Introduction

The accounts payable process involves managing and recording all the company’s expenses and financial obligations to suppliers and vendors.

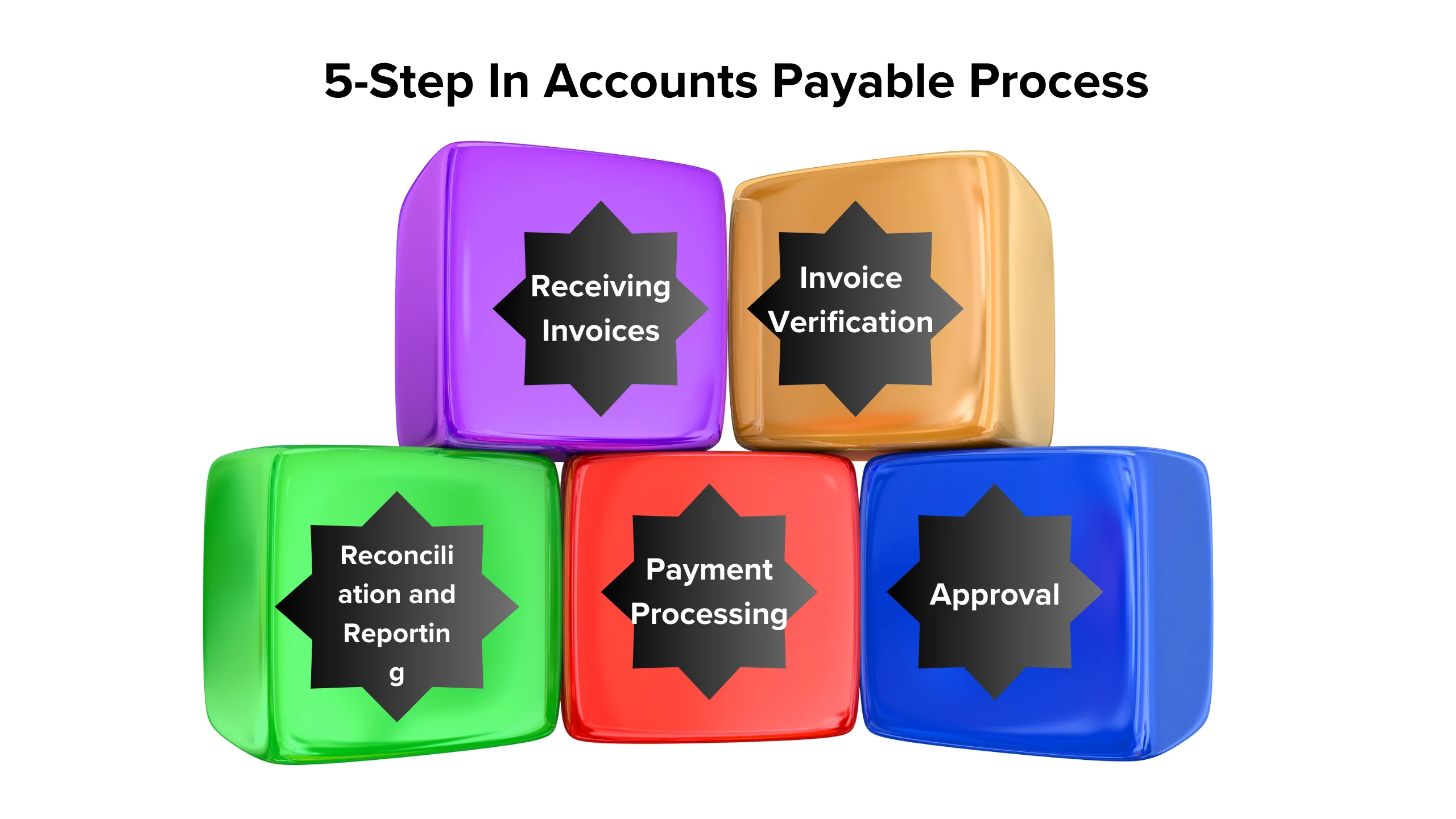

Here are the typical steps in a 5-step accounts payable process:

- Receiving Invoices: The first step involves receiving invoices from suppliers for goods or services provided. Invoices should be reviewed for accuracy and matched with purchase orders and receiving documents.

