Strategies for Reducing DeFi Wallet Fees

What is DeFi Wallet Fees?

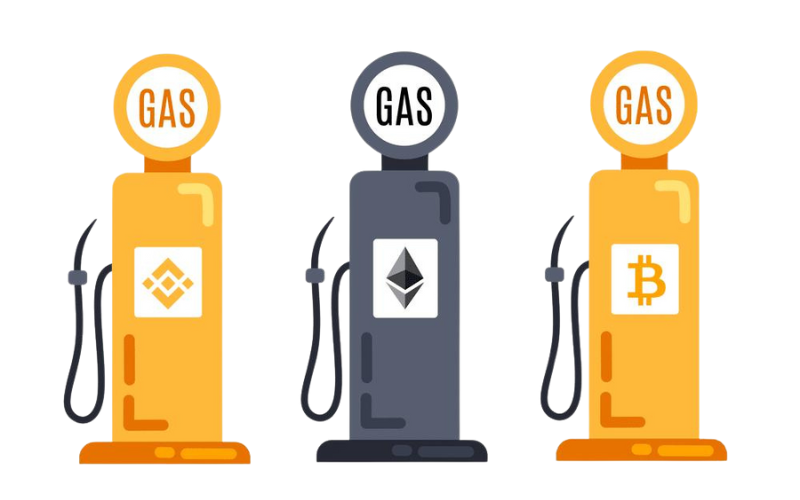

DeFi wallet fees refer to the costs associated with using decentralized finance (DeFi) wallets, which are digital wallets designed to interact with decentralized applications (dApps) and protocols on blockchain networks. These fees typically include transaction fees, gas fees (for Ethereum-based networks), and network fees for executing various financial activities such as lending, borrowing, trading, or staking within the DeFi ecosystem.

As the DeFi space continues to evolve, users may encounter varying fee structures depending on the specific protocols or services they engage with. Some DeFi wallets may offer competitive fee structures or even fee-less transactions to attract users. However, it’s essential for users to carefully review fee schedules and understand the cost implications before engaging in any DeFi activities.

DeFi development company play a crucial role in shaping the landscape of decentralized finance by creating innovative solutions, protocols, and wallets. These companies specialize in building DeFi infrastructure, smart contracts, and user interfaces to enhance the accessibility, security, and functionality of DeFi applications. By incorporating DeFi wallet fee management features and optimizing transaction processes, these development companies contribute to improving the overall user experience and driving the adoption of decentralized finance.

Top 10 strategies to reduce defi wallet fees

- Batch Transactions: Combine multiple transactions into one to save on gas fees. This can be done by bundling several transactions together, such as swaps, deposits, or withdrawals, into a single transaction.

- Gas Optimization Tools: Utilize gas optimization tools provided by DeFi wallets or third-party services. These tools help estimate optimal gas prices for transactions, ensuring you don’t overpay.

- Wait for Off-Peak Hours: Execute transactions during periods of lower network congestion to benefit from lower gas prices. Gas fees tend to be higher during peak hours when the network is more congested.

- Use Layer 2 Solutions: Explore Layer 2 scaling solutions like Optimistic Rollups or zkRollups, which can significantly reduce transaction costs by processing transactions off-chain before settling them on the Ethereum mainnet.

- Gas Tokens: Utilize gas tokens, such as CHI or GST2, to pre-purchase gas at lower prices during times of low demand and redeem them when gas prices are high, effectively reducing transaction costs.

- Choose the Right Network: Consider using alternative blockchain networks like Binance Smart Chain (BSC) or Polygon (formerly Matic) that offer lower transaction fees compared to the Ethereum network.

- Opt for Limit Orders: When trading on decentralized exchanges (DEXs), opt for limit orders instead of market orders. Limit orders allow you to set a specific price at which you are willing to buy or sell, potentially saving on gas fees compared to market orders.

- Use Fee Delegation: Some DeFi protocols allow users to delegate transaction fees to liquidity providers or other participants, reducing the burden on individual users. Explore platforms that offer fee delegation features.

- Optimize Token Selection: Be mindful of the tokens you’re transacting with. Some tokens may have lower gas fees compared to others due to differences in their smart contract complexity or network demand.

- Stay Informed: Keep track of gas prices and network congestion using tools like Etherscan or GasNow. Being aware of gas price trends can help you time your transactions more efficiently and save on fees.

Types of DeFi Wallet Fees

A. Transaction Fees

B. Gas Fees

C. Withdrawal Fees

D. Exchange Fees

E. Deposit Fees

F. Smart Contract Interaction fees

G. Management Fees

H. Subscription Fees

How to Reduce DeFi Wallet Gas Fees?

Invest in sdlccorp’s Efficient Low Gas Fees Based DeFi Wallet

Advantages of storing and sending cryptocurrency using a DEFI wallet

Storing and sending cryptocurrency through a decentralized finance (DeFi) wallet offers several advantages:

- Control and Ownership: With a DeFi wallet, users have complete control over their funds. They own the private keys, which means they have full custody of their assets without relying on third parties like banks.

- Global Accessibility: DeFi wallets allow users to access their funds from anywhere in the world as long as they have an internet connection. There are no geographical restrictions or barriers to entry, making it easy for anyone to participate in the decentralized finance ecosystem.

- Security: DeFi wallets prioritize security through various means such as encryption, multi-factor authentication, and smart contract protocols. Users can trust that their funds are secure, reducing the risk of hacks or unauthorized access.

- Transparency: The nature of blockchain technology ensures transparency in transactions. Users can track their transactions on the blockchain, providing a level of transparency that traditional financial systems may lack.

- Interoperability: DeFi wallets often support multiple cryptocurrencies and tokens, allowing users to manage various assets within a single interface. This interoperability enhances convenience and efficiency for users who hold diverse portfolios.

- Decentralization: DeFi wallets operate on decentralized networks, eliminating the need for intermediaries like banks or financial institutions. This decentralization fosters financial inclusion and empowers individuals by providing direct access to financial services.

- Lower Fees: DeFi wallets typically have lower fees compared to traditional financial services. Transactions on decentralized networks often incur lower fees since they bypass intermediaries, reducing costs for users.

Examples of using DeFi Wallets

DeFi wallets serve as gateways to the decentralized finance (DeFi) ecosystem, enabling users to securely store, manage, and transact with their digital assets. These wallets are essential tools for participating in various DeFi protocols, such as lending, borrowing, staking, and decentralized exchanges (DEXs).

For example, a user might utilize a DeFi wallet to connect to a DeFi lending platform. By linking their wallet to the platform, they can deposit their crypto assets as collateral and borrow other assets against it, all within the decentralized environment. The wallet acts as the intermediary, facilitating interactions between the user and the DeFi protocols.

Additionally, DeFi wallets provide access to yield farming opportunities, where users can earn rewards by providing liquidity to DeFi liquidity pools. By connecting their wallet to a DeFi landing platform, users can seamlessly participate in yield farming activities, earning interest or governance tokens in return for their contributions to the liquidity pool.

Conclusion

Contact Us

Let's Talk About Your Project

- Free Consultation

- 24/7 Experts Support

- On-Time Delivery

- sales@sdlccorp.com

- +1(510-630-6507)