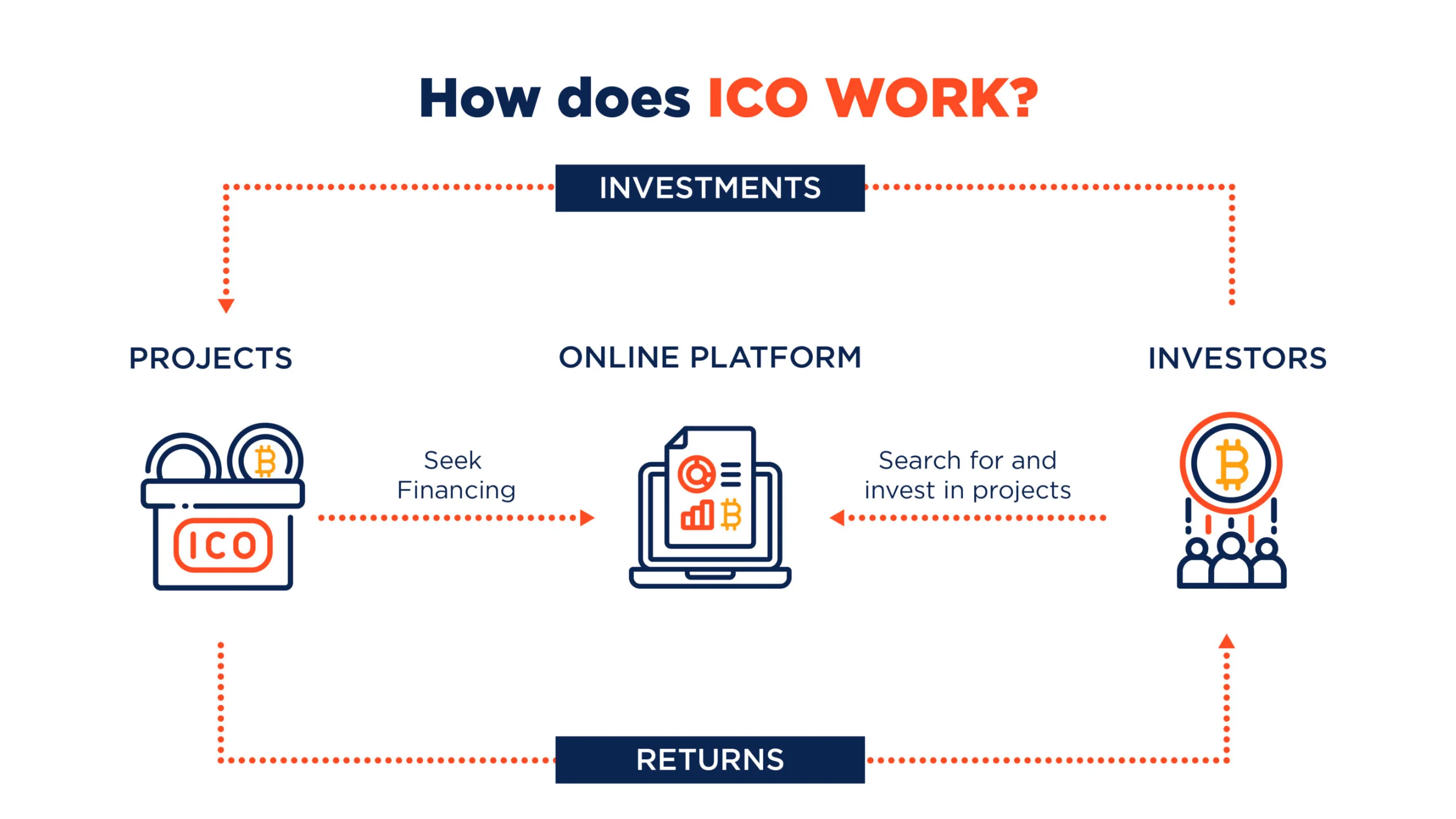

How does an ICO work?

