Introduction

Initial Coin Offerings (ICOs) have emerged as a revolutionary fundraising method within the realm of cryptocurrency and blockchain technology. In essence, an ICO is a means by which a company or project can raise capital by issuing digital tokens to investors in exchange for cryptocurrency, typically Bitcoin or Ethereum. These tokens often represent a stake or utility within the project’s ecosystem. ICOs gained prominence as an alternative to traditional fundraising methods like venture capital or initial public offerings (IPOs), offering greater accessibility to both investors and project founders. They democratize investment opportunities, allowing anyone with internet access and cryptocurrency to participate in early-stage funding rounds. Leveraging ICO development services ensures the seamless creation and deployment of tokens, providing a solid foundation for a successful fundraising campaign.

What are the legal considerations for an ICO business?

Regulatory Compliance

Securities Laws

Know Your Customer (KYC) and Anti-Money Laundering (AML)

Whitepaper and Legal Documentation

Legal Counsel

Engage experienced ICO consultants specializing in blockchain and cryptocurrency law to provide guidance throughout the ICO process. These consultants offer invaluable insights into regulatory requirements, draft legal documents, and provide strategies for compliance and risk management tailored specifically to ICOs. Partnering with ICO consulting services ensures thorough legal support, mitigating risks and maximizing the success of your token offering.

What are the step-by-step processes involved in Planning and Preparation?

1. Define Project Goals and Objectives

2. Develop a Detailed Project Roadmap

3. Budgeting and Resource Allocation

4. Establish a Project Team

Assemble a skilled and dedicated team with expertise in areas such as blockchain development, marketing, legal compliance, finance, and project management. Partnering with an ICO development company and an ICO consulting company will ensure a comprehensive approach to token creation and strategic planning. Additionally, collaborating with an ICO marketing & promotion company will maximize visibility and engagement during the token sale. Utilize pre ICO services to fine-tune the project’s concept and strategy, and leverage post ICO services for ongoing support and community management. Define roles and responsibilities clearly to facilitate collaboration and ensure accountability within the full ICO team