- Invoice Verification: Once invoices are received, they need to be verified for accuracy and authenticity. This includes ensuring that the goods or services were received, the prices are correct, and any discounts or terms are applied correctly.

- Approval: After verification, invoices need to be approved for payment. Depending on the organisation, this may involve obtaining approval from a manager or department head. Approval ensures that the company is only paying for legitimate expenses.

- Payment Processing: Once invoices are approved, they are ready for payment. Payment processing involves selecting the payment method (e.g., check, electronic funds transfer), scheduling the payment, and recording the transaction in the accounting system.

- Reconciliation and Reporting: The final step in the accounts payable process is to reconcile payments made with the company’s financial records. This involves matching payments to invoices and ensuring that all expenses are properly recorded. Additionally, reports may be generated to analyze cash flow, track expenses, and identify opportunities for cost savings.

Why use a structured process approach?

Using a structured process approach in accounts payable offers several benefits:

- Efficiency: A structured process helps streamline accounts payable tasks, making them more efficient. By defining clear steps and responsibilities, it reduces the risk of errors and delays.

- Accuracy: Following a structured process helps ensure that invoices are processed accurately. This reduces the risk of overpaying or underpaying suppliers and helps maintain good relationships with them.

- Compliance: A structured process helps ensure compliance with internal policies and external regulations. It helps in capturing and retaining the necessary documentation for audits and regulatory requirements.

- Cost Control: By improving efficiency and accuracy, a structured process can help control costs associated with accounts payable. It can help identify opportunities for discounts, avoid late payment fees, and prevent duplicate payments.

- Supplier Relationships: A structured process can improve relationships with suppliers by ensuring timely and accurate payments. This can lead to better terms, discounts, and overall satisfaction.

- Visibility and Reporting: A structured process provides better visibility into accounts payable operations. It allows for tracking and reporting on key metrics such as invoice processing time, payment accuracy, and outstanding liabilities.

Overall, using a structured process approach in accounts payable can lead to cost savings, improved compliance, better supplier relationships, and more efficient operations.

Optimize your AP process—follow our 5-step guide today!

Why is the accounts payable process important?

The accounts payable process is crucial for businesses because it ensures that all invoices from suppliers and vendors are accurately recorded and paid on time. This process involves verifying the accuracy of invoices, matching them to purchase orders and receiving documents, and obtaining approval for payment.

By managing accounts payable effectively, businesses can maintain positive relationships with suppliers, avoid late payment fees, and take advantage of early payment discounts. Additionally, a well-organised accounts payable process provides accurate financial data for budgeting, forecasting, and decision-making, helping businesses to manage cash flow more effectively and maintain good financial health.

Ready to streamline AP? Learn the 5 key steps now!

How does a structured process approach benefit accounts payable?

A structured process approach benefits accounts payable in several ways.

Firstly, it ensures that all invoices are processed consistently and accurately, reducing the risk of errors and duplicate payments. This helps to maintain the integrity of financial records and strengthens internal controls.

Secondly, a structured approach helps to streamline the accounts payable process, making it more efficient and reducing the time and resources required to manage invoices. This can lead to cost savings for the business.

Thirdly, a structured approach improves visibility and transparency into the accounts payable process, making it easier to track the status of invoices, identify bottlenecks, and resolve issues promptly. Overall, a structured process approach helps to improve the accuracy, efficiency, and control of the accounts payable process, benefiting the business as a whole.

Enhance efficiency in AP—master the 5-step process with us!

