Introduction

In the ever-evolving world of blockchain and cryptocurrencies, Initial Coin Offerings (ICOs) have emerged as a popular method for raising funds for new projects. However, launching a successful ICO requires meticulous planning, strategic decision-making, and a solid team of advisors to navigate the complexities of the industry. In this blog, we will delve into the importance of advisors for ICOs and provide insights on how to secure the right advisors for your project.

What is the significance of advisors in ICOs?

How to write an ico whitepaper ? :An ICO whitepaper serves as the blueprint for a cryptocurrency project, providing essential details about its purpose, technology, and fundraising goals. It acts as a persuasive tool to attract investors by showcasing the project’s potential and viability in the ever-evolving digital landscape.

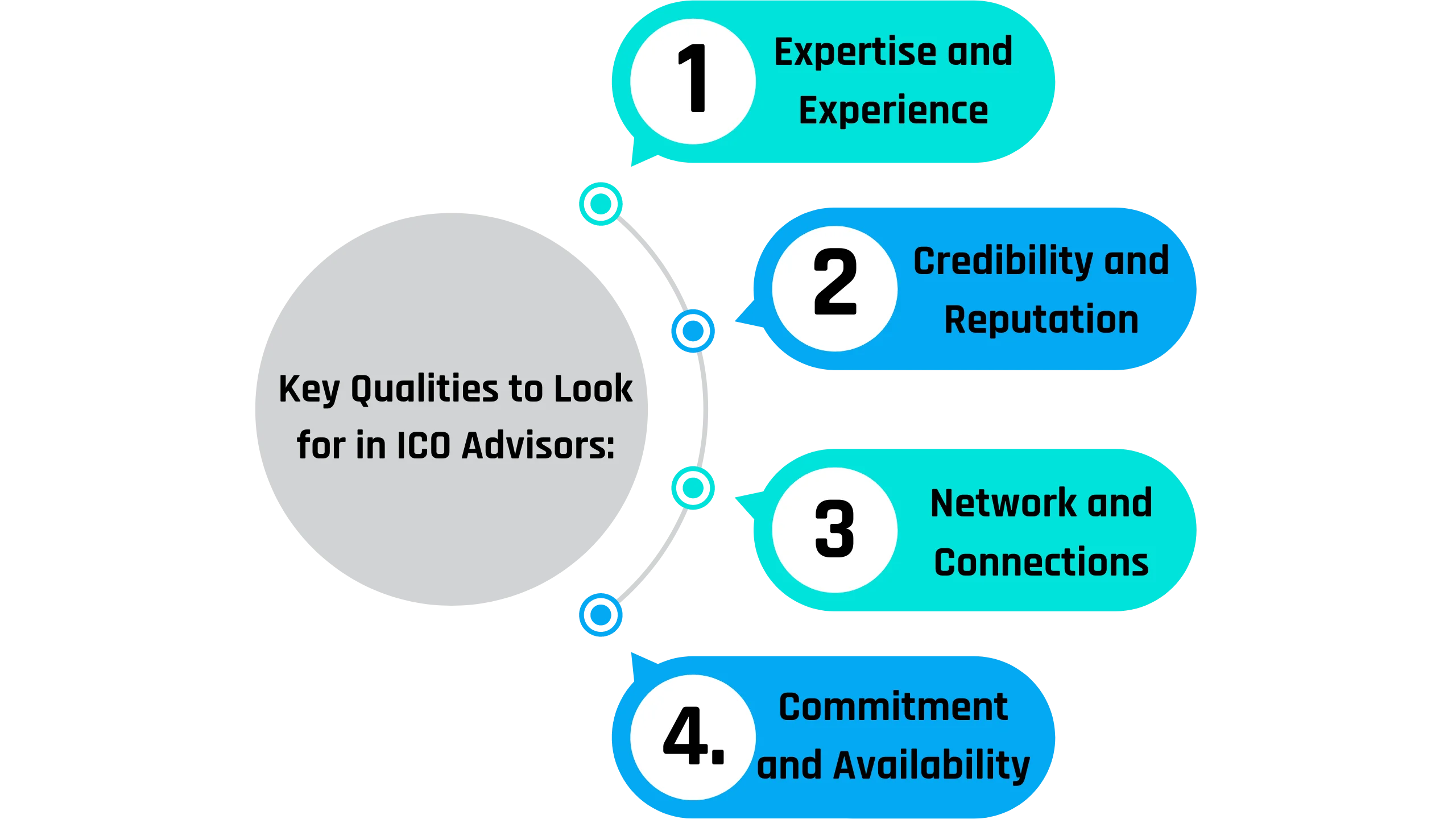

Key Qualities to Look for in ICO Advisors:

1. Expertise and Experience

- Look for advisors with a deep understanding of blockchain technology, cryptocurrencies, and the ICO landscape.

- Experience in successfully launching or advising on previous ICO projects is invaluable.

- Expertise in relevant fields such as finance, legal, marketing, and technology can provide comprehensive support for your project.

2. Credibility and Reputation

- Advisors with a strong reputation in the industry add credibility to your project.

- Check their backgrounds, affiliations, and past contributions to ensure they have a clean reputation.

- Seek advisors who are well-respected by their peers and have a track record of integrity and professionalism.

3. Network and Connections

- The ability to leverage a vast network of contacts can open doors to potential investors, partners, and collaborators.

- Look for advisors with extensive connections in the blockchain and cryptocurrency community, as well as in related industries.

- A well-connected advisor can help your project gain exposure and access valuable resources.

4. Commitment and Availability

- Ensure that advisors are genuinely interested in and committed to your project’s success.

- Clarify expectations regarding their level of involvement, time commitment, and availability for meetings and consultations.

- Avoid advisors who are too busy or spread too thin to dedicate sufficient time and attention to your project.

What are some strategies for securing advisors for your ICO?