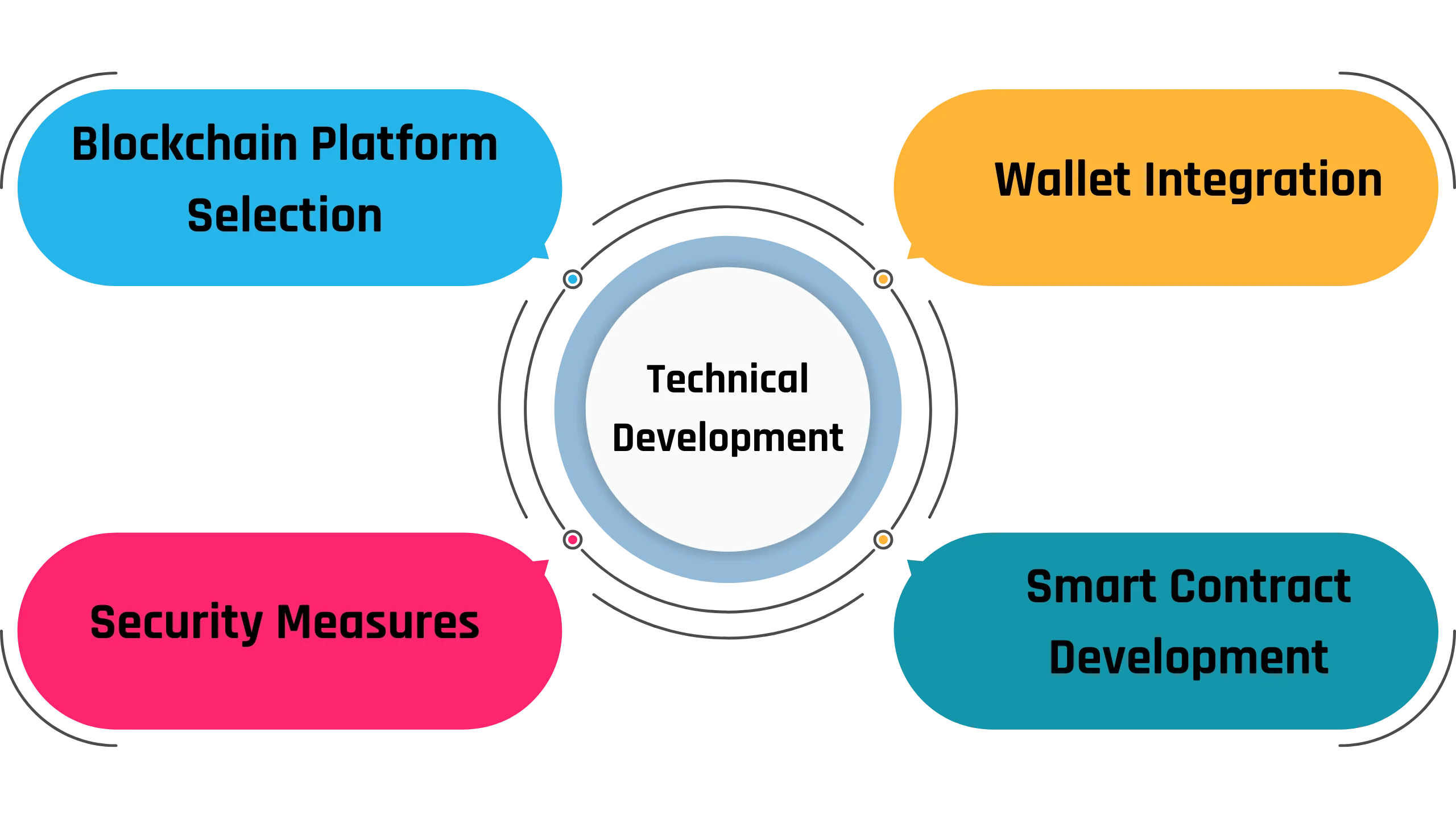

5. Technical Development

What does Technical Development entail?

Blockchain Platform Selection

Smart Contract Development

Wallet Integration

Security Measures

What is the Benefits of ICO Business

Access to Capital

Global Reach

Decentralization

Token Liquidity

Tokens issued through ICOs often become liquid assets that can be traded on cryptocurrency exchanges. This liquidity provides investors with the flexibility to buy, sell, or trade tokens freely on the secondary market, potentially realizing profits or diversifying their investment portfolios.

how to launch a legal compliant ico in singapore? :To launch a legal compliant Initial Coin Offering (ICO) in Singapore, you must adhere to the guidelines set forth by the Monetary Authority of Singapore (MAS). This involves obtaining regulatory approval, ensuring compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, and providing transparent disclosure of project details and token issuance. Engaging legal counsel familiar with Singapore’s cryptocurrency regulations is essential for navigating the complex regulatory landscape and ensuring compliance throughout the ICO process.

Early Access and Incentives

Compliance and Regulation

1. Compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC) Regulations:

- Implement robust AML and KYC procedures to verify the identities of investors and ensure compliance with regulations aimed at preventing money laundering and terrorist financing.

- Collect and verify personal information from investors, including identification documents and proof of address.

- Conduct due diligence checks to assess the risk profile of investors and identify suspicious activities.

- Keep records of KYC documentation and transaction history for regulatory reporting and audit purposes.

2. Tax Considerations for ICOs

- Understand the tax implications of conducting an ICO, including income tax, capital gains tax, and value-added tax (VAT), in the jurisdictions where the project operates and where investors reside.

- Consult with tax professionals to ensure compliance with tax laws and optimize tax planning strategies for the project and investors.

- Determine the tax treatment of ICO proceeds, token sales, and token holdings based on relevant tax regulations and guidelines.

