisfaction: increased by 15 percent

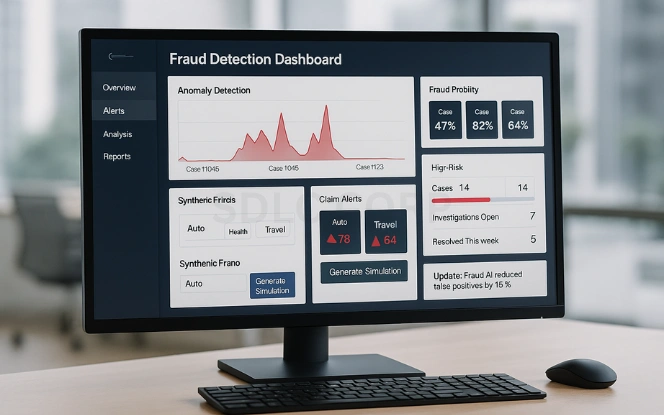

Fraud Detection & SIU

Fraudulent claims cost billions each year. Generative AI strengthens fraud detection by generating synthetic fraud scenarios, training models to recognize suspicious patterns, and drafting case summaries for Special Investigation Units (SIUs).

Combined with Machine Learning for Insurance, this approach reduces false positives while ensuring legitimate claims are paid quickly.

Claims Processing and Risk Assessment

Claims handling involves reviewing large volumes of documentation and correspondence. Generative AI can help draft claim summaries, identify patterns, and support adjuster workflows.

In these cases, a Generative AI consulting company may assist insurers in evaluating use cases, managing model risk, and setting review controls to ensure outputs remain compliant and reliable.

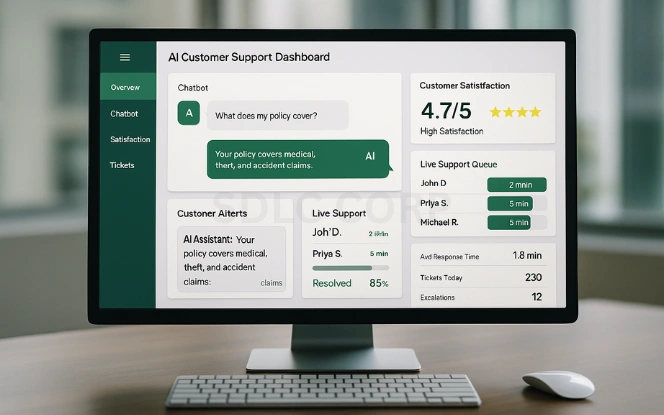

Customer Experience & Support

Insurance is complex for most policyholders. Generative AI can simplify communication by generating personalized responses, writing clear explanations, and supporting customers through virtual assistants.

This builds trust and reduces churn. By embedding Artificial Intelligence in Insurance workflows, customer support shifts from reactive to proactive.

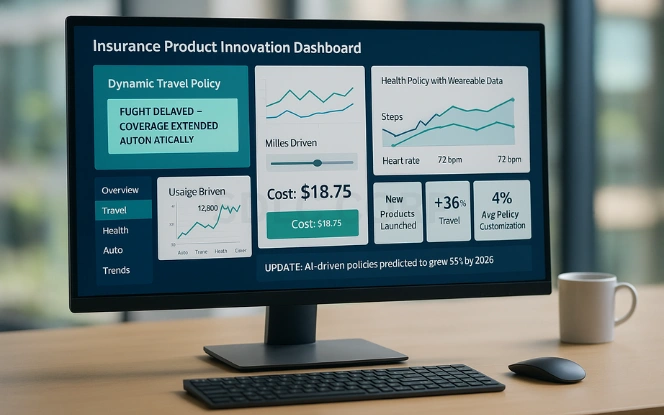

Product Innovation

Generative AI enables products that adapt in real time. Examples include:

- Travel insurance that changes as itineraries shift

- Health policies that adjust with wearable-tracked activity

- Usage-based auto coverage recalculated monthly

These adaptive products are only possible with generative AI, and they represent the future of AI for Insurance Industry innovation.