1. Define Your Project Vision and Needs:

Clearly articulate your project’s vision, goals, and objectives.

Identify the specific areas where you need expertise and support, such as technology development, legal compliance, marketing strategy, or community engagement

2. Conduct thorough research:

- Research potential advisors thoroughly, considering their expertise, track record, and reputation.

- Look beyond superficial credentials and delve into their past experiences, contributions, and industry connections.

- Seek recommendations from trusted sources within the blockchain community or through professional networks.

3. Craft a compelling value proposition:

- Develop a compelling value proposition that highlights the benefits of advising your project.

- Communicate how advisors can contribute to the success of your ICO and what sets your project apart from others in the market.

- Emphasize the potential for advisors to earn rewards, such as tokens or equity, based on their contributions.

4. Reach Out and Build Relationships:

- Approach potential advisors with personalized and well-researched proposals.

- Highlight how their expertise aligns with your project’s needs and objectives.

- Nurture relationships with prospective advisors through ongoing communication, mutual respect, and transparency.

5. Offer incentives and rewards:

- Consider offering incentives or rewards to attract high-quality advisors to your project.

- This could include tokens, equity stakes, advisory fees, or other forms of compensation.

- Ensure that the incentives are aligned with the advisor’s interests and provide a fair value for their contributions.

6. Establish clear terms and expectations:

- Define clear terms of engagement, including roles, responsibilities, expectations, and compensation.

- Draft formal agreements or contracts outlining the terms of the advisory relationship, confidentiality clauses, and dispute resolution mechanisms.

- Maintain open lines of communication and regularly update advisors on the project’s progress, challenges, and milestones.

7. Foster a Collaborative Environment:

- Create a collaborative and inclusive environment where advisors feel valued and respected.

- Encourage active participation, feedback, and constructive criticism from advisors to improve the project’s strategy and execution.

- Leverage the diverse perspectives and expertise of your advisory team to overcome obstacles and seize opportunities.

