Introduction

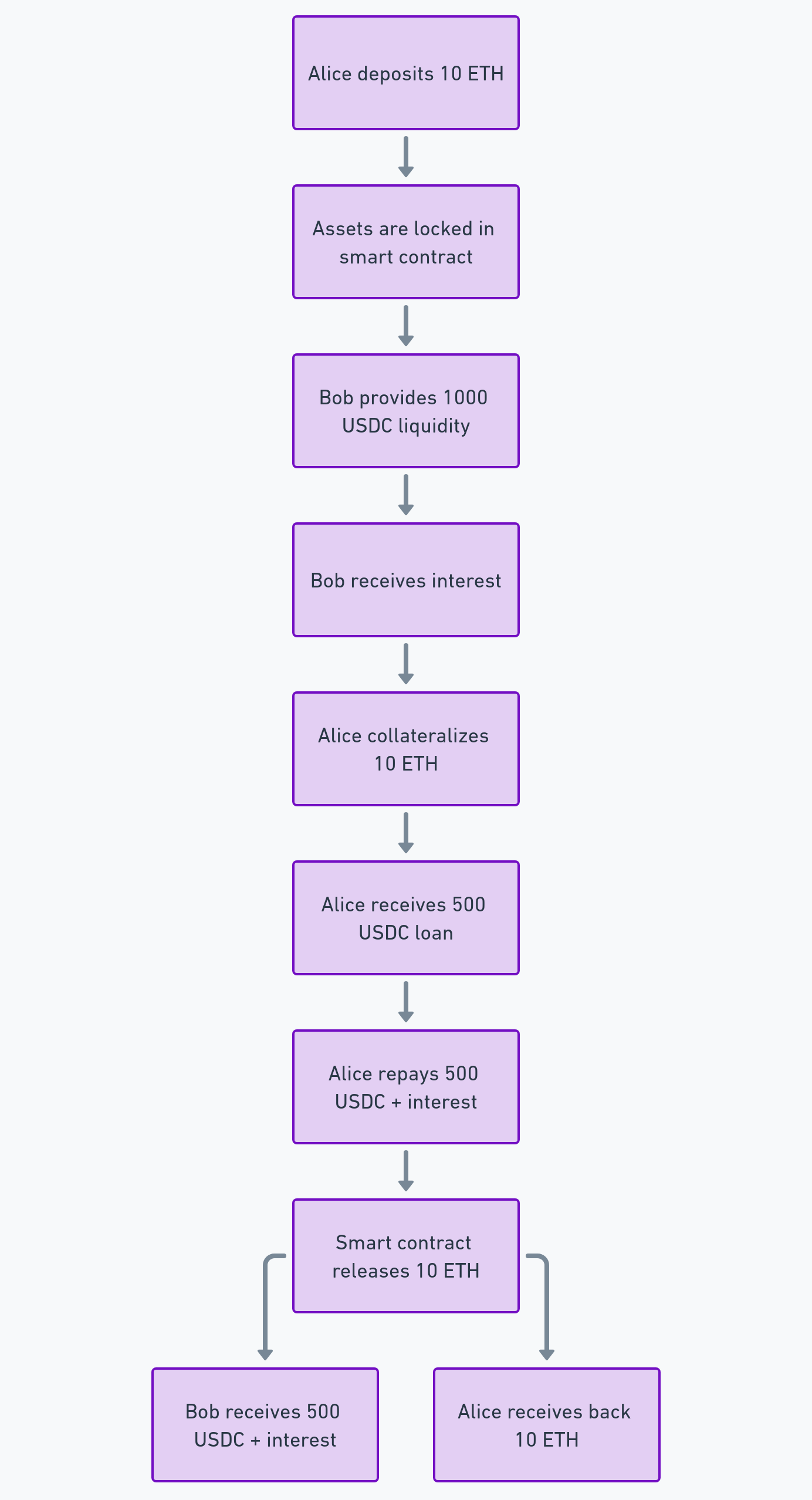

In recent years, the emergence of decentralized finance (DeFi) development has revolutionized traditional financial systems by providing open, permissionless, and transparent alternatives to conventional banking services. One of the most significant innovations within the DeFi space is decentralized lending platforms, which enable users to borrow and lend digital assets without the need for intermediaries. As depicted in the accompanying image, featuring Alice and Bob, this blog will delve into the intricacies of how DeFi lending operates, using real-world examples to illustrate each step of the lending process and its implications for both borrowers and lenders. For those interested in exploring DeFi lending platform development, our team at SDLCCorp offers comprehensive services tailored to the unique needs of this rapidly evolving industry. By following Alice and Bob’s journey through the DeFi lending landscape, readers will gain a deeper understanding of the mechanisms driving this transformative financial ecosystem.

