Introduction

Reducing manual data entry and automating invoice processing can be achieved through several strategies. Firstly, leverage Optical Character Recognition (OCR) technology to extract data from scanned or digital invoices, minimising the need for manual input. Additionally, implement automated workflows for invoice approval, routing, and payment using accounting software or dedicated automation tools. Integrating your invoice processing system with your accounting software enables automatic updates to financial records when invoices are processed and paid.

Utilizing electronic invoicing (e-invoicing) can also expedite processing, as e-invoices can be handled faster and more accurately than paper invoices. Implementing purchase order (PO) matching ensures that invoices are accurately matched with corresponding POs and receipts. Setting up automated reminders for invoice approval and payment helps ensure timely processing and avoids late fees. Establishing approval hierarchies based on predefined rules can further automate the approval process, reducing manual intervention. Regularly reviewing and optimizing your invoice processing workflows helps identify areas for improvement and enhances overall efficiency.

Say Goodbye to Manual Entry: Automate Your Invoices Today!

What tasks are being done manually?

Several tasks related to invoice processing are often done manually, including:

- Data Entry: Manually entering invoice details into accounting or invoicing systems is time-consuming and prone to errors.

- Invoice Routing: Physically or manually routing invoices for approval can lead to delays and inefficiencies.

- Matching Invoices: Matching invoices with purchase orders and receipts requires manual verification and can be error-prone.

- Payment Processing: Initiating payments and updating payment statuses manually can be inefficient and may lead to delays in vendor payments.

- Record Keeping: Maintaining paper copies of invoices and manually filing them for record-keeping purposes can be labor-intensive and prone to errors.

- Communication: Communicating with vendors regarding invoice discrepancies or payment issues often involves manual emails or phone calls.

- Reporting: Manually compiling and generating reports related to invoice processing and payments can be time-consuming and error-prone.

Automating these tasks can significantly reduce the time and effort required for invoice processing, improve accuracy, and streamline the overall process.

What are some technological advancements in invoice processing?

- Artificial Intelligence (AI): AI-powered systems can extract data from invoices, classify them, and automate approval workflows based on predefined rules, reducing the need for manual intervention.

- Machine Learning (ML): ML algorithms can improve invoice data extraction accuracy over time by learning from past data and user interactions.

- Robotic Process Automation (RPA): RPA can automate repetitive tasks involved in invoice processing, such as data entry, validation, and approval routing, leading to faster processing times and reduced errors.

- Blockchain: Blockchain technology can enhance invoice security and transparency by creating a tamper-proof record of transactions, reducing the risk of fraud and dispute.

- Cloud Computing: Cloud-based invoice processing solutions offer scalability, accessibility, and collaboration features, allowing users to access and process invoices from anywhere.

- Mobile Apps: Mobile apps enable users to capture and process invoices on the go, improving efficiency and reducing processing times.

- Integration with ERP Systems: Integration with Enterprise Resource Planning (ERP) systems streamlines the invoice processing workflow by automatically updating financial records and eliminating the need for manual data entry.

- Data Analytics: Advanced analytics tools can provide insights into invoice processing trends, helping organizations optimize their processes and reduce costs.

These technological advancements are transforming invoice processing, making it more efficient, accurate, and secure.

Streamline Your Workflow: Reduce Manual Data Entry, Automate Your Invoices!