3. Staying Updated on Regulatory Changes and Adapting Accordingly

- Stay informed about regulatory developments and changes in the legal landscape governing ICOs, cryptocurrencies, and blockchain technology.

- Monitor updates from regulatory authorities, government agencies, and industry associations regarding new regulations, enforcement actions, and compliance requirements.

- Engage legal counsel specializing in blockchain and cryptocurrency law to assess the impact of regulatory changes on the project and implement necessary adjustments to ensure compliance.

ICO Token Sale Management Software Just @ $5000

What is the significance of Risk Management in the ICO business?

Identifying and Mitigating Potential Risks

- Conduct a comprehensive risk assessment to identify potential risks and vulnerabilities associated with the ICO process, including security breaches, market volatility, regulatory uncertainty, and project execution risks.

- Implement risk mitigation strategies and controls to address identified risks effectively. For example, enhancing cybersecurity measures, diversifying token holdings, and hedging against market fluctuations.

- Regularly monitor and evaluate risk factors throughout the ICO lifecycle, adjusting risk management strategies as needed to mitigate emerging threats and vulnerabilities.

how ico ethereum works?:ICO (Initial Coin Offering) on the Ethereum platform works by allowing startups to raise funds by issuing tokens on the Ethereum blockchain. These tokens represent ownership or utility within the project or platform. Investors can purchase these tokens using Ether (ETH) during the ICO period. The Ethereum blockchain provides transparency and security for these transactions, enabling decentralized crowdfunding for new projects and initiatives.

Establishing Contingency Plans

- Develop contingency plans to address unforeseen events or disruptions that may impact the ICO or project operations. This may include scenarios such as technical failures, regulatory changes, market downturns, or unexpected delays.

- Define clear protocols and procedures for responding to emergencies and executing contingency measures to minimize the impact on stakeholders and project continuity.

- Test and review contingency plans regularly to ensure they remain effective and up-to-date in mitigating potential risks and preserving business continuity.

Insurance Options for ICO Projects

- Consider purchasing insurance coverage to mitigate certain risks associated with ICO projects, such as cyber liability insurance, directors and officers (D&O) insurance, and errors and omissions (E&O) insurance.

- Assess the scope and limitations of insurance policies to determine the extent of coverage provided for specific risks relevant to the project.

- Work with insurance providers and brokers specializing in blockchain and cryptocurrency-related coverage to tailor insurance solutions that address the unique needs and risk profile of the ICO project.

Conclusion

In conclusion, launching and running an ICO (Initial Coin Offering) business involves navigating a complex landscape of legal compliance, regulatory considerations, technical development, marketing strategies, and risk management practices. Despite the challenges, ICOs offer numerous benefits for both project teams and investors, including access to capital, global reach, decentralization, liquidity, and potential for high returns.

However, it’s essential to recognize that ICOs also come with inherent risks, including regulatory uncertainty, security vulnerabilities, market volatility, and project execution challenges. To mitigate these risks and maximize the chances of success, ICO projects must prioritize compliance with anti-money laundering (AML) and know your customer (KYC) regulations, stay updated on regulatory changes, and adapt their strategies accordingly.

Launch your ICO Platform just @ $5000

FAQs

How does an ICO work?

During an ICO, investors purchase tokens offered by the project at a predetermined price. The project uses the funds raised to finance development, operations, and other expenses. Investors may later trade or sell their tokens on cryptocurrency exchanges.

What are the benefits of participating in an ICO?

What are the risks associated with ICOs?

Risks associated with ICOs include regulatory uncertainty, security vulnerabilities, market volatility, project execution risks, potential for fraudulent schemes, and loss of investment due to project failure or lack of market demand for tokens.

Share a few details about your project, and we’ll get back to you soon.

Let's Talk About Your Project

- Free Consultation

- 24/7 Experts Support

- On-Time Delivery

- sales@sdlccorp.com

- +1(510-630-6507)