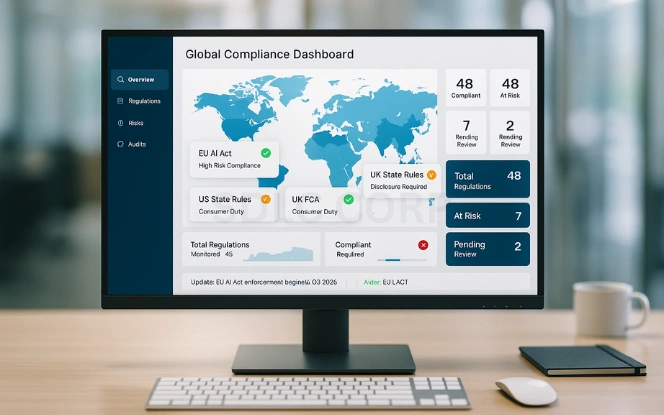

Regional Compliance Snapshot (2025)

As insurers adopt generative AI, regulators are setting new rules. Compliance is no longer optional. It is essential.

| Region | Focus Area | Implications |

|---|---|---|

| EU (AI Act) | Risk classification | Insurers must justify model explainability. |

| US | State-level rules | Different disclosure requirements in each state. |

| UK | FCA guidance | Focus on consumer duty and accountability. |

| India | Draft AI framework | Mandatory audits for large models. |

Adopting Generative AI in Insurance requires aligning every project with these regulatory expectations.

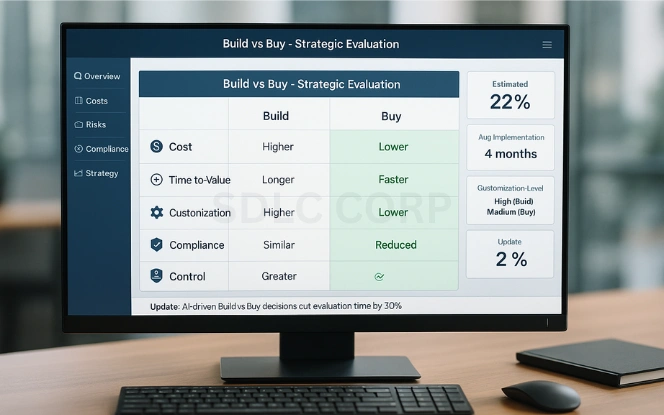

Build vs. Buy: Decision Matrix

Many insurers ask whether to build their own AI systems or partner with vendors. Both approaches have trade-offs.

| Factor | Build (In-house) | Buy (Vendor) |

|---|---|---|

| Control | High | Medium |

| Cost (initial) | High | Lower |

| Time-to-value | Longer | Faster |

| Customization | Full | Limited |

| Compliance | Must manage | Vendor-supported |

This decision shapes how quickly insurers can scale and how much control they retain.

Challenges & Risks

Generative AI is powerful, but adoption carries risks:

- Data privacy: Sensitive customer information must be protected.

- Bias: Models can unintentionally discriminate.

- Model drift: Outputs may degrade over time.

- Change management: Employees must adapt to new workflows.

These risks require planning, but they do not outweigh the benefits.

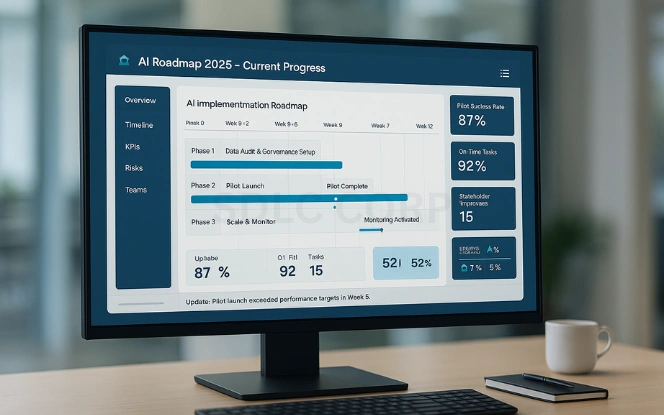

Implementation Roadmap (12 Weeks)

To avoid stalled pilots, insurers should follow a phased roadmap:

- Week 0–2: Audit data and set governance baselines.

- Week 3–6: Launch a pilot in underwriting or claims.

- Week 7–12: Evaluate KPIs, establish monitoring, and scale to new use cases.

This staged approach prevents wasted investment and ensures measurable impact.