Introduction :

(ICO) is a fundraising method used by blockchain projects and startups to raise capital for their ventures. It’s similar to an Initial Public Offering (IPO) in the traditional stock market, but instead of selling shares to investors, ICOs sell digital tokens or coins. A team or individual conceptualizes an idea for a blockchain project, which could be a new cryptocurrency, a decentralized application (dApp), or a blockchain-based platform solving a particular problem. The project team creates a whitepaper outlining the details of the project, including its goals, objectives, technical specifications, use cases, tokenomics (how the tokens will be used within the ecosystem), and the roadmap for development. With the funds raised from the ICO, the project team can focus on developing and implementing the project according to the roadmap outlined in the whitepaper. This involves coding, testing, and launching the product or platform. Beyond the ICO, the project team continues to engage with the community, provide updates on development progress, and work towards achieving the goals outlined in the whitepaper. Building a strong community is vital for long-term project success and adoption.how to invest in ico? : Investing in Initial Coin Offerings (ICOs) involves purchasing newly issued digital tokens or coins from blockchain projects. To participate, individuals typically need to register with the ICO platform, verify their identity, and then purchase tokens using accepted cryptocurrencies like Bitcoin or Ethereum. Investors should conduct thorough research on the project, its team, whitepaper, and roadmap before investing to mitigate risks associated with ICOs, such as regulatory uncertainties and project viability. Additionally, it’s essential to consider factors like the project’s technology, market potential, and tokenomics before making investment decisions.

What are the key features of ICO?

Token Creation:

- ICOs involve the creation and issuance of digital tokens or coins by the project team. These tokens serve various purposes within the project’s ecosystem, such as providing access to services, representing ownership or voting rights, or facilitating transactions.

Whitepaper:

- Projects typically publish a whitepaper outlining their objectives, technical details, use cases, tokenomics, and roadmap. This document serves as a comprehensive guide for potential investors to understand the project’s vision and implementation plan.

Crowdfunding:

- ICOs serve as a crowdfunding mechanism, allowing projects to raise funds directly from a global pool of investors. Investors can participate in the ICO by purchasing the project’s tokens using cryptocurrencies like Bitcoin (BTC) or Ethereum (ETH) during the token sale period.

Decentralization:

- ICOs leverage blockchain technology, which enables decentralized fundraising without the need for intermediaries like banks or venture capitalists. This decentralization promotes accessibility, transparency, and inclusivity in fundraising.

Global Access:

- ICOs offer global access to investment opportunities, allowing investors from around the world to participate in funding projects they believe in. This global reach expands the potential investor base and democratizes access to investment opportunities.

Transparency:

- Blockchain technology provides transparency to ICOs by recording all transactions on a public ledger, commonly known as the blockchain. Investors can verify transaction details and token ownership, enhancing trust and accountability in the fundraising process.

What is token creation?

Token creation is a fundamental step in launching an ICO. It involves several key components: how ico ethereum works? : ICO (Initial Coin Offering) on the Ethereum platform works by allowing startups to raise funds by issuing tokens on the Ethereum blockchain. These tokens represent ownership or utility within the project or platform. Investors can purchase these tokens using Ether (ETH) during the ICO period. The Ethereum blockchain provides transparency and security for these transactions, enabling decentralized crowdfunding for new projects and initiatives.

Choosing a Blockchain Platform

- Ethereum: Ethereum is the most popular blockchain platform for launching ICOs due to its robustness, widespread adoption, and support for smart contracts.

- Other Platforms: Alternative blockchain platforms like Binance Smart Chain, Tron, or EOS may also be chosen based on specific project requirements such as scalability, transaction fees, or ecosystem compatibility.

Smart Contract Development

- Smart Contract Definition: Smart contracts are self-executing contracts with the terms of the agreement between buyer and seller being directly written into code. For ICOs, a smart contract is created to manage the token sale process.

- Token Standard: Ethereum-based ICOs typically use ERC-20 or ERC-721 token standards for fungible and non-fungible tokens, respectively.

- Functionality: Smart contracts define parameters such as token supply, token distribution mechanism, token sale timeline, and handling of funds.

- Auditing: Smart contracts should undergo thorough auditing by security experts to ensure they are free from vulnerabilities and operate as intended.

How is community building achieved?

Building a strong community around the ICO project is essential for generating interest, establishing credibility, and fostering long-term support. This involves:

- Community Management: Assign dedicated team members or hire professionals to manage community interactions across various platforms.

- Communication Channels: Create official communication channels such as Telegram groups, Discord servers, or dedicated forums where community members can engage with the project team and each other.

- Engagement Initiatives: Organize AMAs (Ask Me Anything) sessions, live Q&A sessions, and regular updates to keep the community informed about project developments and address any concerns.

How are social media campaigns conducted?

Social media platforms are powerful tools for reaching a broader audience and generating hype around the ICO. Key strategies include:

- Platform Selection: Identify the most suitable social media platforms based on the target audience and industry trends. Common platforms for ICO promotion include Twitter, Facebook, LinkedIn, Reddit, and specialized cryptocurrency forums.

