Introduction

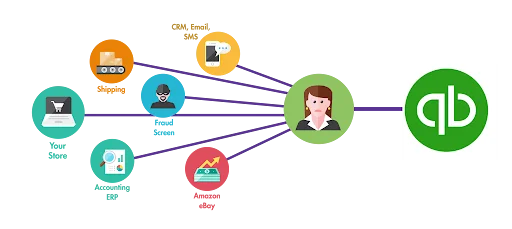

Understanding QuickBooks API Integration

Streamline Your Finances Now with QuickBooks API Integration! Learn More!

Benefits of QuickBooks API Integration

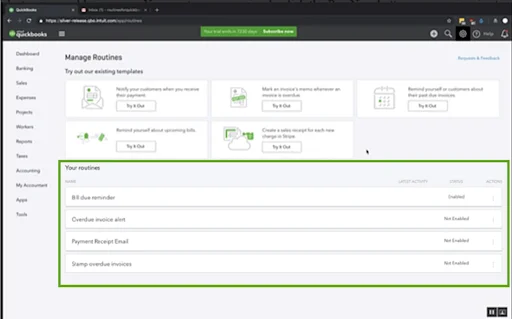

1. Automation of Routine Tasks

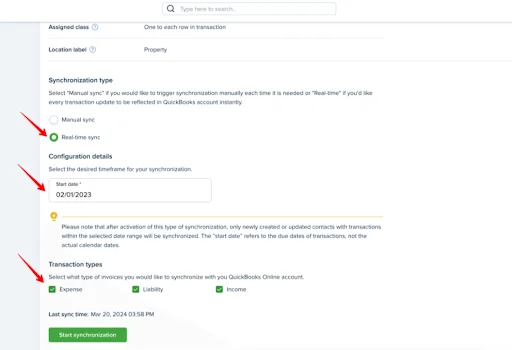

2. Real-Time Data Synchronization

With QuickBooks API, financial data synchronisation occurs in real time, ensuring all platforms are up-to-date. This real-time synchronisation helps businesses maintain accurate financial records, providing a clear and current view of their financial health. It also enables swift decision-making based on the most recent data available. For example, a business can instantly see the impact of a large sale on its cash flow, enabling it to make timely and informed financial decisions.

3. Improved Accuracy

Automated data transfer between systems ensures accuracy and consistency in financial records. By minimizing human intervention in data entry and processing, businesses can reduce errors that arise from manual handling. This accuracy is crucial for maintaining reliable financial statements and complying with regulatory requirements. For example, accurate financial records are essential for tax reporting and audits, where discrepancies can lead to penalties and legal issues.

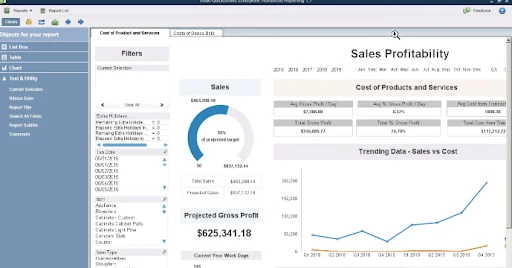

4. Enhanced Reporting and Analytics

5. Scalability

Integrate QuickBooks API for streamlined accounting.

Practical Applications of QuickBooks API Integration

1. E-commerce Integration

E-commerce businesses can benefit from QuickBooks integration by automating sales data entry, inventory management, and expense tracking. This integration ensures that sales data from online stores are automatically recorded in QuickBooks, reducing the workload on accounting staff and improving the accuracy of financial records. For example, when a customer makes a purchase, the sale is instantly recorded in QuickBooks, and inventory levels are updated, streamlining the entire sales process.

2. CRM Integration

Integrating QuickBooks with CRM systems streamlines sales and billing, allowing comprehensive management of customer transactions and payments. This integration ensures that customer data, sales orders, and billing information are consistently updated across platforms, enhancing customer service and operational efficiency. For instance, sales teams can access up-to-date customer account information, enabling them to provide better service and manage customer relationships more effectively.

3. Payroll Systems

Integration simplifies payroll processes by automatically updating employee records, calculating salaries, ensuring timely payments, and reducing administrative workload. QuickBooks API can connect with payroll software to ensure that payroll data is accurately reflected in the accounting system, minimizing errors and ensuring compliance with tax regulations. For example, employee hours recorded in a time-tracking system can be automatically synced with QuickBooks, streamlining the payroll process and reducing the chance of errors.

How to Get Started with QuickBooks API Integration

1. Evaluate Your Needs

Identify the accounting tasks you want to automate and the systems you need to integrate with QuickBooks. Understanding your business requirements will help you determine the scope of the integration and the functionalities you need. For example, if your primary goal is to automate invoicing and payments, you may focus on integrating QuickBooks with your CRM and payment processing systems.

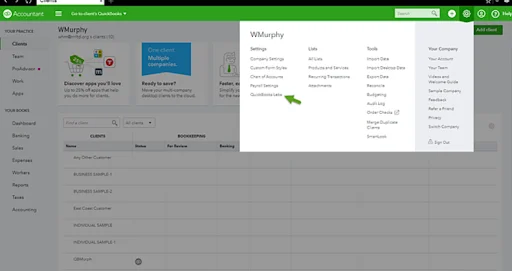

2. Choose the Right Tools

Select the appropriate API tools and platforms that best suit your business requirements. Various integration tools are available that can facilitate the connection between QuickBooks and other applications. Choose one that aligns with your technical capabilities and business needs. For instance, some tools offer pre-built connectors for popular e-commerce platforms, while others provide customizable APIs for more tailored solutions.

3. Hire a Developer

Consider hiring a developer with experience in QuickBooks API integration to ensure a smooth and efficient setup. An experienced developer can handle the complexities of the integration process, troubleshoot issues, and customize the integration to fit your unique requirements. For example, a developer can create custom scripts to automate specific workflows, such as generating financial reports or syncing data between multiple systems.

4. Test Thoroughly

Before fully implementing the integration, thoroughly test it to ensure all systems communicate correctly and data is synchronized. Conducting rigorous testing helps identify and resolve potential issues, providing a seamless integration that works reliably in a live environment. For example, you might run a series of test transactions to verify that sales data is correctly recorded in QuickBooks and that inventory levels are accurately updated.

Conclusion

By integrating QuickBooks API, businesses can optimize accounting workflows, minimize manual tasks, and enhance overall financial management efficiency. The seamless communication between QuickBooks and other applications provides a comprehensive solution for managing financial data and improving operational performance.

Frequently asked questions

What is QuickBooks API?

How does QuickBooks API integration benefit my business?

Can I integrate QuickBooks with my existing e-commerce platform?

Is it necessary to hire a developer for QuickBooks API integration?

What should I consider before integrating QuickBooks with other systems?

Share a few details about your project, and we’ll get back to you soon.

Let's Talk About Your Project

- Free Consultation

- 24/7 Experts Support

- On-Time Delivery

- sales@sdlccorp.com

- +1(510-630-6507)