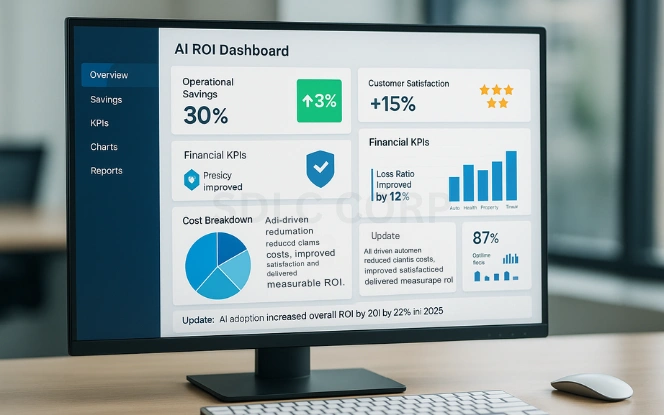

Measuring ROI

Generative AI adoption should be tied to measurable results. Insurers can track progress through:

- Operational KPIs: Claims cycle times and fraud detection rates

- Customer KPIs: Net Promoter Score, resolution speed, and satisfaction scores

- Financial KPIs: Loss ratio improvement and administrative cost savings

This ensures that investments in Artificial Intelligence in Insurance deliver clear business value.

Ongoing Development and Model Oversight

Insurance products and regulations evolve over time, requiring AI systems to adapt accordingly. Generative AI models need continuous updates and review. Some organisations choose to hire generative AI developers to maintain models, refine integrations, and ensure systems remain aligned with business rules and regulatory standards.

Conclusion

Generative AI is no longer an experiment. It is becoming a core driver of insurance transformation. Its applications, including Insurance Automation with AI, AI-powered Risk Assessment, and Machine Learning for Insurance, are already proving their value in underwriting, claims, fraud detection, and customer support.

The key is not blind adoption but responsible adoption. With strong governance, compliance, and transparency, insurers can build trust while improving efficiency.

For insurers preparing for 2025, the opportunity is clear. Generative AI is essential to remain competitive. Contact us SDLC Corp to learn how to implement these solutions with confidence and impact.

To take the next step, Hire AI Development Services with SDLC Corp and explore how tailored solutions can transform your organization.

FAQs

What Are The Most Common Use Cases For Generative AI In Insurance Today?

Insurers are already applying Generative AI in Insurance across underwriting, claims, fraud detection, and customer engagement. Common use cases include automated claims processing, personalized underwriting, synthetic data generation for fraud prevention, dynamic policy creation, and simplified customer communication. These applications help insurers reduce operational costs, improve customer satisfaction, and strengthen decision-making.

How Can Insurers Move Generative AI From Pilot Projects To Full-Scale Deployment?

Scaling generative AI requires a structured approach. Insurers must establish strong data foundations, clear governance policies, and defined business goals. Many follow the “Resources, Responsibility, and Returns” framework to ensure that AI projects are measurable and sustainable. Success depends on moving beyond isolated pilots and embedding AI for Insurance Industry solutions into core processes like underwriting and claims.

What Legal And Regulatory Risks Should Insurers Consider When Deploying Generative AI?

The adoption of Artificial Intelligence in Insurance introduces several legal and regulatory risks. These include intellectual property rights, compliance with data protection laws, potential liability from incorrect outputs, and alignment with new regulations such as the EU AI Act or local frameworks in the US, UK, and India. To mitigate these risks, insurers need robust governance models, bias audits, and clear accountability structures.

In What Ways Does Generative AI Enhance Fraud Detection And Customer Experience?

Generative AI improves fraud detection by creating synthetic fraud scenarios, training advanced detection models, and generating case summaries for investigations. At the same time, it enhances customer experience through virtual assistants, personalized product recommendations, and plain-language policy explanations. By combining AI-powered Risk Assessment with customer-facing tools, insurers can both protect themselves against fraud and deliver better service.

What Challenges Do Insurers Face When Adopting Generative AI, And How Can They Overcome Them?

The main challenges include data quality issues, bias in outputs, integration with legacy systems, regulatory compliance, and employee adoption. Overcoming these requires strong data governance, regular model testing, transparent communication with customers, and training programs for staff. By addressing these challenges early, insurers can unlock the full benefits of Insurance Automation with AI and Machine Learning for Insurance.