Introduction

To streamline the accounts payable process, consider implementing the following strategies:

- Automation: Use accounting software to automate invoice processing, approvals, and payments. This can reduce manual errors and save time.

- Electronic Payments: Encourage vendors to accept electronic payments, such as ACH transfers or virtual credit cards, to expedite the payment process.

- Supplier Portals: Implement a supplier portal where vendors can submit invoices electronically and track payment status, reducing the need for manual data entry.

- Streamlined Approval Workflow: Establish a clear and efficient approval workflow for invoices to minimize delays and ensure timely payments.

- Invoice Imaging: Scan and store invoices electronically to reduce paper clutter and make it easier to retrieve documents when needed.

- Regular Reconciliations: Conduct regular reconciliations of accounts payable to identify and resolve discrepancies promptly.

- Training and Education: Provide training to staff on best practices for accounts payable processes and the use of accounting software.

- Performance Metrics: Establish key performance indicators (KPIs) to monitor the efficiency and effectiveness of the accounts payable process and identify areas for improvement.

- Vendor Management: Maintain good relationships with vendors to ensure smooth communication and resolve any issues promptly.

- Continuous Improvement: Regularly review and update accounts payable processes to incorporate best practices and improve efficiency over time.

What techniques streamline the accounts payable (AP) process?

Several techniques can streamline the accounts payable (AP) process:

- Automation: Implementing automation for invoice processing, approvals, and payments can reduce manual errors and save time.

- Electronic Payments: Encouraging vendors to accept electronic payments can expedite the payment process.

- Supplier Portals: Establishing a supplier portal where vendors can submit invoices electronically and track payment status can reduce manual data entry.

- Streamlined Approval Workflow: Establishing a clear and efficient approval workflow for invoices can minimize delays and ensure timely payments.

- Invoice Imaging: Scanning and storing invoices electronically can reduce paper clutter and make it easier to retrieve documents when needed.

- Regular Reconciliations: Conducting regular reconciliations of accounts payable can help identify and resolve discrepancies promptly.

- Training and Education: Providing training to staff on best practices for accounts payable processes and the use of accounting software can improve efficiency.

- Performance Metrics: Establishing key performance indicators (KPIs) to monitor the efficiency and effectiveness of the accounts payable process can help identify areas for improvement.

- Vendor Management: Maintaining good relationships with vendors can ensure smooth communication and prompt resolution of any issues.

- Continuous Improvement: Regularly reviewing and updating accounts payable processes to incorporate best practices and improve efficiency over time can lead to further streamlining.

ransform your AP process today—digitize, automate, and streamline!

How do businesses leverage AP automation to streamline their AP workflow?

Businesses leverage AP automation to streamline their AP workflow by digitising and automating the accounts payable process. This involves using software and technology to handle tasks such as invoice processing, approval routing, and payment execution. AP automation offers several benefits, including:

- Efficiency: AP automation reduces manual tasks, such as data entry and invoice routing, saving time and increasing efficiency.

- Accuracy: Automated systems can reduce errors associated with manual data entry, ensuring that invoices are processed accurately.

- Visibility: AP automation provides real-time visibility into the status of invoices, enabling better tracking and management of payments.

- Cost Savings: By reducing manual labour and errors, AP automation can lower processing costs and improve overall cost management.

- Compliance: Automation helps ensure compliance with regulatory requirements and internal policies by providing audit trails and controls.

Overall, businesses use AP automation to streamline their AP workflow, improve efficiency, reduce costs, and enhance visibility and compliance.

Boost efficiency and accuracy in AP—implement our streamlined process.

What are the 11 best practices for streamline the accounts payable workflow?