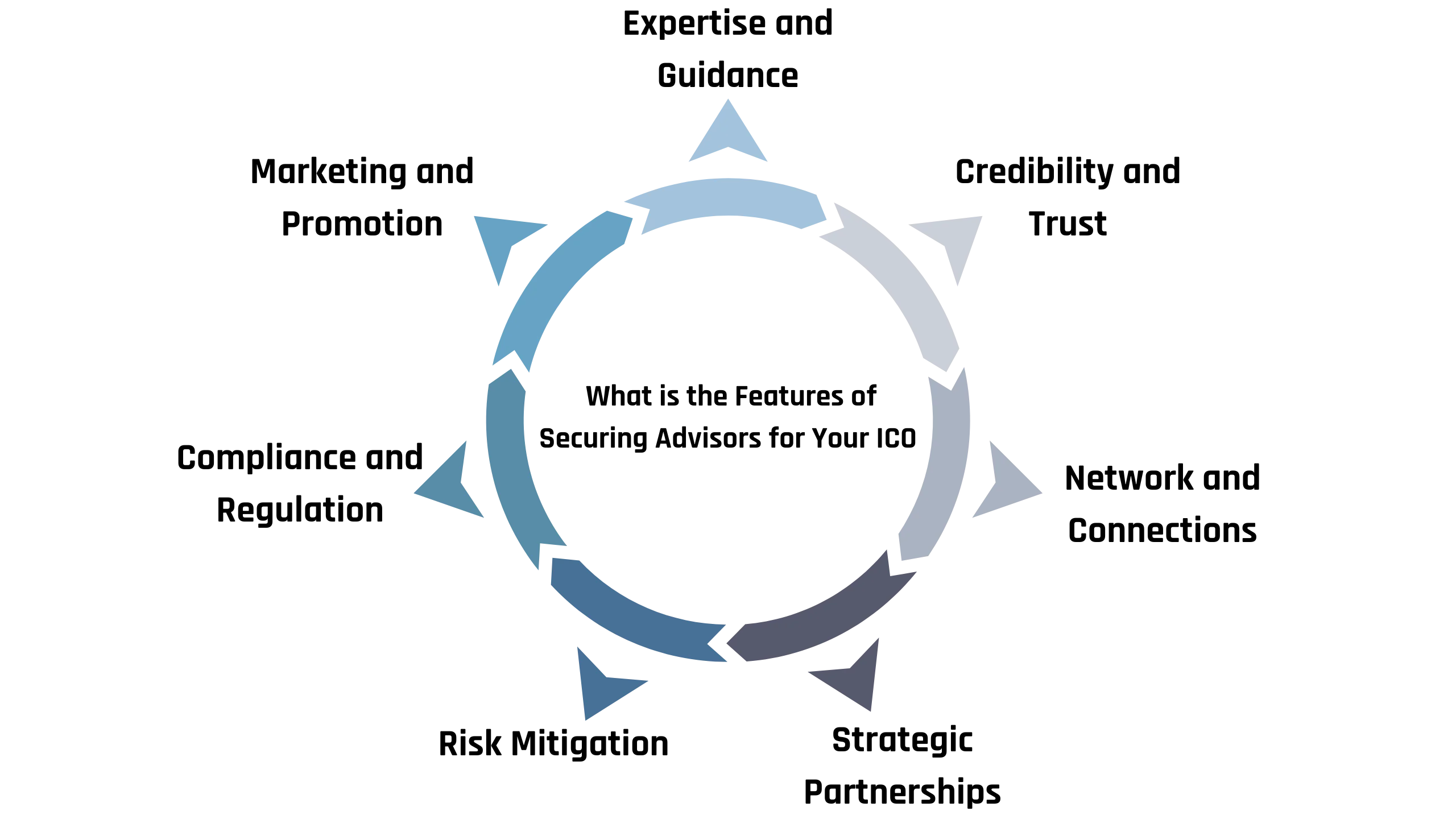

What is the Features of Securing Advisors for Your ICO

1. Expertise and Guidance

2. Credibility and Trust

3. Network and Relationships

4. Strategic Partnerships

5. Risk Mitigation

Experienced advisors can identify potential risks and challenges early on, helping you mitigate them effectively and safeguard your project’s success.

