Introduction

DeFi, or Decentralised Finance, signifies a transformation from traditional, centralised financial systems to peer-to-peer finance enabled by decentralised technologies constructed on blockchain networks. A DeFi landing platform provides the core functionality of DeFi: staking, where users commit their cryptocurrencies to secure network operations in exchange for rewards, typically additional cryptocurrency. Staking is essential to many DeFi protocols as it enhances network security and operational efficiency while allowing stakeholders to earn passive income through these platforms. This process stabilises the network and empowers users by allowing them to participate directly in the financial mechanisms that govern their assets.

There are several types of DeFi staking available, each catering to different risk appetites and involvement levels:

- Simple Staking: Users simply deposit or lock their tokens in a staking pool and earn rewards over time based on the amount staked.

- Liquidity Pool Staking: Users provide liquidity to a trading pair pool (e.g., ETH/DAI) and earn transaction fees as rewards from trades executed within the pool.

- Yield Farming: Similar to liquidity pooling but involves multiple tokens and staking strategies, often moving assets across different protocols to maximise returns.

- Delegated Staking: Users delegate their tokens to a validator who runs the blockchain protocol on behalf of the speaker, sharing part of the earnings in return.

What is DeFi Staking?

DeFi staking refers to locking up cryptocurrencies in a DeFi (Decentralised Finance) protocol to earn rewards or interest. This practice is a core component of the DeFi ecosystem, enabling users to participate in network security and governance while generating passive income from their digital assets. Staking in DeFi often utilizes proof-of-stake (PoS) or similar consensus mechanisms where participants, known as validators or stickers, pledge their tokens to validate transactions and maintain the network. In return, they receive staking rewards derived from transaction fees or inflation.

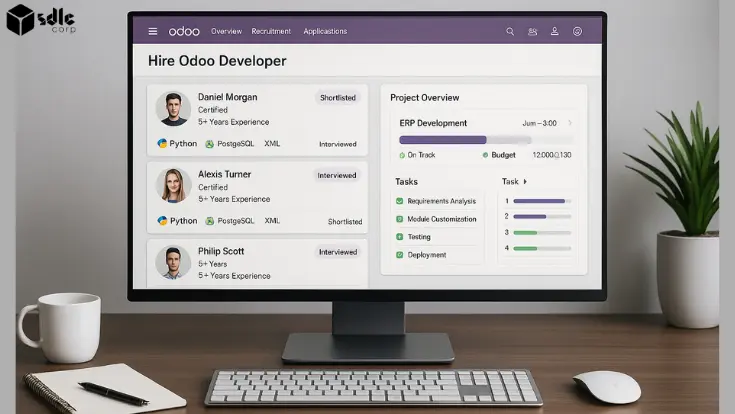

A DeFi lending platform development company specialises in creating platforms that facilitate the borrowing and lending of cryptocurrencies without an intermediary. These platforms automatically use smart contracts to manage loans, interest rates, and collateral, providing participants with a trustless environment. Such companies focus on building secure, scalable, and user-friendly platforms that support various lending and borrowing activities within the DeFi space, thus empowering users to leverage their digital assets more effectively. These platforms often incorporate staking mechanisms to secure the network and reward participants, enhancing the overall utility and appeal of the DeFi ecosystem.

What are the different types of DeFi staking?

1. Proof of Stake (PoS)

Proof of Stake (PoS) is a consensus mechanism blockchain networks use to achieve distributed consensus and security. Unlike Proof of Work (PoW), which requires extensive computational work, PoS selects validators based on the number of tokens they hold and are willing to “stake” as collateral. In DeFi (Decentralised Finance) staking, PoS plays a crucial role by enabling token holders to participate in network governance, secure the network, and earn staking rewards.

2. Delegated Proof of Stake (DPoS)

Delegated Proof of Stake (DPoS) is a consensus algorithm used in blockchain networks, particularly suited for decentralised finance (DeFi) staking applications. It enhances the basic proof of stake (PoS) mechanism by allowing token holders to vote for a limited number of delegates or validators. These delegates are responsible for managing the blockchain’s protocol and validating transactions.

3. Liquid Staking

Liquid staking is a DeFi (Decentralised Finance) mechanism that allows cryptocurrency holders to stake their assets in a staking pool and receive a liquid token in return. This token represents their staked investment and can be used in other DeFi activities, such as lending, borrowing, or trading, without losing the ability to earn staking rewards. Essentially, liquid staking provides users with the liquidity and flexibility to utilise their staked assets in various financial transactions while contributing to network security and earning rewards. This process helps to solve the traditional staking problem of assets being locked up and unusable, enhancing capital efficiency within the blockchain ecosystem.

4. Yield Farming and Liquidity Provision

a. Yield Farming

b. Liquidity Provision:

Liquidity Provision involves users depositing their assets into a liquidity pool, essentially a smart contract that facilitates trading by providing liquidity. In return for contributing to these pools, liquidity providers earn fees generated from trading assets within the pool, proportional to their share of the total liquidity. This activity is crucial for the functioning of decentralised exchanges and other DeFi services, helping to ensure that asset trading can occur smoothly and efficiently.

5. Masternodes

Top 12 Use Cases of DeFi Staking

1. Earning Passive Income

2. Network Security

3. Governance Participation

4. Liquidity Provision

5.Token Bonding

6. Syrup

7. Participation in Early Projects

8. Reducing Token Supply

9. NFT Staking

10. Lending/Borrowing

11. Asset Diversification

12. Yield Farming and Liquidity Provision

a. Yield Farming:

b. Liquidity Provision:

How Does DeFi Staking Work?

DeFi staking allows users to lock up their cryptocurrencies in a DeFi wallet and earn rewards or interest. By participating, users contribute to the liquidity and security of the blockchain network. A DeFi wallet development company specialises in creating secure and user-friendly wallets that facilitate these staking transactions, enhancing the overall efficiency and accessibility of decentralised finance.