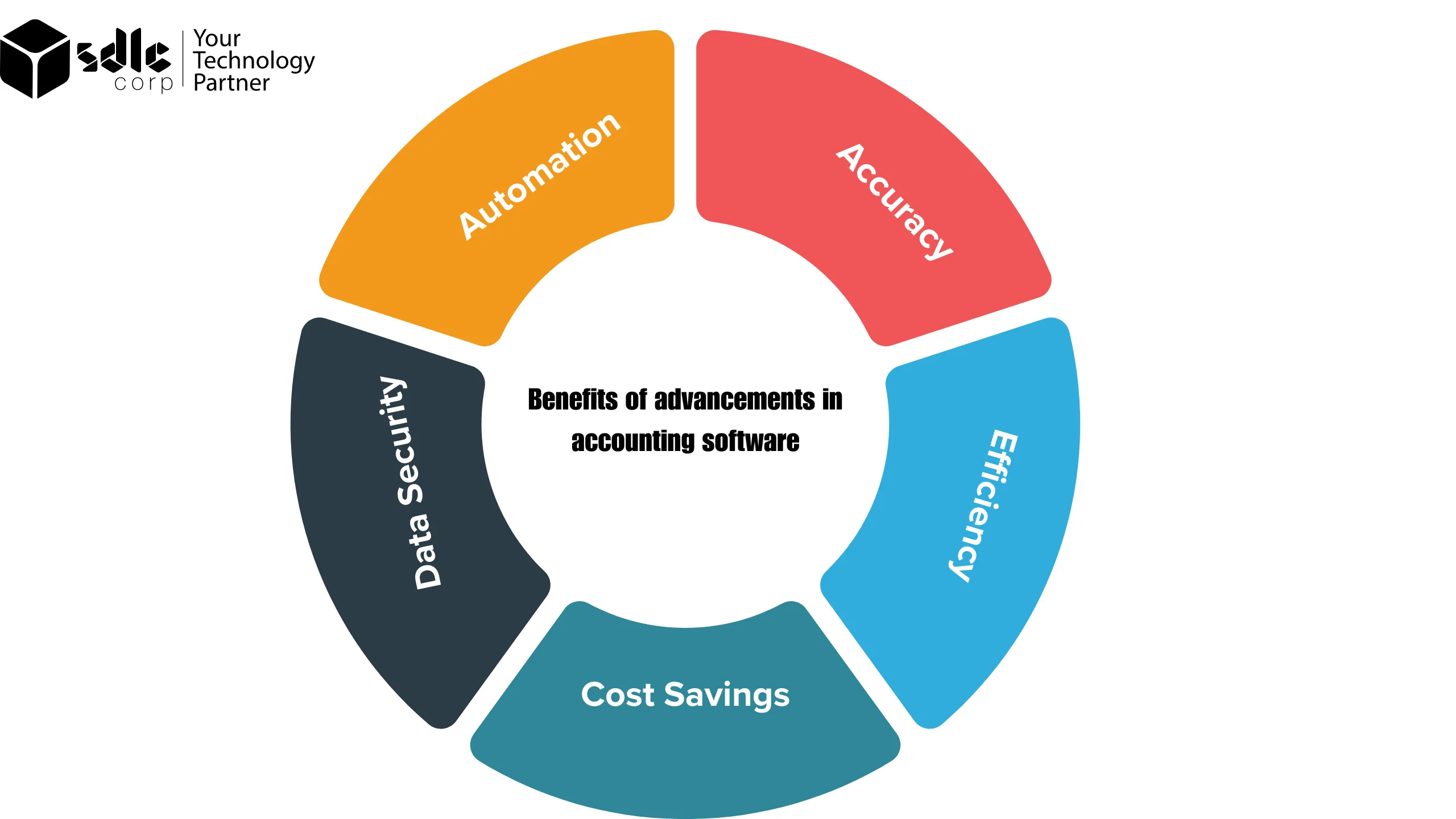

What are the benefits of advancements in accounting software?

Advancements in accounting software offer several benefits, including:

- Automation: Advanced accounting software can automate repetitive tasks such as data entry, invoice processing, and reconciliation, saving time and reducing errors.

- Accuracy: With features like automatic data validation and real-time updates, accounting software helps improve the accuracy of financial records and reports.

- Efficiency: By streamlining workflows and providing real-time insights, accounting software increases efficiency in managing financial processes.

- Cost Savings: Automation and efficiency improvements lead to cost savings by reducing the need for manual labor and minimizing errors that can result in financial losses.

- Data Security: Modern accounting software comes with robust security features to protect sensitive financial data from unauthorized access and cyber threats.

- Accessibility: Cloud-based accounting software allows users to access financial data from anywhere, making collaboration easier and enabling remote work.

- Scalability: Accounting software can scale to accommodate the needs of growing businesses, making it easier to manage finances as the company expands.

- Compliance: Advanced accounting software often includes features to help businesses comply with tax regulations and financial reporting standards.

Overall, advancements in accounting software have made financial management more efficient, accurate, and secure, benefiting businesses of all sizes.

How can a business achieve a smooth transition to reduce manual data entry and automate invoice processing?