A. User deposits crypto assets:

- In this step, a user (the borrower) initiates the lending process by depositing crypto assets into a smart contract on a decentralized finance (DeFi) lending platform. These assets serve as collateral for the loan.

Example: Alice deposits 10 Ethereum (ETH) tokens into a DeFi lending smart contract to secure a loan.

B. Assets are locked in smart contract:

- Once the user deposits the crypto assets, the smart contract locks them, ensuring that they are held securely as collateral for the loan. The smart contract verifies the deposited assets and records them on the blockchain.

Example: The smart contract locks Alice’s 10 ETH tokens, which are now held as collateral for her loan.

C. Lender provides liquidity:

- In this step, a lender (or multiple lenders) provides liquidity to the DeFi lending platform by supplying funds that can be lent out to borrowers. These funds are used to finance loans issued on the platform.

Example: Bob provides 1000 USDC (a stablecoin) to the DeFi lending platform, which is then available to be lent out to borrowers like Alice.

D. Lender receives interest:

- As borrowers like Alice request loans, lenders earn interest on the funds they have supplied to the platform. The interest rates may vary depending on the demand for loans and the terms set by the platform.

Example: Bob earns 5% annual interest on the 1000 USDC he provided to the DeFi lending platform, resulting in a return of 50 USDC per year.

E. Borrower collateralizes assets:

- With the collateral assets locked in the smart contract, the borrower, such as Alice, collateralizes them to request a loan. The borrower specifies the desired loan amount and terms, which are then evaluated by the smart contract.

Example: Alice collateralizes her 10 locked ETH tokens to request a loan of 500 USDC from the DeFi lending platform.

F. Borrower receives loan:

- Upon approval by the smart contract, the borrower receives the requested loan amount in the form of a cryptocurrency or stablecoin directly to their wallet. The loan amount is deducted from the total collateral locked in the smart contract.

Example: After approval, Alice receives 500 USDC in her wallet from the DeFi lending platform, which she can use for various purposes.

G. Borrower repays loan with interest:

- Over the loan term, the borrower repays the loan amount along with accrued interest according to the terms agreed upon. The interest rate may be fixed or variable, depending on the platform’s policies.

Example: Alice repays the 500 USDC loan amount plus 5% interest over six months, resulting in a total repayment of 525 USDC.

H. Smart contract releases collateral:

- Once the borrower fully repays the loan amount along with interest, the smart contract releases the collateral assets back to the borrower. This step ensures that the borrower regains control of their locked assets.

Example: After Alice repays the 500 USDC loan amount plus interest, the smart contract releases her 10 locked ETH tokens back to her wallet.

I. Assets and interest are returned to lender:

- With the loan fully repaid, the lender receives back the initial loan amount along with the accrued interest. This return on investment represents the profit earned by the lender for providing liquidity to the DeFi lending platform.

Example: Bob receives back the 500 USDC he initially provided to the DeFi lending platform, along with the 25 USDC interest earned over the loan term.

J. Collateral is returned to borrower:

- Finally, the borrower receives back their collateral assets, which were locked in the smart contract as security for the loan. This step completes the lending process, allowing the borrower to freely use or manage their assets as desired.

Example: Alice receives back her 10 ETH tokens, which were initially locked as collateral, now that she has fully repaid the loan.

In conclusion, decentralized lending platforms have democratized access to financial services, offering greater inclusivity and efficiency in the management of digital assets. By eliminating intermediaries and leveraging blockchain technology, DeFi lending empowers users to unlock the value of their crypto holdings while providing lucrative opportunities for investors seeking attractive returns. As the DeFi ecosystem continues to evolve, it is crucial for participants to understand the mechanics and benefits of decentralized lending, paving the way for a more accessible and decentralized financial landscape. For those interested in exploring DeFi lending platform development, our team at SDLCCorp offers comprehensive services tailored to the unique needs of this rapidly evolving industry. By embracing the principles of decentralization and transparency, we can collectively shape a future where financial services are accessible to all, regardless of geographical location or socioeconomic status.

Share a few details about your project, and we’ll get back to you soon.

Let's Talk About Your Project

- Free Consultation

- 24/7 Experts Support

- On-Time Delivery

- sales@sdlccorp.com

- +1(510-630-6507)