6. Compliance and Regulation

7. Marketing and Promotion

how ico ethereum works?: ICO (Initial Coin Offering) on the Ethereum platform works by allowing startups to raise funds by issuing tokens on the Ethereum blockchain. These tokens represent ownership or utility within the project or platform. Investors can purchase these tokens using Ether (ETH) during the ICO period. The Ethereum blockchain provides transparency and security for these transactions, enabling decentralized crowdfunding for new projects and initiatives.

What are the Benefits of Securing Advisors for Your ICO

1. Enhanced Credibility

By associating your project with reputable advisors, you enhance its credibility and trustworthiness in the eyes of investors, stakeholders, and the broader community.

2. Access to Capital

3. Guidance and Mentorship

4. Risk Management

Experienced advisors can identify and mitigate potential risks and pitfalls, minimizing the likelihood of setbacks and failures during the ICO launch and beyond.

5. Expanded Network

6. Market Insights

Advisors bring valuable market insights and intelligence to the table, helping you stay informed about industry trends, competitor activities, and investor preferences.

7. Long-Term Success

By building a strong advisory team, you set your ICO project up for long-term success, with access to ongoing support, guidance, and expertise as you navigate the evolving landscape of blockchain and cryptocurrencies.

Conclusion

"Maximize fundraising opportunities for your project with SDLC Corp’s ICO development company"

FAQs

1. What role do advisors play in an ICO?

Advisors play a crucial role in providing expertise, guidance, and credibility to ICO projects. They offer strategic insights, industry connections, and mentorship to navigate the complexities of the ICO landscape and enhance the project’s chances of success.

2. How do I find the right advisors for my ICO?

Finding the right advisors involves thorough research, networking, and due diligence. Look for individuals with relevant expertise, experience, credibility, and industry connections. Seek recommendations from trusted sources within the blockchain community and consider reaching out to potential advisors directly.

3. What criteria should I consider when selecting advisors?

Advisors can benefit from participating in an ICO in various ways, including receiving tokens or equity stakes in the project, gaining exposure and visibility in the industry, accessing potential investment opportunities, building strategic partnerships, and contributing to innovative projects with long-term potential.

4. How do advisors benefit from participating in an ICO?

Advisors can benefit from participating in an ICO in various ways, including receiving tokens or equity stakes in the project, gaining exposure and visibility in the industry, accessing potential investment opportunities, building strategic partnerships, and contributing to innovative projects with long-term potential.

5. What are the typical responsibilities of ICO advisors?

6. How do I approach potential advisors for my ICO?

When approaching potential advisors, be professional, respectful, and transparent. Clearly communicate your project’s vision, goals, and objectives, and explain why you believe their expertise and experience would be valuable to the project. Be prepared to provide detailed information about the project and be open to answering any questions they may have.

7. What incentives can I offer to attract advisors to my ICO?

Incentives for advisors may include tokens, equity stakes, advisory fees, bonuses based on project milestones or performance, and other forms of compensation. Ensure that the incentives offered are fair, transparent, and aligned with the advisor’s interests and contributions to the project.

8. How can I ensure a successful advisory relationship throughout the ICO process?

To ensure a successful advisory relationship, establish clear expectations, roles, and responsibilities upfront. Maintain open lines of communication, provide regular updates on the project’s progress, listen to feedback from advisors, and address any concerns or issues promptly. Foster a collaborative and inclusive environment where advisors feel valued and respected for their contributions.

Share a few details about your project, and we’ll get back to you soon.

Let's Talk About Your Project

- Free Consultation

- 24/7 Experts Support

- On-Time Delivery

- sales@sdlccorp.com

- +1(510-630-6507)