Achieving a smooth transition to reduce manual data entry and automate invoice processing requires careful planning and execution. Firstly, assess your current Sales invoice processing workflow to identify areas that can be automated. Next, select an automation solution that best fits your business needs and integrates seamlessly with your existing systems. It’s essential to involve key stakeholders early in the process and provide adequate training to ensure a smooth transition. Additionally, gradually implement automation in phases to minimize disruptions and allow for adjustments based on feedback. Regularly monitor the new system’s performance and make necessary refinements to optimize efficiency. Finally, communicate transparently with your team throughout the transition to manage expectations and address any concerns.

Is a central database effective for creating, sending, and receiving automotive invoices?

Yes, a central database can be highly effective for creating, sending, and receiving automotive invoices. By centralizing invoice-related data, businesses can streamline the entire invoicing process. The central database can store all relevant information, such as customer details, product or service information, pricing, and payment terms.

This centralized approach makes it easier to create accurate invoices quickly. Additionally, the database can be integrated with email or other communication tools to facilitate the sending of invoices directly to customers. When a customer receives an invoice, they can also use the central database to track payment status and manage their accounts. This streamlined approach reduces manual errors, improves efficiency, and provides a more seamless experience for both businesses and customers.

What are six steps to help your practice reduce manual data entry?

- Identify Manual Entry Points: Start by identifying areas in your practice where manual data entry is prevalent. This could include patient information, billing, or inventory management.

- Implement Automation Tools: Invest in automation tools that can help streamline your data entry processes. This could include software for scanning and digitizing paper documents, or electronic forms for capturing data directly into your system.

- Integrate Systems: Ensure that your different systems (such as electronic health records, billing, and inventory management) are integrated to minimize the need for manual data entry between systems.

- Train Staff: Provide training to your staff on how to use the new automation tools and systems effectively. This can help reduce errors and improve efficiency.

- Regularly Review Processes: Regularly review your data entry processes to identify areas for improvement. Look for bottlenecks or inefficiencies that could be addressed with automation or process changes.

- Monitor and Measure: Monitor the impact of your efforts to reduce manual data entry. Measure metrics such as time saved, error rates, and overall efficiency to ensure that your efforts are successful.

Effortless Invoicing Starts Here: Automate and Save Time Now!

Conclusion on automating data entry

Automating data entry can bring significant benefits to a practice, including increased efficiency, reduced errors, and improved overall productivity. By identifying manual entry points, implementing automation tools, integrating systems, training staff, and regularly reviewing processes, practices can streamline their data entry processes and realize these benefits. Monitoring and measuring the impact of automation efforts is essential to ensure ongoing success. Overall, automating data entry can help practices save time and resources, allowing them to focus on providing high-quality care to their patients.

FAQs

1.Is invoice automation suitable for businesses of all sizes?

Yes, invoice automation solutions are scalable and can be tailored to the needs of businesses of all sizes, from small startups to large enterprises. Whether processing a few invoices per month or hundreds per day, automation can help businesses streamline their accounts payable processes.

2. How secure is automated invoice processing?

Automated invoice processing solutions often come with robust security features to protect sensitive financial data. These may include encryption, user authentication, access controls, and compliance with data protection regulations such as GDPR or HIPAA. Additionally, cloud-based solutions offer secure data storage and backups.

3.How does automation improve invoice tracking and reporting?

Automation improves invoice tracking by providing real-time visibility into the status of invoices. Automated systems can generate reports on invoice processing times, payment statuses, and other metrics, providing valuable insights for improving efficiency.

4. Is it difficult to integrate automated invoice processing with existing accounting systems?

Integrating automated invoice processing with existing accounting systems can vary in difficulty depending on the systems involved. However, many automation solutions are designed to integrate seamlessly with popular accounting software, making the process relatively straightforward.

5. Can automation speed up the invoice approval process?

Yes, automation can significantly speed up the invoice approval process. Automated workflows can route invoices to the appropriate approvers automatically, reducing the time it takes to get invoices approved and processed.

Share a few details about your project, and we’ll get back to you soon.

Let's Talk About Your Project

- Free Consultation

- 24/7 Experts Support

- On-Time Delivery

- sales@sdlccorp.com

- +1(510-630-6507)