- Content Creation: Develop engaging and informative content such as articles, blog posts, infographics, videos, and memes to communicate the project’s value proposition and attract attention.

- Influencer Partnerships: Collaborate with influencers, thought leaders, and industry experts in the cryptocurrency space to amplify the reach of marketing efforts and gain credibility.

- Paid Advertising: Allocate a portion of the marketing budget for paid advertising campaigns on social media platforms to target specific demographics and increase visibility.

What does the contribution process entail?

The contribution process outlines how investors can participate in the ICO and contribute funds to receive tokens in return. Key aspects include:

- Registration: Investors may need to register on the ICO platform or whitelist their wallets to participate in the token sale.

- Wallet Setup: Investors must have compatible cryptocurrency wallets to send their contributions. Wallet compatibility and setup instructions should be clearly communicated.

- Contribution Limits: Define minimum and maximum contribution limits to ensure fair participation and prevent whales from dominating the token sale.

- Token Purchase Procedure: Provide step-by-step instructions on how investors can send their contributions, including the wallet address

How to Choose the right Team for Zerodha like Trading app?

What are the benefits associated with ICOs?

1. Access to Capital

- Fundraising: ICOs provide a mechanism for project teams to raise capital directly from a global pool of investors without the need for traditional intermediaries like venture capitalists or banks.

- Diverse Investor Base: ICOs allow project teams to attract funding from a diverse range of investors, including retail investors, accredited investors, and cryptocurrency enthusiasts from around the world.

2. Democratization of Investment

- Accessibility: ICOs democratize investment opportunities by allowing anyone with an internet connection and cryptocurrency to participate in early-stage funding rounds, breaking down barriers to entry for retail investors.

- Global Reach: ICOs enable projects to reach a global audience of potential investors, increasing access to investment opportunities for individuals in regions with limited access to traditional financial services.

3. Tokenization of Assets and Services

- Token Utility: ICOs tokenize assets, products, or services, representing ownership, access rights, or utility within the project ecosystem. Tokens can be used for various purposes, such as accessing platform features, participating in governance, or redeeming rewards.

- Liquidity: Tokens issued through ICOs can be traded on cryptocurrency exchanges, providing liquidity and enabling investors to buy, sell, or trade their tokens freely.

4. Community Engagement and Support

- Community Building: ICOs facilitate community engagement by allowing project teams to interact directly with supporters, contributors, and early adopters. Building a strong community around the project can foster loyalty, advocacy, and long-term support.

- Feedback and Collaboration: ICOs provide an opportunity for project teams to gather feedback, ideas, and contributions from the community, fostering collaboration and co-creation of value.

5. Innovation and Disruption

- Funding Innovation: ICOs enable innovative projects and startups, particularly those leveraging blockchain technology, to secure funding and bring groundbreaking ideas to life.

- Disruptive Potential: ICOs have the potential to disrupt traditional fundraising models, financial services, and industries by offering new ways to access capital, tokenize assets, and engage with decentralized ecosystems.

6. Potential for High Returns

- Early Investment Opportunity: Participating in ICOs allows investors to gain exposure to potentially high-growth projects in their early stages, offering the opportunity for significant returns on investment if the project succeeds.

- Token Appreciation: Successful ICOs can lead to the appreciation of token value over time as demand for tokens increases due to growing adoption, utility, and ecosystem development.

What is the future outlook for ICOs?

The future outlook for Initial Coin Offerings (ICOs) is influenced by emerging trends, evolving regulatory landscapes, and the rise of alternative fundraising methods. Here’s a look at what the future might hold for ICOs and the broader cryptocurrency fundraising ecosystem:

1. Trends in ICOs

a. Increased Regulatory Compliance

- Regulatory Scrutiny: ICOs are likely to face increased regulatory scrutiny worldwide, leading to greater compliance requirements such as Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures.

- Security Token Offerings (STOs): There could be a shift towards STOs, which offer tokens backed by real-world assets and comply with securities regulations, providing investors with greater legal protection and transparency.

b. Maturation of Projects

- Focus on Utility: ICO projects may prioritize building functional products and delivering tangible utility to users, shifting away from speculative investments and hype-driven token sales.

- Proof of Concept: Investors may increasingly demand proof of concept and evidence of market demand before committing funds to ICO projects, leading to more rigorous due diligence processes.

c. Emphasis on Governance and Sustainability

- Governance Models: ICO projects may explore innovative governance models, such as decentralized autonomous organizations (DAOs), to empower token holders and promote community-driven decision-making.