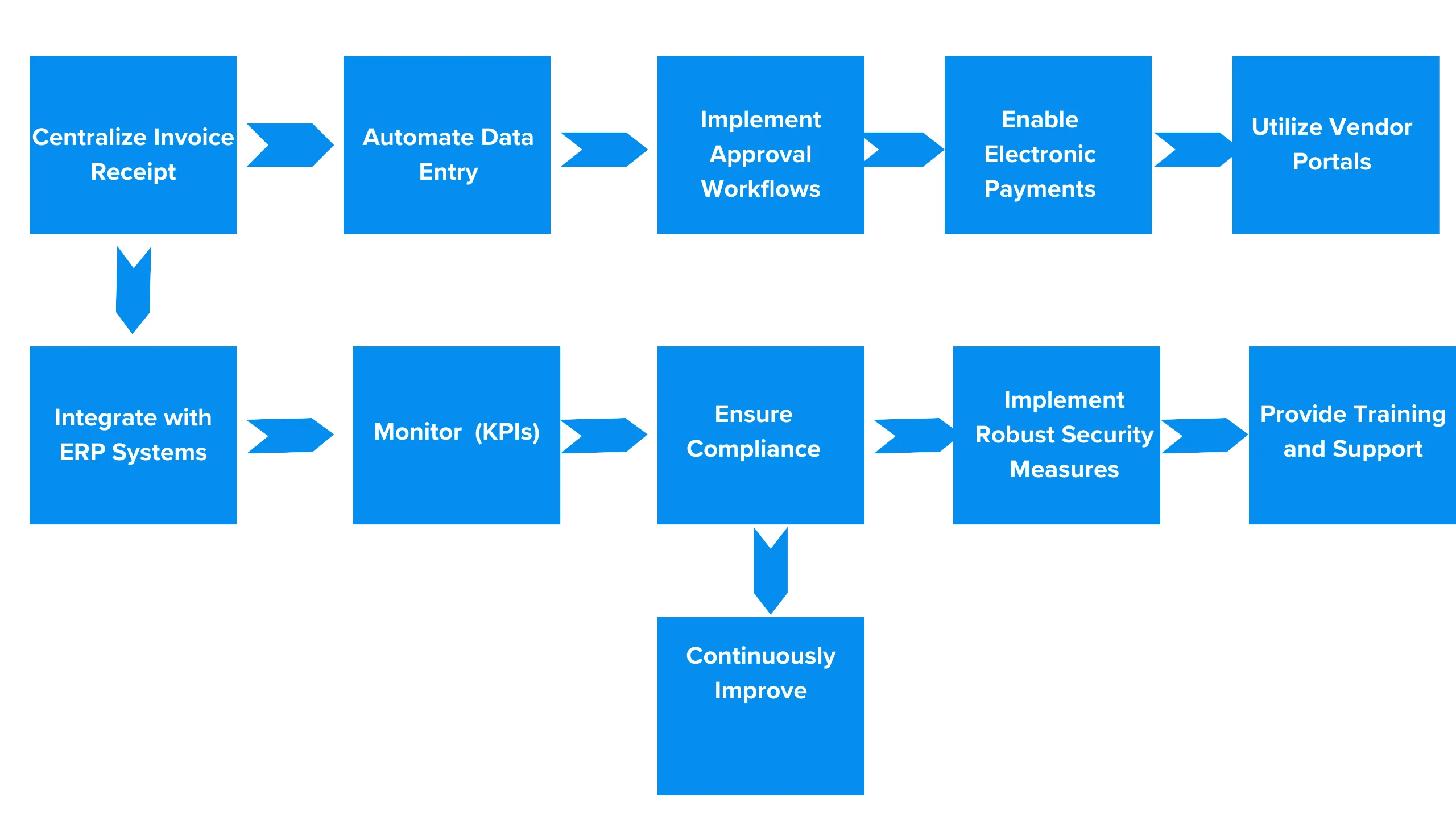

Here 11 best practices for streamline the accounts payable workflow:

- Centralize Invoice Receipt: Establish a centralized system for receiving invoices, whether through email, a web portal, or a dedicated mailbox.

- Automate Data Entry: Use optical character recognition (OCR) technology to automatically extHere aract data from invoices and reduce manual data entry.

- Implement Approval Workflows: Set up automated approval workflows to route invoices to the appropriate approvers based on predefined rules.

- Enable Electronic Payments: Encourage suppliers to accept electronic payments, such as ACH transfers or virtual credit cards, to streamline the payment process.

- Utilize Vendor Portals: Provide suppliers with access to a vendor portal where they can submit invoices, track payment status, and communicate with your accounts payable team.

- Integrate with ERP Systems: Integrate your AP automation software with your ERP system to ensure seamless data flow between systems.

- Monitor Key Performance Indicators (KPIs): Track KPIs such as invoice processing time, early payment discounts captured, and invoice error rates to measure the effectiveness of your AP automation.

- Ensure Compliance: Stay compliant with regulatory requirements and internal policies by implementing controls and audit trails within your AP automation system.

- Implement Robust Security Measures: Protect sensitive financial data by implementing encryption, access controls, and other security measures.