What are the challenges in Accounts Payable Process?

The accounts payable process can be complex, and several challenges can arise:

- Invoice Errors: Inaccurate invoices can lead to payment delays and disputes. Verifying invoice details against purchase orders and delivery receipts can be time-consuming.

- Manual Processes: Many organizations still rely on manual processes for accounts payable, which can be slow, error-prone, and costly.

- Data Entry Errors: Manually entering invoice data into the system can result in mistakes, leading to payment errors and reconciliation issues.

- Invoice Approval Delays: Invoices often require approval from multiple departments or individuals, leading to delays in payment processing.

- Missing or Lost Invoices: Invoices can be misplaced or lost, leading to delays in payment and potential late fees.

- Compliance Issues: Ensuring compliance with regulatory requirements and internal policies can be challenging, especially for global organizations.

- Supplier Relations: Late payments or disputes can strain relationships with suppliers, potentially impacting the organization’s ability to secure favorable terms or discounts.

- Fraudulent Activities: Accounts payable processes can be targeted by fraudsters, leading to unauthorized payments and financial losses.

- Lack of Visibility: Limited visibility into the accounts payable process can make it difficult to track payments, monitor cash flow, and identify areas for improvement.

Addressing these challenges requires implementing efficient accounts payable processes, leveraging automation and technology, and ensuring strong internal controls and compliance measures.

What are the benefits of Accounts Payable Process?

The accounts payable process is crucial for the financial health of a business. Some of the key benefits include:

- Timely Payments: Ensures that vendors and suppliers are paid on time, which can help maintain good relationships and possibly lead to discounts for early payment.

- Accuracy and Compliance: Helps ensure that invoices are accurate, comply with company policies and legal requirements, and prevent overpayment or payment of fraudulent invoices.

- Cash Flow Management: Allows for better management of cash flow by tracking and scheduling payments, helping to avoid late fees and penalties.

- Financial Visibility: Provides visibility into liabilities and expenses, allowing for better financial planning and budgeting.

- Improved Efficiency: Automating the accounts payable process can streamline workflows, reduce manual errors, and free up staff to focus on more strategic tasks.

- Vendor Relationships: Timely and accurate payments can help build strong relationships with vendors, potentially leading to better terms and discounts.

- Financial Controls: Establishes internal controls to prevent unauthorized payments and ensure compliance with company policies and regulatory requirements.

Conclusion:

In conclusion, implementing a structured 5-step accounts payable process can significantly benefit a business. It helps ensure timely and accurate payments, improves cash flow management, enhances vendor relationships, and provides better financial visibility and controls. By following these steps – receiving invoices, verifying invoices, approving invoices, recording invoices, and paying invoices – businesses can streamline their accounts payable operations, reduce errors, and improve overall financial efficiency.

FAQS

1. What are some common challenges in the accounts payable process?

Common challenges include manual data entry errors, invoice processing delays, missing or incorrect documentation, and compliance issues.

2. How can automation improve the accounts payable process?

Automation can help streamline accounts payable tasks, reduce errors, speed up invoice processing, improve compliance, and provide better visibility into operations.

3. What role does technology play in accounts payable?

Technology plays a crucial role in accounts payable by enabling automation, electronic invoicing, digital document management, and real-time reporting.

4. How can companies ensure the security of their accounts payable process?

Some common challenges of streamlining the accounts payable process include manual data entry, invoice approval delays, paper-based processes, lack of visibility, difficulty in supplier management, compliance and security concerns, and lack of integration.

5. What are some best practices for optimising the accounts payable process?

Best practices include centralising invoice receipt, implementing automated workflows, regularly reviewing and updating processes, and conducting regular audits.

Share a few details about your project, and we’ll get back to you soon.

Let's Talk About Your Project

- Free Consultation

- 24/7 Experts Support

- On-Time Delivery

- sales@sdlccorp.com

- +1(510-630-6507)