Introduction

Investment tokens are a category of digital assets designed to represent ownership or investment interests in underlying assets, projects, or ventures. These tokens enable fractional ownership, liquidity, and global access to investment opportunities traditionally limited to institutional or accredited investors. Here’s an exploration of investment tokens, including their characteristics, operational mechanisms, functionalities, and common use cases:

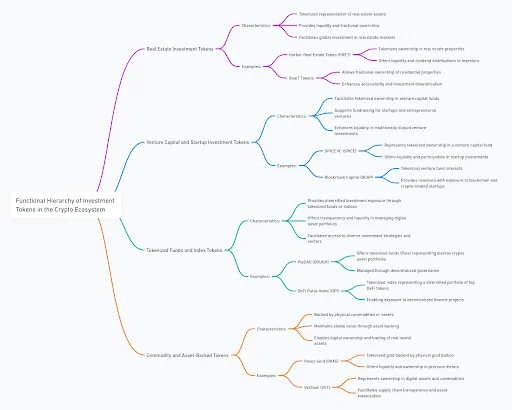

Hierarchy of Investment Tokens in blockchain

In the blockchain ecosystem, investment tokens form a functional hierarchy based on their specific roles, functionalities, and applications within digital asset management, fundraising, and investment diversification. Here’s an overview of the functional hierarchy of investment tokens:

1. Real Estate Investment Tokens

These tokens represent fractional ownership or investment in real estate properties, allowing investors to access high-value assets and benefit from rental income or property appreciation.

- Characteristics:

- Tokenized representation of real estate assets.

- Provides liquidity and fractional ownership.

- Facilitates global investment in real estate markets.

- Examples:

- Harbor Real Estate Token (HRET): Tokenizes ownership in real estate properties, offering liquidity and dividend distributions to investors.

- RealT Tokens: Allows fractional ownership of residential properties, enhancing accessibility and investment diversification.

2. Venture Capital and Startup Investment Tokens

Tokens represent ownership or interests in venture capital funds, startup equity, or entrepreneurial projects, enabling global funding and liquidity for early-stage ventures.

- Characteristics:

- Facilitates tokenized ownership in venture capital funds.

- Supports fundraising for startups and entrepreneurial ventures.

- Enhances liquidity in traditionally illiquid venture investments.

- Examples:

- SPiCE VC (SPICE): Represents tokenized ownership in a venture capital fund, offering liquidity and participation in startup investments.

- Blockchain Capital (BCAP): Tokenized venture fund interests, providing investors with exposure to blockchain and crypto-related startups.

3. Tokenized Funds and Index Tokens

Tokens represent ownership in diversified investment funds, digital asset portfolios, or indices, offering exposure to multiple assets and strategies within a single token.

- Characteristics:

- Provides diversified investment exposure through tokenized funds or indices.

- Offers transparency and liquidity in managing digital asset portfolios.

- Facilitates access to diverse investment strategies and sectors.

- Examples:

- PieDAO (DOUGH): Offers tokenized funds (Pies) representing diverse crypto asset portfolios, managed through decentralized governance.

- DeFi Pulse Index (DPI): Tokenized index representing a diversified portfolio of top DeFi tokens, enabling exposure to decentralized finance projects.

4. Commodity and Asset-Backed Tokens

Tokens are backed by physical assets such as precious metals (gold, silver), commodities (oil, agricultural products), or other tangible assets, providing stability and value preservation.

- Characteristics:

- Backed by physical commodities or assets.

- Maintains stable value through asset backing.

- Enables digital ownership and trading of real-world assets.

- Examples:

- Paxos Gold (PAXG): Tokenized gold backed by physical gold bullion, offering liquidity and ownership in precious metals.

- VeChain (VET): Represents ownership in digital assets and commodities, facilitating supply chain transparency and asset tokenization.

Characteristics of Investment Tokens

- Fractional Ownership: Investment tokens allow fractional ownership of high-value assets, such as real estate, venture capital funds, artworks, or intellectual property rights, making them accessible to retail investors.

- Tokenization: They leverage blockchain technology to tokenize ownership rights or investment interests, facilitating transparent, secure, and efficient transactions on decentralized platforms.

- Liquidity: Investment tokens enhance liquidity by enabling trading and transferability on secondary markets, reducing the traditional liquidity constraints associated with illiquid assets.

How Investment Tokens Work

Investment tokens operate through blockchain-based smart contracts that define ownership rights, dividend distributions, voting privileges, and other investment-related functionalities. Key aspects of how they work include:

- Token Issuance: Issuers tokenize assets or investment opportunities, representing them as digital tokens on blockchain networks.

- Investment Management: Token holders may participate in governance decisions, receive dividends or profits, and benefit from asset appreciation or project success.

- Regulatory Compliance: Issuers often comply with regulatory frameworks, such as securities laws, through token structuring and investor accreditation.

Functionality and Use Cases

- Fractional Ownership and Diversification:

- Functionality: Allows retail investors to diversify portfolios with fractional ownership of diverse assets, including real estate, private equity, and fine art.

- Use Cases: Facilitates global access to investment opportunities traditionally limited to accredited investors, promoting portfolio diversification and risk management.

- Venture Capital and Startup Funding:

- Functionality: Enables tokenized investments in startups, venture capital funds, and entrepreneurial projects, supporting fundraising and liquidity for early-stage ventures.

- Use Cases: Provides liquidity to venture capital investments, facilitates cross-border funding, and enhances transparency in startup financing.

- Real Estate Tokenization:

- Functionality: Tokens represent fractional ownership or investment in real estate properties, offering liquidity, asset-backed stability, and dividend distributions.

- Use Cases: Enhances liquidity in real estate markets, allows diversified investment in high-value properties, and enables global access to real estate investment opportunities.

Examples of Investment Tokens

- Harbor Real Estate Token (HRET):

- Asset: Fractional ownership in real estate properties.

- Functionality: Tokenizes real estate assets, providing liquidity and dividend distributions to investors globally.

- SPiCE VC (SPICE):

- Asset: Venture capital fund interests.

- Functionality: Represents tokenized ownership in venture capital funds, offering liquidity and participation in startup investments.

Conclusion

Investment tokens play a crucial role in democratizing access to investment opportunities, enhancing liquidity in traditionally illiquid markets, and promoting financial inclusion through blockchain technology. Their characteristics, functionalities, and use cases illustrate their potential to transform global finance by enabling fractional ownership, diversification, and transparent investment management. Understanding investment tokens helps stakeholders navigate regulatory challenges, leverage liquidity benefits, and capitalize on innovative investment opportunities in the evolving digital economy.