- Provide Training and Support: Ensure that employees are trained on how to use the AP automation system effectively and provide ongoing support as needed.

- Continuously Improve: Regularly review and update your AP automation processes to identify areas for improvement and optimise efficiency.

Ready to simplify AP? Explore our digitized, automated solutions now!

How can you track your accounts payable process?

You can track your accounts payable process using the following steps:

- Maintain a Clear Process Map: Create a process map that outlines each step of your accounts payable process, from invoice receipt to payment.

- Utilise Accounting Software: Use accounting software to track invoices, approvals, and payments in real-time.

- Implement Approval Workflows: Set up automated approval workflows to track the status of invoices and ensure timely approvals.

- Track Key Performance Indicators (KPIs): Monitor KPIs such as invoice processing time, invoice error rate, and early payment discounts captured to assess the efficiency of your accounts payable process.

- Generate Regular Reports: Generate reports from your accounting software to track the status of invoices, outstanding payments, and payment trends.

- Reconcile Accounts: Regularly reconcile accounts payable balances with supplier statements to ensure accuracy.

- Audit Accounts Payable: Conduct regular audits of your accounts payable process to identify areas for improvement and ensure compliance with policies and regulations.

- Communicate with Suppliers: Maintain open communication with suppliers to resolve any invoice discrepancies or payment delays promptly.

What are the challenges with solution of streamlining the accounts payable process?

By addressing these challenges with the suggested solutions, businesses can streamline their accounts payable process and improve efficiency, accuracy, and compliance.

- Manual Data Entry:

- Challenge: Manual data entry is time-consuming and prone to errors.

- Solution: Implement OCR technology to automate data entry and reduce errors.

- Invoice Approval Delays:

- Challenge: Delays in invoice approvals can lead to late payments and missed discounts.

- Solution: Set up automated approval workflows to route invoices to the appropriate approvers and streamline the approval process.

- Paper-based Processes:

- Challenge: Paper-based processes are inefficient and can lead to misplaced or lost invoices.

- Solution: Digitize invoices and implement electronic document management systems to eliminate paper-based processes.

- Lack of Visibility:

- Challenge: Limited visibility into the accounts payable process can make it difficult to track the status of invoices and payments.

- Solution: Use accounting software to provide real-time visibility into the accounts payable process and track key metrics.

- Difficulty in Supplier Management:

- Challenge: Managing relationships with suppliers can be challenging, leading to communication issues and delays.

- Solution: Implement vendor portals to streamline communication with suppliers and provide them with visibility into the payment process.

- Compliance and Security Concerns:

- Challenge: Ensuring compliance with regulatory requirements and maintaining data security can be challenging.

- Solution: Implement controls and audit trails within your accounts payable system to ensure compliance and protect sensitive financial data.

- Lack of Integration:

- Challenge: Lack of integration between systems can result in data silos and inefficient processes.

- Solution: Integrate your accounts payable system with your ERP system to ensure seamless data flow and improve efficiency.

FAQS

1. How can I implement AP automation in my business?

To implement AP automation, you can start by digitising your invoices and implementing software that can automate data entry, approval workflows, and payment processing.

2. What are some best practices for streamlining the accounts payable process?

Some best practices for streamlining the accounts payable process include centralising invoice receipt, automating data entry, implementing approval workflows, enabling electronic payments, and integrating with ERP systems.

3.What are some best practices for the accounts payable month-end close process?

You can track the accounts payable process by maintaining a clear process map, utilising accounting software, implementing approval workflows, tracking key performance indicators (KPIs), generating regular reports, reconciling accounts, and conducting regular audits.

4. What are some common challenges of streamlining the accounts payable process?

Some common challenges of streamlining the accounts payable process include manual data entry, invoice approval delays, paper-based processes, lack of visibility, difficulty in supplier management, compliance and security concerns, and lack of integration.

5. How can I overcome these challenges?

To overcome these challenges, you can implement OCR technology for automated data entry, set up automated approval workflows, digitize invoices, use accounting software for visibility, implement vendor portals for supplier management, implement controls for compliance and security, and integrate your accounts payable system with your ERP system.

Share a few details about your project, and we’ll get back to you soon.

Let's Talk About Your Project

- Free Consultation

- 24/7 Experts Support

- On-Time Delivery

- sales@sdlccorp.com

- +1(510-630-6507)