- Sustainability: There could be a greater emphasis on environmental sustainability, with projects exploring eco-friendly blockchain solutions and energy-efficient consensus mechanisms.

2. Alternatives to ICOs

a. Security Token Offerings (STOs)

- Regulatory Compliance: STOs offer tokens that represent ownership or rights to real-world assets, such as equity, debt, or real estate, complying with securities regulations to provide investors with legal protections.

- Enhanced Investor Protection: STOs typically involve stringent regulatory compliance measures, including KYC/AML procedures, investor accreditation, and securities registration, enhancing investor protection and reducing regulatory risks.

b. Initial Exchange Offerings (IEOs)

- Exchange Endorsement: IEOs are token sales conducted on cryptocurrency exchanges, leveraging the exchange’s reputation, user base, and compliance infrastructure to facilitate fundraising and token distribution.

- Streamlined Process: IEOs offer a streamlined token sale process, with exchanges handling due diligence, token listing, and investor verification, providing investors with a level of trust and security.

Ready to understand ICO mechanics? Let's unravel it!

3. Regulatory Developments

a. Regulatory Clarity

- Jurisdictional Differences: Regulatory frameworks for ICOs and cryptocurrencies vary significantly across jurisdictions, with some countries embracing innovation while others impose strict regulations or outright bans.

- Global Coordination: There may be efforts to establish global standards and regulatory coordination to address cross-border challenges and promote regulatory clarity and consistency.

b. Investor Protection

- KYC/AML Requirements: Regulators are likely to impose stricter KYC/AML requirements on ICOs and cryptocurrency exchanges to prevent money laundering, terrorist financing, and other illicit activities.

- Investor Education: Regulators may prioritize investor education initiatives to raise awareness of the risks associated with ICOs and cryptocurrencies and empower investors to make informed decisions.

Conclusion

An initial Coin Offering (ICO) serves as a means for blockchain projects to raise capital by issuing digital tokens to investors. Throughout the ICO process, project teams conceptualize their idea, develop a whitepaper outlining the project details, create tokens on a blockchain platform, and establish a token distribution plan. Marketing and promotion efforts are crucial for attracting investors, building community support, and generating interest in the ICO. While ICOs offer numerous benefits, including access to capital, democratization of investment opportunities, and tokenization of assets, they also come with risks such as market volatility, security vulnerabilities, and regulatory uncertainty. To mitigate these risks, project teams must prioritize transparency, compliance, and investor protection throughout the ICO process. While ICOs remain a valuable mechanism for fundraising and innovation in the cryptocurrency space, project teams must adapt to evolving market dynamics and regulatory landscapes to ensure the success and sustainability of their projects. By prioritizing transparency, compliance, and community engagement, ICOs can continue to play a significant role in driving blockchain adoption and fostering innovation in the years to come.

FAQs

1: How does an ICO differ from an IPO?

A: An IPO (Initial Public Offering) is a traditional method of raising capital through the sale of shares to the public on a regulated stock exchange, whereas an ICO involves issuing digital tokens to investors on a blockchain platform.

2: How do I participate in an ICO?

A: To participate in an ICO, you typically need to visit the project’s website, register or whitelist your wallet address, send your contribution in a specified cryptocurrency (such as Bitcoin or Ethereum) to the provided wallet address, and receive tokens in return.

3: What are the risks associated with investing in ICOs?

A: Investing in ICOs carries various risks, including market volatility, regulatory uncertainty, security vulnerabilities, and the potential for project failure or fraud. It’s essential to conduct thorough due diligence and assess the project’s credibility, team experience, and roadmap before investing.

4: What are the benefits of investing in ICOs?

A:

Investing in ICOs provides the opportunity to support innovative blockchain projects, gain early access to tokens with potential value appreciation, and participate in the growth of decentralized ecosystems.

5: How can I identify legitimate ICO projects?

A: To identify legitimate ICO projects, look for clear project documentation (such as a whitepaper), transparent team information, a well-defined roadmap, active community engagement, and reputable endorsements from industry experts or advisors. Be cautious of projects with unrealistic promises, lack of transparency, or questionable team credentials.

Contact Us

Let's Talk About Your Project

- Free Consultation

- 24/7 Experts Support

- On-Time Delivery

- sales@sdlccorp.com

- +1(510-630-6507)